Passive resistence, I think not. All of Europe, China, North Africa, Middle East,UK, rumblings in the United States all add up to one serious blow back from the bend over types as they truly are fed up with everything that was known to be true is no longer true. Arms sales and ammo have increased tremendously since Obama took office, why is that?

BOB

I’ve lived in Wellington for a year and a half now after living in the states my entire life to that point (other than the odd trip). I think there are a few things to keep in mind, not the least of which is that Wellington is to New Zealand as Washington, DC is to the U.S. Prices, on average, are higher than most other places in the country.

That said, you can easily find high quality food for fair prices (from the U.S. perspective). When eating in a restaurant: All prices quoted already count the GST so nothing is added to the bill above the price on the menu. When I used to live in Kentucky, you would add the 6% sales tax (low compared to some places) and I a ways added a 20% tip. When those factors are taken into account, we have found that all nice casual and better restaurants are very comparable to the same places in Louisville, KY, so I imagine they are comparable or cheaper than the same types of places in Washington, DC. There is virtually no tipping in restaurants here. All staff make at least the minimum wage of nearly $13/hour or more so I guess that is how the tipping expectations evolved differently compared to the U.S. For eating out, I have found that “fast food” places are notably more than in the U.S. So when you are going to spend $10 at McDonalds, why not spend $10 at the sole proprietor or mo and pop café next door for better food for lunch?

Quality: With very few exceptions, food quality in New Zealand is very high. Locally grown or raised food is not GMO is one biggie for us. Most grazing animals actually graze grass instead of being feed GMO grains in stressful feedlots. Chicken tastes like chicken in the U.S. used to taster 40 + years ago, beef the same, eggs, cheese, etc. Very amazing after being used to the bland versions of everything I had gotten used to in the U.S.

Prices: You can get a wide range of Dominos pizzas for $6 to $10 each. It is true that Pizza in nice casual or better restaurants is expensive from my POV, with average size pizzas costing $18 to $25, depending on where you are going.

Fresh food prices from last Saturday at the local farmer’s market, buying strait from the producer or, in some cases, one step removed (at most): $1.50 for two cantaloupes/musk melons, $2.00 for a very large robust head of romaine lettuce, $1.00 for about ¾ pound tomatoes, $5.00 for about a pound of nice Portobello mushrooms, $1.50 for a kilo of carrots, Large leeks only $1.00 each or 2 for $1.50, large bunch of spinach at $1.50, about a pound of beets $1.50, 2 kilos (about 4.4 pounds) of plums for $4 to $6, depending on variety and vendor, same or less for apples, oranges, mandarins. Beautiful varieties of artisan style baked breads, large loaves between $5 and $7.

At a local food distributor, you can buy very large bags of most spices for $4 to $7, where I remember the small cans in the U.S. being $3 to $6 or more. These bags contain 10 to 30 times what is in one of those cans. I could go on. The point is that food prices, once you are familiar with where to buy, are reasonable. On yes, all prices are in NZ dollars. So would seem cheaper from a U.S. perspective.

On the other hand, there are lots of opportunities to leverage differences in prices for cosmetics, clothing and shoes which is middle of the road and better stores are very expensive (most of the time) compared to the U.S. I think this is due to the smaller market and lower competition for these more durable goods (compared to food).

As the frequently say in NZ,

Cheers,

Septimus.

PS – We were honored to entertain Erik and his friend a few times while they were in Wellington and hope they come back!

Great interview and thread and nice to hear from you again Erik. I found your comment about the secondary market in Treasuries interesting but as I understand it that is not a feature of the contract, although clearly the law of contracts is bent if not broken. As I understand it the market for US Treasuries in the most liquid in the world. If it should start to dry up or China planned a dump wouldn’t the Fed simply buy and monetize even more debt and isn’t that their plan? One wonders how much cooperation there is with China, at least when it serves the purpose of China, as for example in the closure of the PAGE gold exchange.

I concur with ao that it looks as if 2015 is the date for the endgame. I’ve been seeing it suggested all over the net and the ECB’s LTRO extends until then. I sense it is getting traction, so much so that it could become a self fulfilling prophecy.

I find Erik’s observation that inflation has been exported around the world very insightful. It certainly places my last 10 years in New Zealand into better perspective. Access to high quality and durable products is limited, although the costs of of everything from furniture to garden tools are formidable. The manufacturing sector in NZ was gutted in the 80’s and 90’s and now relies on imports, mostly from Asia. The niche, European-quality products are priced at a premium to the already high prices. People here expect to pay high prices and they don’t expect things to last.I have to disagree with Septimus about food prices and quality in Wellington and New Zealand in general, notwithstanding specific favorable comparisons between US and NZ. Many people find Welllington a reasonably priced city compared to Auckland or Queenstown. I myself have noticed various memes that circulate from time to time; that prices are very high or very low in certain places, but by my direct experience, there are no consistently huge differences. Prices are pretty high most everywhere. You can get a hotel room for about the same price in Auckland, Wellington and Dunedin, the same regarding a restaurant meal. And real estate does not vary as significantly as commonly believed.

New Zealand is the least regulated country in the OECD, and most times there is less oversight and less media coverage than anywhere else. Scratch the surface of the clean green image and NZ struggles with the same unscrupulous practices that most other countries face, albeit with reduced ability to fund remediation of the problems.

Small business owners have been shoved out of the market in most business sectors. An independent stationery cannot afford to import office supplies competitively, so there are one or two chains which are featured in every town, and that theme is repeated everywhere. The dairy industry may be a cooperative, but it acts as a monopoly, manipulating prices of it’s various "brands" to move inventory. NZ is the national equivalent of a one-horse-town. The national persona has declared itself passionately in love with its automobiles, and it’s public transport system has been systematically deconstructed.

I would really like to hear more from people with experience in NZ who have an eye toward the issues we talk about on this site. It is hard not being a financial expert and trying to tease apart news reports for actual relavent information about how NZ is placed to weather coming storms. Many people, naively I believe, have a rosy perspective on NZ, whereas I see a goose that is still being fattened up for the eventual kill. In the last year or two we have seen "Goldman Sachs economists" commenting in the newspapers- it is a disturbing sign.

To my mind, NZ is highly vulnerable to the coming oil price shocks, Japan collapse, and high overseas debt. Although just a short while ago it was well placed, it has now caught up to the rest of the OECD in terms of debt vulnerability. There sems to be a pattern here of having great solutions which are promptly abandoned in favor of falied solutions of other countries. It all feels so unnecessary, but inevitably it seems countries do not learn from other countries’ mistakes.

One of the biggest shocks I had when I moved to Waiheke Island (off the coast of Auckland) in 2002 was the cost of a pizza. As Erik says, an upscale town with no competition can charge what it likes, but it was still staggering. Because, coming from the US, where pizza is one of our food groups, it is hard to relate to the Kiwi view of pizza. You can find a Domino’s in Auckland for cheap, but that is about it. This country is aligned with Great Britain, and so the cheap takeout food is fish and chips, not pizza. Since moving to NZ I hardly eat out at all. When I think of how often I ate in restaurants in the US, it is a 180 degree shift. And yet, people here spend money with abandon, buy overpriced wine to go with (IMO) overpriced meals (or pay the restaurant $5- $60 "corkage fee" to bring their own wine, if that makes any sense at all), and do not complain. Those prices tend to go along with the house prices, rated behind only Canada and Norway at the moment as the most overpriced based on rent to house price ratio. The average wage in NZ is around $50,000. On Waiheke median income is $23,500. Median house sale price is upwards of $400,000. Something is not right, it just defies basic mathematics.

I would love to hear from others how they consider that the NZ case is different than Ireland, because on the ground here it looks exactly the same. I think you take a bunch of people who have not made a lot of money historicially, and you puff them up with credit expansion leading to house price explosion which makes everyone feel and spend like Rockefellers, and they all fall into the same debt trap.

On this site and especially this thread, I hear people saying they would not pay such high prices, because it doesn’t make sense. What I don’t understand is why the people here in this country don’t share that view. By and large, it seems, no one wants to admit that they can’t run with the big dogs.

[quote=Travlin][quote=ao]

In my mind, the most likely outcome will be repression and subjugation rather than resistance and revolution. Another alternative though, a wiser one in my mind and therefore the least likely to occur, would be widespread non-violent, passive civil non-participation (as opposed to active and overt civil disobedience) to bring about reform. I’ve been mulling over some thoughts along these lines but it’s late and I’m heading to bed. Tomorrow, if my day allows …

[/quote]

In my mind, the repression and subjugation are already here and accelerating. I expect them to get much worse. I too doubt we’ll see serious resistance and revolution. The last two generations of “consumers” have been conditioned to be very passive and conformist to fit into our corporate and bureaucratic culture. They have too much to lose to “rock the boat”. It takes real desperation to risk it all. The last time we had a revolution we were a nation of small farmers, craftsmen, and merchants. People were much more independent in every sense of the word, but especially their livelihoods.

I am intrigued by your idea of passive civil non-participation as opposed to active civil disobedience. How does that work? As Thatchmo said, this deserves its own thread. I’d love to hear more of your thoughts on these issues.

Travlin

[/quote]

Travlin,

I fully agree with your statement about repression and subjugation already being here and accelerating snd your other statements.

To the group,

With regards to what I’ve been pondering, here are some thoughts. In considering the individuals (and the institutions and organizations they comprise and represent) who have lead us to the ruinous situation we face both nationally and globally, they are a small and rather select group. The individuals I’m thinking of include chief executives, top aides, cabinet members, senators, congressmen, supreme court justices, international bankers (Rothschilds and Rockefellers topping the group), top multi-national corporate executives and boards (particularly in the banking and financial fields like the big 5 banks but also corporations like GE, Exxon, Rio Tinto, Monsanto, and others of a similar ilk), top consultants (Greenspan, Kissinger, Brzezinski, etc.), inner circle members (CFR, Bilderberg, Trilateral Commission, Club of Rome, etc.), the George Soros-type currency killers and nation destroyers, and the other narcissistic, sociopathic vampires who are sucking the life blood out of the middle and lower classes. I’m guessing they number less than 10,000 total. As such, numberwise, they really don’t amount to much. And they can only express their power through others that are beneath them on the power hierarchy. What if we could take that power away?

They would have you think they are the most brilliant, the most talented, the most worthy, etc., created and destined to control the masses and without them, we would all be lost. But the truth is, they need us but we don’t need them. We’d have more life (i.e. less wars and conflict), more wealth and abundance, more freedom and liberty, and more of almost everything good without them. The fact is, they need us. That’s right, they need us. Why? Because we provide them with everything that makes their life worth living. Virtually all the goods and services they use come from us. Besides the physical aspects of what we provide, we also provide powerful emotional satisfaction for them, be it adoration, admiration, respect, etc. or more pathologically, someone over whom they can have a feeling of superiority, someone over whom they can have a feeling of power, or even someone in whom they can instill fear and suffering. Both these physical and psychological needs are important to them.

While historically, such repression as is developing has virtually always eventually resulted in violent revolution and upheaval, perhaps we have evolved to the point where more effective tools can be used against this tyranny. Just as in the area of torture, the perpetrators of this evil have progressed from the crude barbarities of Spanish Inquisition type tortures to the simple but severe effectiveness of sleep deprivation and water boarding, so too, from the standpoint of fighting for goodness, righteousness, and justice, perhaps we can adopt more elegant tools such as social distancing and ostracism and depriving the elite of the basic necessities of a comfortable existence. When one looks at human fears, some of the greatest human fears relate to rejection and/or losing face and the loss of familiarity, comfort, and security.

Imagine tomorrow, Henry Kissinger wakes up to find he no longer has access to a housekeeper, a cook, a driver, or a body guard. All those individuals tell him they are sick and tired of his complicity in the disastrous events that have befallen us. His toilet gets clogged but a plumber refuses to come to his house. He goes down to the local coffee shop to get a break from the smell but the waitress puts way too much sugar in his coffee and the cook visibly sneezes on his eggs (by accident of course) and leaves them runny. It starts raining but the cab driver he hails down to go home refuses to stop when the cabbie recognizes him so he has to walk home in the rain. He catches cold. The doctor he calls tells him his schedule is booked, call back next week. He goes to the dry cleaner to pick up his suit but the dry cleaner doesn’t have it ready for him or accident burns a hole in the seat of his pants with a cigarette. His electric power and gas get turned off unpredictably due to unforeseen glitches at control desks. His flight reservations get confused and cancelled by accident.

You get the drift. What if there were a widespread boycott to deprive these people of goods and services and ostracize them in public and in private dealings, ostracize and deprive their children and family, etc. What if they were treated, within legal bounds, in the same manner in which they have treated so many others, either directly or indirectly, with indifference or avoidance or callousness or disdain or disgust.

Imagine the chinks that might begin to appear in their armor and what might be possible by this collective approach to pressure the elite towards reform.

There are other possibilities, of course, of both individual and collective action but time runs short and I have other things to do right now. Hopefully, later in the week I’ll have time to explore other options of passive non-participation.

Your thoughts are appreciated, as always.

Hi Millie!

You just made quite the entrance with these outstanding posts! Welcome to the site.

We just came from 4 wonderful days on your beautiful island, and really loved the place. (Other readers, think Martha’s Vineyard but as beautiful as the california coast in the Hurst Castle region, and only a 45 minute ferry ride from downtown Auckland). The pizza mentioned earlier came from your island as well. The natural beauty just astonished us. So did the pizza and house prices.

We were taken aback by the real estate prices, but not that much because we’ve been checking them out as we travel and they are through the roof across the world. Dirty money leaking out of China is driving a lot of it. We also had the impression Waiheke real estate includes a very substantial premium for being a beautiful island only a few minutes from a major international city. How does the rest of New Zealand compare? Would places like Napier and surrounds cost as much as the prices we saw in Waiheke? What about Coromandel Peninsula?

To your specific question, the key lies in the long-term housing price chart for New Zealand, something I don’t have but I bet if we send out good vibes, someone on this thread will point us to one. You want to find the long-term price trendline BEFORE easy money started to distort the market. Then you compare that trendline to present prices. The other very critical chart to consider (again, ask and we may receive a pointer from others here) is the one that shows median household income against median mortgage principal. It’s different in every country, and the extent to which a market is over-extended will depend on how the easy money hit the market, how long it was available, and so forth.

The reason people here don’t think of it as a bubble is that nothing has crashed yet. The extent to which the market is vulnerable to the downside if a "crash" develops depends almost entirely on how far current prices and debt to income rations have detached from the long-term mean.

Anybody got the data?

Erik

[quote=ao]

… perhaps we can adopt more elegant tools such as social distancing and ostracism and depriving the elite of the basic necessities of a comfortable existence. When one looks at human fears, some of the greatest human fears relate to rejection and/or losing face and the loss of familiarity, comfort, and security.

There are other possibilities, of course, of both individual and collective action …

Hopefully, later in the week I’ll have time to explore other options of passive non-participation.

Edited by Travlin.

[/quote]

Thanks Ao

Your line of thought is very intriguing and has promise. I know you have pondered these issues long and hard. I look forward to your next installment.

Travlin

LOL! That was really funny…!

Welcome to the future… it never ceases to amaze me how anyone not on a high income can eat out all the time. Pizzas are a treat here, we can’t have one delivered, too far, and nor would I drive the 25 mile return trip to pick one up! So we make our own if the wood stove is lit up…

Australia’s the same. Don’t forget, we don’t tip in AUS/NZ.

It probably is the same as Ireland, it’s just that our housing bubbles are only now starting to burst, prices are slowly starting to come down, in Australia at least.

They don’t know any different, that’s why. How many Australians and Kiwis belong to this community? SIX? And when you tell sheeples the plain truth, they just don’t believe you anyway… there are STILL people around me who think prices will pick up again, as asoon as the tooth fairy comes back.

Sheeeesh…

Mike

[quote=ao]

To the group,

With regards to what I’ve been pondering, here are some thoughts. In considering the individuals (and the institutions and organizations they comprise and represent) who have lead us to the ruinous situation we face both nationally and globally, they are a small and rather select group. The individuals I’m thinking of include chief executives, top aides, cabinet members, senators, congressmen, supreme court justices, international bankers (Rothschilds and Rockefellers topping the group), top multi-national corporate executives and boards (particularly in the banking and financial fields like the big 5 banks but also corporations like GE, Exxon, Rio Tinto, Monsanto, and others of a similar ilk), top consultants (Greenspan, Kissinger, Brzezinski, etc.), inner circle members (CFR, Bilderberg, Trilateral Commission, Club of Rome, etc.), the George Soros-type currency killers and nation destroyers, and the other narcissistic, sociopathic vampires who are sucking the life blood out of the middle and lower classes. I’m guessing they number less than 10,000 total. As such, numberwise, they really don’t amount to much. And they can only express their power through others that are beneath them on the power hierarchy. What if we could take that power away?[/quote]

Hi ao… we CAN!

Just stop making payments on your mortgages and credit cards.

If even half the people did this, the Matrix would be on its knees in THREE DAYS! The other half would soon catch on…

Puzzled as to why you included the Club of Rome in that list above though…

Mike

Google is your friend…

http://www.interest.co.nz/news/40732/opinion-why-real-house-prices-are-25-above-their-long-term-trend

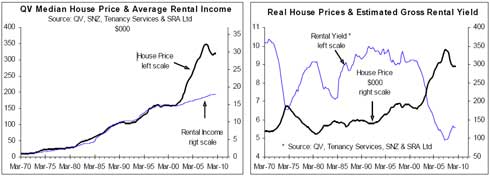

By Rodney Dickens I wrote the first "housing hell" report in August 2007. It looked at what was likely to happen to real or inflation-adjusted house prices after the mega-boom, using NZ and UK experiences. In that report I concluded that "to get the rental yield back to the historical average of 7.7%, the average rental income will have to increase 71% or the median house price will have to fall 42%. Or, more likely, some combination of the two will unfold." In the second "housing hell" report, written in March 2008, I looked in more detail at the extent to which house prices were out of line with incomes and rents. These reports offered valuable insights for anyone serious about understanding the underlying economics of the housing market, which has implications to the long-term performance of house and section prices. They were not designed to quantify near-term prospects for house prices, but these reports also provided advance warning of the imminent fall in house prices. House prices and, to a lesser extent, section prices subsequently fell and in time-honoured fashion the media was there to tell the horror stories. In a 6 January 2009 article on the front page of the business section of the Herald I was identified as picking that house prices would fall 42% in 2009 from the peak level in 2007. 42 might be the answer to the meaning of life, the universe and everything, but it wasn’t my pick for house prices in 2009 (see here for my rebuttal).

Ironically, in our January 2009 pay-to-view Housing Prospects reports I wrote that "interest rate cuts should underwrite a sufficient upturn in housing demand in the first half of 2009 to halt the downward pressure on house prices" and that "by which time the national median price should have fallen 10-12% from the peak". Based on the QV quarterly house price index, which is the most accurate measure of house prices, the national average house price fell 10% from the peak in the December quarter of 2007 to the March quarter of 2009. By the time May 2009 rolled around I was predicting in our Housing Prospects reports that "price increases could emerge in some places before year end", which demonstrates that I am not the moribund pessimist some property people paint me as, and that the analytical framework I have developed over many years is just as useful for picking near-term upturns as it is for warning about near-term pain. However, as was the case with the earlier "housing hell’ reports, the focus of this Raving is not on near-term prospects but is on the big-picture (i.e. how far along the adjustment process are real house prices). The left chart below updates the relationship between the national median house price and the national average annual gross rental income on rental dwellings that was shown in the first "housing hell" report. The fall in house prices in 2008 made a bit of a dent in the yawning gap between house prices and rents, which resulted in some improvement in the gross rental yield (blue line, right chart).

As I was a batchelor for lunch today, I ventured to do some research on this question of whether the pot pie was unrepresentative of inflation in the broader food economy. So off to Burger King I went to sample the opposite end of the price spectrum.

A double Whopper with Cheese and small french fry (no drink) set me back NZ$12.85.

Methinks the inflation of which Chris and I spoke is both real and pervasive.

Erik

ErikSo that NZ $12.85 is roughly USD $10.56. It may sound like inflation being exported. But is it?

I just called a Burger King in Kansas City, Missouri:

10517 Blue Ridge Blvd

Kansas City, MO 64134

(816) 984-6979

USD $7.56 for a double Whopper with cheese, small french fry, no drink.

Just to be fair, I also called Burger King in New York City:

273 Canal Street

New York, NY 10013-3515

(212) 219-2516

USD $7.09 for a double Whopper with cheese, small french fry, no drink.

Better than the $57 pot pie, but still… Even my examples are mere anecdotes. Couldn’t there be other, perfectly reasonable causes of the difference in price between New Zealand and the United States?

NZ Cost Of Labor

Take for example the cost of labor. In New Zealand, the minimum wage for an adult 16 years of age or older is NZ $13.00 per hour (or roughly USD $10.68). In Missouri and New York, it is USD $7.25. Obviously I am not including other payroll expenses. But since labor costs are easily 30% of fast food restaurant sales, surely labor costs may have a larger influence on prices?

NZ Value-Added Tax

How about New Zealand’s Goods and Services Tax (GST), which is a Value-Added Tax (VAT), of 15%? VATs, unlike American-style sales tax, roll up.

I haven’t brought up other possibilities - differences in business taxation, regulatory compliance, etc. But those could also be non-inflationary cost factors, right?

Sir, if you want to make the claim that inflation is being exported, you have to be able to show some conclusive information specifically geared towards proving that. And that evidence has to be able to explain away other, very plausible causes.

Poet

I re-listened as I always do the Podcast of this week or the one before. What a jewel to have heard this again for the first time (3rd time). We all should be aware of the inflation around us as a constant. Where there is food and Oil the price can fluctuate from the mornings drive to work, and on the way home. Business will begin to pass along the costs of fuel inflation if they haven’t started already. Why? The stock market is up, and everyone is feeling better about our economy. Even if it is all an illusion, which it is. Erik has surmised that we are in the next Great Depression, and that has been obvious for some time now. Imagine!, $110 a barrel WTI in the bowls of a DEPRESSION!!! Erik’s hypothesis isn’t to far reaching really.Erik, forgive me but I was upset that you didn’t get your ass up out of that chair and refuse to pay $57 bucks for a chicken pot pie! It was silly of me. Frankly, if I’m with my Lady, and a nice time was at hand then price wouldn’t get me out of my chair either. I know this though, I wouldn’t go back!!! I’ll look for you over at Financial Sense…

BOB

Fast food in NZ is about the same price as the sole proprietorship small cafe restaurants all over the country. I have gotten many nice meals at these cafes for $8 to $14 or about the same price as the American fast food chains. On the otherhand, in the U.S. the fast food chains compete so much and have gotten so used to having all types of value meals and dollar menus that most people on a budget and going for a quick bite to eat at lunch do go to them rather than the ever decreasing number of indivudual cafes. I rather have the variety of restaurants than the cheaper whooper.

But, the fast food competition is coming to NZ… saw a Wendy’s commercial the other day and they are having a bunch of $5.00 value meal specials. Also just checked the wendys.co.nz web site and saw a "Steakhouse Garlic double decker" burger with fries and drink for NZ $6.90 for a half pound burger, etc.

The NZ fast food chains generally use NZ ingredients too.

re: chicken pi…

warning - geeky.

http://www.theregister.co.uk/2012/03/14/pi_day_2012/

http://www.youtube.com/watch?v=VsZFiMo8TIc

"the tau that can be halved is not the indivisible tau…" - tao-kerchiiiiiiing…

http://www.youtube.com/watch?v=jG7vhMMXagQ

and finally…

"The Yen Buddhists are the richest religious sect in the universe. They hold that the accumulation of money is a great evil and a burden to the soul. They therefore, regardless of personal hazard, see it as their unpleasant duty to acquire as much as possible in order to reduce the risk to innocent people." - Terry Pratchett.

Erik,

just today the NZ Prime Minister was on breakfast TV stating his belief that House Prices were set to take off again

Some charts with recent housing market information for NZ

Reserve bank NZ figure on household debt

http://www.rbnz.govt.nz/keygraphs/fig5.html

Reserve Bank NZ house prices and aggregate dwelling values

http://www.rbnz.govt.nz/keygraphs/Fig4.html

(you can download the graph data for the figures above from a link on those web pages)

And if you want to look for some more stats from RBNZ then go to http://www.rbnz.govt.nz/statistics/az/2989605.html

John Pemberton has analyzed some of NZ debt at

http://www.johnpemberton.co.nz/html/debt_graphs.html

His analysis of housing is at

http://www.johnpemberton.co.nz/html/housing_debt.html

And he has links to the RBNZ source data…

Erik

Your interview with Jim was excellent. It was very interesting to learn about your past and your thoughts about your travels. I’m afraid you are right about the growing repression of the US government and where that may lead. I hope you’ll report further as you complete your journey.

Travlin