The 1st thing you want to do is place the Attorney General.Next,you have your daughter pulled out of opiate enforcement and into the Financial Crimes Enforcement Network.(they are tasked with investigating money laundering)And finally have son-in-law Tyler McGaughey placed as White House Council.Gotta love family…

Michael Every, Rabobank’s Head of Financial Markets Research Asia-Pacific, shares my view on today’s bizarro markets:

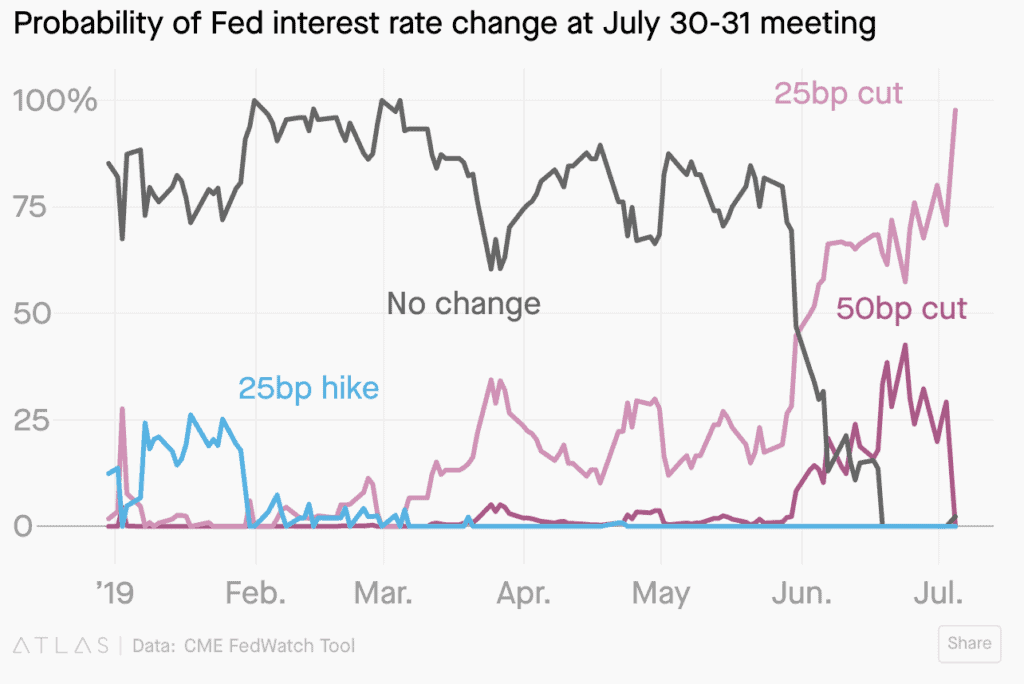

If one ever wanted a perfect example of just what a mess we are in globally, look at the market reaction to Friday’s payrolls data. Even with the caveats offered in the last Daily (that the data are an often-revised, backwards-looking, lagging, and artificial “birth-death model” statistical rounding error) what we saw was a very healthy report. Jobs rose 224K vs. 160K expected, even though the unemployment rate rose a tick to 3.7% and wage pressures again remained absent. In short, despite genuine fears of recession ahead, these often-revised, backwards-looking, lagging, and artificial “birth-death model” statistical rounding error say that all is well and hence the economy--on the surface--is just fine. That should have been a gift to the Fed presented on a silver plate – but it wasn’t. Why? Because post-release, US Treasury yields naturally went up again, with 10s back to around the 2% level… and yet US equities went down, while USD also went up. So it would seem the crucial stock market and its presumed rational pricing basis of a projected flow of future corporate earnings would rather have juicy rate cuts than a healthy US economy. Which, as I said, speaks volumes about where we are now globally. And it also risks presenting the Fed’s head on a silver plate. Just what is the Fed supposed to do now? On the measures they look at the outlook is good and trade wars aren’t escalating (yet); interest rates are still very low by historical standards; those all-important equity markets remain close to record highs. So is Fed Chair Powell, who testifies this week, going to make clear that while he is ready to step in if needed, right now he isn’t? If so, can we expect an apple in his mouth? Equity markets want those rate cuts.Markets are continuing to sweat this month's upcoming Fed announcements. Investors want to see bad data, so that Papa Powell will ride to the rescue with more delicious liquidity. But with record-high asset prices and booming jobs, can Powell justify the cuts the market is counting on? Heading into July, investors pegged the odds of a 50 basis point rate cut near 50%. Friday's number put a bullet in those hopes: Market prices need to adjust downward a lot further for that change in expectation. They haven't yet. Also, how can Powell justify the now-baked-in expected 25 basis point cut? Prices are sky-high, inflation is very low (by the Fed's yardstick), and jobs are a-rockin'. What is the rationale for cutting here when rates are already so historically low? And if Powell decides he can't justify cutting and surprises investors by keeping rates unchanged, that could be the pin that causes the next market correction.

Where to from here? It all depends on what investors think Powell will do next:

Jack Coles is still in prison, isn’t he, for trying to identify quakes through electromagnetic signals?

And we KNOW some rocks (including quartz) are piezoelectric, or STM microscopes wouldn’t work; and we KNOW some rocks are piezoluminescent; and yet the establishment is so intent on forcing the position that Temblors Cannot Be Predicted™, that they must send people to jail who don’t toe the line.

A Great Day For Science (also TM).

Mike from Jersey -

“As a kid I was required to “pledge allegiance to the flag” each morning in school. A culture that valued freedom would have taught children to pledge allegiance to the “Bill of Rights” or to a functioning democracy. A culture that valued critical thinking would have encouraged examination and criticism of government and corporate action.

Love your comments. Pledging allegiance to the symbol of the real thing, instead of the real thing itself is the same type of error as muddling claims on real wealth with real wealth, itself. An error in thinking that keeps us from looking at and talking about what matters because we’re focused on the wrong level.

It is my understanding that Deutsche Bank (DB) is too important a globally interconnected bank that poses such an acute systemic risk that TPTB will not let it fail. I am not a financial expert, but my “un-educated” guess is that the central banks (CBs), now as the Buyers-of-Last-Resort, will somehow buy/subsume those bad DB “assets” either directly or indirectly. Being completely jaded as to the blatant, pervasive and ongoing manipulation of the financial “markets”, I would not be surprised if insolvent DB’s latest strategy has been already known and agreed up by DB, Central Banks and…TPTB.

Who else in their right mind would buy those toxic DB assets–including tranches of derivatives with unknown but potentially massive, exponential risk/debt to the downside???

Given this Barzarro world where up is down, and bad news = higher stock indices, one might expect that DB shares would actually increase due to this latest (smoke and mirrors) plan. You can bet that some DB high-level execs are poised to cash-in/cash-out on their options, while investors and 18,000 DB employees scramble to salvage what they can from this financial debacle.

DB’s and Central Banks’ strategy will only delay the inevitable market correction/collapse and world-wide financial contagion (with social uprising) to follow.

ht Time2Help

Begins at 46:35, if you want to hear Dr Null’s 5G report you can back it up.

https://youtu.be/RgfzfSFQpwA?t=2795

I don’t get it, what is this? This isn’t a real tweet.