For the record, I still believe that there will not be a breach of the debt ceiling and no overt default for the US. Things will be worked out in the nick of time, like they always are.

For the record, I still believe that there will not be a breach of the debt ceiling and no overt default for the US. Things will be worked out in the nick of time, like they always are.

However, the media is full of articles wondering about what ‘investors’ might do in response to a US default and/or credit downgrade. What will happen to Treasury prices? Will they go down as investors dump them en masse in response to a credit downgrade forcing interest rates to climb?

It’s a big question, and the most likely answer is “No, not really”. Partly because these so-called investors have been well-conditioned to believe that another bailout is always around the corner, but mainly because they have nowhere to go.

The big money is trapped.

For example, imagine that you are in charge of a money market fund with $100 billion under management, your job is to both cover your expenses and assure a return for your depositors, and you are heavily invested in US Treasurys. Or imagine that you are in charge of a public pension with $200 billion under management, with the same basic concerns of managing expenses and delivering returns, plus a heavy exposure to US Treasurys but with a much longer time horizon.

In either case, in light of the possibility of a US default, what would you do? Where would you put your money right now if you were suddenly of the mind that the $50 billion you had in Treasurys should be placed somewhere else? In reality, there are not that many places to quickly move such large sums of money. Further, there might be fiduciary restrictions that limit your investment options to regions, securities types, and/or ratings grades, or there might be a minimum liquidity requirement for the investment pool.

So let's imagine that you have to make very large and important financial decisions and that you have to put your money to work; it's an actual fiduciary or operational requirement of yours. An excessive amount of cash is not an option, and neither are hard assets such as land, gold, or silver. Where would you put it? What realistic options exist? It turns out there are not that many.

The Treasury market is the largest and most liquid in the world, by far. For many big money funds there really aren’t any realistic options other than the Treasury market, and this present reality will limit the market reaction to any downgrade.

A Foul Choice

With interest rates on 'safe' sovereign debt at or near zero on the short end and well below the rate of inflation on the long end, safe bonds offer a negative real yield (meaning a yield below the rate of inflation). This is a compounding disaster for everyone, but especially for pension funds with their longer time horizons. Worse, we now know sovereign debt can no longer be considered safe (even the US is facing a downgrade threat) - which means that on a risk-adjusted basis, the returns are even more unattractive than the negative real yields on offer.

On the surface, the choice that Bernanke has engineered for investors is between guaranteed losses via the miracle of negative real compounding and taking on more investment risk. But he’s managed to combine both negative returns and risk into a very unattractive investment brew.

Most big money funds have opted to take on more risk rather than suffer such low returns (who could blame them?) and have done so by going to where the yields happen to be. This means buying up corporate paper and European debt, both of which have far more risk than their nominally more attractive yields would imply. For individual investors, especially savers and those living on small incomes tied to interest rates, the negative interest rates have been especially difficult, if not an outright disaster.

Once again, we can thank Ben Bernanke et al for driving interest rates into punishingly-low territory, forcing everyone with a desire or responsibility to save and invest to either lose to inflation or to take on more risk.

Part of the goal behind ultra-low interest rates was to drive money back into the stock market, which the Fed has been specifically and openly targeting in both word and deed. It is a well known fact that low interest rates are supportive to the stock market, and so far that strategy has worked.

On the flip side of this success is the fact that a lot more risk has been forced into the system. When prices are artificially distorted to the upside for stocks or bonds, then it is axiomatic that risk becomes mispriced.

Having to choose between mispriced risk and negative returns is truly a foul choice indeed.

The Deficit Theatre

All of this brings us to the current sad state of affairs now put into high relief by the deficit talks in DC, which should be more properly viewed as political theater rather than a legitimate attempt to square the federal budget up with reality. If the talks were truly legitimate, then on the expense side, everything would be on the table, especially and including defense spending, and a balanced budget amendment would not be a source of contention but a mutually agreed upon goal.

Instead, the Democrats are willing to entertain higher spending cuts in the vicinity of $250 billion per year as long as they can have a debt ceiling increase that would get them safely past the 2012 elections. Conversely, the Republicans, as represented by Boehner, are ready to concede to relatively meaningless spending cuts in the vicinity of $100 billion per year as long as they can force the debt ceiling to be an issue for the 2012 election cycle:

Mr. Reid, the Senate’s top Democrat, was trying Sunday to cobble together a plan to raise the government’s debt limit by $2.4 trillion through the 2012 election, with spending cuts of about $2.5 trillion. He would seek to avoid cuts to entitlement programs, but it was unclear how those savings would be achieved.

Notably, the plan does not currently contain any new or increased taxes, an approach that many in his caucus would probably balk at.

The contours of Mr. Boehner’s backup plan were far from clear, but it seemed likely to take the form of a two-step process, with a short-term increase in the debt limit along with about $1 trillion in cuts, an amount the Republicans said was sufficient to clear the way for a debt limit increase through year’s end. That would be followed by future cuts guided by a new legislative commission that would consider a broader range of trims, program overhauls and revenue increases.

(Source – NYT)

In just looking at the proposed levels of deficit reduction, whether it's $1 trillion or $2.5 trillion, neither plan will drop the deficit enough to prevent the US from slipping deeper and deeper into the red. The true drivers of the debate, such as they are, center on political advantage and power. Count us among the unsurprised at this turn of events.

It would be nice - essential, even - to have enough information to go on to really assess the true dimensions of the deficit reduction proposals. But even for a committed analyst like myself, there’s just too little detail to make a decent analysis of any of the competing packages.

However, we can be almost certain that their baseline assumptions about GDP and revenue growth that undergird the putative future deficit levels are unrealistic. They always are in these sorts of circumstances, which means the amount of future savings being bandied about is unlikely to be as robust as claimed.

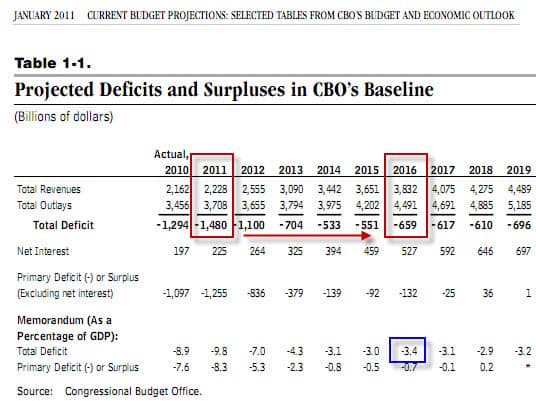

For example, the most recent CBO budget projections (the foundation upon which the deficit reduction proposals are most likely built) assume that over the next 5 years (2011 – 2016) revenue will grow at a compounded rate of 11.4% per annum (!), expenses by 3.9%, and GDP by a whopping 4.95%.

Per year.

(Source)

These assumptions are just silly. Costs have risen much faster, and revenue and GDP far slower, over the prior five years, and if these pie-in-the-sky projections do not come to pass, then all of the deficit numbers will blow out to the upside in those future years.

For example, if we assume that GDP growth is 2.5% per annum instead of nearly 5% (and that revenues are tied to GDP), and that revenues will therefore 'only' increase by 5% per annum (both completely reasonable assumptions at this stage), then the additional cumulative deficit that will accrue between 2011 and 2016 is $2.7 trillion dollars.

This will completely eliminate all of the projected savings from even the most agressive of the proposals on the table. Is this unlikely? No, in fact these are a far more defensible set of assumptions than those currently being put forth by the CBO.

To really make a mockery of the current budget projections, there is absolutely no chance of the government both cutting its share of GDP by 2% per year and having the GDP grow by nearly 5% per year. Implied is a rate of economic growth in the private sector that would be truly extraordinary. Further, there is no chance of revenue climbing by more than 11% per year over the next five years without an enormous increase in taxes, which neither party is currently proposing.

In short, without knowing the underlying assumptions that are driving the projections, we cannot say much about the proposals themselves. All I can tell you for sure is that for as long as I have been crunching government numbers, taking their rosy projections and cutting them in half has always been a reliable and reasonable starting point.

A Dawning Awareness

What should not be lost on anyone is the degree to which some of the biggest names in the financial world are starting to openly question fiat money and the entire system of debt itself. They’re even doing it on prime-time TV and on the op-ed pages of the largest newspapers.

Again, by the time we are seeing such open questioning of the very firmament of the entire system, this tells us something about how far along in the narrative we really are. Just a few years ago, such talk would have been relegated to the very fringes of the blogosphere.

Here are a few recent examples:

Debt talk damage has already been done

As Washington dithers over raising the nation's debt ceiling, investor confidence is flowing away.

"The issue is not just whether Moody's or Standard and Poor's were to downgrade (U.S. Treasury debt), it's whether the market decides to downgrade," said Rochdale Securities bank analyst Richard Bove.

"If they lose faith in the Congress and the government to, in essence, create a solid security for the buyers of that security, then you get the downgrade," he said.

The sentiment was echoed overseas, where many countries hold U.S. Treasuries as an investment. "An adverse shock in the United States could have serious spillovers on the rest of the world," warned Christine Lagarde, the managing director of the International Monetary Fund.

"We live in a highly interconnected international financial world that is really based upon confidence," said financial services industry lobbyist Paul Equale.

"And without confidence, both domestically and internationally — that the United States is mature enough and has a system that can handle making the big decisions — without that confidence we're going to see things like the dollar becoming less important as the world's reserve currency."

Debt-based fiat money relies on multiple levels of confidence. There has to be confidence that the money will not be over-produced in response to every perceived crisis (oops), that its allocation is justified and fair to all parties when it is placed into circulation (oops, again), and there has to be confidence that the future will be exponentially larger than the past to justify ever-increasing levels of debt (this is the big ‘oops’).

We are drawing ever closer to the simple recognition that endless growth is neither possible nor a reasonable expectation. There are even doubts now that growth as we’ve recently known it will return for one last cameo appearance over the next five to ten years.

With the evaporation of that all-important narrative of growth, everything else becomes immediately suspect, especially money itself.

Sometimes you will hear or read someone exclaim that ever since the slamming of the gold window in 1971, US dollars are not backed by anything. This is not true; they are backed by debt. Debt is an incredible motivator and assures that the person, entity, or country under its yoke will dedicate some portion of their productive efforts towards servicing that debt.

Another Big Round Number (and a Nice Symmetry)

On August 15, 2011, we experience the 40th anniversary of the slamming of the gold window back on the same date in 1971. Perhaps we should all bow our heads and have a silent moment to mark the occasion.

Interestingly, that’s almost exactly the date, give or take a few days, on which the US Treasury will run out of money here in 2011:

“We don’t think there will be a default,” Ahrens, head of U.S. rates strategy for UBS in Stamford, Connecticut, said yesterday in a telephone interview. He estimates the Treasury has enough cash to make all payments until Aug. 8-10.

(Source)

Forty years has passed between a final abandonment of the last vestige of external restraint on money/credit creation and the dawning recognition that the US has simply gone too far, spent too much, and is now in an enormous fiscal predicament. In the annals of history, that's just about right for the lifespan of a purely fiat currency.

Mark the date on your calendars: We’ll certainly be observing the anniversary here at PeakProsperity.com. Forty is a big, round number, and is therefore important.

So what's likely to happen to the dollar and key asset classes in the aftermath of the looming August 2 deadline? In Part II of this report, What Should Happen and What Will Happen, we analyze the probable future direction of stocks, bonds, precious metals, commodities, real estate, and other assets. Additionally, we assess the odds of a resumption of quantitative easing by the Federal Reserve, and what changes to the picture that will cause when/if it occurs.

Click here to read Part II of this report. (free executive summary, enrollment required to access)

This is a companion discussion topic for the original entry at https://peakprosperity.com/debt-ceiling-dilemma-the-foul-choice-facing-investors-2/