As we observe the growing unrest in Ukraine, there is the usual rush to ascribe a cause. Was it meddling by the West? Russia? Was it corruption by prior leaders? Simmering resentments that stretch back centuries that finally erupted?

The answers to these questions apply to Ukraine as well as to many other countries. Which is why having an accurate framework, a clear 'lens' for seeing what is actually transpiring, will prove far more useful to you than 99% of what you will hear on the nightly news.

In response to my recent report on the devolution of events in Ukraine, a veteran reader asked:

- Which snowflake causes the avalanche?

- Why are the people in Ukraine are angry enough to start a civil war, while the people in Greece are upset but ultimately willing to go along with years of Troika diktat in order to save the German and French banks? In other words: why was the avalanche in Ukraine so ready to happen?

- Martin Armstrong attributes the high degree of Ukraine unrest to the populace crossing its tolerance level for corruption, after years of rising discontent. Is it that straightforward?

- How about the Arab Spring: Do we blame the policewoman who slapped that fruit seller in Tunisia? Or Facebook and Twitter for facilitating communication among the populace in a manner outside of the control of the State?

Was it any of these reasons? All of them? Perhaps some others, too?

Why people in country A are ready to revolt, while those in country B are not, is worth exploring; especially for those considering moving to another country. If you plan to re-locate to a "better" society, you really need to make sure you fully understand the community and culture you'll be placing yourself into -- and whether its benefits are indeed extended to new-coming 'outsiders' such as yourself.

The 40% Rule

If you were going to try and understand why revolts happen, but wanted to limit yourself to a single variable, you’ll be hard-pressed to find something better than the price of food.

There's quite a bit of research to support the idea that people who spend above a certain percent of their income on food are more likely to protest, riot, or otherwise become restive. That number seems to have a minimum threshold of 40% of income to food costs, give or take:

Since the beginning of 2014, riots have occurred in countries including Thailand and Venezuela. Although they’re different cultures on different continents, these mass protests movements may all have one commonality; increasing food prices may have contributed to their occurrence. The cost of food has been steadily increasing in both Thailand and Venezuela; last month demonstrators in Caracas took to the streets marching with empty pots to protest food shortages. According to Dr. Yaneer Bar-Yam and fellow researchers at the New England Complex Systems Institute (NECSI), events such as these may be anticipated by a mathematical model that examines rising food costs.

The events of 2014 aren’t without precedent; the price of food has provoked (and placated) throughout history, beginning in Imperial Rome when Augustus introduced grain subsidies. In recent years, the Middle East has been particularly affected by the cost of grain. Centuries after Egypt developed bread as we recognize it, the nation experienced a bread intifada – the country rioted for two days in January 1977 following Anwar Sadat’s decision to drastically decrease food subsidies. More recently, under the rule of Hosni Mubarak, the price of grain rose 30 percent between 2010 and 2011. Then, on January 25, 2011 a new revolution began in Egypt.

(Source)

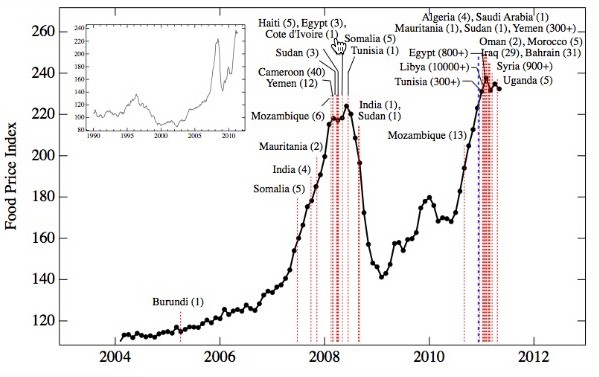

While the study used data through 2011, so much has happened since that I strongly expect the results are even stronger now. To wit, if we were to update the above chart we'd have to add Thailand, Argentina, Ukraine, Greece and Venezuela to the list.

It’s delightfully intuitive that food prices and people’s sense of contentment are tightly linked. Where the various meddlers in the Ukrainian situation were able to obtain quite large reactions from relatively simple efforts, it might be nearly impossible to incite a similar reaction in Switzerland, even with 50x more provocation and propaganda.

This conforms to my views on terrorism which I see as a very rare occurrence that results when a group feels they have literally zero other options left. Usually what governments call terrorism is not even that; rather, it's the type highly asymmetrical warfare that one gets when a vastly weaker party believes it has to react to a stronger foe. That is, it's a tactic not a genetic defect or cultural ideology.

The main connection between these points on social unrest and terrorism is that people are generally very slow to react, and will only resort to unrest and violence if they already have their backs against a wall. A very effective wall is the lack of access to affordable food.

But there are others. From the same article as linked above:

Of course, man cannot riot off bread alone; factors such as unemployment, oppression, economic instability and corruption also contribute. Still, there is something so fundamental about food, and the implications of not having it, that makes people react. As Bar-Yam explains, “The analysis suggests the doubling of food prices we have seen since 2005 pushed many in the greatest poverty across the line from bare subsistence into desperation and starvation. When people are not able to feed their families, they have little to lose and become willing to take strong actions.”

Certainly one popular story in the West is that the people of Ukraine rose up against a corrupt president, Yanukovych, and that’s certainly true to an extent. Instead of viewing the corruption as the only factor at work, though, those willing to do a modicum of digging will soon realize it was merely one of several final straws.

Under- and unemployment contributed, as did oppression and a generally poor economy. Heavy fuel costs were mixed in there, too. And all of these threaten to get worse under the terms of the IMF ‘loan’ to Ukraine.

Rising Oil, Rising Food

Who controls the food supply controls the people; who controls the energy can control whole continents; who controls money can control the world.

- Henry Kissinger

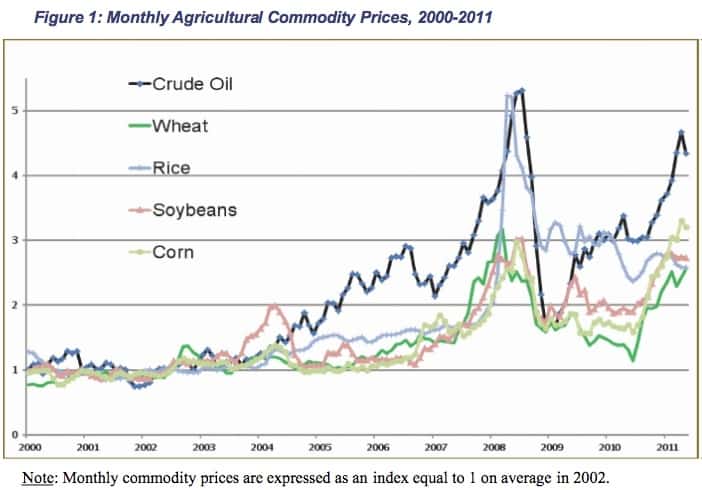

There are numerous research studies showing that rising food prices are highly correlated with oil. Analysis reveals that the price of oil influences the price of food but that, in reverse, the price of food does not influence the price of oil. That is, there’s more than correlation, there’s causation -- with oil driving the price of food over the long haul. Specifically, the price of corn, soybeans and wheat, with rice not showing much of an effect possibly because so much of it is planted and harvested with muscle-power vs. oil.

Here’s a long run view showing this relationship:

(Source)

What’s interesting is that the obvious effect of rising oil prices is on the supply side. All of the inputs costs more: fertilizer, diesel for the tractors, chemicals and transport. The less obvious part of the story is on the demand side, as higher fuel costs end up diverting cropland to energy production in the form of corn-based ethanol and palm oil. This removes land for food production and creates competing demand for the same edibles in the case of corn.

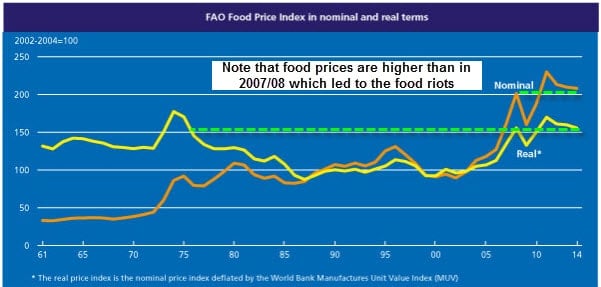

In 2005, the price of oil began its volatile rise to the current worldwide price of over $100 per barrel. Correspondingly, the world price for food has also risen over the same period and is now above the levels that ignited the so-called Arab Spring, which really could be renamed the Hungry Uprising:

(Source)

Food prices are high by historical standards and this is one of the key flashpoints for so many of the recently afflicted countries. The reason energy prices and food prices are so tightly coupled is because there are anywhere from 10 to 20 energy calories embedded in each 1 food calorie.

It seems quite likely that food prices will only continue to rise from here for a number of reasons, high oil prices being just one. There’s also increasingly chaotic weather impinging on harvests, which seem to be a part of our new normal. Already driving the price of food is a fair degree of speculation on the possibility of the emergence of El Nino in the Pacific later this year (2014); previous similar weather patterns have proven to be especially damaging to global grain harvests.

Droughts, as well, have been particularly vexing to several regions of the world, including the US. One that began in 2008 is almost certainly a main contributor to the Syrian uprising:

Lebanon Prays for Rain to Avoid Syria’s Fate

May 9, 2014

Three years ago, on the cusp of the Arab Spring, a devastating drought sparked anti-government protests in Syria, which eventually devolved into a grinding civil war. Now a new drought has arrived—one that’s expected to be theregion’s worst in decades. Only this time, the parched country in peril is Lebanon.

Things are so bad in this nation of 4 million that snow was largely absent from the country’s famed ski resorts this year—a vital source of groundwater during the summer—and some villagers near the Israeli border have even reportedly turned to the ancient ritual ofshish balli, or praying for rain. And asthe dry monthsapproach, some worry thatLebanon, as well as Syria, is on the brink of a severe water crisis.

(Source)

Perhaps droughts have always been a staple in the global climate tool kit but when you combine drought with high population densities, ruined soils, and generally dim economic prospects they can be quite destabilizing as has proven true across the Middle East - North African belt.

In the case of Syria, there’s no good news yet on the horizon.

UN warns of Syria food shortage due to looming drought

Apr 8, 2014

The UN has warned that a drought in Syria could lead to a record low wheat harvest and put millions of people at risk.

The World Food Programme (WFP) said rainfall since September has been less than half the long-term average.

At the same time, WFP food aid has been cut by a fifth due to a lack of funds from international donors.

"WFP is concerned about the impact of a looming drought hitting the northwest of the country, mainly Aleppo, Idlib, and Hama," WFP spokeswoman Elisabeth Byrs told reporters in Geneva.

"A drought could put the lives of millions more people at risk," she said.

Up to 6.5 million Syrians could need emergency food aid as a result, up from the current figure of 4.2 million, Byrs said.

As a result of the drought, Syria could be forced to import more than the 5.1 million tonnes of wheat it needed last year, the WFP said in a report.

Syria was last hit by a drought in 2008, three years before the outbreak of the civil war.

On Monday, the WFP announced that it had to cut the size of its food parcels to Syrian families by 20 per cent.

(Source)

It’s pretty obvious that part of the tension that led to uprisings in Syria was related to both this drought and generally high food prices, even before poor harvests added to the misery.

Importing Water

An additional factor in my prediction for rising food prices stems from the gross over-withdrawal of water from aquifers that has been ongoing for decades.

If you compare the map below with a list of trouble spots in the world you will note a high degree of overlap:

(Source)

Some of those countries are not yet in revolt, but are on a very dangerous path that may well take them there. India is badly over-pumping its main aquifers and is hugely dependent on the food that comes from those efforts.

Saudi Arabia’s main aquifer is slated to run out as early as 2016. Because it has abundant energy resources Saudi Arabia will be able to turn to desalination plants, but for how long and at what costs to their ability to export oil as that same oil is being used to power those plants?

It takes up to 1,000 tons of water to grow one ton of wheat. Therefore, when China imports grains, like corn, soybeans and wheat, it is actually importing water, something it increasingly needs to do because of aquifer depletion and surface water pollution.

Given the trends in world food production, energy prices, droughts, El Ninos, depleting aquifers, and the like -- we actually have to work very hard to come up with any scenarios wherein food prices might fall instead of rise.

The only one that really makes sense is an economic accident of such grand proportions that it causes a deflationary impulse so strong that it drags pretty much everything down with it, including food prices. But then, we’d expect literally everything to be cheaper in price; from real estate to stocks to bonds to politicians to used cars.

It remains our view that such an outcome, while possible, will be fought tooth and nail by the world's central banks. They'll print and distribute additional rounds of ‘deflation fighting’ money to keep the system afloat.

And, just as none of the central bankers have given one thought to the savers they have tossed under the bus wheels to ‘save the system’, they will give about as much thought to the immense pain that exporting food inflation will meant to dozens of countries and billions of people.

Conclusion (Part 1)

In Part 2: What To Avoid When Relocating we apply the framework above to understand why Ukraine was actually a very likely candidate for the unrest that's broken out there, and why the math strongly indicates the situation is likely to get considerably worse.

Dwindling resources produce the least admirable human behaviors, something science has tested and understands quite well. Ukraine is a bellwether; we will see other conflicts like it elsewhere in the world, and likely, in time, within our own nation. Which is why understanding the nature of social unrest is so important, particularly to those considering relocation (within or outside of their home country). You certainly don't want to leap from the frying pan into the fire as resource scarcity and conflicts are now part of the global equation.

Click here to access Part 2 of this report (free executive summary, enrollment required for full access).

This is a companion discussion topic for the original entry at https://peakprosperity.com/rising-resource-costs-escalate-odds-of-global-unrest/