[Every year, friend-of-the-site David Collum writes a detailed "Year in Review" synopsis full of keen perspective and plenty of wit. This year's is no exception. Moreover, he has graciously selected PeakProsperity.com as the site where it will be published in full. It's quite longer than our usual posts, but worth the time to read in full. A downloadable pdf of the full article is available at the bottom of the post -- cheers, Adam]

Background

I was just trying to figure it all out.

~ Michael Burry, hedge fund manager

Every December, I write a Year in Review that has now found a home at Chris Martenson’s website PeakProsperity.com.1,2,3 What started as a simple summary intended for a couple dozen people morphed over time into a much more detailed account that accrued over 25,000 clicks last year.4 'Year in Review' is a bit of a misnomer in that it is both a collage of what happened, plus a smattering of issues that are on my radar right now. As to why people care what an organic chemist thinks about investing, economics, monetary policy, and societal moods I can only offer a few thoughts.

For starters, in 33 years of investing with a decidedly undiversified portfolio, I had only one year in which my total wealth decreased in nominal dollars. For the 13 years beginning 01/01/00—the 13 toughest investing years of the new millennium!—I have been able to compound my personal wealth at an 11% annualized rate. This holds up well against the pros. I am also fairly good at distilling complexity down to simplicity and seem to be a congenital contrarian. I also have been a devout follower of Austrian business cycle theory—i.e., free market economics—since the late 1990s.4

Each review begins with a highly personalized analysis of my efforts to get through another year of investing followed by a more holistic overview of what is now a 33-year quest for a ramen-soup-free retirement. These details may be instructive for those interested in my approach to investing. The bulk of the review, however, describes thoughts and observations—the year’s events told as a narrative. The links are copious, albeit not comprehensive. Some are flagged with enthusiasm. Everything can be found here.5

I have tried to avoid themes covered amply in my previous reviews. There is no silver bullet, however, against global crises, credit bubbles, and feckless central bankers. Debt permeates all levels of society, demanding comment every year. Precious metals and natural resources are a personal favorite. This year was particularly distorted by the elections; I offer my opinions as to why. Sections on Baptists, Bankers, The Federal Reserve, and Bootleggers describe the players in Jack Bogle’s Battle for the Soul of Capitalism.6 Special attention is given to a financial crime diaspora fueled by globally overreaching monetary policies. Everything distills down to a relentlessly debated question: What is the role of government? I finish light with the year’s book list that shaped my thinking. I acknowledge individuals who have made pondering capitalism a blast through direct exchanges over the years. They brought wisdom; I brought the chips and dip. You already know who you are. And then there are those characters whose behavior is so erratic, sociopathic, criminal, or just plain inexplicable—you guys are central to the plot. I leapfrog Rome and Titanic metaphors and go straight to the Lusitania.

One last caveat: I subscribe to the Aristotelian notion that one can entertain ideas without necessarily endorsing them, often causing me to color way outside the lines. With trillions of dollars circumnavigating the globe daily, nefarious activities are not only possible but near certainties. If you are prone to denounce conspiracy theories and conspiracy theorists to avoid unpleasant thoughts, you should stop reading now. I’m sure there’s another Black Something sale at Walmart. If you are a bull, you should also bail out or buckle up. This is the bear case. I will remain a permabear until some catharsis knocks me off my stance and they find a cure for my market- and politics-induced PTSD.

As this review was being completed, Lauren Lyster and Demetri Kofinas recently uploaded a companion interview on the Year in Review I did with Capital Accounts on RT_America (to be aired on December 21st and posted on Youtube.)7 In this context I offer wisdom from the Master:

If there is ever a medium to display your ignorance, television is it.

~ Jon Stewart

Footnote superscripts appear extensively throughout this review. The actual footnotes and associated hyperlinks can be found here.

Contents

Part 1

- Background

- Contents

- Investing

- Thinking About Capitalism

- Election Year

- Events

- Broken Markets

- Precious Metals

- Resources and Energy

- The Baptists

- The Bankers

- The Federal Reserve

- The Bootleggers

Part 2

- Personal Debt

- Mortgage Debt

- Student Debt

- Municipal and State Debt

- Corporate Debt

- Sovereign Debt

- Pension Crisis

- Roth IRAs: A Bad Idea

- Europe

- Asia

- Government Corruption

- Civil Liberties and the Constitution

- Limits of Government

- Books

- Acknowledgements

- Links

Investing

The elevated prices of financial assets have already eaten the future.

~ John Hussman, CEO of Hussman Funds

With rebalancing achieved only by directing my savings, I have changed almost nothing consequentially in my portfolio year over year. The total portfolio as of 12/15/12 is as follows:

Precious Metals et al.: 52%

Energy: 15%

Cash Equiv (short-term): 30%

Other: 3%

Most asset classes lurched off the starting line in January like Lance Armstrong. My portfolio eventually settled down and spent most of the year snorkeling slightly up or slightly underwater. In a relatively rare instance, an overall return on investment (ROI) of 4% was beat handily by both the S&P 500 (13%) and Berkshire Hathaway (17%), although nearly the entire return of the S&P was p/e expansion.8 A majority of hedge funds struggled to beat the S&P this year as well.9

My precious metals are distributed in approximately three equal portions to the gold-silver holding company Central Fund of Canada (CEF), Fidelity’s precious metal fund (FSAGX), and physical metals (Figure 1). Gains in gold (17%) and silver (8%) were offset by a horrendously lagging performance for the second year in a row by the corresponding precious metal-based equities (-10%). The metal-equity divergence began in January 2011 and continues to baffle the hard-asset crowd (Figure 2). A plot of the ratio of the silver ETF (SLV) versus the world’s largest silver miner, Pan American Silver (PAAS), is striking (Figure 3). In May I emailed a dozen gurus for opinions about arbitraging (swapping) an SLV position for PAAS. Realizing that collectively these folks controlled billions of dollars, I felt I had to move on the idea pronto (my only portfolio change for the year). After a few weeks of an overwhelming sense of superiority, gyrations eventually left the arbitrage at about break-even. I’m guardedly optimistic about the precious-metal equities, but they have been widowmakers for two years.

Figure 1. Precious-metal-based indices (GLD in green, XAU in red, SLV in brown, and XAU in red) versus the S&P 500 (in blue) for 2012.

Figure 2. Relative performance of gold-based equities (XAU in red) vs. gold (GLD in blue).

Figure 3. SLV/PAAS ratio over three years.

A basket of Fidelity-based energy and materials funds afforded 2-16%. They are represented emblematically by the XLE spider (3%) and XNG Amex natural gas index (1%) in Figure 4. I am wildly bullish on natural gas for reasons discussed in detail two years ago.2 Unfortunately, Fidelity’s natural gas fund (FSNGX) foisted upon me by Cornell got crushed in 2009 and subsequent years relative to its peers. Making the right calls is hard enough without that kind of headwind. New management as of 2010 seems to be finally tracking the XNG. I keep adding to an already chunky position. Friends deeply embedded in the energy complex suggest that the fracking glut will take 2-3 years to burn off. (It is also claimed that the derivatives traders are whacking out the price discovery; what else is new?)10 A global shift toward natural gas should reward patience.

Figure 4. Energy-based indices (XLE in red and XNG in green) versus the S&P 500 (in blue) for 2011.

Cash was in a U.S. Treasury-backed money-market bunker returning 0%. I had a $25K money market fund that failed to reach the IRS taxable threshold! I could care less what risky gangplank Bernanke wishes that I walk. Buying ten-year Treasurys returning <2%, with or without your finger quivering over the sell command, is a fool’s game: I’ll take the yield hit. The bond market will eventually become a killing field. Those who are pair trading—long bonds/short brains—will get their organs harvested. This seems like a near certainty.

The most disappointing part of the year was a personal savings equivalent of only 11% of my gross income compared with 29% last year and 20-30% in typical years. Unusual expenses in the form of a year of college education, a serious violin upgrade, and very large landscaping costs don’t excuse the fact that we chose lower savings over lower consumption. This troubles me deeply. Profound austerity is not a cause but an effect, something the Europeans may be just now figuring out.

To understand my lifetime returns, you must understand two unusual premises that have dominated my thoughts and actions. First, you must become wedded to an investment. Did I just say that? Yep. You’ve got to be a true believer to resist being shaken out of good investments or suckered into bad ones. Many say it’s never a bad time to take a profit. Total hooey. Those ten-baggers—the miracles of compounding—will never materialize if you bail after 20%. Just ask the Microsoft investors who exited in 1990 for a handsome profit.

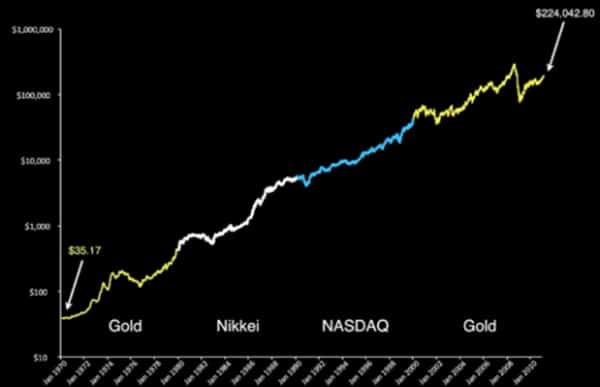

My second premise is that you have to get it right only about once a decade. One of my favorite bloggers and an e-pal, Grant Williams, illustrated how daisy-chaining four secular bull markets—Gold, Nikkei, NASDAQ, and Gold—could have produced a virtual return of 640,000%—a 6400-bagger (Figure 5).11 Admittedly, this kind of luck is only found in Narnia. Statistically, somebody might have done this, although not likely in such a Texas Hold’em all-in fashion.

Figure 5. Sequential investments in secular bull markets starting in 1970.11

My variant of such a sequential trek via imbalanced portfolios changed in decadal rhythms as follows:

1980-88: exclusively bonds (100%)

1988-99: classic 60:40 equities:bonds

1999-2001: cash, precious metals, shorts (minor)

2001-2012: cash, precious metals, energy, tobacco (minor)

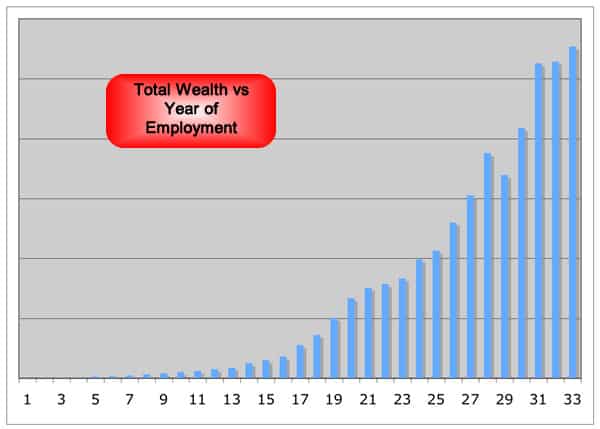

My total wealth accumulated through a combination of savings and investment as shown in Figure 6. (I redacted the dollar amounts along the y-axis.) Avoiding 1987 and 2000 equity crashes and capturing the bull market in precious metals proved fortuitous. You can see that 2008 was the only down year. Berkshire has dropped five years since 1991. A 13-year accumulation rate beginning 01/01/00 of 11% annualized compares favorably to an annualized return on the S&P of -0.03% and on Berkshire of 7%.

Figure 6. Total wealth accumulated (ex-housing) versus year of employment. Absolute dollar values have been omitted.

I also monitor overall progress by what I call a salary multiple, which is defined as the total accumulated investable wealth (excluding my house) divided by annual salary (line 22 of the 1099 form excluding capital gains). Over 33 years my salary (actually total income) rose twelve-fold, which I can fairly accurately dissect into a fourfold gain resulting from inflation and a threefold gain (relative to starting salaries of newly minted assistant professors) due to increasing sources of income and merit-based pay raises. My accumulated wealth normalized to the moving benchmark of a rising income is plotted versus time in Figure 7. The fluctuations visible in Figure 7 not apparent in Figure 6 result from income variations.

Figure 7. Total wealth accumulated measured as a multiple of annual salary versus years of investing.

To clarify the origins of a 13-year return of 11% per year I offer Figure 8. By plunging into the precious-metal and energy sector early and avoiding all other forms of investments (S&P in particular), I was able to capture the entire hard-asset bull market. According to Money magazine’s calculator,12 I can spike the ball in the endzone and dance. They are wrong. My ultimate target—a valid target—is to accumulate 20 salary equivalents over the next 12 years (age 70). This will require an inflation-adjusted (real) annual growth of 4-5%. Some of that will come from savings. As you can tell by the Hussman quote and discussions below, however, such gains are not assured.

Figure 8. Plot of Central Fund of Canada (CEF; 1:1 gold:silver by value), XLE, and S&P.

Thinking About Capitalism

When the blind lead the blind get out of the way.

~ First grader

I realize that is what I do—I think about capitalism. It’s not deep stuff; more like taking a weed whacker to a hay field of information. This year, however, there was something askew—something corrupting the information flow. It was the presidential elections. This is a good starting point.

Election Year

No serious person would question the integrity of the Bureau of Labor Statistics. These numbers are put together by career employees.

~ Alan Krueger, White House Council of Economic Advisers

To a news and economic data junkie, presidential elections are profoundly distorting. The news feeds are inundated by election analyses that are mundane at best and nauseating on a bad day. It’s a variant of Gresham’s Law—bad information pushes out good. The pundits are either talking about the elections explicitly or couching potentially credible news stories in the context of the election. Terrorist attacks in Benghazi mutate into Obama’s Big Screw Up. The news feeds are further corrupted by billions of campaign dollars spent to deceive us. Frank Rich, award-winning New York Times journalist, estimates that George Bush had 120 “journalists” on payroll. They get overtime and hazard pay during elections. The shenanigans go deeper.

There have been numerous accusations of voter fraud. From my recollection, it was mostly the left accusing the right (the CEO of Diebold in particular). A window opened when the mischievous computer hackers, Anonymous, did a smash-and-grab on Stratfor’s server, obtaining over 5 million emails. Stratfor provides confidential intelligence services to large corporations and government agencies, including the U.S. Department of Homeland Security, U.S. Marines, and U.S. Defense Intelligence Agency. From 971 emails released to date (by Wikileaks), we find that Democrats stuffed the ballot boxes in Pennsylvania in 2008 that went unchallenged by McCain. Jesse Jackson shook down Obama for a six-digit payoff.13 Emails detailing the Bin Laden capture are worth a peek.

The most insidious election year distortion may be the tainting of economic data feeds that the marketplace relies on. Data coming from career statisticians in the federal government are always suspect. The inflation numbers, for example, are widely believed to be cooked beyond recognition using corrections recommended by the Boskin Commission.14,15 This year, however, the data massaging morphed into an all-out rub ‘n’ tug to ensure a happy ending for the Democrats.

The data from the Bureau of Labor Statistics (BLS) are especially susceptible to corruption. The Birth-Death Model, for example, estimates new jobs being created that nobody can detect.16 Apparently, the absence of data demands that some get fabricated. These embryonic jobs have reached epidemic proportions—hundreds of thousands per month—oftentimes overwhelming the detectable jobs. Curiously, no administration ever fabricates undetectable job losses.

Another trick is a very simple iterative process for reporting statistics: Step 1—Announce inflated economic statistics as good news; Step 2—correct the inflated statistics at some later date to a very deflated number, hope nobody notices, and call it “old news anyway”; Step 3—Report new inflated numbers that are spectacular improvements relative to the recently deflated statistics. Rinse, lather, repeat.17

The fibbing gets serious during an election year. When pre-election unemployment numbers plummeted by 0.4%—a monumental drop—the response was immediate, visceral, and seemingly uncontestable disbelief. David Rosenberg expressed it well:

I don't believe in conspiracy theories, but I don't believe in today's jobs report either.

~ David Rosenberg, Gluskin Sheff and ex-Merrill Lynch

Well, Rosie, apparently you do believe in conspiracy theories. Within minutes of the report Jack Welch, no neophyte to creative bookkeeping, released his now-infamous Tweet:

Unbelievable jobs numbers...these Chicago guys will do anything... can't debate so change numbers.

~ Jack Welch, former CEO of General Electric

It was an election year, however, so the goofy employment numbers morphed into a hot-button issue. Right-wing pundits accused the Obama administration of cooking the books. Left-wing pundits fired back with the shrill accusation, “Conspiracy theorists!” Few remembered that the GOP accused the Democrats of cooking the same numbers back in 2003.18

The whole sordid affair took a strange turn when Zero Hedge noted an odd mathematical relationship between the two carefully measured employment statistics:

Measured employment numbers:

fully employed/partially employed = 873,000/582,000 = 1.5000…

Gosh. What are the odds that those numbers were actually measured? I would say about 2.000…%.19

Counting those who no longer receive unemployment benefits as no longer unemployed, an accounting gimmick that became chronic once the crisis began, by no means was invented by Team Obama. None of this is new. LBJ was rumored to send economic statistics back to the kitchen for more cooking. The U-6 unemployment numbers account for that mechanical engineer who is now a part-time “deposit bottle recycling engineer and firewood procurement officer.” U-6 is a more accurate measure of the employment stress and is staying persistently above 14%.20

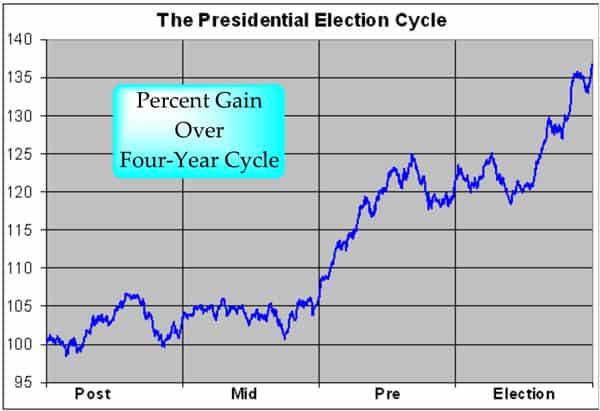

Election year pandering may contribute to a very odd stock cycle.21,22 If you break the 20th and 21st century into 27 four-year fragments corresponding to the election cycle—2009-2012 being the most recent—and average the returns, you get what is called the Presidential Election Cycle (Figure 9). What causes this cycle? One cannot exclude the role of friendly central bankers (sado-monetarists) juicing the markets. Mitt Romney, when he promised to fire Bernanke, may have sealed his fate.

Figure 9. Four-year election stock cycle throughout the 20th century.21

Maybe the four-year cycle in Figure 9 is a statistical anomaly and, even if real, we may not have a clue why it occurs. Nevertheless, it suggests that “Sell in May and go away” has a longer wavelength variant: “Buy the midterm and sell the Presidential.” Urban legend or not, 2013 is looking dangerous.

Events

Dan, quit embarrassing yourself.

~ Caroline Baum of Bloomberg Tweeting to a money guru who claimed that Hurricane Sandy will be stimulative

Acts of God—force majeure—tantalize market watchers and sophists alike but seem to have little effect on even the intermediate term: Economies and markets just keep marching forward. Katrina took its toll and irreparably altered lives, but it primarily illustrated government doing a heckuva job. Hurricane Sandy also exacted revenge against the civilized world (and New Jersey). It may portend things to come, should global warming live up to its billing. There is no doubt that corporations will use Sandy as an excuse for anything and everything. Q4 and year-end reports will have more Sandy-derived debris (including kitchen sinks) than dumpsters along the Jersey shore. Sandy also ushered in like clockwork the absurd claims that Frédéric Bastiat was wrong and that smashing windows and destroying infrastructure is good for the economy. Sandy will increase the GDP, but that is not economic gain. Sandy will be a bump in the road for the nation at large.

As I write this paragraph, cremnophobia—fear of cliffs—is sweeping the land. I submit that base-jumping the Fiscal Cliff may be exciting but doubt it will be some proximate trigger that causes cascading failure. The move to substantially greater austerity seems inevitable and likely to be painfully protracted—think Japan. The Fiscal Cliff would be a fumble on our own ten-yard line. It is just one down in a very, very long game. Regardless of outcome, this will be a topic for my 2013 Year in Review.

Broken Markets

A strange game. The only winning move is to not play.

~ The W.O.P.R. computer on “Wargames”

Since Cro-Magnon Man began trading flint, furs, and women, there have been nefarious activities in the marketplace. Painting the tape—moving markets at the end of a quarter to dupe customers—is tolerated. The pop icon Jim Cramer spilled his guts describing how players of even modest means can push prices around.23 I bet Jim would like a do-over on that video. Options expiration week is always exciting, as the options dealers purportedly move the equities to minimize payouts on the heavily leveraged options to maximize pain on the plebeians. Insider trading is a death sentence for a nobody, but is a misdemeanor for the big bankers. When caught, the going rate on the punishment of investment banks is a 3-5% surcharge on the profit from the illicit trade. One can only imagine how much it would cost us in punitive rebates if the criminal behavior caused a loss.

In general, however, blaming markets for your losses is a fool's game. Nonetheless, something has changed. The Federal Reserve—the Fed—has explicitly stated a vested interest in both the magnitude and direction that markets move, abandoning all willingness to let markets determine prices. These guys are playing God, taking full possession of our hopes and dreams. In analogy to global warming, their loose monetary policy jacks up prices with markedly increased volatility and enormous social costs. Kevin Phillips’ 2005 American Theocracy

This is a companion discussion topic for the original entry at https://peakprosperity.com/2012-year-in-review/