Clif High is going through this. Start at about 10:50 min. He has several properties that are all being hit with a huge increase. The lowest increase is 43% and the most interesting is the increase in the “Raw Timber Land” is 83%. Yep, it’s a thing. At the very least, we all need to appeal when it comes our way. You will own Nothing.

This happened to us once. The appraisal was during a a boom. The next appraisal was 2 years before a bust in housing (2006). We lived with it for 2 years, then called the township. The attorney was very helpful, telling me everything I needed to appeal. A few weeks later the taxes were reduced, but so was the value of the house on Zillow. So if we want to sell, we need to provide comps to Zillow and every other RE site. It appears that is how one determines the value oneself.

İnterestingly, here in Istanbul, property taxes (for residential properties anyway from our experience) are practically nothing.

We pay about $100 annually in property taxes on an apartment that was assessed in 2022 at a little over $500,000.

There is general sales of 18% on most things, including services, with a lesser amount, 8%, on most food.

There is income tax of 15-35% on worldwide income, generally.

Hard to believe that Türkiye might be less corrupt than US in this regard?

Also in Istanbul, our water/sewage bill is about $5/month. There is no additional charge for trash removal but they do not pick up individual building’s trash. Everyone brings their trash to a neighborhood skip which is very conveniently always located close by.

Dreinmund i hope so too. It is unconstitutional to tax unrealized gains.

“Sorry, Mr. Retiree - should not have bought a home in 1980 that you cant afford in 2024 due to corrupt government taxation.”

Apparently Property Tax delinquency rates are dropping but rental evictions rates are climbing as property ownership shifts more & more to Corporate control. But they seem fairly synonymous to me, property tax is essentially paying rent on something that you should own outright.

But what we are really talking about here, across the board, is “Taxation without Representation” The 16th Amendment was passed a mere 5 weeks after the creation of the Federal Reserve in 1913 - tell me that wasn’t already planned & prepped! So we’re talking 100 years of being the pooch in Screw the Pooch, all for the most massive negative return on investment imaginable in human history. This was all by design and is defined as “Bonded Labor” The student loan fiasco, now sitting at $1.7 Trillion, totally encapsulates this concept to the T.

This quote from 1913 on the eve of Woodrow Wilson selling out the nation, establishing the Federal Reserve & allowing British Empire to regain control of it’s rogue colonies, “Every American will be forced to register or suffer not being able to work and earn a living. They will be our chattel , and we will hold the security interest over them forever, **by operation of the law merchant under the scheme of secured transactions. Americans, by unknowingly or unwittingly delivering the bills of lading to us will be rendered bankrupt and insolvent, forever to remain economic slaves through taxation” We really do need to revisit the Boston Tea Party & the Stamp Tax imo. On This Day: The Stamp Act plants seeds of the Revolution | Constitution Center

Along with taxation this other plan has been in place for almost as long as the Federal Reserve.

@cmartenson

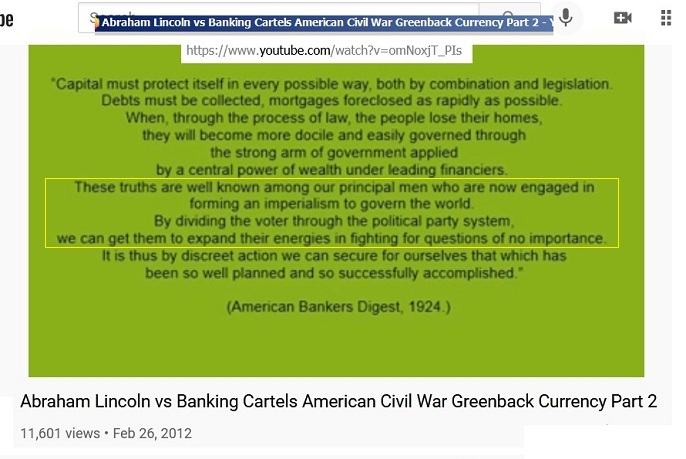

A quote from American Bankers Digest 1924 reveals the source of part of this problem …

…

Another bread crumb in the long trail! Dovetails in with the Chattel quote I Shared, I take everything back to August 27, 1859 & the 1st successful oil well in the United States - the machinations of the Bank of England had already had a heavy hand in American Politics for many years by that time but the hydrocarbon molecule sealed the fate of the nation - for the worse!! this gave rise to the American Oligarch aka “Robber Barons” and the Rule of Wealth we are currently living. The United States has the highest per capita concentration of these parasites.

I think whoever quoted this got one word wrong. “expand” should read, “expend”

Makes much more sense.

Hence the division in the Country over so much that has nothing to do with real, fundamental issues.

That may be, but the other could be used in this context:

The word expand works ok, its the opposite of reduce…

If people are expanding their energies, they are working harder than if they were working smart and reducing their efforts…

#US Banker’s Magazine, Aug. 25, 1924. (attributed) - Thor's Web

…

Did you happen to see what’s going on in Florida condos? There is a new law which requires the associations to do periodic property audits and catch up past due deferred maintenance budgets. Between that and the raised property owner’s insurance, some people are not just paying a few thousand a year, but thousands per month on paid off mortgages.

Also, in TX the average property tax rate is 1.81%. If the government decides your house is worth $1M, then your tax rate would be just over $18k/yr.

Sitting here processing thyme this morning so “got some thyme on my hands” (argh, argh) & watching/listening to the podcast. What keeps running through my head sitting here is it’s like listening to the audiobook version of Les Leopold’s 2009 “The Looting of America” similar to the doubling down on Covid policy, they’ve just doubled down on even more nefarious doings since the GFC.

don’t put all your eggs in 1 basket, you can never unlock the value without departing with it.

If you want to live in one place forever, it can’t be your only store of wealth, because you can’t unlock the value…

Well… Texas is special. It has a lot of government services needs and no income tax to be able to unlock that revenue. Remember, state and local governments, like their citizens, are fighting against Washington and the Federal Reserve’s money creation as well that filters into everything (ie the cost of municipal upkeep).

I have NO problem with going after this structural issue, but the low level city & county agency people are essentially forced to find some kind of way for their financing to keep up with the demands on their systems. This was the way they chose. Fraud is everywhere.

As Chris likes to say, this is not a left-right problem, it’s an up-down. I think there should obviously be up-down dynamics between city/county/state/federal and to lump all government in as 1 ugly entity is shortsighted and misses an opportunity to gain “insiders” to our cause.

So it appears that Texas (a low/no income tax state) would be a common culprit. They have to make up the difference somewhere, so this merits reform obviously.

I do not see this being rampant in where I live (Minnesota) and I constantly peruse the tax data for my job (I work in infrastructure and development for a civil engineering firm).

as the data is per county, and never aggregated I cannot speak to any state or county if one is greater than the other…MN may very well have low property values and low property taxes… again I think there is value in the analysis… I can tell you for any west coast metropolitan… taxes are starting to exceed mortgage payments in many areas

all states do it, which is still fair and which is still unfair… would require more data…

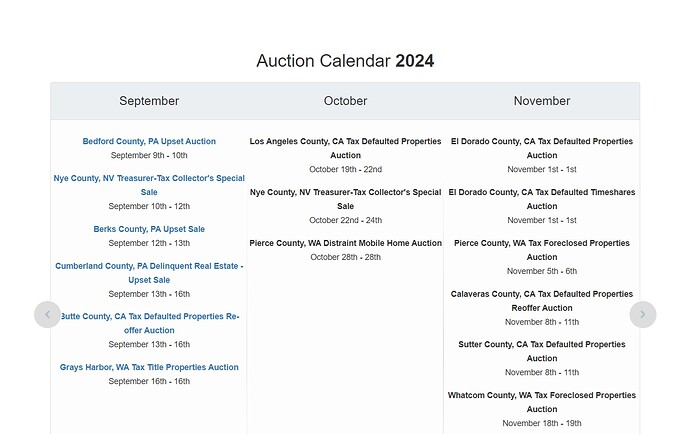

MN I don’t know anything about… however auctions they have too quick google search… now are these remote counties vs metro, raw land vs house I don’t know but it happens there too…

an aside topic… if these are cheap plan B’s near you or anyone else in the tribe close… if might be worth attending these upcoming ones in the next month…

That’s fine for today, but unfair to expect someone in 1980 to act that way.

Hindsight is always 20/20