Contents

Part 1

- Background

- Contents

- Investing

- Thinking About Capitalism

- Election Year

- Events

- Broken Markets

- Precious Metals

- Resources and Energy

- The Baptists

- The Bankers

- The Federal Reserve

- The Bootleggers

Part 2

- Personal Debt

- Mortgage Debt

- Student Debt

- Municipal and State Debt

- Corporate Debt

- Sovereign Debt

- Pension Crisis

- Roth IRAs: A Bad Idea

- Europe

- Asia

- Government Corruption

- Civil Liberties and the Constitution

- Limits of Government

- Books

- Acknowledgements

- Links

Personal Debt

I spent all my money on women and wine, and the rest I wasted.

~ George Best, Irish soccer player

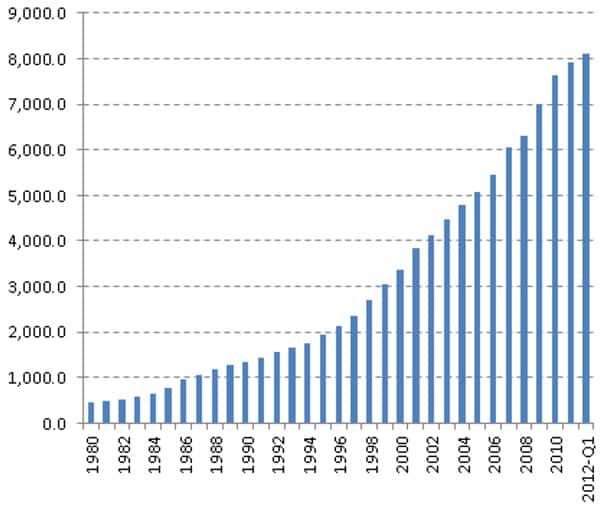

Debt permeates all levels of the global economy. In the U.S., debt is growing much faster than the GDP (Figure 12). A montage of over 50 charts showing all facets of debt is well worth a peek.164 Authorities are convinced that more spending and more debt will be our salvation. Daniel Bell, a Marxist from the turn of the 20th century, took the other side of this bet, suggesting that the consumer would eventually consume themselves. Apparently, I’m a Marxist. In this section I would like to briefly discuss personal debt. (Special aspects of student and mortgage debt are cordoned off into their own sections.)

Figure 12. Accrued debt with annotations showing dollars of debt required per dollar of GDP (source link lost).

The so-called resilient consumer is getting squeezed from every direction. The income of the average family has dropped from $53,000 to $47,000 in only 5 years.165 Deleveraging is evidenced by a dropping debt-to-income ratio in Figure 12, yet two thirds stem from defaulted mortgages.166 The national savings rate has once dropped to zero from historical norms of 10%. Credit card debt is said to be the leading cause of suicide among adult males.167 Trimtabs reports a 40% drop in net median family worth since 2007.168

Should the average family of four earning $47,000 happen to rashly buy everybody iPhones, they just committed 4-5% of their gross income to phone service. I’m not sure even families earning $150,000 should spend that much on phone service. Television and children’s activities used to be largely free; now we pay. Internet, as amazing as it may be, is a necessary expense. Don’t think so? See how your kids do in school without it. Figure 13 shows the ratio of personal consumption versus compensation. That rise stems from a combination of decreased savings and increased debt.

Figure 13. Personal consumption versus compensation.169

In 2010 I discussed an insidious and overlooked contribution to inflation—accelerated depreciation. It is still overlooked by the mainstream so I am going to take one more abbreviated whack at it. For example, in 2009 I broke a 40-year-old blender. The Boskin Commission14 would argue that its replacement is even cheaper than the price tag would indicate because it has more buttons. Government statisticians actually “hedonically” adjust the price down for improved quality. Alas, that really cheap blender died after only two years of dedicated service. Chintzy goods at affordable prices have trapped consumers in a vicious replacement cycle. If Boskin et al. had looked at the per year cost of the blender, they would have corrected for depreciation with a 20-fold price multiplier before comparing the relative prices of old and new. The net domestic product—the gross domestic product with depreciation included—is an antiquated concept that needs resurrection.170 Meanwhile, the consumers are choking on their vomit trying to keep up with depreciation.

Mortgage Debt

There is not a menace in the world today like that of growing public indebtedness and mounting public expenditures.

~ Warren G. Harding, former President of the United States

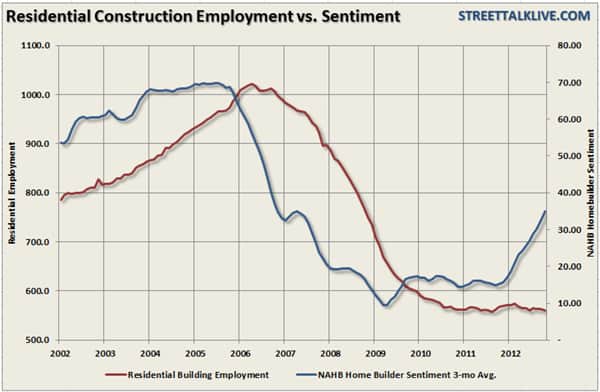

Harding was considered to be one of the least competent presidents. Could have fooled me. Mortgage debt presents its own unique issues. We are slowly winding down the mortgage bubble that burst in 2007 through a combination of defaults and debt restructurings. To say, however, that a modest uptick in housing activity means that the problem is solved is ridiculous (Figure 14). Is housing recovering? Not really. Maybe sentiment has begun to change but only with the unprecedented force of a central bank behind it.

Figure 14. Home building employment (red) compared with home builder sentiment (blue).

There are still an estimated 11 million homeowners underwater on their mortgages, including more than a million people who have just bought in the past two years.171 Ill-advised efforts to bail them out—foreclosures clear the market—seem to have faltered. Special Inspector General of the TARP Neil Barofsky discovered Geithner never intended to aid homeowners, only to delay foreclosures for a year or two so that they could occur orderly. Writedowns are taxable income,172 which prevents homeowners from accepting them. Distressed real estate purchased by speculators appears to decrease the housing glut. Unfortunately, this shadow inventory still exists if the speculators intend to flip the houses for a quick capital gain. The market won’t clear until demographics and income growth clear it, both of which are going backwards.

There seems to be some resolution of the catastrophe caused by the Mortgage Electronic Registration System (MERS) in which the ownership of millions of houses are being thrown into legal purgatory by foreclosure. Bank of America supposedly offered to take a deed in lieu of foreclosure, presumably to get the deed legally.173 Legally dubious foreclosures are clearing through the legal expedient of turning a blind eye. Efforts in California to use eminent domain to clear out problematic underwater mortgages are so egregious that I have deferred them to the section on Civil Liberties and the Constitution.

Student Debt

Bart: don’t make fun of grad students. They just made a terrible life choice.

~ Marge Simpson

You’re f*cked.

~ Robert Reich, former Secretary of Labor, to Class of 2012

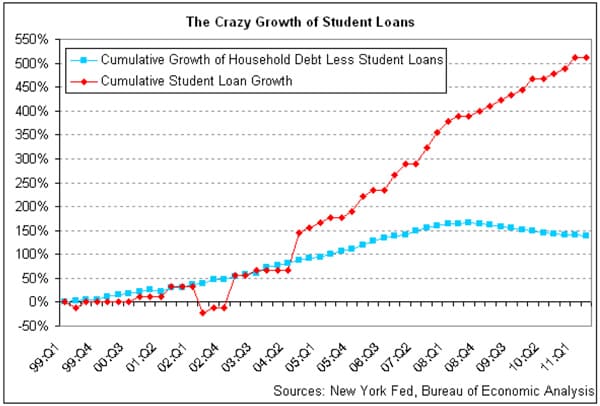

Student loans have soared from $200 billion in 2000 to over $1 trillion today (Figure 15),174 surpassing credit card debt. Some say there is a student loan bubble, but the Bush-era legislation ensuring that student debt cannot be discharged even in bankruptcy suggests there is no bursting mechanism. Nevertheless, something will give, because loan delinquencies are going parabolic.175 The paradoxical effect of the full-recourse loans is that banks are happy to provide almost unlimited funding to a slice of society rich in ill-conceived ideas. This debt is also localized in the most financially vulnerable demographic slice during a severe economic downturn. It ain’t just the kids. An estimated $38 billion in student loans are owed by seniors 60 and older, probably stemming from desperate efforts to retool their careers as well as co-signed loans for children and grandchildren.176

As if the debt burden was not enough, potential employers are checking credit reports. High student debt can render you unemployable.177 Seems unfair. The average medical school graduate has $161,000 in student loans.178 The ultimate irony is that those young doctors on the cusp of achieving the American Dream cannot afford a starter house. Ben Bernanke’s son is said to be $400,000 in the hole.179 Bernanke is indeed the father of a gigantic credit bubble. Financial independence for twenty-somethings—a rite of passage only a few years back—has become increasingly out of reach.

Figure 15. Comparison of student loan growth and other consumer debt growth.180

An entire generation has been set up for debt servitude. We are eating our young. The source of the problem is a complex and nuanced confluence of factors. The chronically profligate boomers, stressed by inflationary pressures and dazed by the equity and real estate downturn, are in no position to help their kids pay for college. The cost of a four-year college education has also soared, while earnings after college have stagnated (Figure 16).181 The number of 26-year-olds living with their parents has jumped almost 46 percent since 2007.182

Figure 16. Plot comparing college costs and earnings in early adulthood.183

What is causing the rapidly escalating college costs? As a professor of 33 years, I can offer a few thoughts and opinions.

(1) College tuition—the cost of running a small city—may be the single best measure of inflation. The tuition growth squares well with the inflation numbers posted by John Williams of Shadowstats.com.

(2) Rapidly growing federal and state mandates to universities escalate bureaucratic costs. You know all those extra positions you see in secondary schools that didn’t exist when we were kids? Universities have them too.

(3) Universities are much more complex, interconnected organizations than they were 30-40 years ago.

(4) The quest to attract the best possible students and faculty has produced something akin to an arms race among the schools, forcing up the costs of chasing the competition.

(5) Universities are financial enterprises that can approach $1 billion annual operating costs and are managed largely by academics often lacking the requisite training. The Dean of Arts and Sciences at Cornell is a physicist—a smart guy by any measure. What prepared him to run a $100+ million enterprise?

(6) Guaranteed payers—banks offering unlimited student loans in this instance—are always inflationary.

I have an aversion to debt jubilees, but I suspect we are heading for a federally sponsored bailout of borrowers and those who traffic in student loans. How do we prevent a repeat of this debt problem? First, a warning: Don’t buy into the increasingly common claims that college is a waste of money. Such blanket statements are counterfactual. One rich dude bribed 100 kids not to go to college.184 Some will be fine but others are going to get hit by the cluster truck. There are, however, many circumstances in which a kid should not go to college.

Students must be good consumers. It’s not just a degree; it’s an education. This means choosing paths wisely and working hard. Not all majors or institutions are created equal; enough said. Debt is a bad idea if it is not self-extinguishing—paid off with the net gain in proceeds from the education. If the kids lack direction or need a break, parents need to let them take time off. You read that right— it's the parents, not the kids, who oppose the change. Save your money until it will be used wisely. For their part, schools need to focus on strengths and, in many cases, specialize. Paul Smith's College, a small college in the Adirondack Mountains, is a great example. They educated my older son. His profound success after an inauspicious secondary education stems from the school’s focus—only four, highly pragmatic, majors. What a great model!

How do we fund college educations going forward? I understand the origin of full-recourse loans but find non-dischargeable debt to be anathema to the American system. We’ve got to curb predatory lending; full recourse loans with interest rates and penalties akin to subprime debt is loan sharking. The libertarian in me says caveat emptor, yet this is a vulnerable demographic lacking fully developed frontal cortexes. The best idea may involve creditors purchasing a percentage of the students’ earnings after graduation for a fixed period (10% for ten years, by example). It’s a form of venture capitalism. I would gladly invest in a tranche of loans to MIT students promising a slice of their earnings—at the right price, of course. For those schools in which the bet is a bad one—the loans are too big, attrition is TOO high, or incomes after graduation are on average too low—the resulting market-determined high interest rates would force change or the institution would fail.

The idea of “no child left behind” would take a beating, but I don’t buy the notion that we need more college-educated adults. We need better-educated adults. Whether this means education in a four-year college or a trade school is highly student dependent. Father Guido Sarducci’s “Five Minute University” has an appeal.185 Another very entertaining parody makes a case for Princeton.186 I would also say beware of law schools. They can be great opportunities but can also be exceedingly expensive holding tanks for college graduates still lacking direction.187

By the way, would somebody—anybody—start teaching courses in personal finance at the high school and collegiate levels? That void is what got us into this mess in the first place.

Municipal and State Debt

This is not a boating accident.

~ Richard Dreyfus in Jaws

The balance sheets of municipalities and states are a total mess. Forbes recently noted 11 states flagged for dangerous finances.188 It’s not just the sand states that are in trouble. Syracuse, NY is considering a debt restructuring due to excessive expenditures and pension promises.194 Reuters reported that outstanding bonds, unfunded pension commitments, and budget gaps exceed $4 trillion for the 50 states.195 That’s approximately $40,000 per taxpayer in the country. Illinois is now $150 billion in the hole, yet the voters defeated legislation designed to stem rising pension costs.189

California’s estimated annual deficit rose from $9 billion to a considerably larger $15 billion in a matter of months. California alone owes over $600 billion, with New York coming in a distant second at $300.1 billion.190 These are self-inflicted wounds. Orange County paid lifeguards annualized salaries of $200K.191 Hermosa Beach meter maids racked up an astonishing $300K annual salaries.192 Stockton, San Bernardino, and Mammoth Lakes all filed for bankruptcy protection this summer.193 San Bernardino City officials sped up the filing to preempt legal action by creditors. Under Chapter 9, all court cases and other legal actions are halted until the bankruptcy case is over.

Rock star banking analyst Meredith Whitney predicted serious financial stresses for municipalities, yet she made the fateful mistake of predicting what and when.196 The Mayans taught us that you never predict both. At year end, the criticisms have been mounting. With that said, Moody’s is looking to downgrade some California municipal bonds. Buffett picked up a pile of municipal bonds at deep discount during the crisis, presumably using inside knowledge of the Fed backstop that he helped design, only to dump a bunch of these bonds this year.197 The muni bond story is just getting started.

Corporate Debt

In aggregate, US balance sheets are in very poor shape.

~ Andrew Smithers, CEO of Smithers and Co.

You may have heard recently that…U.S. companies…are sitting on growing piles of cash they are ready to invest in the economy. There's just one problem: It's a crock.

~ Brett Arends, MarketWatch

Andrew Smithers and Brett Arends are the only two guys I know who claim that corporate balance sheets are not in good shape.198,199 Everybody else raves about the robust corporate balance sheets while focusing on only one side. Corporations are flush with cash and chock full of debt (Figure 17).200 They are hoarding cash, presumably in anticipation of more credit constraints. The DOW 30 has a net debt (debt minus cash) of $500 billion despite fortress balance sheets by a minority including Microsoft, Cisco, and, if you believe them, JPM. Only 7 of the DOW 30 have net positive cash positions. Pensions of large-cap companies are also significantly underfunded (vide infra). It is estimated that major corporations globally will be refinancing $45 trillion of debt over the next couple of years.201 None of this suggests strong balance sheets, only generous credit lines.

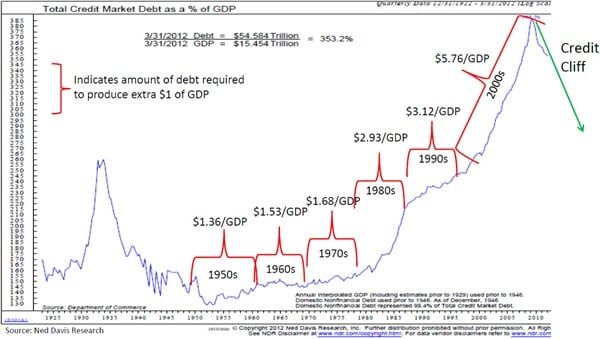

Figure 17. Non-financial US corporate debt market (billions of dollars) (source: SIFMA).

Sovereign Debt

There are two ways to conquer and enslave a nation. One is by the sword…the other is by debt.

~ John Adams, former President of the United States

There’s always the Federal Government to bail us out, right? Maybe, but we’re in serious trouble. The U.S. debt doubled in only four years (19% annualized). A recent Treasury report indicates that in less than a year we added $2.1 trillion to the national debt. Although it is tempting to point fingers, a screw-up of this magnitude requires a bipartisan effort. The Federal debt and deficit inspired Egan-Jones to downgrade U.S. debt,202 which then inspired the SEC to investigate them (Egan-Jones, that is).203 The spendthrifts declare that we had a financial malaise to deal with. I wonder if history will look favorably on a Keynesian experiment in which we injected $1 million of government stimulus for each newly created job.204

It is estimated that we are collecting only 60 cents of every dollar spent by the Federal government. This is not the beginning of the end of some debt frenzy. It is the end of the end. Who is buying all this debt? Funny you should ask. The Fed is buying 60-80% of it. How do we afford it? Oddly enough, the Fed controls the interest rate on federal debt. Uncle Sam has an unbelievably cushy line of credit thanks to Fed largesse. The whole Fiscal Cliff debate illustrates that austerity is too inconvenient to deal with right now. We can worry about tightening the belt later. But this secular bond bull market is very long in the tooth. At some point rates will rise just like night follows day. Each 1% rise in rates on $16 trillion dollar debt adds an additional $160 billion to our interest rate payments.

What if we just really suck it up? Seriously. What if we go to the extreme by dropping all discretionary spending? No more military, highways, education, parks, etc. and pay only the interest on the debt and other payments mandated by statute. We still fall short of a balanced budget.205

For those confused about the Clinton-era balanced budget, it was a hoax—we had gobs of off-balance-sheet expenses putting us in the red. The reported deficit is the innocuous part. If one looks at unfunded liabilities—promises made to the populace for which we haven’t a clue where the money will come from even after projected tax revenues are included—we are in huge trouble. Years ago, Kotlikoff, Burns, and Smetters estimated $44 trillion of unfunded liabilities. Kotlikoff is now estimating over $200 trillion—40 Krugmans! (1 Krugman = $5 trillion)206 That comes to an IOU of $2 million dollars per viable taxpayer. So let’s not trivialize this issue by suggesting that this will hurt our grandchildren. As far as I am concerned, they are on their own. This is gonna crush you and me.

Pension Crisis

Demography is like a glacier: It doesn't move fast, but it is very predictable...it's inexorable.

~ Neil Howe, author of The Fourth Turning

We have a massive, multi-dimensional pension problem. Let’s begin with a look at the personal pension plans most commonly associated with 401K plans and related IRAs. Optimistic retirement planners at Fidelity recommend socking away 8x annual income by retirement.207 That’s not enough. More conservative estimates reach as high as 20x or even 25x your annual salary in savings.208 Further problems stem from the bond market, which approximates 40% of all retirement portfolios.209 In the downturn, huge gains in principal mitigated the pain of the equity losses. The best-case scenario going forward is that rates stay low forever, resulting in miniscule cash flows and no loss in principal. The more likely scenario is that interest rates rise and prices drop causing significant losses in principal. There is no slack left. Reaching for yield buying sketchy forms of fixed income is likely to be a road to ruin. Bold assumptions of 7-8% annual returns on pension portfolios will require double digit equity gains. Buffett and anybody else actually paying attention, however, will tell you that dropping rates, not low rates, helps equities.<a href="https://www.peakprosperity.com/blog/8032

This is a companion discussion topic for the original entry at https://peakprosperity.com/2012-year-in-review-contd/