Every year, friend-of-the-site David Collum writes a detailed "Year in Review" synopsis full of keen perspective and plenty of wit. This year's is no exception. As with past years, he has graciously selected PeakProsperity.com as the site where it will be published in full. It's quite longer than our usual posts, but worth the time to read in full. A downloadable pdf of the full article is available here, for those who prefer to do their power-reading offline. -- cheers, Adam

Introduction

“He is funnier than you are.”

~David Einhorn, Greenlight Capital, on Dave Barry’s Year in Review

Every December, I write a survey trying to capture the year’s prevailing themes. I appear to have stiff competition—the likes of Dave Barry on one extreme1 and on the other, Pornhub’s marvelous annual climax that probes deeply personal preferences in the world’s favorite pastime.2 (I know when I’m licked.) My efforts began as a few paragraphs discussing the markets on Doug Noland’s bear chat board and monotonically expanded to a tome covering the orb we call Earth. It posts at Peak Prosperity, reposts at ZeroHedge, and then fans out from there. Bearishness and right-leaning libertarianism shine through as I spelunk the Internet for human folly to couch in snarky prose while trying to avoid the “expensive laugh” (too much setup).3 I rely on quotes to let others do the intellectual heavy lifting.

“Consider adding more of your own thinking and judgment to the mix . . . most folks are familiar with general facts but are unable to process them into a coherent and actionable framework.”

~Tony Deden, founder of Edelweiss Holdings, on his second read through my 2016 Year in Review

“Just the facts, ma’am.”

~Joe Friday

By October, I have usually accrued 500 single-spaced pages of notes, quotes, and anecdotes. Fresh ideas occasionally emerge, but most of my distillation is an intellectual recycling program relying heavily on fair use laws.4 I often suffer from pareidolia—random images or sounds perceived as significant. Regarding the extent that self-serving men and women of wealth do sneaky crap, I am an out-of-the-closet conspiracy theorist. If you think conspiracies do not exist, then you are a card-carrying idiot. Currently, locating the increasingly fuzzy fact–fiction interfaces is nearly impossible thanks to the post-election bewitching of 50 percent of the populace.

“The best ideas come as jokes. Make your thinking as funny as possible.”

~David Ogilvy, marketing expert

You might be asking, “What’s with the title, Dave? My 401K is doing great, and I own a few Bitcoin!” Yes, indeed: your 401K fiddled its way to new highs day after day, but this too shall pass—it always does—and not without some turbulence. This year was indeed a tough one to survey. As many peer through beer goggles at intoxicatingly rising markets, I kept seeing dead people (Figure 1).

“We seem to be living in the riskiest moment of our lives, and yet the stock market seems to be napping: I admit to not understanding it.”

~Richard Thaler, winner of the 2017 Nobel Prize in Economics

Figure 1. An original by CNBC's Jeff Macke, chartist and artist extraordinaire.

A poem for Dave's Year In Review

The bubble in everything grew

This nut from Cornell

Say's we're heading for hell

As I look at the data…#MeToo

~@TheLimerickKing

Some will notice that in decidedly political sections, the term “progressives” is used pejoratively. Their behavior has become nearly incomprehensible to me. My almost complete neglect of the right wing loonies may reflect some bias, but politically, they have taken a knee. They have become irrelevant. Free speech is a recurring theme, introducing interesting paradoxes for employee–employer relationships.

Some say I have no filter. They obviously have no clue what I want to say. In case my hints are too subtle, I offer the following:

Sources

I sit in front of a computer 16 hours a day, at least three of which are dedicated to non-chemistry pursuits. I’m a huge fan of Adam Taggart and Chris Martenson (Peak Prosperity), Tony Greer (TG Macro), Doug Noland (Credit Bubble Bulletin), Grant Williams (Real Vision and TTMYGH), Raoul Pal (Real Vision), Bill Fleckenstein (Fleckenstein Capital), James Grant (Grant’s Interest Rate Observer), and Campus Reform—but there are so many more. ZeroHedge is by far my preferred consolidator of news. Twitter is a window to the world if managed correctly. Good luck with that. And don’t forget it’s public! Everything needs an open mind, discerning eye, and a coarse-frit filter.

“You are given a ticket to the freak show. When you’re born in America, you are given a front row seat, and some of us get to sit there with notebooks.”

~George Carlin, comedian

Contents

Footnotes appear as superscripts with hyperlinks in the “Links” section. The whole beast can be downloaded as a single PDF xxhere or viewed in parts—the sections are reasonably self-contained—via the linked contents as follows:

Part 1

- Introduction

- Sources

- Contents

- My Personal Year in Review

- Investing

- Economy

- Broken Markets

- Market Valuations

- Market Sentiment

- Volatility

- Stock Buybacks

- Indexing and Exchange-Traded Funds

- Miscellaneous Market Absurdities

- Long-Term Real Returns and Risk Premia

- Gold

- Bitcoin

- Housing and Real Estate

- Pensions

- Inflation versus Deflation

- Bonds

- Banks

- Corporate Scandals

- The Fed

- Europe

- Venezuela

- North Korea

- China

- Middle East

- Links in Part 1

Part 2

- Natural Disasters

- Price Gouging

- The Biosphere and Price Gouging

- Sports

- Civil Liberties

- Antifa

- Harvey Weinstein and Hollywood

- Political Correctness–Adult Division

- Political Correctness–Youth Division

- Campus Politics

- Unionization: Collum versus the American Federation of Teachers

- Political Scandals

- Clintons

- Russiagate

- Media

- Trump

- Las Vegas

- Conclusion

- Books

- Acknowledgements

- Links in Part 2

My Personal Year in Review

Who cares what an academic organic chemist thinks? I’m still groping for that narrative. In the meantime, let me offer a few personal milestones that serve as a résumé while feeding my inner narcissist. I remain linked into the podcast circuit, having had chats with Max Keiser and Stacy Herbert (Russia Today aka RT),5 Chris Martenson,6 Jim Kunstler (The KunstlerCast),7 Lior Gantz (Wealth Research Group),8 Anthony Crudele (Futures Radio Show),9 Susan Lustick (News-Talk 870 WHCU),10 Jason Burack (Wall St. for Main St.),11 Dale Pinkert (FXStreet),12 Lance Roberts (Lance Roberts Show),13 and Jason Hartman (Hartman Media Company).14 I also spoke at Lance Roberts’s Economic and Investment Summit discussing campus politics15 and the Stansberry Conference (Figure 2) arguing the merits of price gouging.16 I got into a big spat with the American Federation of Teachers and some local social justice warriors that made it to the national press (see “Unions”) and dropped 30 pounds unaided by disease.

“And, before anyone should doubt what a chemistry professor would know about unions and what effect they would have, it should be noted that Collum has amassed a following for his annual 100-page papers on the state of business and politics. Turns out, he knows a thing or two about economics and politics as well.”

~Joe Cunningham, RedState

Figure 2. The lovely Grant Williams, brainy Danielle DiMartino Booth, and one of the Paddock brothers in Las Vegas.

On the professional side, I had a great year: I finished my stint as department chair; started a sabbatical leave; broke my single-year total publication record; and broke my single-year record for papers in the elite Journal of the American Chemical Society. I attempted to extend a contiguous string of 20 federal grants without a rejection by submitting two NIH grants and subsequently got totally blown out of the water. (OK. I’m still walking that one off. I think the panel finally noticed that I am deranged.) I was accepted into an organization called the Heterodoxy Academy, whose membership includes hundreds of tenured professors standing up for free speech on college campuses.17

“My job is to write the exact same thing between 50 and 100 times a year in such a way that neither my editors nor my readers will ever think I am repeating myself.”

~Jason Zweig, Wall Street Journal columnist

Investing

“I dig your indefatigable bearishness, my friend.”

~Paul Kedrosky, one of the earliest bloggers

I’m sensing a tinge of Paul's sarcasm. My net worth from January 1, 2000, has compounded at a ballpark annualized rate of 7 percent. That’s not so bad, but the path has been rather screwy. From mid ’99 through early ’03, I carried cash, gold, silver, and a small short position. I kept buying gold through about 2005 (up to $700 an ounce), resumed in 2015, and bought several multiples of my annual salary’s worth in 2016. I’m done now. Gold is up 8 percent, and silver is down –2 percent in 2017 thanks to a minor end-of-year sell off. The spanking from ’11 to ’15 seems to have subsided.

Precious metals, etc.: 29%

Energy: 0%

Cash equivalent (short term): 62%

Standard equities: 9%

“Most people invest and then sit around worrying what the next blowup will be. I do the opposite. I wait for the blowup, then invest.”

~Richard Rainwater

I was totally blindsided by the downturn in gold starting in ’11 and energy in ’13. (Energy peaked in ’08 but was on the mend until ’13.) I bought energy steadily starting in ’01 with broadly based energy funds and a special emphasis on natural gas. The timing of entry was impeccable and all was going swimmingly—I was a genius!—until the Saudi oil minister attempted to talk oil down from $110 to $80 per barrel18 in '13. He thought he could blow the frackers out of the game fast, but it was a hold-my-beer moment for our credit system. The frackers kept fracking, the oil price overshot the Sheik's target by $50 per barrel, and I got whacked for 30–45% losses over four years starting in '14.19

It is impossible to know when you’re being a highly disciplined buy-and-hold investor—a Microsoft and Apple gazillionaire refusing to sell—or just an idiot. I sensed that the rotten debt had been purged and we were through the worst of the energy downturn. I worried that a recession could do a number on me, but it took years to get to my position through incremental buying. I’m holding on, goddammit! We seem to be running out of downside. Unbeknownst to me until October, however, my employer had liquidated my energy funds—every last one of them—and put me in a life-cycle fund in April. Sell ’em after they plummet? Thanks guys. A rational investor, if committed to hold them, would undo the general equity fund restrictions—I did—and buy the energy funds right back—I didn’t. Friends in high places all said to wait. About a week later, the Middle East erupted in what looked like a sand-to-glass phase transition (see “Middle East”), and energy started to move in sympathy. Peachy.

Fidelity actually saved me a little money, but I am still white-knuckling the cash, growing a long wishlist, waiting for a generalized sell-off/recession to offer some serious sub-historical-mean bargains (see “Broken Markets”). The correction in ’09 at the very bottom brought us to the historical mean, but not through it. For this reason, I have largely skipped this equity cycle. The current expansion is long in the tooth and founded on poor fundamentals. I hope that the wait won’t be too long. Until then . . .

“Remember, when Mr. Market shows up at your door, you don’t have to answer.”

~Meb Faber, co-founder and CIO of Cambria Investment Management

Economy

“A decade after the biggest crisis since the Depression, a broad synchronized recovery is under way.”

~The Economist, March 2016

Whoa! Fantastic! Goldilocks survived another bear. There is just one hitch: that was a total load of crap in 2016, and it’s a colossal load now. Let’s take a peek at a few gray rhinos—“large and visible problems in the economy that are ignored until they start moving fast.” GDP growth rates from 1930–39 and 2007–16 were as follows:20

GDP growth in the 1930’s

1930: –8.5% 1935: 8.9%

1931: –6.4% 1936: 12.9%

1932: –12.9% 1937: 5.1%

1933: –1.3% 1938: –3.3%

1934: 10.8% 1939: 8.0%

GDP growth in the new millennium

2007: 1.8% 2012: 2.2%

2008: –0.3% 2013: 1.7%

2009: –2.8% 2014: 2.4%

2010: 2.5% 2015: 2.6%

2011: 1.6% 2016: 1.6%

Whether you use the arithmetic or geometric mean, both gave us 1.3 percent annualized growth. Let’s spell this out: during the recent era in which markets soared, the economy tracked the Great Depression. It is instructive to look at the economy with a little more granularity than the writers at The Economist-Lite.

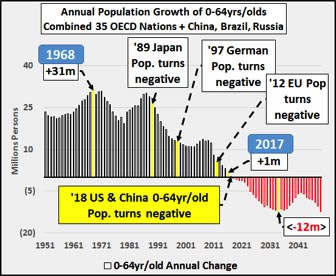

According to John Mauldin, total domestic corporate profits have grown at an annualized rate of just 0.1 percent over the last five years.21,22 Goldman’s Abby Joseph Cohen says R&D spending is down to 2.5 percent of GDP from 4.5 percent and is a drag on the economy.23 Economic bellwether General Electric saw revenue drop 12 percent and earnings fall 50 percent year-over-year,24 and these numbers are aided by the company’s legendary creative accounting schemes.25 Meanwhile, corporate America witnessed a 71 percent rise in business debt since 2008. According to economist Lacy Hunt, “It’s the investment, the real investment, which grows the economy,” prompting the legendary market maven @RudyHavenstein to state dryly, “I like Hunt.” Where are they spending all that borrowed money? Hold that thought. Long-term demographic problems—“quantitative aging” (Figure 3)—exacerbated by dropping sperm counts26 suggests the economy will continue to shoot blanks.

Figure 3. Demographics looking sketchy.

Putative job gains affiliated with this low growth are fragile if not dubious as hell and are being boosted by the “Dusenberry effect”—consumers’ reluctance to stop spending even after their income drops—which will cause the next recession to be a real Dusey. (Sorry.) Eventually, common sense prevails as companies run out of credit and savings-deficient consumers reassume the fetal position. According to extensive work by Ned Davis Research, cash levels among households are near their lowest levels of all time; consumer resiliency is always temporary.

“When it is all said and done, there are approximately 94 million full-time workers in private industry paying taxes to support 102 million non-workers and 21 million government workers. In what world does this represent a strong job market?”

~Jim Quinn, The Burning Platform blog

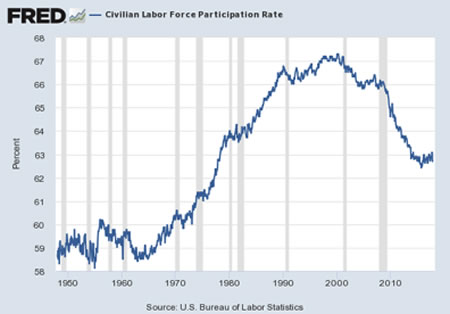

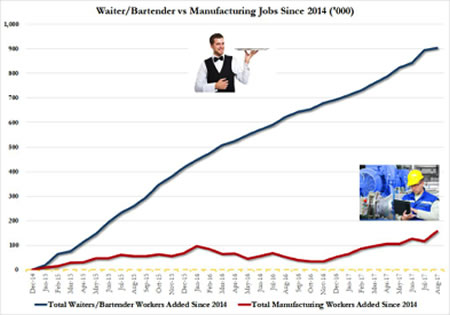

The Bureau of Labor Statistics has turned to Common Core math. How can we have 100 million working-age adults—40 percent of the working-age population—not working, 4 percent unemployment, and employers claiming the labor market is tight? Are 90 percent of those without jobs professional couch potatoes? Let’s first look at employment in some detail and then address that whole “tight” part. Googles of pixels have been dedicated to the obligatory labor force participation rate (Figure 4), a critical component of any economic debunking. Of those employed, 26 million people are in low-wage, part-time jobs (Figure 5), 8 million hold multiple jobs, and 10 million are “self-employed.”27 Another 21 million work for the government, which means they are a tax on the free market. In 2016, 40 percent of new jobs were fabricated through the specious “birth and death model.”28 2017 will presumably post similar numbers. Occasional reports of large job growth are deceptive. July, for example, witnessed 393,000 benefit-free, part-time, low-skill jobs offset by a drop of 54,000 full-time workers. Payroll numbers keep coming in lower than expected, which economists invariably blame on some big, yet unseen effect they are paid to notice. Nine out of 10 millennials living on their parents’ couches a year ago are still clutching TV remotes.29 There are now 45–50 million Americans on food stamps, up from 14 million in December 2007,30 when the last recession was already underway.

Figure 4. Labor force participation.

I am going to let Jeff Snyder take a crack at explaining the tight labor market:31

“The economy is tight, not favourably tight as in no slack in the labour market, but more so tight in that there is little margin for addition. . . . The reality in the markets is this: executives are reluctant to pay wages at a market-clearing rate.”

~Jeff Snyder, Alhambra Investments

Figure 5. Low-paying service jobs versus manufacturing jobs.

Poor economic numbers are pervasive. Auto sales are canaries in the coal mine and getting crushed despite aggressive incentives.32 Ford is already suffering and predicting a multi-year slowdown.33 A car industry crunch analogous to that in ’09 may appear in ’18 as expiring leases leave consumers underwater owing to dropping used car prices, and decreasing profits in the auto industry may “then turn from secular to structural problems.”34 Morgan Stanley predicts a 50 percent drop in used car prices over the next 4–5 years,35 which will gut the new car business. The auto downturn has already begun. Wells Fargo is reporting large drops in auto loans after a long stretch during which subprime car loans flourished yet again.36 That should put a fork in the new car market.

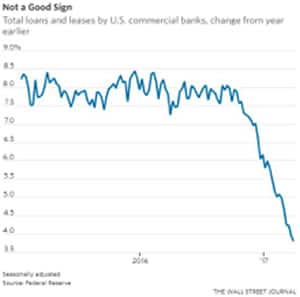

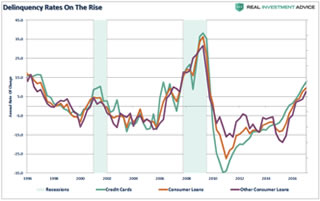

Yield-starved investors are chasing cash- and income-starved car buyers. Subprime auto-asset-backed securities will take yet another beating. Chrysler is teaming up with Santander Consumer USA to push out “unverified income” subprime auto loans using “automated decision making.” Santander seems to have nine lives, and they’ll need all of them. The hyperdeveloped loan market for used cars, however, is already faltering (Figure 6); delinquency rates are rising. Goldman expects “challenging consumer affordability” and has downgraded General Motors to “sell.”37 Those cars y’all bought on cheap credit yesterday will not be bought tomorrow. Claims that the hurricanes cleared out auto inventory38 are grotesquely underestimating the magnitude of the overhang and will be paid for by reduced consumption in other sectors. Any consumption pulled forward with debt has a deferred cost.

Figure 6. Some key auto industry stats (a) loans and leases, (b) loan delinquencies.

We’ll take a crack at the housing market in its own section and simply note here that the cost of renting or buying normalized to income has never been higher. Approximately half of tenants spend more than 30 percent of their income on rent, doubling from a decade ago.39 A survey of 20 cities showed that housing costs are growing at a 6 percent annualized pace. Our paychecks are not. Housing is a bubblette and likely to offer fire-sale bargains again. What many fail to grasp is that the reduced cost of borrowing owing to low rates is offset by higher prices. When interest rates were 15 percent, houses were cheap.

Austrian business cycle theory says easy money policies generate overdevelopment and other malinvestment. The day of reckoning appears to be here. (I say that every year…channeling Gail Dudek.) Familiar brands like Toys “R” Us (my keyboard has no backwards R), JCPenny, Abercrombie & Fitch, Sears, Bon-Ton, and Nordstrom are gasping their last gasps before drowning in debt with no customers to save them. Total retail revenues and sales (including online) are up only 28 percent from the 2007 high.40 The management of Ascena Retail referred to an “unprecedented secular change.”41 More than 100,000 retail jobs have vaporized since October 2016.42 Credit Suisse estimates that more than 8,000 retail outlets closed this year.43 Consumer goods companies have held up better because consumers generally put off starving or freezing to death until all options are exhausted. Restaurants are extending the longest stretch of year-over-year declines for 16 consecutive months (last I looked).44 Business Insider blames millennials because they are “more attracted than their elders to cooking at home” (particularly when it’s their parents’ home.) Manhattan retail bankruptcies are called “horrifying.”45

Chapter 11s and company reorganizations in foreign courts increased sevenfold.46 Mall owners are using jingle mail—a term from the ’08–’09 crisis referring to leaving keys to creditors. Commercial retail will be coming into its own refinancing wave in 2018. Bears are sniffing around commercial-mortgage-backed securities as malls around the country begin to die.47 The next downturn will finish many of them off. Exchange-traded funds (ETFs) are positioning to short the brick-and-mortar retail. (Quick: somebody grab the ticker symbol “MAUL.”) Some suggest the Rout in Retail is merely a secular shift to online. Sounds logical except online sales represent only 8.5 percent of total retail sales.48 This argument might be masking a huge downturn in retail corresponding to the bursting of yet another Fed-sponsored bubble.

As Amazon encroaches on every nook and cranny of retail sales, what began as a murmur has turned into a chorus: “This isn’t fair; somebody must do something!” Walmart knows this plotline. Market dominance does not connote “monopoly,” but Amazon has an image problem. Amazon gets a $1.46 subsidy (discount) per box from the USPS, well below its cost.49 Seems cheesy. Congress is showing concern out of self-interest. A monopoly is when a company uses its power to blow its competitors out of the water garishly. Who decides what is garish and when enough is enough? A judge under political pressure. A detailed summary of the breadth of Amazon’s market share and its anti-competitive pricing suggests that we are getting close.50 There’s nothing like a protracted anti-trust suit to mute the growth of a large conglomerate. Just ask the Microsoft high command.

If our problems are not Amazon, what are they? Austrian business cycle theory says that our debt-driven, consumer-based economy endorsed by sell-side economists and analysts worldwide is unsustainable. Wealth is made, mined, grown, or coded, only then do you get to consume it. Wealth is extinguished by consumption, depreciation, and destruction. Central bankers seem to believe you can will wealth into existence by generating animal spirits.

The next recession will start unnoticeably. Economists seem to miss every single one, often declaring telltale indicators irrelevant. Then you will hear phrases like “technical recession,” “growth recession,” or “earnings recession,” all eventually giving way to somebody opening the Lost Arc. If the next recession flushes the waste products (malinvestment) left behind by the central-bank-truncated ’08-’09 recession, it w

This is a companion discussion topic for the original entry at https://peakprosperity.com/2017-year-in-review/