Argh…today’s update is hard to write with a cool head.

As the historic and unprecedented carnage wrought on the economy in both size and scale by covid-19 becomes clearer, the markets blithely march higher. Prices are simply completely disconnected to the reality of the situation.

Today’s case in point: the April unemployment rate was released this morning. 14.7%!

And we already know this number is far below reality. April’s rate only reflects 20 million jobs lost; the latest tally is over 33 million.

Minneapolis Federal Reserve President Neel Kashkari estimates the current true unemployment rate is closer to 24%(!!)

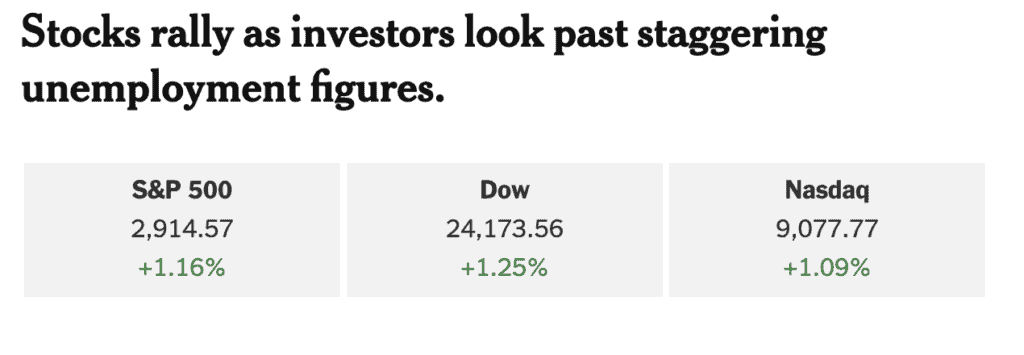

So, what’s the reaction of the markets to today’s worst-ever-by-far-in-history unemployment print? They rally, naturally:

Since rebounding sharply from the March lows, the markets have re-entered a manic melt-up phase where no news is so terrible it can’t send prices higher.

The NASDAQ is green on the year now, for crying out loud. How is that even possible since, between then and now, GDP has fallen by 30%???

In an attempt to makes sense of these increasingly non-sensical markets, we’ve once again asked the lead partners at New Harbor Financial, Peak Prosperity’s endorsed financial advisor, for their latest perspective.

In the below video, we discuss the current melt-up, what history tells us comes next, and why seasoned successful investors like Warren Buffett and Paul Singer are currently selling stocks and buying gold:

Anyone interested in scheduling a free consultation and portfolio review with Mike and John can do so by clicking here.

And if you’re one of the many readers brand new to Peak Prosperity over the past few months, we strongly urge you get your financial situation in order in parallel with your ongoing physical coronavirus preparations.

We recommend you do so in partnership with a professional financial advisor who understands the macro risks to the market that we discuss on this website. If you’ve already got one, great.

But if not, consider talking to the team at New Harbor. We’ve set up this ‘free consultation’ relationship with them to help folks exactly like you.

This is a companion discussion topic for the original entry at https://peakprosperity.com/market-update-maximum-stupid/