What does it mean to say the Unit is 40% backed by gold? Unless I can turn in a Unit for x amount of gold, the whole backed by thing is just more financial smoke, mirrors and BS.

Re: Kamala’s unusually not-horrible performance in the debate, several of my friends are suggesting her earings were recievers and she was being fed answers. And being warned not to cackle.

I mean, for her to come across as even vaguely human is suspect.

And the Donald was absolutely off his game. ![]()

t crossed my mind that maybe he or his family was threatened not long before the debate, and he was a bit rattled. I think it was more than simply being unprepared.

Buried in the Obama Health Care Bill is a section that states that a person is not allowed without written declaration to take out or into the US more than 2 x one ounce gold coins. The direction and intent is clear.

Home

Paul Craig Roberts

Institute for Political Economy

- Home

- Scholarship Summaries

- Stories

- About

- Interview archive

- Articles

- Books

- Guests

- Contact

- Western Stories

- Growing Up In America Series

The Big Collapse Awaits

September 12, 2024 | Categories: Articles & Columns | Tags: | ![]() Print This Article

Print This Article

This website depends on readers’ support

The Big Collapse Awaits

Paul Craig Roberts

In the 1970s when I served in the congressional staff and in the 1980s when I served in the executive branch, there was still some intelligence in the US government, with the exception of the Federal Reserve, where there has never been any intelligence.

Today there is no sign of intelligence anywhere in the US government. That fact is documented every day on my website.

As I recently reported, about 900,000 new jobs that had been claimed over the preceding year have just disappeared in a revision. A further downward revision could follow.

These non-existent jobs were the Federal Reserve’s evidence for a hot inflation-prone economy justifying high interest rates. All the time the Fed was preaching inflation, the Fed was contracting the money supply, a contraction that has been underway for 2.5 years. This in itself is proof that the “inflation” was really higher prices caused by the shortages the senseless Covid lockdowns caused. In other words, the higher prices were due to mandated shortages, not to inflation. A central bank too stupid to recognize this is too stupid to justify its existence.

Whenever the Fed contracts the money supply recession follows. If the contraction is too large and lasts too long, as it was following the 1929 stock market crash, the result is a decade of depression and high unemployment.

A contraction in the money supply means that the same level of economic activity and employment cannot be maintained at the same level of prices. Either economic activity and employment fall or prices fall. Historically, it has been economic activity and employment that fall first, and prices follow. Generally, that means profits fall.

Now that it has dawned on the dummies at the Fed that they have set a recession in place, the talk is interest rate reductions. Wall Street is salivating over a possible half of one percent beginning. For Wall Street, a reduction in interest rates means an increase in money, and it is liquidity increases that drive stock prices higher. What usually happens is that stock prices rise in expectation of the Fed loosening, but by the time the Fed loosens the economy is in a recession. So stock prices rise while profits fall, with the market banking on recovery to bring profits up to the level implied by the stock prices that have jumped the gun.

Things, however, can go wrong. Expectations of lower interest rates is a signal to start up home building. But if a recession is in place, who is going to be purchasing homes? If the builders’ loans are due before the houses sell, the builder goes bust.

In today’s immigrant-invader overrun America, there is a new consideration. According to even presstitute media reports, in blue cities immigrant invader gangs are seizing homes and apartment buildings, and soon, if not already, newly constructed homes. If you are sufficiently stupid to live in a blue city, you can go to the grocery store and return to find your home occupied by immigrant-invaders. The police will not remove them.

If you are stupid enough to live in a blue city, what this means is that you cannot risk going shopping, or to a medical appointment, or to pick up your kids from the school that indoctrinates them unless you hire a security service to occupy your home in your absence. You cannot possibly risk your home by going on a vacation. Builders will have to provide armed security for nearly finished homes, apartments, or any type of structure.

No, I am not delusional. This is what is already happening.

Keep in mind also my reports on The Great Dispossession. Federal regulators have taken away your ownership of your investments and bank account and given them, in the event that your depository institution enters financial difficulties, to the creditors of your depository institution. This is what is meant by a “bail-in.” If you thought you didn’t need to read my articles, you made a mistake. Use the search feature and find them.

To be clear, we already own nothing if there is another financial difficulty. Given the Federal Reserve’s record, such a difficulty is certain.

Will it be this time, or the next time, or the one after

I find it very helpful to keep my focus on happy truths! It’s a sunny day, I’m going to be collecting seeds from my flowers for next year’s planting, and I’m looking forward to BBQ’d chicken for supper. Counting my blessings! Have fun camping!

Thanks for posting this @rosasam1 . I’ve not heard of him before but this is very much in line with Dr. Martenson’s coverage of The Great Taking.

Can you provide chapter and verse for that? A link to the exact regulation?

Could you please do an episode focused on financial repression. Specifically how it is instituted and how it has been used historically. Thanks for all the great content!

That was long time ago. The bullion dealers in the US were extremely upset and there were

Articles in the newspapers. You should be able to research that info from the news or some of the larger precious metal coins dealers.

Post debate polling show Trump up 2 points in battleground states

So even when he whiffs he wins over blatant cheating.

Gold Coin Sellers Angered by New Tax Law

Gold coin sellers say new tax law is unfair.

ByABC News

July 21, 2010, 1:49 AM

Does President Obama Want to Confiscate Your Gold?

By Travis Johnson, Stock Gumshoe, October 19, 2010

ADVERTISEMENT

- Posted

There is plenty info on internet. But your exact request might come from the older workers at the large gold selling and buying stores, who may have made copies. I remember the outrage from various standpoints. One being that one must only declare liquid assets over 10 k and two three gold one ounce coins are of much less value.

Chris,

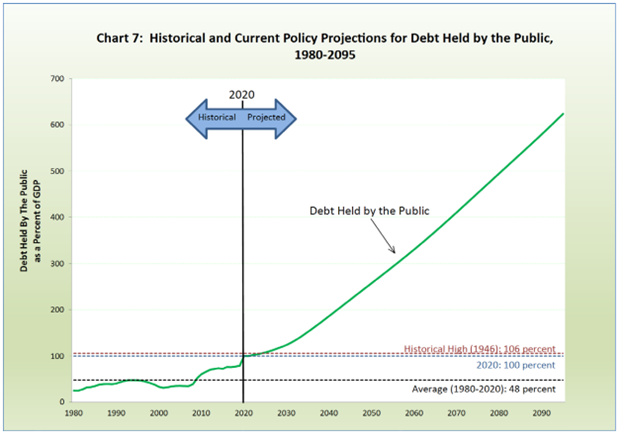

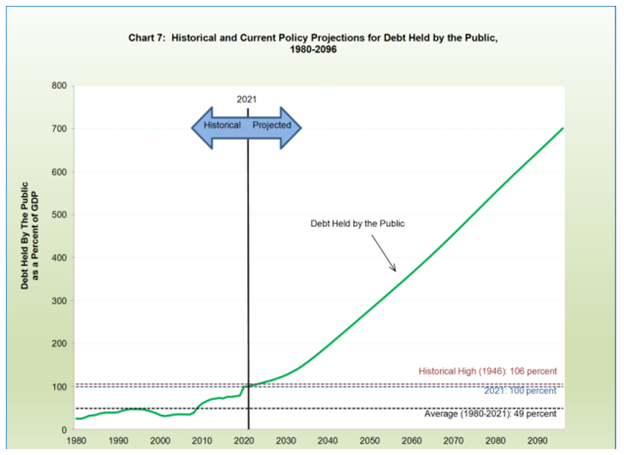

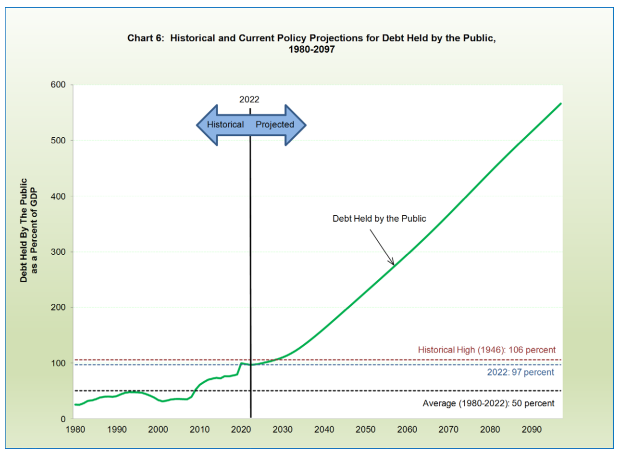

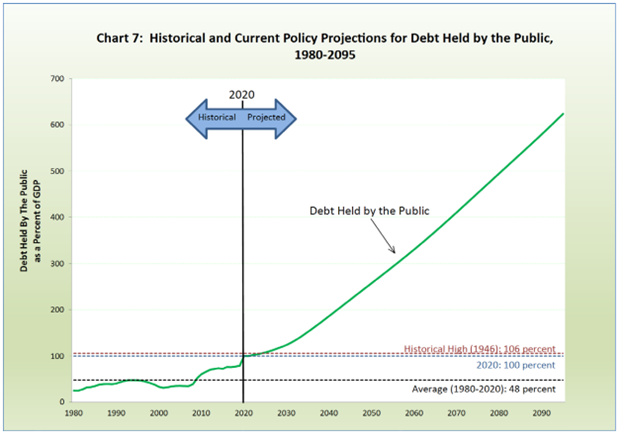

Since the advent of the DS sponsored Covid 19 “plandemic” - the annual U.S. Treasury Fiscal Report for FY2020, FY2021, FY2022 and FY2023 – has stated essentially the same warning - “The debt-to-GDP ratio rises continuously in great part because primary deficits lead to higher levels of debt. The continuous rise of the debt-to-GDP ratio indicates that current fiscal policy is unsustainable [emphasis added].”

These Reports have 75-year (fictional-fantasyland) forecasts for U.S. debt-to-GDP ratio of:

→ 623% for FY2095;

->701% for FY2096;

→ 556% for FY2097; and

→ 531% for FY2098, respectively.

The last two (2) forecasts are lower than the forecast for FY2020 and suggest a downward trend in the debt-to-GDP forecasting! This trend perhaps is logically inversely correlated with the corresponding year-to-year increasing all-cause-mortality.

Question: Are the two most recent annual U.S. Treasury Fiscal Reports merely modeling (debt-to-GDP) projections that are simply accounting for the fiscal impact of the depopulation effect from the DS sponsored genocidal Covid plandemic? Depopulation today means less unfunded U.S. Government liabilities in the out-years – right?

Note: The U.S. Treasury clearly acknowledges the indicated “trend” – but obviously fails to connect the dots – aka acknowledge the mortality caused by the plandemic Covid-shots mandated & coerced by Government puppets (“These debt-to-GDP projections are lower than the corresponding projections in both the 2022 and 2021 Financial Reports.”; FY2023 Report, p.30).

Below are the Treasury debt-to-GDP projection charts from the indicated Reports:

FY2020, excerpt p.10 (fr-03-25-2021-(final).pdf (treasury.gov))

FY2021, excerpt page 10 (2021-FRUSG-FINAL-220217.pdf (treasury.gov))

FY2022, excerpt page 8 (02-16-2023-FR-(Final).pdf (treasury.gov))

FY2023, excerpt page 8 (02-15-2024-FR-(Final).pdf (treasury.gov))

As always, thanks for your reporting and analysis.

pbd (PeaBoDY)

That was an issue around 2010 and that specific section and others may have been repelled. The key issue was registration of purchase and sell. Therein lies the moral of this issue. Famous international economists (Mark Färber, Harry Schultz) lawyers and others have stated that one should not have gold stored in the US or Switzerland. My experience

Is that one should not buy or sell gold where the transaction has to be registered to your ID and one should not have to pay more than 1% above or below spot. Storing gold in a large gold storage vault (or even bank) is also a no no. Having said that however, many US states have now eliminated sales tax on gold. A small step forward. My comment has merit in the fact that these new laws were buried deep in the massive health care bill (not to mention the 1930 confiscation). Direction and intent. Or as Chris says, believe him the first time.

Looking at the FRED chart on foreign vs native employment, I can’t help but think of all the help-wanted signs around town coming out of Covid. All the working-age kids preferred to stay home and collect stimmy checks and unemployment, rather than go to work. Businesses still have problems staffing. The blue line may, in part, reflect the quiet-quitting of entitled citizens while the red line represents those that are not entitled to the benefits and are hustling.

That said, It would only account for part of the picture. Springfield reporting reveals locals that want to work and cannot obtain work, while Hatians are receiving employment.