what will be desirable. Based on what I am seeing in my immediate heighborhood, investors should know that there is a trend towards multi-generational, single-family (according to code) homes. I live in what used to be a fairly basic middle-income neighborhood. It is now changing before my eyes even though I’ve only lived here for 2.5 years. The house across the street was occupied by 2 women – a mid-late 80 year old and her daughter – when we bought. The older woman died and the estate put the house on the market. The house was eventually bought by a family that currently has at times as many a three generations living there with one couple likely trying to make it four. (The home went from one car in the driveway to 7-8 vehicles everywhere.) Within 3 houses on either side of us there are 3 multi-generational households. 2 with disabled offspring (adults) and 1 with a father living with his son or daughter. Although multi-generational housing has been around for generations in ethnic neighborhoods it has traditionally not existed in most middle-class neighborhoods.

Multi-generational housing – even in a single-family coded neighborhood – will become the norm as the middle-class gets squeezed. Disabled children will become more likely as we continue to use GMOs, pesticides, and herbicides that should have all been rejected through the wisdom of the precautionary principle.

In a recent interview with Richard Dolan, CAF talks about the missing money and a bunch of other things. But buried in the interview was her oft-made observation about how the theme of Mr Global’s operation: centralizing profits.

And that's what Amazon has done. They've centralized the profits. Same with Google. Same with Facebook. Same with Wal-Mart. The net effect is to strip customers and profits from local businesses, and turn what used to be small business owners with agency into cogs working for The Big AI Machine. If we project this forward, in 20 years, Amazon will have turned into The Company Store, and it will have destroyed local retail, and it will also be in position to strip profits from all the providers of the actual products, since Amazon will utterly control the delivery channel to the customer. In this situation, product-providers will have to pay some variable percentage of their profits to Amazon, the only channel that remains in existence. Amazon's AI will calculate what you must pay with unerring accuracy, since it will know your balance sheet and income statement, and the AI will leave you just enough profit to limp by. They will also personalize prices to the customer - because they know just how badly each customer wants whatever-it-is. Like facebook, Amazon (Alexa!) will know you better than your mom. The Amazon AI will be fantastically good about stripping the maximum amount of profit from both ends of the chain, handing it over to Jeff Bezos. Oh and Bezos, Richest Guy In The World, owns his very own propaganda site, The Washington Post. I suspect this is just the first site of many. Perhaps the New York Times will be next. Or maybe CNN. Clever fellow, Bezos. To my mind, Amazon needs to be taken down. It is way too powerful. So while I suspect New York probably missed out on a reasonably big gravy train, the larger question is, should such a gravy train even exist? For me, the answer is no. New York already has one such gravy train - the collection of banksters downtown - which it assiduously protects from harm. Armstrong goes on and on about how you can't hope to win any sort of lawsuit against the banksters in any New York court. He should know, he's had personal experience. Anyhow, that's just my Amazon Thought For The Day. I humbly submit a new tagline for the Bezos WAPO: "Democracy Dies When The Press is Owned By The Oligarchs".That was pretty dark (can’t disagree with anything you said). Please give us some humor to relieve the stress when you hit the dark nails on the head like that! We can always hope for an EMP to destroy Amazon’s business model and renew our need for local merchants and producers.

Amazon’s headquarters may pay high salaries, but remember that the workers in their distribution hubs are ‘enslaved’ by an exploitative system that pays very little and offers no job security:

Elwood, Illinois (Pop. 2,200), Has Become a Vital Hub of America’s Consumer Economy. And It’s Hell.

I resolve to buy fewer things on Amazon. Shop locally. Support small business. But. It’s. Just. So. Darn. Easy. to Click…

Back in 2000, Amazon experimented with an embryonic “dynamic pricing” project that charged people different amounts for a DVD, based on who knows what - zipcode, shopping habits, etc. Consumers spotted this, got annoyed, and so Amazon backed down and allegedly issued refunds to all their customers who were overcharged.

There are lots of firms that engage in “dynamic pricing” today. If they can identify you as a rich customer who is price insensitive, they’re going to gouge you worse than a tuk-tuk driver in Bangkok.

Mac users may well be charged more than Windows users, for instance. Frequent fliers are charged more than occasional travelers. (Ah, the benefit of being a repeat customer - whose data the airline already has).

Seriously. The only way to survive such indignities is to have a single-use browser session that strips as many identifying marks out of its signature as possible, with your connection made via VPN, preferably appearing to originate from some poor neighborhood in East Bupkis, NJ. Of course if you have to log in to provide delivery instructions, they’ve got you. Or - in the future - when Amazon owns retail, you simply won’t have an alternative. By then, even bricks-and-mortar (Amazon “GO”, naturally) will have “digital price tags”, where the store recognizes you using face recognition (plus your phone’s digital emissions signature), changing prices as appropriate in real time as you wander around, to match your ability and/or willingness to pay.

Once they own retail, there won’t be much you can do about it.

Centralizing profits. Mr. Global. That’s the risk anyway.

https://medium.com/syncedreview/ai-powered-dynamic-pricing-is-everywhere-4271a9939d11 A different and more controversial angle in dynamic pricing is setting different prices for different customers. Many major E-commerce companies prefer not to disclose whether they do this, or may do it discreetly, as the practice can be regarded as a form of discrimination pricing. It’s not unusual for example to see a different price for a travel package when visiting a booking website on your laptop versus the price displayed on a friend’s computer, or even on the booking company’s app on your smartphone.Online retailers’ dynamic pricing systems build and respond to individual users’ pricing profiles, which can be based on their zip code, device type, the type of products they have browsed and ordered, and other data. Like a savvy car salesman, sellers endeavor to size up the customer to determine how much they can afford; it is thus natural to set a higher price for those who can be expected to pay it.

Back in 2000, Amazon was found to be charging different people different prices. The company apologized and promised it would not set prices based on customer demographics. However even if pricing remains consistent on a specific product, there are other variations that can create personalized pricing scenarios:

Create different pricing tiers tailored to different customers

Customize product bundles based on users’ pricing profiles

Target different customers with different product suggestions at different prices, etc.

Such subtle adjustments in presentation and pricing, augmented by algorithmic dynamic pricing, can also result in some shoppers paying more than others, which benefits the seller.The expansion of sales platforms using dynamic pricing is making it increasingly difficult to detect potentially unfair pricing schemes or protect oneself against them. Consumers would do well to apply the age old “caveat emptor” not only to the product they are purchasing but also the price tag it carries — even if one’s wits alone will not unravel the mystery and complexities of algorithmic dynamic pricing.

I don’t really understand what the downside was for the NYC / Amazon arrangement. The local gov’t wasn’t PAYING Amazon any money to move there, just offering low tax incentives for doing so, right? So it’s not like the gov’t had to foot the bill for any of it, only accept a smaller (or delayed) ADDITIONAL stream of tax revenue from the new arrival. But Amazon’s employees, suppliers, and local businesses that would benefit from it would in turn be producing more tax revenue for the local gov’t as well. Tax revenue that would otherwise never be realized, given no other company or entity is considering such a massive investment in the area. Surely it would be more than enough to cover any additional expense related to city infrastructure (since the area is for the most part developed). And the placement of a second HQ there isn’t the same as a Walmart for example that competes directly with a lot of the local businesses. Perhaps there’s some clause in the agreement that really does put the city at an economic disadvantage compared to where they are at now, but I haven’t seen it yet.

Now I DO have big reservations about Amazon itself… if nothing else I think it’s too big and overly large entities typically lead to centralization of power & wealth. And their big Web Services contracts with the Intelligence Community?.. surely nothing bad will come about having a monolithic entity that deals with data on millions of people also being involved in domestic and international spy activities! ![]() But I think that should be a separate issue from the HQ question, and from a purely logical point of view I don’t understand the level of resistance to Amazon’s presence there. And I can’t really fault Amazon changing it’s mind. As I put in the subject, “money flows to where it’s best treated”. You don’t want to hand a company the proverbial keys to the store to attract them to move in, but if you don’t present a business-friendly environment (i.e. lower taxes and REASONABLE regulatory policies) they (and their money) will go elsewhere.

But I think that should be a separate issue from the HQ question, and from a purely logical point of view I don’t understand the level of resistance to Amazon’s presence there. And I can’t really fault Amazon changing it’s mind. As I put in the subject, “money flows to where it’s best treated”. You don’t want to hand a company the proverbial keys to the store to attract them to move in, but if you don’t present a business-friendly environment (i.e. lower taxes and REASONABLE regulatory policies) they (and their money) will go elsewhere.

Viewing it from afar here in Asia, the situation seems more like a class-warfare game than anything else. The earlier reference here to “Let’s you and him fight” by THC seems spot on to me, and is likely just priming the pump for “Stick it to the evil rich” future policies. I understand the danger of wealth inequality, but attacking the symptom and not the root cause is going to hurt a lot of innocent people… poor, middle-class, and rich alike.

Just to clear up a big misconception that I see being expressed quite often; NYC was never “giving” Amazon any money. They were offering tax breaks that supposedly totaled 3 billion [ though I have read it was more like 1.5 ].

The problem is, people on the left have started calling tax breaks “subsidies” in an effort to cloud the understanding of their followers. Ive heard it often repeated by those that champion higher taxes that tax reductions are “give-aways” that have to be “paid for”. This kind of talk started about 12 years ago. It’s part of a strategy of framing all money as belonging to the government, which lets you keep some at it’s own “cost”.

In reality there is no extra 3 billion now in NYC’s coffers. They never had the 3 billion. The 3 billion they were “giving” Amazon was Amazon’s own money that they were gratiously allowing them to keep. Dont get me wrong, I dont believe Amazon should get ANY breaks that the rest of us dont get. I believe in a free market where government agents do not intervene to pick the winners and losers. That being said, all this talk of tax breaks being “subsidies” has lead alot of people to be confused [ and thats the whole purpose ] about what is really going on.

Heres a basic analogy of what’s going on and the convoluted mentality of some people regarding this situation;

I am going to rob 100 dollars from you. Now I just gratiously changed my mind and have decided not to rob you after-all. There, I just “gave you” 100 dollars! Now how am I supposed to pay for that money I just gave you?? These “subsidies” are unfair…I’m not sure I can afford them.

Now you have grown tired of my BS and have left town…great! I just “saved” 100 dollars. Money I didnt take from you which was costing me 100 dollars. Not robbing you was “costing” me a fortune!

Some good clarifications on the “missing 3 billion” that NYC allegedly “gave” to Amazon. Which they clearly didn’t.

However. Let’s assume the following scenario:

There are currently enterprises already in place that are paying taxes to the city - they weren’t “cool” enough to get special treatment. Then Amazon comes in and displaces them. But Amazon doesn’t pay any taxes. So the city no longer receives revenues from the displaced companies, and doesn’t receive revenues from Amazon. That would seem to leave a hole in the city budget, while the city retains the same cost structure for police, fire, road repair, etc.

It probably isn’t a $3 billion hole (since Amazon’s taxes would definitely be larger), but a hole nonetheless.

My earlier question amounted to: how would the city expect to fill that hole.

And one last semi-snarky observation:

To those quasi-libertarians who don’t believe government should be doing things like this, consider: there is a “marketplace” of cities out there, and each city is acting to compete in this “marketplace”, and so offers like this to companies are just an example of a different sort of free market at work - offering “location & tax products” to their mega-corp “customers.” Its a viewpoint, certainly. ![]()

From what I understand Amazon was making its HQ in an area that didnt have much going on. It wasnt going to take up a building in the financial district, for instance. So, if it displaced empty building, or buildings falling apart rented out for very low economic uses, which is the case and why the area went for the deal, it was not displacing other good tax-income payers to the city.

I don’t know what it would have displaced. Presumably that’s what would have been in the economic analysis. But even if its just a vacant lot, the owner pays a property tax on the lot, which (presumably) Amazon wouldn’t have to pay at all. I just assume the amount of tax being paid currently is non-zero, and it would be replaced with zero, which is what Amazon would have paid. As I understand it.

And, also presumably, the wear and tear on the roads from all those new people is an added cost, as is the number of firemen and police they’d need to add to the area. With no direct offsetting taxes. So it is a hole.

I just don’t know the numbers; who wins and who loses. State of New York would have been a winner (increased state taxes, and presumably increased sales taxes), so they’re pissed. Property owners near the site: huge winners, also pissed. Renters in the area? Big losers, probably relieved. Local restaurants? Big winners: pissed. And so on.

Oh dear,name calling Dave, none of that going on here or in your texts. You’re more of a shaming kinda guy. A true gentleman. Fact rich you say?

https://www.yanisvaroufakis.eu/2019/02/19/utopian-science-fictions-legitimising-for-our-current-dystopia-2019-taylor-lecture-oxford-university/

Amazon ws never going to pay zero taxes " … De Blasio and Democratic Gov. Andrew Cuomo said the $2.8 billion in tax breaks and subsidies they were offering Amazon would result in $27 billion in tax revenue…" and this is over a number of years, not all in one year. And, yes, it was part of the economic analysis by the rea which is why they WANTED Amazn there. 27 Billion in tax revenue. Way more than unused warehouses it would have displaced. This is all easy to look up.

Police and roads and infrastructure would have all been big winners from this. Yes, it would lead ot some run down housing replaced with new renovated housing. But, with so much new tax income they could have easily mitigated that

The past few days have seen a wild tit-for-tat in the media/twitterverse as the disparate players in the NYC/Amazon melodrama flail about trying to finger a scapegoat.

The anger amongst the populace of NYC/Queens appears predominantly directed at the politicians who skunked the deal – a deal roughly 70% of New Yorkers were in favor of (with minority voters – and Queens residents specifically – polling as most in favor)

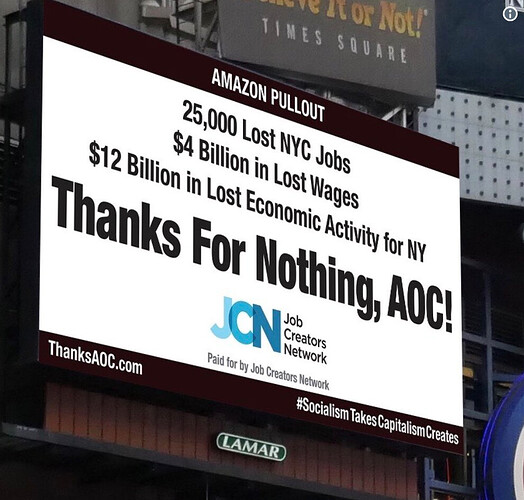

The latest salvo in this mudslinging-fest comes from the Job Creators Network, which just put up this billboard in Times Square:

Alexandria Ocasio-Cortez is getting some negative reviews in her home city. Fresh off helping drive Amazon’s planned headquarters out of New York City, the rising Democratic star has inspired a billboard in Times Square. “Amazon Pullout, Thanks for Nothing, AOC,” the billboard, located on 42nd street near 8th Avenue, reads. The high-visibility blast is funded by the Job Creators Network and will be up for all to see until next Wednesday. “The Amazon pullout is a perfect example of what we’ve been saying: socialism takes and capitalism creates,” Alfredo Ortiz, JCN president and CEO said in a release on Wednesday. “The economic consequences of the HQ2 termination gives America a small taste of the harm that is to come if Ocasio-Cortez’s anti-business canon comes to fruition and is made federal policy.” (Source)It's increasingly looking like those responsible for scuttling this deal will be remembered as the villains, not the heroes.

if she gets any traction with the Green New Deal. This Amazon deal skunking is just practice.

Oh dear,name calling Dave, none of that going on here or in your texts. You're more of a shaming kinda guy. A true gentleman. Fact rich you say?Yeah, I'm still waiting for you to include any sort of data at all in your posts. But I am happy that you 'fessed up to all the name-calling. Saying "oh gosh, you do it too" - such an accusation, whether accurate or not - tacitly admits the truth of my claim. So I do appreciate your honesty. Thanks. But I'm still waiting for data. I know, I know. Data takes work to collect. Its just tedious. And data is open to interpretation. Opinion is ever so much easier to generate. That's probably why the "news people" engage in opinion-generating these days. Its so much less work. And it makes it more difficult for the readership to think for themselves. And maybe that's the goal.

mntnhousepermi-

Amazon ws never going to pay zero taxes " ... De Blasio and Democratic Gov. Andrew Cuomo said the $2.8 billion in tax breaks and subsidies they were offering Amazon would result in $27 billion in tax revenue..." and this is over a number of years, not all in one year. And, yes, it was part of the economic analysis by the rea which is why they WANTED Amazn there. 27 Billion in tax revenue. Way more than unused warehouses it would have displaced. This is all easy to look up.It turns out, it isn't all that easy to look up, because (as I understand it) the deal was just an MOU whose terms weren't yet finalized. Here is what "curbed.ny" had on the deal (though I had to go to the wayback machine - the article is now 403'd): Amazon will build a campus of at least 4 million square feet near the Anable Basin on the East River waterfront, on a site that’s partially owned by Plaxall Realty and partially owned by the city. But rather than going through the city’s extensive land use review process, known as ULURP, the state will take the lead and override local regulations on the lot, currently zoned for manufacturing space. Amazon will receive $897 million from the city’s Relocation and Employment Assistance Program (REAP) and $386 million from the Industrial & Commercial Abatement Program (ICAP). It will receive an additional $505 million in a capital grant and $1.2 billion in “Excelsior” credits if its job creation goals are met. That brings the total amount of public funds granted to $2.988 billion—in other words, the city and state will pay Amazon $48,000 per job. Amazon could also earn even more tax breaks separate from the city and state subsidies: The census tract in Long Island City where HQ2 (or HQ3) will be built is designated as an opportunity zone under a provision of the so-called Tax Cuts and Jobs Act, the tax overhaul President Trump signed into law almost a year ago. Amazon will also lease 1 million square feet at One Court Square, also known as the Citigroup building; the banking firm will vacate its space in 2020. In order to fund local infrastructure, Amazon will utilize the city’s PILOT (payment in lieu of taxes) program, estimated by Deputy Mayor Alicia Glen at $600 to $650 million over four decades; the specifics of how those funds will be allocated will be decided upon via community engagement. Now then. Take the $897 million from REAP. The article makes it sound like cash. Is it? No. It does mean they won't pay taxes to NYC for some length of time.

https://www1.nyc.gov/site/finance/benefits/business-reap.page

The credit may be taken against the following: NYC General Corporation Tax (GCT) Banking Corporation Tax (BCT) Unincorporated Business Tax (UBT), and/or Utility TaxPILOTs: they spend money instead of paying property taxes. Amazon spends the money though, they don't receive it. ICAP: that's a program where you don't have to pay property tax for a period of time if you build or renovate:

https://www1.nyc.gov/site/finance/benefits/benefits-industrial-and-commercial-abatement-program-icap.page This program provides abatements for property taxes for periods of up to 25 years. To be eligible, industrial and commercial buildings must be built, modernized, expanded, or otherwise physically improved. ICAP replaced the Industrial Commercial Exemption Program (ICIP) which ended in 2008. Previously approved ICIP benefits were not affected.Property taxes zeroed out? Its not clear what an "abatement" really means. Here's another article which has a better breakdown. There is one key table in particular I liked. In the table, only one of the line items appeared to be a cash grant to Amazon: "capital grant" for $325/$505 million.

https://cbcny.org/research/breaking-down-amazon-hq2-dealThe only cash Amazon would get comes from the following:

Unlike the Excelsior tax credits, the capital grant to be provided by Empire State Development (ESD) is fully discretionary. The grant will reimburse Amazon for capital costs of office build out at $75 per square foot, up to a maximum of $480 million, and costs of site preparation and infrastructure improvements up to a maximum of $25 million, for a total of $505 million. It will be paid over a period of up to 15 years. The incentive proposal includes a schedule of grant disbursement that ties it to the same cumulative job creation and annual investment commitments as the Excelsior credits. If Amazon creates 25,000 jobs the capital grant can reach a maximum of $325 million. If job creation reaches 40,000 by 2033, an additional $180 million will be available, bringing the total to $505 million. (See Table 1.)Amazon gets $500 million to construct themselves a building. That's nice work, if you can get it. Its not $3 billion, as some were saying, but it is $500 million, in cash, paid over 15 years - $33 million/year. That's $75 psf cost. Supposedly, NYC office space construction costs are $575 psf. So while Amazon would get a cash grant, its only 13% of the total construction cost they can expect to pay. https://therealdeal.com/2019/02/07/construction-costs-continue-to-climb-in-nyc/ Hmm. I guess you were right: it wasn't all that difficult to look up. Fortunately that "cbcny" group did a study. https://cbcny.org/

SHould I post this? should I not post this, do I really give a flying fluctuation? (what’da hell)

Look! sorry if you guys can’t take a joke, peanuts in galleries, whatever. Good thing you don’t live in NYC. Oh and BTW where do you think Trump learned to be a mob boss? Yeah, dats right. The Giulliani, orchestrated the take-over years ago. (what do you think replaced the Five Families?)

Bezo probably just avoid a fate worse than death with his thumbs attached. And yeah, another thing, you can’t believe everything you read in the papers! LOL (Trump didn’t invent that either he just took it over to amuse the moans).

Right, the Section 8 tenents in Queens decided to put up a sign in Madson Sq Garden, riiiiiiight! They’re so upset.Who’s got that kinda stash? The same mob Trump slithered out of.

When did you guys give up on a little thing called de-mock-rah-see. How can the morons in Queens be upset if no body and I mean NO BODY was involved in the deal. City Council? screw’m District board, screw’m, voters, who?

You can squeeze your cheeks all you want around imaginary “facts” and promises, but when have these guys ever followed through on those promises. What, suddening you are believers?! They are long gone by the time folks get the notice they’re getting evicted the rent just triplede and a nice geekie looking neutra-sexual wants your apartment. These are mean streets so get your heads into the gutter if you want to understand whats at stake for New Yorkers. Disclaimer: thanks to Giulliani and Bloomberg this place has already turned into a Disney reproduction of Cinncinati with Wall St and Broadway, where you can see such gripping plays as King Kong, bring da family.

(Gotta keep the chumps paying,and most importantly, I’m the biggest chump of them all, I believed) No more! Got my yellow vest ready to go, along with the three G’s.

BTW any one of you’z want to guess how many phantom employees worked on that new tunnel between Queens and Manhattan? its a big number… What you look’n at!

Cheers!

So, uh, I guess you’re saying that renters would have been one of the losers in the big Amazon deal.

I’m pretty sure I said that too. Yay, we agree.

Again, while as I said, not a big fan of the planetary consumer/depletion and stock market ponzi model Amazon represents and enables, I’m not enough into the now theoretical details to know whether I would think it would have been good deal for NYC or not if I’d had to decide - which no one does now.

As always, it’s worth following the money for information sources. The HarrisX poll Adam quotes showing 70% support for the deal was commissioned by Amazon. Commissioning a poll doesn’t mean the poll is biased, but if you look at poll differences over time, that often seems to be the case. Here, it’s worth noting that another poll from the Siena College Research Institute found that 56% of New Yorkers support the deal - still a solid majority, but not nearly as impressive.

On the Times Square sign, as Adam notes, that was put up by the Job Creators Network (guess which party they tend to agree with), whose CEO Alfredo Ortiz, according to their website:

“was instrumental in helping pass the historic tax cuts bill of 2017. Working with former Speaker of the House, Newt Gingrich, Ortiz focused and directed JCN’s grassroots and business community to support Congressional leadership and include small business owners in the tax cut bill. JCN sent more than 550,000 emails to Congress and ran a multi-million dollar media campaign to support the bill.”

(see their Job Creators Network site: https://www.jobcreatorsnetwork.com/about/)

I now know people across the political spectrum, and I’m one of them, who think the tax cut bill of 2017 was an outrageous trillion dollar plus giveaway to the richest of the rich that shafted ordinary Americans in the process in a big, big way. So, IMO, that fact that this guy’s non-New York, elite-favoring outfit had enough money to put up a cute sign in Times Square actually argues against the validity of whatever points he’s trying to make.