Contents

If you've not yet read Part 1, click here to do so. The whole enchilada can be downloaded as a single PDF here or viewed in parts via the hot-linked contents as follows:Part 1:

- Background

- Content

- Sources and the Fourth Estate

- On Conspiracy Theorizing

- Investing

- The Economy

- Bending, Breaking, and Broken Markets

- Precious Metals

- Energy

- Personal Debt, Savings, and Retirement

- States and Municipalities

- The Bond Caldera

- Argentina Versus the Bond Vultures

- Inflation Versus Deflation

- Wealth Disparity

- Banks and Bankers

- AIG

- The Federal Reserve

- Baptists

- Bootleggers

- Europe

- Asia

- China

- Japan

- ISIS

- Russia

- Ebola

- Government

- Clintons

- Barack Obama

- IRS Scandal Part Deux

- Bundy Ranch and Ferguson

- Militarization of Police

- Civil Forfeiture

- Civil Liberties

- Conclusion

- Books

- Acknowledgments

- Links Part 1 | Part 2

Wealth Disparity

“Printing money out of thin air does not increase wealth, it only increases claims on existing wealth.”~Charles Hugh Smith

In the olden days, claims that the rich were getting richer and the poor were getting poorer were a thinly veiled rallying cry for class warfare. Thomas Sowell reminds us that a growing economy lifts all boats, and those at the bottom strata percolate up generationally from garment worker to bookkeeper to doctors and lawyers (well, maybe just doctors). It feels different now, and the angst over wealth disparity resonates with growing numbers of adherents. It is no longer just the dregs of society but the increasingly struggling middle class, or what I prefer to call “the median class.”

“Only the wealthy can afford a middle-class lifestyle.”~Zero Hedge

The contrasts are stunning. While 53% of adults earn less than $30,000 per year,ref 197 the rentier class—big-gun money managers—are muffin topping out at $3 billion.ref 198,199 David Tepper earned almost $500K per hour. Stevie Cohen ranked second in earnings as a full-time defendant for insider trading. The median retirement savings of a working-age adult is $2,000, yet we’ve got folks with the cash to pay for brain surgery on goldfish,ref 200 $60 million Steve Martin–like balloon art,ref 201 $500K watches,ref 202 and $2,000 glamburgers (“gluttonburgers”).ref 203 A full 47% of millennials are using >50% of their paychecks to pay down debt.ref 204 Twenty percent of US families have no employed family members.ref 205 This is a problem demanding solutions for which none are obvious. The elite billionaire society, Beta Kappa Phi,ref 206 is dominated by the rentiers rather than wealth-creating capitalists. This is not about Bill Gates or Michael Dell. Wealth inequality is about the inordinately high pay for those who don’t actually create wealth and the inordinately low pay for those whose toils do. We have reached the apex of another gilded age.

“It's not just enough to fly in first class; I have to know my friends are flying in coach.”~Jeremy Frommer, Carlin’s chief executive

Seven Habits of Highly Successful People: skiing, yachting, snorkeling, golf, polo, dinner parties, and shopping.

We will be tempted to redistribute. But ramping up the minimum wage by fiat quickly ushers in the 360-burger-per-hour robot.ref 207 “Our device isn’t meant to make employees more efficient,” said Momentum co-founder Alexandros Vardakostas. “It’s meant to completely obviate them.” (Note the careful use of “obviate” rather than “replace.”) Debates about whether we should throw money to the rich or money to the poor, however, beg the key question: why are we throwing money at all?

“A smoothly operating financial system promotes efficient allocation of saving and investment.”~Janet Yellen

Killin’ it Janet! But then she went on to make some unfortunate comments suggesting that the poor need to own more assets. Oh well. It is ironic that some (including me) attribute the wild disparity squarely on the Fed.

The economy has been financialized to dysfunction, a hallmark of a failing empire according to Kevin Phillips in American Theocracy. By flooding the market with capital, central bankers have made it difficult for workers to compete with capital-intensive technology. (I hasten to add that I’m unsure where I stand on this point given that creative destruction is central to growth.) The excess capital, however, also renders our hard-earned savings—our capital—worthless. I know where I stand on this point. Why pay savers for use of their capital when the Fed hands it out for free? By driving down rates to zero, the Fed is impoverishing savers unwilling to step out on the risk curve. Those of the median class who spent time out on that risk curve have been generationally wounded and, more important, are broke. They lack the capital to close the gap. Despite claims of impending deflation, the spending power of paychecks for the staples—food, energy, health care, and education—has tanked. Alliance Bernstein does a remarkable job of laying out the almost unattainable goal of a stable retirement.ref 208

“I would say [Fed policy] has been in some sense reverse Robin Hood.”~Kevin Warsh, Stanford University and former Federal Reserve governor

“Maybe the Fed is delusional about the effects of its policy . . . in widening the gulf between rich and poor in this country.”~William Cohan

“Part of the impact of these very, very low interest rates is that we've created this disparity. The wealthy are benefiting from government policy and the non-wealthy aren't. We have a president who says we've got to fight this disparity, and we have a Fed who's encouraging it everyday.”~Sam Zell, former real estate mogul

History shows that ugly things happen when classes start battling for their share of the pie. A McShitstorm hit the McDonalds annual meeting from clashes of cops and protestors.ref 209 Ferguson (see below) is not just about a dead black guy. Models show a high correlation of global riots with global food prices.ref 210 We are there again. Nick Hanauer, a guy who is quite familiar with wealth creation, suggests that the billionaires of the world should be nervous:ref 211

“What everyone wants to believe is that when things reach a tipping point and go from being merely crappy for the masses to dangerous and socially destabilizing, that we’re somehow going to know about that shift ahead of time. Any student of history knows that’s not the way it happens. Revolutions, like bankruptcies, come gradually, and then suddenly. One day, somebody sets himself on fire, then thousands of people are in the streets, and before you know it, the country is burning. And then there’s no time for us to get to the airport and jump on our Gulfstream and fly to New Zealand. That’s the way it always happens. If inequality keeps rising as it has been, eventually it will happen. We will not be able to predict when, and it will be terrible—for everybody. But especially for us.”~Nick Hanauer, to his fellow billionaires

Nick sees pitchforks in the future. The Hanauer editorial posted in Politico generated upward of 10,000 comments from 10,000 pitchfork wielders. This plotline—a possible Fourth Turning—is just coming into focus.

Banks and Bankers

“The Bank never ‘goes broke.’ If the Bank runs out of money, the Banker may issue as much more as needed by writing on any ordinary paper.”~Monopoly board game rule book

Simon Johnson noted that six years after the crisis, the big banks are still only 5% capitalized (20:1 leveraged).ref 212 Twenty-five European banks failed the stress test, which will force them to recapitalize.ref 213 The largest banks were mandated by the Dodd–Frank Bill to “put their affairs together” with formal plans to ensure stability: the Federal Reserve and FDIC rejected all of them—a 100% failure rate.ref 214 JPM has total assets of $2 trillion and a total derivative exposure of $71 trillion.ref 215 Beware of flappy-winged butterflies. If the Fed taps the brakes, those guys are headed right through the windshield. If we hit a bump in the road, it’s out through the moonroof.

“The tragedy is not that things are broken. The tragedy is that they are not mended again.”~Alan Paton, Cry, the Beloved Country

Let’s ignore the awkward question of why you recapitalize insolvent banks—you’re not supposed to according to Bagehot.ref 216 How do you recapitalize them? Best I can tell, banks clean up their risk (a) through a grinding, multiyear balance sheet rehabilitation (a good ground game), (b) by getting their friends at central banks to engineer highly profitable carry trades, or (c) by simply selling their garbage to taxpayers way above market value. The Fed chose the latter two for US banks. They set up “good” banks and “bad” banks. The good banks hold good assets—heads they win—and the bad banks are like state-run Ebola clinics (tails we lose). The banks are also using more traditional methods; they are stepping away from the mortgage market, leaving it to the shadow banking industry. Get ready for good shadow banks and bad shadow banks.

The banks amassed almost $200 billion in fines,ref 217 paradoxically without any convictions of major bankers. (Actually, Iceland just hurled a banker in jail.ref 218 Go Vikings!) There are several nice summaries of JPM’s and BofA’s illegal activities.ref 219 The tenacious Matt Taibbi describes how the system was corrupted by backdoor dealings to avoid any jail time in The Divide (see Books). Taibbi tells us the no-jail policy was indeed a written policy by Eric Holder and the Obama DOJ. It is said that as you age you tend toward one of two paths: altruism or narcissism. Holder chose the latter. Barry Ritholtz claims that the fines are cleaning up the corporate culture despite the lack of satisfaction.ref 220 I like Barry but wholly disagree: the bill for this legal and moral lapse has yet to arrive.

“The behaviour of the financial sector has not changed fundamentally in a number of dimensions since the crisis . . . some prominent firms have even been mired in scandals that violate the most basic ethical norms.”~Christine Lagarde, managing director of the IMF

Nothing gets through those beer goggles, Columbo. The details of this year’s shenanigans warrant some comment. Credit Suisse admitted to helping wealthy US folks evade taxes but claimed that management was unaware they were running a crime syndicate.ref 221 The Gnomes of Zurich chronically aided and abetted tax evaders. Deutsche Bank and Barclays were in on the scam too.ref 222 (Don’t take me too seriously; I understand arguments for the evasion.) We found that JPM was complicit in the Madoff case, and the DOJ knew it.ref 223 (One should assume the same for Worldcom and Enron.) JPM’s Asian CEO was brought up on corruption charges because traders cooked the books to conceal losing trades.ref 224 Of course, the whistleblower was denied whistleblower status by the regulators because of the DOJ’s zero-tolerance whistleblower policy.ref 225 JPM also helped BNP launder money to sanctioned countries.ref 226 Preet Bharara, Prosecutor of the Stars and head of his own Rainbow Coalition, went after BNP shareholders for almost $10 billion because you never help sanctioned countries. The actual criminals within BNP were left unscathed. JPM paid only $88.3 million to settle similar unlawful dealings with Cuba, Iran, and Sudan.ref 227 Apparently, you get a two-decimal discount if you are domiciled in the United States. Even Bharara has his tolerance limits; he got majorly pissed at Jamie Dimon for giving himself a 74% raise.ref 228 I’m guessing it will make Jamie’s huge campaign donation to help Preet crowd source his political career harder to explain. I have a suggestion, Preet: Stop fining shareholders and start jailing criminals. Convict somebody—anybody. Blythe Masters, after narrowly escaping a prison sentenceref 229 (not even close), left JPM and accepted a job as Regulator for a Day at the CFTC.ref 230 That’s how quickly her detractors processed the absurdity and stopped it.ref 231 Blythe will be played by Julianne Moore in the sequel to Catch Me If You Can.

HSBC overstated its assets by what some might call a rounding error ($92 billion),ref 232 which forced it to restrict withdrawals by demanding proof that you need cash (bank run).ref 233 Do grocery receipts count? It also recruited the former head of MI5 (British CIA clone) to join its board, which seems oddly consistent with suggestions that HSBC was laundering money to Hezbollah.ref 234 This also squares nicely with my previous assertionref 2 that HSBC is a retread of the profoundly corrupt and now defunct BCCI. After the next bailout—there will be another—Goldman will underwrite the IPO of HSBCCI.

RBS losses since '08 were shown to top £40 billion since '08,ref 235 an amount oddly comparable to that dumped into it by the taxpayers of one or more countries.ref 236 Fortunately, RBS managed to scrape together executive bonuses totaling 200% of base pay.ref 237 CEO Ross McEwan apologized. All was forgiven. . . . at least forgotten.

Citigroup got hit with a $10 billion tax from the DOJ for its role in the crime spree.ref 238 On a more humorous note, it inadvertently paid out $400 million in fake invoices sent by Banamex (Mexican princes).ref 239 Trolling for payments using fake invoices to huge corporations is a provocative business model.

“Regulators are starting to ask: Is there something rotten in bank culture?”~New York Times news flash

The punitive qualities of all these fines are often muted by their tax deductibility. And, by the way, where does this $200 billion garnered by the Big Shakedown go? State and federal governments have found a number of worthy causes that are also politically expedientref 240—”a wealth redistribution scheme disguised as a lawsuit.”ref 241 Andrew Cuomo threatened to withdraw BNP’s license to operate on Wall Street if they didn’t up his vig by $1 billion.ref 242 I can taste vomit in my mouth.

The relief was palpable when MF Global officers and directors were allowed to use insurance money to defend officers and directors rather than give it to creditors.ref 243 A judge ruled that Goldman’s shell game, in which they moved aluminum from warehouse to warehouse, was unintentional.ref 244 It was just the tip, your honor! It was just the tip! The actor who played McGruff the crime dog got 20 years for pot and weapons charges,ref 245 the former being legal in some states and the latter a constitutionally protected right. A spoof article describing Holder’s departure to JPM was outlandish but so believable that I had to confirm with the source that it was actually satire.ref 246

“When you won, you divided the profits amongst you, and when you lost, you charged it to the [central] bank.”~Andrew Jackson, former president of the United States

There are a few lawsuits weaving through the courts, and nothing terrifies bankers more than the discovery phase of a trial. Thirteen global banks were sued by Alaska Fund for ISDA fix rigging.ref 247 I’m not sure how you rig a fix or fix a rig or whatever. The nonprofit Better Markets has alleged that the DOJ violated the Constitution (shocking) by acting as the investigator, prosecutor, judge, jury, sentencer, and collector, without any check on its authority or actions.ref 248 A Freedom of Information Act suit showed that the SEC colluded with banks to ensure that they were prosecuted for only a single credit default obligation (CDO) charge and that the rest were covertly included in the settlement.ref 249 Barclays’ court battles over Libor rigging could produce some interesting discovery about “fantasy rates.”ref 250 The AIG trial seemed sufficiently consequential as a window into this huge heist that it gets its own section.

The charter of the Export-Import Bank (Ex-Im Bank) is up for congressional renewal.ref 251 Ex-Im bank is, according to Wikipedia, “the official export credit agency of the United States federal government . . . for the purposes of financing and insuring foreign purchases of United States goods for customers unable or unwilling to accept credit risk.”ref 252 It lends money to foreign debtors who cannot get credit through normal channels (credit being so tight and all).ref 253 Who might they be? Well, sovereigns who buy lots of Boeing jets presumably to bomb other countries who also buy lots of Boeing jets.ref 254 Lobbying—quite possibly illegal foreign lobbying—will ensure that the bill is passed. Why not let private banks fund these guys? They’ve been instigating and then funding foreign wars since antiquity. Congressional opponents risk an airstrike on their next campaign.

Is there any hope that the system will correct itself? In Vietnam, they execute bankers who egregiously screw up by “binding perpetrators to a wooden post, stuffing their mouths with lemons, and calling in a firing squad.” That’s making lemonade out of lemons. I suspect that the next crisis may see some punishment meted out extralegally in the US. There appears to be some already.

Zero Hedge was the first to pick up on a rash of dead bankers that stopped short of inspiring a Whack-O-Meter based on the bank Implode-O-Meter from 2009.ref 255 I lost count at about 20 and was shocked to find it is now 36.ref 256 Unfortunately, the guys most likely to make everybody’s short lists are not the ones heading off to the ultimate gated community. It’s possible that bankers suffer from the Werther effect—the tendency of suicides to come in waves.ref 257 It may simply be the Baader–Meinhof phenomenon,ref 258 or what I’ve always called the “green van effect”—buy a green van and then notice how many are already on the road. Nassim Taleb would likely tell us we are being fooled by randomness: 36 suicides in the large sample size may be normal . . . but I doubt it. Some of the subplots were curious. One was accidentally shot by two guys on a motorcycle. Another, according to the Denver Post, offed himself with eight shots from a pneumatic nail gun.ref 259 It read like satire given that this Final Exit was likely assisted by the Kevorkian brothers. We know there was at least one twisted bastard in the room. One banker went to the light with his whole family, which strikes me as over the top even for a banker. Although JPM’s payroll contained several who met untimely deaths, JPM had taken out $680 billion worth of life insurance policies (curtains default swaps) on their employeesref 260 presumably as a precaution against unfortunate accidents. A Chinese banker both died and fell from a fourth-story window, although the translation is unclear about the order in which the two occurred.ref 261 Even the head of a Bitcoin exchange cashed out.ref 262

“Perhaps sometimes it is easiest if the weakest links, those whose knowledge can implicate the people all the way at the top, quietly commit suicide in the middle of the night.”~Zerohedge

AIG

Hank Greenberg's lawsuit against the Fed proved the Rosetta Stone of the bailouts. The world was aghast when the Fed bailed out the insurance behemoth to the tune of $187 billion, ostensibly to save AIG but really to save its counterparties (read: Goldman Sachs). The world subsequently blew a collective snot bubble when gazillionaire and former head of AIG, Hank Greenberg, sued the Fed for the bailout.ref 263 Greenberg's suit asserted that the Fed had no right to confiscate 92% of the company without formal proceedings of any kind. Hmmm. It does sound a little sketchy when put that way.ref 264 Well, the lawsuit reached the discovery phase this summer, and the media were all over it:“The government never sought to couch AIG’s lifeline as a way to push money into the hands of Goldman Sachs, Deutsche Bank, Société Générale and the dozens of other banks around the world. . . . The problem is that so many people don’t like the answers.”~Andrew Ross Sorkin, Wall Street darling and putative journalist

Not so fast, Andy. Last year I alluded to David Stockman’s assertion that the dominant insurance component of AIG was cordoned off by state insurance statutes—legal tourniquets—from the rotten part of the corpse: the risk of collapse was nil.ref 2 New York’s superintendent of insurance (Dinallo) testified as such in the trial.ref 265 Tim Geithner, Hank Paulson, Ben Bernanke, and anyone else intimately involved seemed to have truth issues along with very bad memories. Matt Stoller wrote some great pieces on the AIG case.ref 266,267

“I would be guessing, but I guess I would guess sometime in '08—but I'm not sure.”~Timothy Geithner under oath, recalling squat about AIG

That is some seriously evasive mumbling. Bernanke was said to have two moods while on the witness stand with David Boies bearing down on him: “annoyed and really annoyed.” Records show he used the pseudonym “Edward Quince” in emails (to Linda Green?) during the crisis,ref 268 presumably to be secret to all except those with a Jekyll Island decoder ring. Key witness and Fed lawyer Scott Alvarez was clear that Paulson had done some serious fibbing to Congress while pushing the TARP (i.e., AIG bailout) through Congress under false pretenses. Alvarez’s use of “I don’t know” 36 times and “I don’t recall” 17 times in one day made for riveting testimony.

Boies: Would you agree as a general proposition that the market generally considers investment-grade debt securities safer than non-investment-grade debt securities?Alvarez: I don’t know.

Judge Wheeler was smart and easily irritated at Alvarez’s bad memory. And unlike Congressional hearings, Boies had all . . . day . . . long.

We heard about the numerous potential suitors wanting to buy up the company as a distressed asset and how Geithner and the gang wanted nothing to do with that: none would pay Goldman back 100 cents on the dollar.

“...Geithner and company shot AIG in the head, and then let other banks feast on its rotting carcass.”~Matt Stoller, journalist, channeling Matt Taibbi

Will anything come of this? I don’t know. Many prominent journalists wrote scathing indictments of those bringing the suit. Some called it laughable, frivolous, ludicrous, absurd. I, however, am rooting for Kappa Beta Phi alum Hank Greenberg. The Fed should not have commandeered AIG the way it did. It should have let the counterparties eat their mistakes rather than carrion. AIG wasn’t the only organization that left the reservation. MF Global is suing Price Waterhouse for the bad accounting that led to its demise.ref 269 Maybe somebody will yank Corzine from the Hamptons long enough to take the stand. Watch out for guys on motorcycles, Jon.

The Federal Reserve

“I found myself doing extraordinary things that aren’t in the textbooks. Then the IMF asked the U.S. to please print money. The whole world is now practicing what they have been saying I should not. I decided that God had been on my side and had come to vindicate me.”~Gideon Gono, governor of the Reserve Bank of Zimbabwe

“We have [made] a colossal muddle. . . having blundered in the control of a delicate machine we do not understand.”~John Maynard Keynes

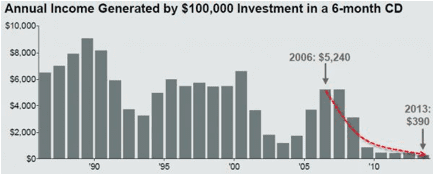

The Fed’s dual mandate as both arsonist and firefighter puts it in the untenable situation of relentlessly fighting blazes it lights. It spent most of 2014 trying to convert one zero-interest-rate policy (ZIRP; Figure 13) via the so-called taper to another (ZIRP-lite), the whole time babbling incoherently to maximize its flexibility to use data of its choosing at times of its choosing. Phrases like “macroprudential” and “central tendency outcomes” are all designed to conceal the real purpose behind their sado-monetary policy.

Figure 13. Graphical view of financial repression.

ZIRP is praised by some as a means of providing cheap funding for public and private debt, allowing equity withdrawal from appreciating assets—kind of like an ATM. Hmmm . . . how'd that work for homeowners? The cost of the Fed's No Banker Left Behind financial repression program is estimated by Bloomberg at more than $1 trillion to the savers (errata: money hoarders). I know I've been repressed. It takes a balance of $480,000 in my checking account for the interest to pay my $4 monthly account fee.“Savers are figuratively on their hands and knees and rooting around in bushes and between sofa seats for loose change on which to sustain themselves.”~James Grant, editor of Grant’s Interest Rate Observer

The Fed’s primary justification for the risk and high cost of their latrogenic ZIRP, however, is to jack up asset markets to all-time highs. Yellen noted that “the channels by which monetary policy works is asset prices . . . I think it is fair to say that our monetary policy has had an effect of boosting asset prices.” Richard Fisher concurred: “We juiced the trading and risk markets so extensively that they became somewhat addicted to our accommodation.”

“We make money the old-fashioned way. We print it.”~Art Rolnick, chief economist for the Minneapolis Fed

Life According to ZIRP seemed pretty good, but $4 trillion is a lotta scratch. A less aggressive approach would have been to monetize it more gradually at, say, $5 million of debt per day, but that would have required starting at the birth of Christ to hit the $4 trillion target. In the midst of the '09 crisis, the Fed needed it fast—Damn the Torpedoes . . . Shock and Awe . . . Surge! Unfortunately, the notion that you cannot print your way to prosperity is gaining traction.

There was a lot of chatter about the Fed scarfing up all the high-quality collateral, causing stress in the repo market.ref 270 Anyone professing to understand the repo market is smarter or more dishonest than I. What I do know is that if the Fed buys up the good stuff—relatively speaking, of course—that leaves only the riskier crap for the rest of the fixed-income buyers, which seems

This is a companion discussion topic for the original entry at https://peakprosperity.com/2014-year-in-review-part-2/