This will be my last post on this topic for a few weeks. I try to stay away from social media, in part because of the back and forth that is happening now. It is a waste of my time and it is a beautiful day outside and I want to enjoy it. I will post one more comment on this in a few weeks to say how I intend to respond based on the response or lack of response from CM and AT. I am open minded and stand ready to change my thoughts and opinions.

Pipyman: I agree. I don’t think your comment had tones of aggression. I was trying to say that I don’t see the “aggression” or “anger” in my posts. Anger wasn’t my intent. As far as I can tell, there are two possibilities. 1.) There is not much evidence of aggression because it was not aggressive. 2.) I have anger in my post and I am not aware of it and would need it to be pointed out to me, so that I can reflect on it. Can you inform me of the specific words or phrases that indicate anger to you emanating from my words? Please know that I won’t respond again, but if you make some good points, then I will reflect on them. I love learning and improving.

VTGothic: There is so much to unpack in your post and it will take too much of my time, so I will condense it. The amount of untrue assumptions that you put onto me is staggering. I count 7 completely untrue assumptions that you made about me. I have not made any about you. I would hope that you would retract it, but I don’t control that. I spent the drive into work wondering if there is a connection between assumptions and emotion. Do assumptions over lay strong emotions? I don’t know.

I don’t hold anyone, including myself or CM, above appropriate questioning. Most of the time, questions go unanswered. That’s life and the nature of stone walling. There should be no problem with asking some questions of CM that were NOT answered in his post. CM spent a bit of 2020 criticizing censorship, nondisclosed conflicts of interest, and poor communication in the major institutions and corporations around the world. He was right to be critical, but here he is engaging in small forms of that same thing.

I am not entitled to answers and NEVER did I think that I was (This statement contains an emotion called anger because you insulted me with your baseless assumptions about me).

Anyway, it is a beautiful day and I am going to water the greenhouse and take the dog for walk. Get out there and enjoy it while you still can.

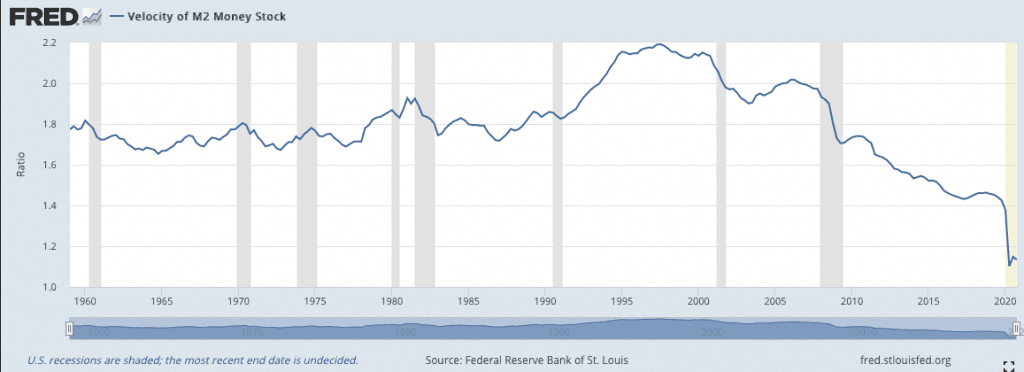

AP: Just for clarity, when you highlight credit inflation as self extinguishing, do you mean those who borrow, will repay, so that represents the extinguishing factor? Or do you mean the act of repayment, will curtail spending, so self extinguishing in that way, or both?Exactly. Also debt default will also extinguish the "money" created by the loan. Or, the loan (credit) can be taken out of circulation by the FED and die a slow death on their books. The main problem that I see with a credit-based monetary system is that money that is loaned into existence (by the banking system) cannot be paid enough if the monetary velocity is not high enough. Here is the current M2 Velocity chart:

It's the lowest in at least 60 years (probably ever). See that little blip-up on the far right side of the graph? That is what is feeding the current hyperinflation hysteria.

Our debt is our money supply, but if money isn't exchanging hands in the economy at a high enough rate, the debt cannot be paid off and will be defaulted on (and/or exchanged for more credit by the FED).

It is an ingenious system (I'm only half-joking)

It's the lowest in at least 60 years (probably ever). See that little blip-up on the far right side of the graph? That is what is feeding the current hyperinflation hysteria.

Our debt is our money supply, but if money isn't exchanging hands in the economy at a high enough rate, the debt cannot be paid off and will be defaulted on (and/or exchanged for more credit by the FED).

It is an ingenious system (I'm only half-joking)

How do you see actual government give-aways affecting this process?I don't know. I guess it depends on who (or if) the government is borrowing the money from. But if the herd thinks it is inflationary then I'm saving all my "worthless" dollars because the herd is always wrong. "Cash will be King" again, and just in time.

Just a note that I hope for investors is a one off. I just got back from walking the dog and talked to a neighbour who had just sold her house (or so I thought); she said ‘up until a half hour ago’. She said the purchaser’s money was in bitcoin and he could not get the bank to accept it(?) so the sale fell through. She didn’t understand the process but felt sorry for the man and his family.

Sorry for hammering you last night on an order snafu.

Think ‘blockchain’.

Decentralized, can’t be de-platformed, secure, fast, etc.

With all your Youtube videos & streaming show, think ‘Theta’, started by the co-founder of Youtube.

https://www.thetatoken.org

Decentralized/distributed networks can’t be shut down & allows direct links between consumers and content creators.

Think about your own blockchain enabled website, and your own crypto tokens.

Instead of memberships, like-minded members of the ‘Tribe’ purchase tokens.

Tokens can be used to ‘tip’ content creators, tribe members who post great content, spend them on farm projects, assign to members of your ‘governance committee’, etc.

If ‘Tribe’ members don’t spend their tokens during their membership period, they go into the ‘Treasury’ run by the Governance Committee.

If they spend them sooner, perhaps they will buy more early.

Tips can rank & prioritize content, so content most valued by the tribe is the easiest to access by all.

You, as the main content creator, would get the most tips (tokens).

Unspent tokens can ‘stake’ members of the governance committee. The Committee is basically voted in/out by tokens ‘staked’ their way.

Polyface, Salatin, Chris, Eva, etc.

This way, your Tribe is engaged in direction, projects, etc.

As tribe members comment and add content, tips awarded to them will energize them further. Tips awarded can perhaps even be turned into cash, or used by tribal leaders to spend as they want in your ecosystem.

The tribe sets the direction & tribal leaders will come and go, based on keeping the tribe energized and engaged, network effect, etc.

Perhaps this can all be done on a mobile friendly platform/app?

Hope any of this helps, lots more ideas, Decentraland, NFT’s, etc.

Big Sky Farm in Cincinnati

I subscribed to chrismartenson.com when I was in my 20s. I turn 40 next year. I’m here because I didn’t have the time necessary to get anything useful out of the news. I needed someone to read, learn, and tell me what’s 1.) likely true and 2.) worth paying attention to. I’m with you Chris.

Adam, you’ve got me on LinkedIn. Let me know how I can help. I’ll certainly watch when you have interesting guests.

Hello 2retired, Bitcoin is rapidly descending into a system of barter. A person buys bitcoin with their hard earned savings but then finds that they can’t trade their coins for cash. So they want to trade it for things, like houses, private boxes at sports stadiums, etc. Forewarned is forearmed.

I have no problem with your questions, they’re totally legitimate. It was simply your tone. It came across as someone that had been slighted. It wasn’t any single comment.

In post #157, agitating prop wrote: The government will provide more fiscal stimulus checks because one trend is clear: the month stimulus is released into the populace, and the month after, consumption returns toward pre-Covid normal. But in the month(s) following, consumption drops back to dangerously low levels. Apparently, as long as people don't have jobs, they don't spend unless the government hands them money. Go figure. [agitating prop quoting VTGothic.] The repuglicans are going to fight this tooth and nail, so dems will have to deal with it by eliminating the fillibuster. And they will do it. It is literally a matter of life and death.agitating prop, I read this post the other day, and it bothered me. I've been thinking about it on-and-off since then. I understand that you were responding to VTGothic concerning the inflation / deflation question. As such, I may be off base with this response because I'm not dealing with that question. Based on your tone, I doubt it. If you remember, those in government throughout this plandemic have been downplaying therapeutics and prophylaxes measures that would reduce the deathly effect of the coronavirus except for those who would generally succumb to the annual flu. They locked us down, told us to wash our hands, wear a mask, and social distance while we wait for a vaccine. They claimed that there were no studies concerning vitamins/minerals, HCQ, or IVM that show these treatments work. If they performed a study, it was designed to intentionally fail. They either applied the drug too late, applied it at the wrong dosage, or neglected to include zinc or some other medication that would improve efficacy. That gave them cover so they could issue an Emergency Use Authorization to Big Pharma concerning vaccines that haven't been through the established safety protocols. (I hope the irony isn't lost on you.) Because of the governments' actions, the economy has mutated quite a bit since early 2020. Big box stores and on-line delivery websites (like Amazon) have flourished. The small mom-and-pop main street businesses have floundered. As a result, we ended up with lots of unemployment, and reduced wages. We can't have the unemployed kicked out of their houses, right? Government mandated that renters who can't afford to pay rent will have their rents deferred. As far as I know, there wasn't any official criteria to determine if someone couldn't pay rent - it was self determined. Now, the economy is getting back in gear. What percentage of those who deferred their rent will skip out on the landlord when the bill comes due? Should the government cover the cost of the last year's rent to the landlords who provided the housing - without getting compensated? Should the government raise taxes to cover the shortfall ... or just borrow it so future generations are additionally burdened? Congress (both sides of the aisle) created this mess. I don't remember exactly who coined the phrase, "never let a crisis go to waste." This definitely was a crisis! They certainly didn't let it go to waste. You can bet that the big winners were those entities who contribute handsomely to reelection campaigns. The big boyz are agnostic concerning political campaign contributions. They donate to both sides. Why? So they can get "favors" later ... regardless of who wins. All it takes is a significant loophole in taxing or regulating to make them happy enough to continue contributing. So, let's get back to government hand-outs. The knee-jerk reaction is to give out stimulus checks. This latest US stimulus totaled $1.9 trillion. Of that, only about 9% went to direct payouts to the little people. Who is going to have to pay back that $1.9 trillion? (Remember that the big boyz contribute to congressoids to reduce their taxes.) Should the government just do the despicable thing and default on the debt? That surely won't have any negative repercussions. </sarc> Of course, those who consider skipping out on their deferred rent probably don't care who pays the bill as long as they get their "stimmy" check. They don't care that they'll have to pay back ~11 times as much (plus interest) as they got in manna from congress. Those in power (congressoids) don't seem to care as long as they can get reelected. If the stimmies become normal, do you think at least some of these people would vote for the political team offering the bigger future stimmy? Where does it end? As far as eliminating the filibuster, the "Dems" removed a provision concerning Supreme Court nominees when they held the Speakership under Obama. It came back to bite them when Trump nominated Amy Coney Barrett and they couldn't stop it. The "Dems" cried foul play when Trump did it. (Of course, they cried foul play on everything Trump did.) Do you really think it is wise to permanently modify the rules that drastically for temporary gain? Where does it end? Grover

I am glad to know that you have come to an agreement and found a solution for your situation. I wish you both the best and will be following closely what will happen here at Peak Prosperity and the new endevour with Wealthion.

As promised, I am replying to your post #154. Upon reading through it more carefully, however, I realized that JAG in posts #160 and 201, and Whoknew79 in post #200 addressed your post quite adequately.

As Whoknew79 pointed out, you made many statements that are either on their face false or at least very questionable. And, of course, you wrote the whole post without citing one source. As has been said, from those who make extraordinary claims, extraordinary proof is required. You provided none. IOW, you have the burden to support your claims, I don’t have the burden of refuting unsupported claims.

Besides, it is a beautiful day here and I have lots of outdoor chores to do.

Take care y’all.

Doug

I really liked the end where the kids tell adults to grow the fuck up and just spend money exponentially. Eventually the velocity of money will pick up and the massive growth in M2 will compete for real goods on a finite planet. As Jim Rogers says, I trust history more than the latest smart person that thinks this time is different. I can hardly stand the late night comedian “news” people. They are so smug it’s painful, no wonder the people who watch them think everyone that disagrees with them is an idiot. Sad.

What did you think you needed to refute? I didn’t know I was arguing with you. You posted, and I reposted, this:

The question in my mind is why we haven't seen runaway inflation or economic collapse while both have been predicted loudly and repeatedly for four decades now, particularly on this site for the past 13 years. What is actually happening and why?So I thought I'd help by giving you some context, and posted my understanding of "what's actually happening". How does that call for a refutation from you? I don't get it. I'm also confused by your statement that I made a lot of claims with no sources. What do you need sources for in my response? Do you need me to cite wikipedia where it defines terms like "fiscal stimulus" and "monetary stimulus"? I hope not: those are common terms; nobody cites sources for common terms, unless someone claims that a word doesn't mean what it means, then one has to appeal to a dictionary - but as far as I know you don't dispute the meaning of the words I used. Do you? I also don't see that JAG is disagreeing with me. He's approaching the same issues from a different perspective but, like me, he notes that low velocity means no inflation. I said that, too. And I don't disagree with his observation that credit creation is different than money printing. What concerns people this cycle is that money was printed and put in the hands of Joe and Jane. That does produce greater volatility in the short run; then the economy crashes again. Historically, low volatility has been the reason for minimal to zero inflation. We both note that. JAG and I might disagree on whether we can keep creating credit forever with no downside for the dollar. I'm not sure if he'd say 'yes, we can.' If so, then he and I disagree. But a disagreement about something that hasn't reached its conclusion is not a contradiction, only a difference of opinion. Whoknew79 is calling me out on a completely different post. S/he objects to what I wrote in post 177, not 164. 164 is where I gave you my opinions as an answer to your question about "what's really happening" in the economy. In 177 I told Whoknew why I don't think "a few tough questions from the membership is appropriate," and why I don't agree that "We cannot move past this without fully flushing all of it into the light of the day."

One item that bothers me on both sides of the MMT Argument. Both tend to straw man MMT as I understand it. (not saying you are doing this).

MMT, as I understand, stipulates that you can create and distribute money into the economy, and the closer to productive purposes the better. It also stipulates that you better have pretty automatic procedures in place to stop creating money or even reduce money when inflation starts to show.

The popular vision on the left is that the money handouts are fine at any level, while the right just shouts about austerity and the govt should not ever create something like UBI.

MMT, if it could be really done, would not allow infinite money printing, but also it wouldnt necessarily require taxes, it would just adjust the money supply up or down based on inflation and try to put the money in its most productive places to support the correct money velocity and greatest purpose in society. Granted the allocation would need to be handled fairly rigorously to not spin out of control in some way, so im not saying it would be easy – as the desire to manipulate would still be present as it is today.

This would be an awesome series of podcasts, maybe for wealthion?

I love 90% of what John Oliver does, but that debt piece was frighteningly misguided. Self-liquidating debt is a good thing, but the finite planet stuff was ignored, as was the fact that we can’t seem to stop people from accruing non-self-liquidating debt (like debt that’s taken on to get a liberal arts undergrad degree). Sadly, John Oliver is one of the only investigative journalists on TV.

“…Is like adjusting the shower knob based on the water temperature.” -CM

VT: What concerns people this cycle is that money was printed and put in the hands of Joe and Jane.First, my apologies VT, but I didn't read your post. I enjoy reading your posts but I was in a hurry at the time. Sorry if I was redundant. Regarding the statement above, I guess it really depends on what the banks do. Counter-intuitively, when the Treasury dumps this 'for-the-people-money" into the banking system, if it is a large deposit, it can actually cause liquidity problems for the banks (so can the FED monetary dumps) because their reserve requirements under the newly reinstated SLR (Statutory Liquidity Ratio). This is a theory postulated by Barton Wang in his Liquidity Matters newsletter.

Wang: The main assumption here is that a couple of major banks have balance sheet sizes fairly close to their SLR limits. Sudden (1-day) influx of large reserve causes their broker/dealer arm to freeze or even withdraw margins of their clients (e.g. hedge funds). And it takes a few days for these big banks to shed the extra reserve on their balance sheets to other players (e.g. MMF, foreign banks etc.).He explains much of his theory in this podcast: https://youtu.be/Sq9Qc3Q97pQ?t=4499 I don't really understand the plumbing of the banking system, but I think it is safe to assume that the banks create inflation (as commonly defined) and feed the inflation-trade by providing margin in their brokerage divisions. Japan has been giving money directly to its citizens for a few years now with no resulting inflation. Regarding hyperinflation, I think Dr. Lacy Hunt said it best here: https://youtu.be/rIHfj15pJVM?t=3434

CM would be one of the few persons whos in depth investigation of a topic like MMT, I would tend to trust.

They work for large hospital systems. They’ve been inundated with ‘CDC guidelines’ and NIH says ‘blah blah blah’. I work in a small group, so, much less pressure to ‘toe the line.’

IMO, the adoption of EHR has ‘trained’ most of us to submit to authority.

I never even received a reply. Yes, I know he’s busy and I wasn’t expecting much but a one word acknowledgement might have been nice. Annie, watching this website, my first thought is it lacks some organisation.

Granted the allocation… let me be the first issuer….