If Martians land in my backyard, the space shuttle lands safely inside my 50’ round pen without hitting any cattle panels, and I win Powerball five times in a row without buying a ticket, it’ll be negative because destroy the economy to save it. I have no idea why I feel that way since 2008.

Warren Buffet’s take on silver. (34 min)

.

.

Bottom line, be careful out there.

Oops.

https://x.com/SwanDesk/status/1992283931841114381

Grok says it means this:

Bitcoin mining is like a giant competition where people (or companies) use powerful computers to solve complex math puzzles. This helps secure the Bitcoin network and process transactions.

In return, miners get paid in new bitcoins and fees.“Hashprice” is basically a measure of how much money miners earn per day for every unit of computing power they contribute (specifically, per “petahash per second,” which is a huge amount of processing speed).

Think of it as the daily paycheck for your mining rig’s effort.This message is saying that right now, that paycheck has dropped to an all-time low of about $34.49 per petahash per second—the lowest it’s ever been in Bitcoin’s history.

It’s fallen more than 50% in just a few weeks, which is even worse than during big past crises, like when China banned mining in 2021 (forcing many operations to shut down or move) or the 2022 crypto crash (when prices tanked overall).

As a result, many miners are losing money fast because their electricity and equipment costs are higher than what they’re earning. This could force them to sell off the bitcoins they’ve already mined to cover bills, or even shut down their machines entirely.

That selling pressure might push Bitcoin’s overall price down further, and fewer active miners could temporarily make the network less secure until things adjust.

I wouldn’t know, this isn’t my area, but what happens if/when the miners stop mining? Can Bitcoin still Bitcoin?

What does Warren Know?

BitCoin goes to ZERO??

36 minutes

Since I’ve mined a number of blocks, I have a sense for how the mining economy works.

If there are 100 miners trying to mine a block, the fastest one to (calculate) the code gets the win. In that environment, if the miner tech is the same speed for each miner, a miner has a 1:100 chance to mine each new block. Energy spend remains constant.

So if 90 miners drop out because “declining bitcoin price”, then the 10 remaining miners have a 1:10 chance to mine each new block. So that’s a 10-bagger for the remaining miners, minus the dropping price. So as long as its not a 90% drop in price, it should be fine. And even if that happens, maybe 5 miners remain, and so they still do just fine.

There is a disclaimer in the first few seconds so watch closely or you might miss it:

“DISCLAIMER

This content is inspired by Warren Buffett’s public investment philosophy and teachings

But is NOT created by, endorsed by, or affiliated with Warren Buffett or Berkshire Hathaway.

We use TTS voice technology to present this educational analysis.” (and the disclaimer continues)

That sounds like:

The speaker is not Warren Buffett.

The message is not from Warren Buffett.

The message is not from Berkshire Hathaway.

The picture appears to be a picture of Warren Buffett.

The message does not state that the audio is Warren Buffett’s actual voice recording.

Read the warning carefully, and everyone do your own due diligence.

There is a disclaimer in the first few seconds so watch closely or you might miss it:

“DISCLAIMER

This content is inspired by Warren Buffett’s public investment philosophy and teachings

But is NOT created by, endorsed by, or affiliated with Warren Buffett or Berkshire Hathaway.

We use TTS voice technology to present this educational analysis.” (and the disclaimer continues)

That sounds like:

The speaker is not Warren Buffett.

The message is not from Warren Buffett.

The message is not from Berkshire Hathaway.

The picture appears to be a picture of Warren Buffett.

The message does not state that the audio is Warren Buffett’s actual voice recording.

Read the warning carefully, and everyone do your own due diligence.

What happens if 99 miners drop out… how does the system survive?

Just guessing, this means that the time to solve a block just went up by some factor? 9 or 10?

The Bitcoin ecosystem requires a LOT of energy for the mining operations. So energy = time in this equation.

Fewer miners = less energy = more time.

Is this an issue, or are the block solutions running speedily enough that nobody would really notice or care?

The setup targets an average mining time of 10 minutes, based on how long it has taken to mine the other recent blocks.

https://bitcoin.stackexchange.com/questions/67623/could-i-theoretically-mine-a-block-faster-than-10-minutes

“This is somewhat unrelated to the randomness, because a more powerful computer can try more hashes anyway so is more likely to find a valid block sooner, yes. But this is the purpose of the mining difficulty. The difficulty changes once every 2016 blocks to keep the time roughly 10 minutes average. If blocks are mined too quickly, the difficulty will increase so it again takes 10 minutes on average.”

So if most of the miners disappeared, the system would adjust to make sure mining time remained on average about 10 minutes - by reducing difficulty, less energy is consumed.

My guess: the difficulty has been adjusted to be very high right now (= more energy used) because there are so many miners. It has been adjusted this way automatically by the system.

If you think about it this way - bitcoin was being mined back when coins were $10. It will re-adjust to this if necessary, as the miners drop out, by reducing difficulty.

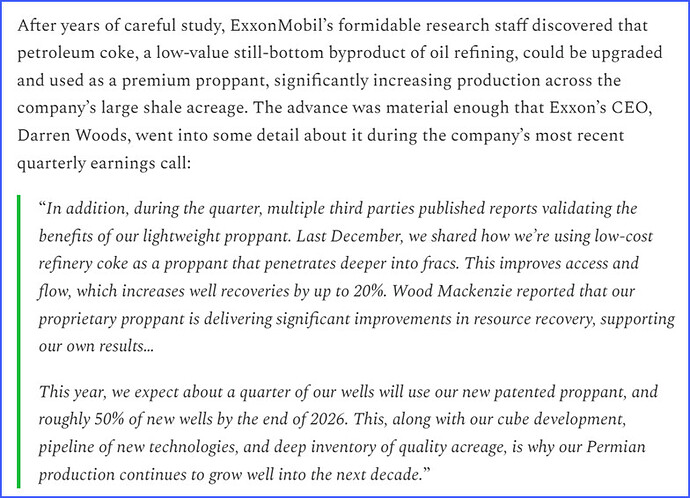

Some of the evidence used by Chris regarding this bubble is his belief we are running out of oil. He sometimes quotes poorly respected government data regarding reserves and extrapolates forwards. But he does not look at all the technological advancements along with new discoveries. Here we have the price saying we are incredibly well supplied and Chris states the opposite. He has been wrong for years on this subject. The fact is the is plenty of oil and it is in many cases politics alone that keeps us from exploiting it. Here is a quote from the CEO of XOM. The advance was material enough that Exxon’s CEO, Darren Woods, went into some detail about it during the company’s most recent quarterly earnings call:

“In addition, during the quarter, multiple third parties published reports validating the benefits of our lightweight proppant. Last December, we shared how we’re using low-cost refinery coke as a proppant that penetrates deeper into fracs. This improves access and flow, which increases well recoveries by up to 20%. Wood Mackenzie reported that our proprietary proppant is delivering significant improvements in resource recovery, supporting our own results…

This year, we expect about a quarter of our wells will use our new patented proppant, and roughly 50% of new wells by the end of 2026. This, along with our cube development, pipeline of new technologies, and deep inventory of quality acreage, is why our Permian production continues to grow well into the next decade. ”

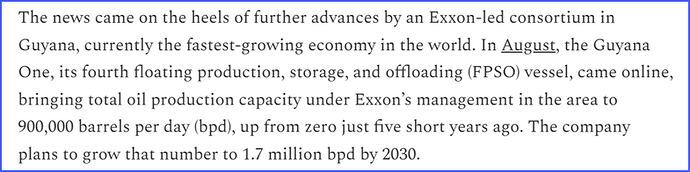

And yet Chris says the Permian is going to start an inevitable production decline soon. My money is on the genius of man and the power of capitalism to keep us well supplied. Below is yet another massive oil find.

The news came on the heels of further advances by an Exxon-led consortium in Guyana, currently the fastest-growing economy in the world. In August, the Guyana One, its fourth floating production, storage, and offloading (FPSO) vessel, came online, bringing total oil production capacity under Exxon’s management in the area to 900,000 barrels per day (bpd), up from zero just five short years ago. The company plans to grow that number to 1.7 million bpd by 2030.

One issue is energy return on getting the oil. We can agree there is a YUGE amount of oil remaining, but if it costs 1 unit of energy to get 0.5 units of oil, its probably not a great idea to do it. I sure wouldn’t invest in the company that tried this.

When I did an analysis long ago, I saw how quickly the “energy return” was dropping. Oil in the ground wasn’t gone, it just was getting a lot more expensive to get it out.

I don’t know what EROEI is now, but it used to be 30-50x, and then it dropped to somewhere around 5x, because the wells deplete about 30-40% in 1 year rather than the old wells which had a 30 year lifespan.

Do you have stats on Permian well lifespan, and EROEI?

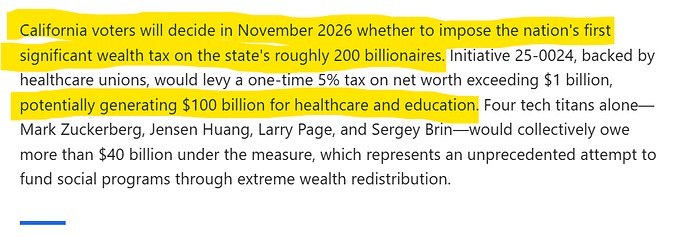

Next year, its a 5% “one-time” tax on Millionaires.

Year after that, its a 5% “one-time” tax on Hundred-thousand-aires.

Year after that, its a 5% “one-time” tax on Five-hundred-aires.

Then French Laundry makes it permanent - along with an Exit Tax of 20%.

Sounds like you’ve been reading Doomberg. Always best to source your sources, so it doesn’t appear like you are cribbing someone else’s work and representing it as your own.

You know, just to be clean and clear about it.

Here are two snippets from Doomy’s latest, just for comparison:

Hmmmm…those are exactly “your” points word for word. Weird. If you stick around, you’ll find we don’t abide integrity lapses for very long, and failing to attribute is a major lapse.

Next:

Some of the evidence used by Chris regarding this bubble is his belief we are running out of oil.

Wrong.

I never say “we’re running out of oil.” I always speak of Peak Oil as a peak of maximum flow rates.

Which is because, you know, that’s what it is.

But I can feel your emotions from here. Which is fine, but that means it’s up to you to discover where you have a belief system.

My belief system is that making oil cheaper using paper market control merely makes it cheaper for a while, which - Jeavon’s alert!! - makes people want to use more of it and more quickly, not less:

I had one thought, conspiracy category for now: can AI datacenter boom be cover for bitcoin reserve world dominance(suggesting “AI” is marketing term for general public holding anything and everything under the sun what they can actually do in those) ?

In one chart China and US were competing for 1st place who has biggest holdings. As gold is tough for US, could it be bitcoin they seek to rule…