Important disclaimer: None of the commentary in this article is intended to be politically partisan. Peak Prosperity is a strictly non-partisan organization.

The Obama administration has come out in support of the idea of exporting U.S. natural gas. This stance is counterproductive and shortsighted, and if followed, it will prove harmful to domestic manufacturing (i.e., value generation) and to future generations of Americans.

While exporting natural gas would certainly prove to be an economic boon for a very select minority of companies and individuals, it makes no sense from an energy standpoint and undermines our national interests. All it will do is enrich a few while boosting prices for all domestic consumers and shortchanging the energy and environmental inheritance we pass along to our children.

First, the news:

Obama backs rise in U.S. gas exports

May 5, 2013

The Obama administration has signalled support for more plants to export liquefied natural gas, as the US embraces its surging energy production as a key new element of its national security policy.

Barack Obama said at the weekend the US was likely to be a net gas exporter by 2020, the strongest sign yet that the president is swinging his support behind higher energy sales overseas.

The Department of Energy is studying applications for new liquefied natural gas terminals, with approval of one in Texas likely within months. It would be only the second such approval granted for sales to countries without trade agreements with the US, such as Japan, the world’s largest importer of LNG.

Let's start with the most obvious blunder of such a policy. Again, while exporting natural gas may result in short-term profit economically, it doesn't make any energy sense. Here's why.

In order for natural gas to be turned into a liquid (a.k.a. liquid natural gas or LNG), it has to be compressed and refrigerated all the way down to an astonishing -260 degrees Fahrenheit. If you have a refrigerator, you already know that it takes energy to cool something down. And the deeper the cooling, the higher the energy required.

In order to export LNG, it takes energy to simply turn that energy into a liquid. How much? Roughly 25%. That's right; a quarter of the embedded energy in the natural gas is lost before it even makes its way to a customer.

Here's the thing. The natural gas that we are currently fracking out of shale beds was laid down over tens of millions of years, and it is a one-time resource that we only get to burn once. That is, it has a defined amount of energy that we can use in the form of work to do things – such as move vehicles, erect buildings, fertilize crops, re-build a crumbling national infrastructure, or build out an infrastructure for our alternative energy future.

One thing we cannot do is burn it twice. You get to use the energy in natural gas exactly once.

That the Obama administration thinks that the best use of that embodied energy is to waste fully one-quarter of it on the act of refrigeration and compression so that we can ship those BTUs outside of our borders tells me that they do not really understand or appropriately value this finite resource.

Using the energy in natural gas to turn it into a liquid might be economically profitable, but it is energetically wasteful. It's our view that the very last thing we can afford to be at this point in history is wasteful with our energy resources.

The Carbon Fallacy

In trying to pitch the idea, one of the oft-cited statistics politicians offer in favor using natural gas is that it lowers carbon emissions. This is true, but only if the natural gas offsets coal consumption for electricity production AND only if this occurs in isolation AND only if this offset is permanent. So if we just burn the natural gas now while it's cheaper, but then later get back to burning coal, the fracked natural gas will actually enhance, not decrease, total carbon emissions.

Despite these complexities, the current administration uses 'carbon lowering' as a reason to use more natural gas and presumably to support the export of LNG.

Rise in U.S. Gas Production Fuels Unexpected Plunge in Emissions

Apr 18, 2013

U.S. carbon-dioxide emissions have fallen dramatically in recent years, in large part because the country is making more electricity with natural gas instead of coal.

Energy-related emissions of carbon dioxide, the greenhouse gas that is widely believed to contribute to global warming, have fallen 12% between 2005 and 2012 and are at their lowest level since 1994, according to a recent estimate by the Energy Information Administration, the statistical arm of the U.S. Energy Department.

And this:

Natural Gas Is Key To Low-Carbon U.S., DOE Nominee Says

Apr 9, 2013

U.S. energy secretary nominee Ernest Moniz affirmed his commitment to President Barack Obama's "all-of-the-above" energy development strategy during his Senate confirmation hearing Tuesday, including the increased development and use of natural gas as a bridge fuel to a low-carbon future.

Moniz would have a say over the production and export of liquefied natural gas. The DOE is weighing whether to approve 16 applications to ship domestically produced natural gas to countries with which the U.S. lacks free trade agreements.

When pressed on whether he would approve LNG exports as energy secretary, Moniz said he favored the deliberate approach taken by current Energy Secretary Steven Chu.

"In the overarching public interest criteria, the status of the domestic natural gas market is right up there," Moniz told the panel. "I think we have a responsibility to make a judgment license by license."

To claim credit for lowered carbon emissions due to natural gas and then also support the idea of exporting LNG (where fully 25% of the base energy is combusted in order to simply liquefy the product) is hypocritical. These are two ideas that work against each other. Either you use natural gas wisely and efficiently as you move away from coal resources and claim a carbon credit for these actions, or you support throwing 25% of natural gas' energy right into the atmosphere just to cool it for transport.

So it's a fallacy to imply that exporting natural gas will help lower carbon emissions. In all honesty, total emissions will most likely be higher than otherwise – because let's be realistic; the most likely path is for humanity to burn up all the natural gas and then burn up the coal next.

Further, where the U.S. carbon emissions have gone down due to less coal being burned, that happy circumstance resulted in Europe doing exactly the opposite:

Shale Boom a Bust for Europe's Gas Plants

May 8, 2013

FRANKFURT—The ripples of the North American shale boom continue to spread, as a growing number of European utilities are forced to mothball modern gas-fired power plants that can't compete with growing imports of cheap coal dislodged from the U.S.

Norwegian state energy company Statkraft said Wednesday it has idled a gas-fired power station in Germany that couldn't compete with its coal-fired rivals, while German utility E.ON SE said it is seriously considering mothballing more gas-fueled plants, including a state-of-the-art facility in Slovakia.

Other European utilities have taken similar action, presenting policy makers with a dilemma—cheaper coal-fired power could provide some relief for the region's struggling economies, but might be incompatible with long-term goals for carbon emissions and renewable energy.

The closures across Europe are another example of the far-reaching effects of the North American energy-supply boom. Surging supplies of natural gas in North America, unlocked from shale rock by a new combination of technology known as hydraulic fracturing, have prompted many U.S. power generators to switch away from coal, pushing increasing amounts of the fuel into Europe as cheap imports.

In 2012, U.S. exports of coal to Europe rose 23% to 66.4 million short tons, according to data from the U.S. Energy Information Administration.

Does natural gas help to lower carbon emissions? No, it merely pushes the carbon emissions elsewhere while the U.S. feasts on relatively cheap natural gas domestically. The only thing that lowers carbon emissions is NOT burning coal, natural gas, or petroleum – collectively.

100 Years of Gas

In his 2012 state of the union address, Obama said, “We have a supply of natural gas that can last America nearly 100 years, and my administration will take every possible action to safely develop this energy.”

The idea that we have nearly 100 years of natural gas is quite powerful and comforting, because, after all, 100 years is pretty far out into the future. The only problem with this statement is that it is not even close to correct.

As usual, the all-important caveat – at current rates of consumption – was left off. The way you get 100 years' worth is you take 2010 consumption and you divide it into the total possible reserves and estimated resources, no matter how speculative or improbable their eventual extraction may be.

That is, 100 years is the highest possible number. But once you factor in increasing consumption (which is a sure thing, by the way), you get a much lower number. How much lower? Well, if we increased our consumption by 7% per year – admittedly a high figure, but not unthinkable, especially if we use more for transportation purposes – the 100 years collapses to just 29 years.

Such is the miracle of compounding.

To continue, we might not be able to extract all of the possible and speculative resources that are part of the 100-year calculation. If it turns out that we're only going to be able to extract, say, 75% of everything we think is there, the rest simply won't be economically extractable. If we combine this 75% figure with a yearly increase in consumption of 7%/yr, then we discover there's just 25 years of natural gas left. That's just simple math. While 25 years is at the extreme end of the dismal view, it does help to bracket the "100 years" claim.

So let's say total gas left is somewhere between 25 and 100 years – let's assume a mean value of around 50 years – and this is before we entertain any thoughts of exporting LNG. Any exports will only eat into these figures, possibly quite dramatically.

How dramatically?

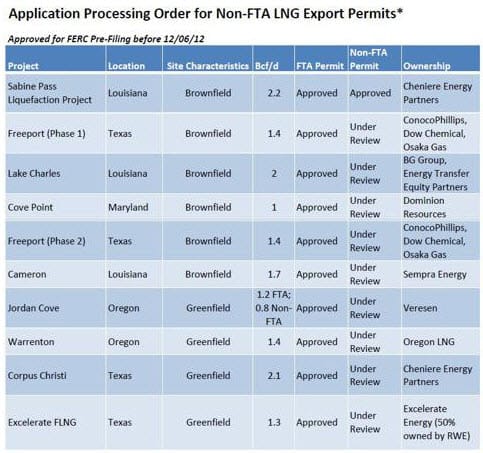

Here is a partial list of the LNG export terminals that are in some stage of approval by the U.S. government:

(Source)

If we add up all of the proposed projects, inlcuding an equal number not on the above list, we discover that their collective export capacity is just a hair under 30 billion cubic feet per day, or a whopping 43% of current U.S. production.

Now I realize that they can't all be approved, or maybe I should say won't be approved, because that would absolutely destroy the domestic U.S. natural gas supply. But if they were, just for the sake of running the numbers, here is what happens to the "100 years of natural gas":

Assuming that the exports come out of increased production and not at the expense of domestic consumption, meaning that the ability to export just drives the gas drilling industry absolutely bonkers and they are able to meet that additional 30 billion cubic feet of demand (highly unlikely, by the way), then we get some very startling results.

Holding domestic consumption constant (which is, again, unrealistic), and assuming we get 100% of everything out of the ground including even the most speculative of resources, we find that exporting 30 billion cubic feet per day reduces the "100 years" to just 30 years.

But let's make this more realistic. If we add a quite realistic 4% per year increase in domestic consumption to the equation, the 30 years falls to 25 years. If we then apply a modest haircut to the natural gas resources of 25%, we find that the U.S. natural gas supply falls to just 19 years.

Nineteen years. That's quite different from 100 years, now isn't it?

Okay, it stands to reason that any export driven demand for natural gas will drive up the domestic price of natural gas, which will slow down if not reverse the recent trend of manufacturing concerns returning to U.S. soil. They have done so because of the cheap price of natural gas. End of story.

Rapid Depletion

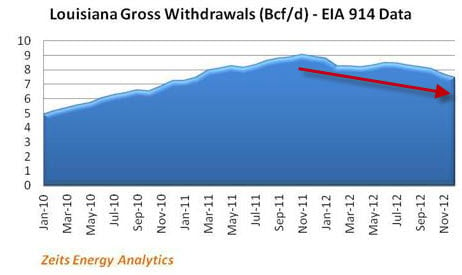

In fact, it may be too early to yet claim that the U.S. has an energy bonanza that is so large we should plan on exporting it. The reason is that the shale plays are a very recent development.We are learning about them in real-time, and, unfortunately, a lot of what we know about them comes to us from the very same producers that benefit from telling a good tale.

The simple fact is that shale wells deplete at horrific rates, such that they lose anywhere from 80% to 90% of their initial production after just 3 years. As long as we keep drilling them at a faster and faster pace, we'll have more and more natural gas – until we begin to run out of new drilling spots, that is.

Consider this story: The largest shale gas play in the U.S. until the Marcellus shale took that honor, was the Haynesville shale play in Louisiana. Let's travel back, way back in time, all the way to...2008...and hear what the CEO of Chesapeake Energy had to say about that particular play:

CEO: Haynesville Shale is fourth largest in the world

Jul 3, 2008

The Haynesville Shale is likely to become America's largest natural gas field and perhaps the fourth largest in the world, Chesapeake Energy Chairman and CEO Aubrey McClendon disclosed Wednesday in a conference call with its newest partner, Plains Exploration and Production Co.

McClendon's confidence in the Haynesville Shale's ability to produce such volumes of natural gas is based on two years of research. More than 70 well penetrations into the deep shale in an area considered the core were analyzed, along with hundreds outside of the core, he said.

How exciting! Indeed, the Haynesville play turned out to be a monster producer and Chesapeake Energy was in there as a major player. The hype was only true for a very short while. All of that excitement back in 2008 had evaporated by 2011 when the Haynesville play hit its peak of output...just three years later.

(Source)

Wow. That was fast.

For its part, Chesapeake alone hit 2.0 billion cubic feet (bcf/d) per day from its Haynesville wells just about a year ago and is now producing just 1.3 bcf/d. Part of the reason for the rapid decline is that very few wells are being drilled in the play right now because the price of natural gas is well below the cost to drill and produce natural gas from this formation. But the dynamic is illustrated well by the Haynesville example; these shale plays produce quickly and decline just as rapidly. In other words, making long-term plans on our energy export markets based on a few years of data with a brand new energy reservoir about which we know relatively little seems hasty at best.

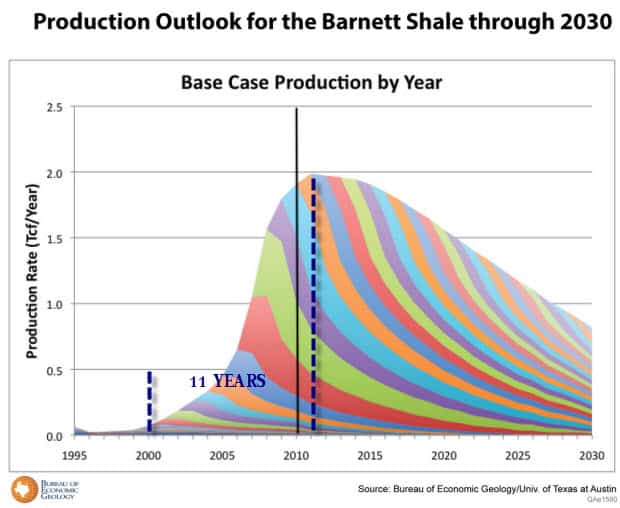

One more example, this one from the first and formerly largest shale gas play in America, the Barnett Shale in Texas, shows a similar story. From inception of significant drilling operations to peak was just 11 years.

(Source)

Again, the story here is that even the very best shale gas plays are relatively short-lived, which is exactly what we’d expect from an energy source that depletes so rapidly. The summary is that a commitment to export becomes a commitment to drill at a faster pace.

Conclusion

Without any question, exports of natural gas from the U.S. will simply accelerate the day when that finite resource runs out. Further, there cannot be any question but that as additional demands are placed upon the domestic supply, prices will rise.

This will hurt our resurgent domestic manufacturing industries as well as future generations that will have to contend with less domestic energy than they might otherwise have had available to them.

In all of this, there is a very obvious and demanding issue of generational stewardship. Is it really our 'job' to extract a finite natural resource so quickly? Can we not think of anything else to do with these "one-time use" BTUs besides wasting 25% of the embodied energy simply to export it for money?

Imagine if the Americans of 100 years ago had figured out a way to export all of the U.S.'s natural gas bounty, and we were now struggling with the aftermath of those actions. I, for one, would look quite unfavorably on those who so utterly failed to appreciate the limited nature of that abundance that they literally wasted it.

Perhaps our job is not to extract things so rapidly that it creates pricing problems for the overproducers. Perhaps instead it is to use our finite resource as judiciously and as wisely as possible.

My proposal would be to retain all natural gas for domestic use, and couple that abundance to a rational and forward-thinking energy policy that delivers a robust and resilient energy infrastructure to future generations. They will thank us for giving them efficient buildings and rational transportation systems at a time when energy finally becomes truly scarce – and proportionally expensive.

The time has come to give greater weighting to energy matters than to economic and political desires. To continue to be energetically wasteful at this time in history, when so much data is telling us that the effluent of our activities is measurably altering our support systems, is beyond embarrassing. It's tragic.

~ Chris Martenson

This is a companion discussion topic for the original entry at https://peakprosperity.com/the-obama-administrations-natural-gas-policy-is-tragically-misguided/