It's impossible to predict with certainty how much more insane our financial markets will get before an inevitable correction. But my personal bet is: A lot!

For my reasons why, take a few minutes to watch the chapter on bubbles below from The Crash Course. For those who haven't seen it before, the takeaway is this: bubbles pop only when greed in the market has been exhausted:

https://youtu.be/7KpwrJHC6_0?list=PLRgTUN1zz_ofJoMx1rB6Z0EA1OwAGDRdR

Bubbles make no sense economically. Or rationally. But they happen all the time as a part of the human condition.

Even while financial bubbles are enabled by dumb monetary and banking decisions, their actual genesis is rooted in primal human emotions. Greed on the way up, and fear on the way down.

The hardest part about these bubbles is not being swept up in them. As the above video shows, history is chock full of asset bubbles. We humans just never seem to learn. Like Charlie Brown's endless attempts to kick Lucy's football, we get suckered in by the promise of easy riches, only to end up flat on our back when the market suddenly yanks that promise away.

Wash, rinse, repeat.

Most of you reading this might be thinking “Hey, I’m a reasonable intelligent person. I won't fall victim to the next bubble.” Perhaps, but maybe not. The numbers say that the majority of you will. Unfortunately, being smart -- even a genius -- is no protection against being ruined by a bubble.

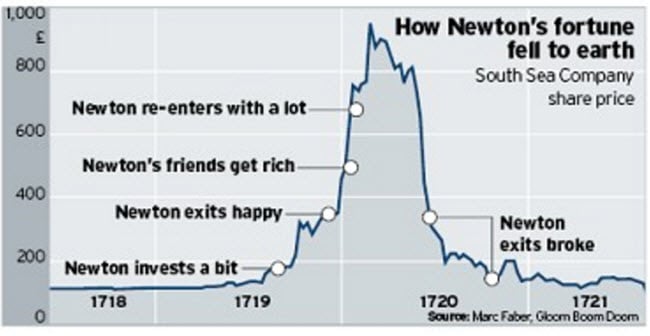

Remember from the video that even Sir Isaac Newton, easily one of the most brilliant humans ever to live, got his clock cleaned by the South Sea Bubble:

(Source)

Bubbles are much easier to enter than to exit. As they build, all your friends and neighbors are diving into the pool and enjoying easy riches. You deserve some of that good fortune, right? And there will be plenty of eager parties willing to help you get on the bandwagon.

But when the bubble pops, though, action becomes much harder to take. At first, everyone assumes that the sudden drop is a temporary aberration and that the party will shortly resume. As prices fall further -- and they typically fall at a faster rate than when they were rising -- folks become paralyzed by fear on the way down, slowly realizing that their paper profits may indeed be gone for good. At first they're unwilling to give up the dream of the "sure thing" they so recently had, and then, once the losses start mounting, they find themselves resistant to locking in those losses by selling. Instead, they hold on to the increasingly threadbare hope that prices will at least recover to where they can ‘get their money back.’

Of course, that never happens. For all those who bought in during the mania, their money was hopelessly betrayed the moment they placed their bet. And that’s what bubbles are – merely bets. And that bet is: I bet I can get out before everyone else.

That’s mathematically impossible for the majority. It’s really only possible for a very tiny few who have the vision and the discipline (and more often than not, the luck) to pull it off. Very rare are the people who get out at the top.

Don't Be A Victim

So, to avoid becoming victim in the future, the first thing you need is the clarity to know when you have a bubble on your hands.

Well, it really doesn’t get any clearer than this:

Why Toronto (and Other Cities) Inflate Housing Bubbles to the Bitter End

Feb 20, 2017

“Let’s drop the pretense. The Toronto housing market and the many cities surrounding it are in a housing bubble,” Bank of Montreal (BMO) Chief Economist Doug Porter told clients in a note last week.

Many have called it “housing bubble” for a while, but now it’s official, according to BMO.

In January, the benchmark price and the average price were both up 22% year-over-year, with the average price of detached homes up 26%, of semi-detached homes 28%, of townhouses 27%, and of condos 15%. Double-digit price increases have become the rule in recent years.

But this jump was “the fastest increase since the late 1980s – a period pretty much everyone can agree was a true bubble – and a cool 21 percentage points faster than inflation and/or wage growth,” Porter explained in his note, cited by BNN.

(Source)

Holy smokes! Or rather, what are people smoking up there? Bubble weed, or something. A 22% yr/yr gain? On top of a string of recent years of double-digit gains?

Here are two more features about bubbles we need to keep in mind:

- Bubble exist when prices rise beyond what incomes can sustain

- Bubbles always have a blow-off top

First, house prices rising a ‘cool’ 21 percentage points above wage growth over a single year is the very definition of bubble behavior. Simple math tells us that anyone who borrows to buy property eventually has to pay that loan back.

The money to pay back that property loan comes from wages. Ergo, property prices and wages cannot depart from each other forever, or even for very long, without a lot of repayment defaults resulting.

As for ending in a "blow-off top", that's just how history tells us bubbles finally exhaust themselves. They draw in every last sucker and lazy-thinking ‘investor’ until there's no "greater fool" left willing to pay a higher price. This doesn't require 100% participation from the local population; only 100% participation from everyone who can be drawn in. When that finally happens, that’s when the bubble bursts all of its own accord.

There's another way for a bubble to end, but it practically never happens. Responsible bankers and lenders could prevent the bubble's formation by simply not lending ridiculous amounts. It almost never happens for the same reasons that people buy overpriced houses: greed and our social programming to follow the herd. If all your banker buddies are making big bucks writing loans to anyone who can fog a mirror, then you'll be rewarded for doing the same. Nobody wants to be the lone, unpopular voice urging restraint when the crowds are going wild.

The quotes below from the 1850’s show how this dynamic is nothing new to society:

“Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.”

“In reading The History of Nations, we find that, like individuals, they have their whims and their peculiarities, their seasons of excitement and recklessness, when they care not what they do. We find that whole communities suddenly fix their minds upon one object and go mad in its pursuit; that millions of people become simultaneously impressed with one delusion, and run after it, till their attention is caught by some new folly more captivating than the first.”

―Charles Mackay,in Extraordinary Popular Delusions and the Madness of Crowds

Well, the good people of Toronto -- as well as Vancouver, Palo Alto, Melbourne, and a large number of other real estate markets -- have fixed their minds on the delusion that the recent skyrocketing price appreciation means that home prices will continue to always rise from here. So get in now! You can't lose! Don't risk getting priced out of the market!

What particularly crazy about this is that we just saw 10 short years ago how this movie ends. But those caught up in the current mania simply aren't thinking logically right now. They're fully captured by the bubble mania.

And, as before, it’s lonely out here for those of us trying to be the voice of sanity and reason. Nobody want’s to hear that now.

And later, once the painful correction has wrought its destruction, those of us who dared to sound an alert may be blamed as responsible for the losses - as if by pointing out the delusion we caused the burst to happen.

Conclusion

I could go on and on, risking being the boy who cried wolf, and point out all the other obvious bubbles infecting our financial landscape that all but assure a very difficult future of financial and economic pain.

But I won’t at this time, having already pointed out the major bubbles in last week's article, The Mother of All Financial Bubbles.

The delusion much of society wants to believe in is that we can get something for nothing. That is, to become rich, all we have to do is buy an asset like a house or Apple stock and simply wait.

The wealth will just magically arrive. No work performed, nothing new created, nothing done. Just buy, and wait.

Of course, even a cursory examination of all of life in nature (or before humans invented thin-air money printing) quickly reveals that actual wealth comes from hard work, usually coupled with taking risks.

But somehow we’ve slipped back into the common and very human delusion of that our current culture has somehow figured out how to escape the old bonds of wealth creation. This time is different!

The Romans re-minted coins in smaller and less pure weights and it worked! For a while. Then its empire collapsed on itself.

Zimbabwe (and now Venezuela) printed and it worked! For a while. Then its citizens were left impoverished.

Society's dangerous conceit is in thinking that somehow we’ve managed to, this time, escape the hard rules of wealth creation and have discovered a new principle by which we can all get wealthy without doing anything at all. All you have to do is play the game. Put your money to work! Buy stocks and houses and you can't go wrong!

And it’s working! For now.

But when we back up a bit, it’s pretty easy to see how this cannot be true. Not for the majority. Why? Because real wealth isn't a paper gain on a house. Nor is it even money in the bank. Or a large stock portfolio.

Real wealth consists the final things you consume: food, appliances, transportation, entertainment, clothes, energy, etc.

Those are real things. They have to come from somewhere. Which means they have to be produced, stored, transported, and sold. By themselves, your cash and your stock portfolio have no value. Those are merely claims on true wealth.

So how can it be possible for everyone to be exponentially increasing their claims on real wealth, without the underlying pie of real wealth itself, increasing at an equivalent rate?

It’s not.

And that’s the painful lesson that gets learned and re-learned as each new generation gets duped and then dumped by an asset bubble.

Sadly, bubbles used to happen only once in a generation. Once those burned by the last bubble have died off, the younger generation has no living memory to prevent them from getting suckered by the next one. But for some reason, our current generation has something of an addiction to bubbles. We've lived through the tech stock bubble, the real estate bubble, and now we're living inside the 'everything' bubble.

What's wrong with us?

My advice is to sell your house if you live in Toronto, or a similarly bubblicious real estate market. Similarly, reduce your exposure to stocks and bonds at these record highs, and develop a wealth protection strategy with a financial adviser who understands the risks in today's markets.

Know what the bubble signs are and be smarter than Newton by standing aside, nodding knowingly, and tolerating your "smart" friends and neighbors.

It’s one of the very hardest things to do, but it’s also one of the most important.

Odds are high you'll be proven the smart one once the current bubble bursts.

And if you haven't read it yet, read our report How Bad Will It Get? in which we detail the tremendous scale of the losses that will result when this Mother Of All Financial Bubbles collapses. It will be a traumatizing time for society, and many, many people will see their wealth vaporize.

The key objective at this time is to position yourself for physical and financial safety. For those who do will be in a position to prosper greatly, as well as offer much-needed support to others, when the coming reset arrives.

Click here to read the report (free executive summary, enrollment required for full access)

~ Chris Martenson

This is a companion discussion topic for the original entry at https://peakprosperity.com/its-bubble-time/