Contents

Footnotes appear as superscripts throughout this review; associated hyperlinks can be found here. The contents are as follows:

Part 1

- Background

- Investing

- The Bear Case

- The Economy

- Broken Markets

- Gold

- Debt and Retirement

- Municipal Debt

- Student Debt

- Bonds and Sovereign Debt

- Housing the Mortgage Markets

- Europe

- Cyprus

- Rest of the World

Part 2

- Confiscation

- The Fourth Estate

- CNBC–Rise Above

- Bankers and Finance

- Federal Reserve

- Bootleggers

- Paul Krugman

- Baptists

- Government Gone Wild

- Mr. Obama Goes to Washington

- Civil Liberties Part 1

- Civil Liberties Part 2: Edward Snowden versus the NSA

- Books

- Acknowledgements

- Links

Confiscation

“This could go down as a blunder of historic proportions.”

~ Tyler Cowen on Cypriot bailout

Cyprus could slide into grinding abject poverty without anybody really noticing, but that is only part of the story. Confiscation of bank deposits was declared illegal and unreasoned by squeals across the blogosphere and globe. The reality might be a little more nuanced and a little scarier. A number of countries have mechanisms for confiscation embedded deeply in their legal system, including the United States.197 Come again? Poland overtly nationalized private pension funds.198 Spain implemented a “clunkers for cash” program by converting 97% of the social security pensions to Spanish government debt, up from 50% in 2008. Russia nationalized its pension funds.199 Both the IMF proposed a 10% tax across the Eurozone,200 and the BIS proposes bail-ins internationally including the U.S.201 Ouch. France’s President Hollande wishes to remove the inflation adjustment from the country's pension fund.202 Next up? Inflation, of course.

People in positions of power seem enamored with the bail-in (confiscation) model to correct imbalances. A student of history would not find this surprising. According to Matt King of Citigroup, “the very success of the [Cyprus] solution now being adopted seems likely to lead to its replication elsewhere.”203 The Troika set their sights on Luxembourg, possibly for another beta test.204 Eurogroup head, Jeroen Dijsselbloem (pronounced “Diesel....BOOM!”) suggested that “a rescue program agreed for Cyprus...represents a new template for resolving euro zone banking problems, and other countries may have to restructure their banking sectors.”205 EU economic affairs chief Olli Rehn enthusiastically endorsed the bail-in model while assuring Europeans that “the limit of 100,000 euros is sacred; deposits smaller than that are always safe.”206 Very soothing words indeed.

JPM warns of capital controls across Europe. I suspect that an ongoing stealth bank run is afoot in Europe. Would you keep your money in Luxembourg, Portugal, Spain, Italy, or Greece? I didn’t think so. Dmitry Medvedev caught many people’s sentiments with the cryptic but unambiguous suggestion that you should “Get all money out of western banks now!”207 It’s not just Europe: the Aussies are going to double-tax their Roth IRA equivalent.208

Let’s bring it to the U.S. and see how we're doing. The risk of confiscation is showing up in some not-so-subtle ways. The U.S. Consumer Financial Protection Bureau is weighing whether it should take on a role in helping Americans manage the $19.4 trillion they have put into retirement savings. Bureau director Richard Cordray is “interested in...what authority we have” but “didn’t provide additional details.” Little good will come of this. Beware of people from the government offering to help. Along comes Fed governor Donald Kohn declaring that a bail-in is needed to protect the system from too big to fail banks.209 You now have my attention, Don.

In 2006 I diversified my assets across a broader range of banks to dodge bank runs—I did see it coming—but that now provides much less protection. New bank account protection changed from $250K per account to $250K per Social Security number.210 Deposits in foreign branches of U.S. banks are no longer FDIC insured. We are all Cypriots now. A number of years ago the blogosphere was chattering about the role of a depositor at banks and owners of equities and mutual funds at brokerage houses. In the simplest of terms, equities are in the name of the brokerage. That turns us peasants into creditors and not very senior ones at that. (File under lessons learned from MF Global.)211

Steve Forbes warned that a Cyprus-style seizure of your money could happen here.212 I’ll take “Holy Shit!” for $1000, Alex. JPM has already limited cash withdrawals and wire transfers abroad for reasons that elude me now but probably will become clear later.213 This move seems to be at the behest of the Federal Reserve. Apparently, only the Fed is allowed to ship unimaginable sums to other countries.

Jim Rogers certainly sees dead people: “401k plans, IRA’s, and pension plans which the government knows about [may be next]...Anything they know about they might easily take”214 (my emphasis). Discussions at the highest levels have already hinted at capping retirement withdrawals to a “$205K per year annuity.”215 A little rampant inflation could bring many retirees under that umbrella (not unlike the alternative minimum tax.) The term “annuity” should also trouble potential heirs. In other incarnations, the administration proposes to “prohibit individuals from accumulating over $3 million in tax-preferred retirement accounts.”216 (I think they meant “tax-deferred, because “tax-preferred” is a phrase of little merit.) Does that mean that they will skim anything above that? It ain’t just Mitt who will take a hit. I may terminate my sheltered contributions.

“This is a major, major game changer...full-blown socialism, and I still can’t believe it happened”

~ Lars Seier Christensen, CEO of Saxo Bank

The brutal reality is that the pension doomers (Pete Petersen, Larry Kotlikoff, and Rich Marin to name a few) know that the system is going to topple. Reality could be far worse than the threats described above, and it will play out at the local, state, and sovereign level. Cities are confiscating assets in police raids as a source of revenue.217 The use of eminent domain to confiscate mortgage-backed securities ostensibly to help home owners is downright creepy.218 Remember: austerity is not a policy.

“And now you know the rest of the story.”

~ Paul Harvey

The Fourth Estate

“It’s become a cliché these days to say you don’t trust the media. But you know what? You’re right not to do so. The problems aren’t as bad as they appear. They are much, much worse.”

~ Brett Arends, Wall Street Journal

In the ultimate irony the media was in the news this year. Of course, there were the little things like Charles Payne buying stocks before touting them on Fox Business News. Chicago algo traders who were beating the speed of light in trading (see Broken Markets) appeared to be getting their advance info on the Fed minutes from “sequestered” prostitutes posing as reporters. My favorite mishap was this poor guy whose first day on the job at a local station didn’t go as smoothly as he’d hoped.219 But there were some really big stories. Some, like the role of the Guardian in the Edward Snowden leak and battles over what defines a legitimate member of the media (hint: not bloggers), are embedded in Civil Liberties. Other media-centric scandals are mentioned here.

Bloomberg reporters were snooping on traders using the famous Bloomberg terminals. Traders were baffled by Bloomberg’s sleuthiness. The snooping was detected when a Bloomberg reporter asked about someone who had “not logged into his terminal in a few weeks.”220 Don’t lie to me Big Mike: Did Bloomberg reporters use a subscription service to monitor the activities at the big banks? Not exactly a Chinese wall. Ten’s of thousands of intercepted text messages give this story a shade of Rupert Murdoch.

The University of Michigan confidence numbers (MCSI), popular triggers for algos and HFTs, were being released by Reuters early; dissemination times depended on a tiered pay scale.221 The earliest notices went to the deep-pocketed banks and brokerages, of course. Academia got a black eye when it was revealed that University of Michigan was in on the scheme. When New York attorney general Eric Schneiderman told Reuters to cease and desist, he ran into a remarkably remorseless opponent;222 Reuters defended their private service and reserved the right to allocate data as they saw fit. This is not a bad argument, but Reuters terminated the practice (at least until the furor dies down). The odd pre-release trading disappeared.223

An interesting new form of media has emerged that is either the very beginnings of a media revolution or a skit in Saturday Night Live. Either way, I wanted a piece of that action, so I did an hour on BTFDtv.13 BTFDtv is an unscripted, unproduced, unprofessional, and at times very uncouth network of shows that live stream on the web. This new group was formed by a bunch of crazed traders who seem to share collective roots at Zero Hedge. Time will tell if this idea gets legs. Watch and just BTFD (buy the dips).

CNBC—Rise Above

“You shouldn’t be saying things you cannot prove....Fact? What’s a fact? I don’t like spewing things that are not actual facts on this program.”

~ Maria Bartiromo, JPMorgan Chase spokesperson

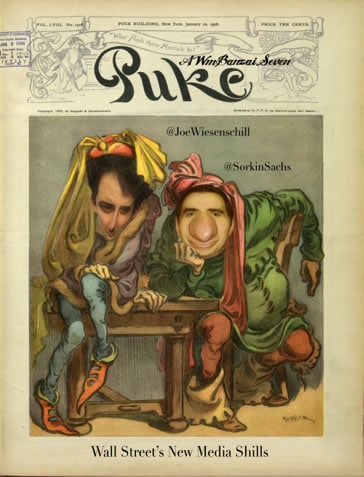

@WilliamBanzai7

These media shills are like fools

They’ve broken old media rules

They don’t apply heat

But praise the elite

To help them abscond with our jewels

~ @TheLimerickKing

These Banksy/Robert Frost wannabes are Twitter legends who crank this stuff out. I requested the media theme.

Every year I manage to pick a fight or two that is unnecessary, but I simply cannot resist. Let’s get right into it with CNBC. We are all sympathetic. Your ratings are tanking to 20-year lows in an up market.224 Although I am still smarting from my failed Twitter campaign to be a guest host on CNBC under the pseudonym “Joe Sixpack”, I must admit I really like some of the pundits. Kelly is great. Andrew, Becky, and Rick are affable. Liesman has his moments. Joe seems to be recovering from his bout of Kudlowphilia and showing real signs of grasping the severity of the problems we must solve. Hobbs and Sedgwick should contribute to the unemployment stats.

Let’s get to my really big gripe: You guys breathlessly announce earnings beats without a shred of useful information. A vast majority of your earnings are reported "ex-items." If those items are so dismissably rare, why do they appear every quarter from nearly every company? In the olden days you called them “pro-forma" earnings—earnings with embedded vendor financing deals, monetized eyeballs, and written down operating expenses. Pro forma earnings were bogus, and we had a train wreck to show for it. Well, you’re doing it again. I’ve griped about “ex-items” to you guys directly via Twitter and gotten answers suggesting you “don’t have time” or “talk about that a lot” or that “you make an excellent point”. My favorite was, “I hear you, Dave, but it’s what the market tends to trade on—what is delivered compared to what analysts expect.” Apparently, these traders you speak of are trend followers who don’t even care if the numbers are fake and are quite likely not human. The rest of us—the viewers who you hope will number in the millions—would like some truthiness.

Start afresh. Rise above. When you report earnings “ex-items” ask the following questions:

- What were the “items” being excluded?

- What was the dollar value of the exclusion?

- Are you friggin’ kidding me?

Provide the facts, and you might get your viewers back. As it stands, only the algos and algo-like traders use the data, and they are not going to generate advertising revenues; you'll get lapped by BTFDtv if you’re not careful. CNBC—We deceive-you decide. I think it’s time for you folks to decide.

And while you’re at it, work on some of the little stuff. Jerry Bowyer explains in “Confessions of a CNBC Optimist” that his job was to “body check” pessimists. One of Kudlow’s bearish guests was subjected to such brutish behavior that the next guest on called it a “Sacco and Vanzetti interview.” Brian Sullivan’s attack on Elizabeth Warren was embarassing,225 and he got outplayed. Calling Jon Hilsenrath a “Fed watcher” is like calling Heidi Fleiss a “date”. Your series on “Market Masters” series could have been called “Pandering to Power”. Also, could you please quit kissing Warren Buffett’s ass so much? He is the greatest investor in the world, but the fawning gags me with a spoon.226 He is, after all, a deeply embedded insider with an unparalleled skill at gaming the system.

“Let’s say you believe that China is making up the numbers. But if the stock market there keeps going up because of it, and you believe the government will keep priming the numbers, isn’t that sort of a reason to bet on the Chinese stock market?”

~ Brian Sullivan, CNBC

Yes, Brian, that is an excellent strategy if your goal is to be on the reality TV show The Greater Fool. Rise above...rise above...

Bankers and Finance

“I’m standing in one of New York’s most crime-ridden neighborhoods. I’m standing on Wall Street.”

~The Daily Show

“Financial Sector Thinks It’s About Ready To Ruin World Again”

~ Headline from the Onion

“They don’t have a ‘negative cash-flow position’. They’re broke! They’re fucking broke!”

~ George Carlin

2013 seems like an off year for banking crimes. Of course, there was a steady stream of behavior that makes you want to lynch a bunch of them, but we witnessed volumes of follow-throughs of old scandals and very few new, really colorful ones. The high point of the year was when JPMorgan decided to communicate with the public via Twitter by encouraging questions using hashtag #askJPM. They got thousands—literally thousands—of the most truly raucus rhetorical questions you could imagine:

"I have Mortgage Fraud, Market Manipulation, Credit Card Abuse, Libor Rigging and Predatory Lending. AM I DIVERSIFIED? #AskJPM"

~ Representative tweet to #askJPM

JPMorgan Chase was the major focus of the DOJ’s catch and release program, rendering this syndicate the biggest headline grabber of the year. The shear magnitude of JPMs trouble was foreshadowed by a $28 billion slush fund set aside for legal problems.227 For weeks at a time you couldn’t click Zero Hedge without seeing a new charge. Gretchen Morgenson and Bill Moyers suggested that the JPM board of directors needed stronger oversight, possibly removing oversight powers from the chairman of the board, Jamie Dimon. That would be the same Jamie “That’s Why I’m a Bigger Douchebag Than You” Dimon who is JPM’s CEO in desperate need of oversight. The idea that Dimon would be removed from the Board sent Bartiromo heels up (again) in his defense.

Lehman creditors sued JPM because the London Whale (Bruno Iksil) mismarked positions that led to an epic and apparently rather invalid $8.6 billion margin call in ‘09.228 The most senior trader suggested that his group “stop reporting losses unless there was a market-moving event that could easily explain the losses.” No wonder bad news comes in clusters. The chief risk officer promoted fibbing about these trades, failing to grasp that a “risk officer” is there to mitigate risks.229 JPM discovered that some of the attacks against the Whale’s losing trades were coming from within the JPM itself—a form of autoimmune disease. The former CEO of a major banking subsidiary told me that he discovered traders “buying our own shit”.230 TBTF means too big to function I guess. JPM eventually threw a couple of expendable employees under the bus to clean up the Whale scandal, but at minimal inconvenience. (Temps were hired to vacuum the 12th and 13th floors.) I’m sure they were just legions of honest mistakes needing only an apology, but the DOJ insisted JPM accept guilt by publically declaring “my bad.”

JPM had to ante up some serious bucks for making Jefferson County, Alabama squeal like a pig owing to kinky derivatives deals that sent them into insolvency.231 The robosigning fine came due this year.232 Good news: the dozen or more fraudulent “Linda Green” signatures at the center of the robosigning controversy have all been indemnified;233 there is no mess that is too big to clean up with the stroke of the pen.

“If JPMorgan were just an average mook on the street, by now it would have been consigned for life to San Quentin”

~ Saule Omarova, University of North Carolina School of Law

Whether it's the ethanol derivatives or the energy markets in general, the Enron-esque manipulation of commodity prices by JPM continues. (JPM has not yet rigged the aluminum and copper markets because Goldman controls those234 along with pornography,235 which they promptly sold once they got caught.) JPM’s rig-a-thon extended into the Forex markets,236 but they’ve seen the error of their ways. They've now moved the most dubious deals offshore, away from the long arm of the aggressive U.S. regulators.237 This is purely prophylactic; there are no regulators fitting that description.

JPM’s really big problems came in the form of gargantuan fines for their role in mortgage-backed securities. I must admit to being sympathetic to their supporters’ (Bartiromo’s) claims that these problems were baggage from Countrywide and Washington Mutual that JPM absconded with at steep discounts. Maybe the $28 billion is just a claw back of the $30 billion of Fed backing they garnered during the forced purchase of Bear Stearns. If so, the Feds stuck that landing like a Rumanian gymnast. Tax deductibility of the penalties added salve to the wounds of all but 100 million taxpayers.

“A billion here, a billion there, pretty soon, you’re talking real money.”

~ Everett Dirksen, former U.S. senator

Many summaries of this criminal behavior have been penned, all of which have led to the expected number of prosecutions (zero).238 A few generic deeds of the banks are also worthy of comment. Fifteen states banned payday lenders, prompting the banks to move the funding for them off shore. Six BofA employees accused BofA of shepherding homeowners into foreclosure rather than through the Fed-assisted mortgage restructuring. For the record, I think BofA had this one right (see Housing); nevertheless, the BofA whistle-blowers should get remote starters for their cars. Whistle blowing has become a dangerous career path; the truth no longer protects you from retribution. I return to this in Civil Liberties.

We discovered that BofA gives bonuses to employees who acquire high ranking government jobs, showing that the door truly revolves. A clause in his 2006 contract scored big for the new Secretary of the Treasury, Jack Lew, and probably much bigger for BofA.239 This is not surprising given Lew is in Robert Rubin’s orbit. Insider trading in the Heinz acquisition was tracked to Goldman.240 Goldman’s "Fabulous Fab" Fabrice Tourre went to trial and nobody cared.241 After years of being called a lunatic, Patrick Byrne of Overstock was exonerated when emails surfaced showing that traders had indeed naked shorted his stock into dust.242 (Naked shorting is illegal and very destructive to small cap companies.) S&P, a banking subsidiary euphemistically called a bond rating agency, defended against charges of fraud in its ratings by correctly arguing that the reports put out were mere “puffery” and not to be believed. That is true, but then they lost.243 That’s an 0-for-2 ouch. Nomura got caught helping Banca Monte dei Paschi di Siena use derivatives to hide losses.244 In an Escherian way, Deutsche Bank used derivatives to cover up derivatives losses.245 The quadrillion dollar derivatives market, rich in counterparty risk, seems like the odds-on favorite to destroy the world, but for now it serves its purpose:

“Banks use derivatives they create to help their clients deceive the public. Other times, they enable the banks to deceive those clients.”

~ New York Times

Hank Greenberg et al. sued the Feds for an unlawful taking when the Feds essentially nationalized AIG.246 I’m taking Greenberg’s side. Stockman describes in The Great Deformation how the bulk of AIG was fully cordoned off from its derivatives traders that supposedly would have brought it down. Reams of statutes insured (pun intended) that AIG would not have been dragged under, providing yet further evidence that The Great Intervention of ‘09 was both a colossal breach of capitalism and illegal. In a more general sense, the system should not have been saved in its current, highly mutant, form. Dean Baker provided a nicely phrased, sarcasm slathered, thank you to Tim Geithner, who just exited the private sector-sponsored public sector to buyout firm Warburg Pincus via the revolving door.247 There were tackier exit channels than that, but he will need a good tax accountant nonetheless.

“You’re going to look like you’re giving money to people who were responsible for burning down the economy.”

~ Tim Geithner, former head of the New York Fed

There’s a story that is potentially big and hasn’t gotten much coverage. Most know that Elizabeth Warren isn’t a fan of the banks. She has criticized them for getting freebies from the Fed of $85 billion per year. Warren and McCain have introduced a bill to break up the ginormous banks and bring back Glass–Steagall-like regulations.248 The untold story is that brilliant credit analyst Chris Whalen criticizes Warren for being off on her numbers—way off on her numbers. He claims that the central banks are actually giving them a m

This is a companion discussion topic for the original entry at https://peakprosperity.com/2013-year-in-review-part-2/