Every year, friend-of-the-site David Collum writes a detailed "Year in Review" synopsis full of keen perspective and plenty of wit. This year's is no exception. As with past years, he has graciously selected PeakProsperity.com as the site where it will be published in full. It's quite longer than our usual posts, but worth the time to read in full. A downloadable pdf of the full article is available here, for those who prefer to do their power-reading offline. -- cheers, Adam

Background

“To the intelligent man or woman, life appears infinitely mysterious, but the stupid have an answer for everything.”

~Edward Abbey

I am penning my seventh “Year in Review.” These summaries began exclusively for myself, evolved into a sort of holiday cheer for a couple hundred e-quaintances with whom I had been affiliating since my earliest days as a market bear in the late ’90s, and metastasized into the Tower of Babble—longer than a Ken Burns miniseries—summarizing the human follies that capture my attention each year.1–7 Jim Rickards kindly called it “a perfect combination of Mel Brooks, Erwin Schrodinger & Howard Beale.” I wade through the year’s most extreme lunacies as well as a few special topics while trying to find the overarching themes. I love conspiracy theories and detest detractors who belittle those trying to sort out fact from fiction in a propaganda-rich world. My sources are eclectic, but I give a huge hat tip to sites like Peak Prosperity and Zerohedge. If half of what they say is right, the world is a very weird place.

“Ninety percent of everything you read or hear is crap.”

~Sturgeon’s Law

“The amount of time you waste online doubles every 18 months.”

~Collum’s Law

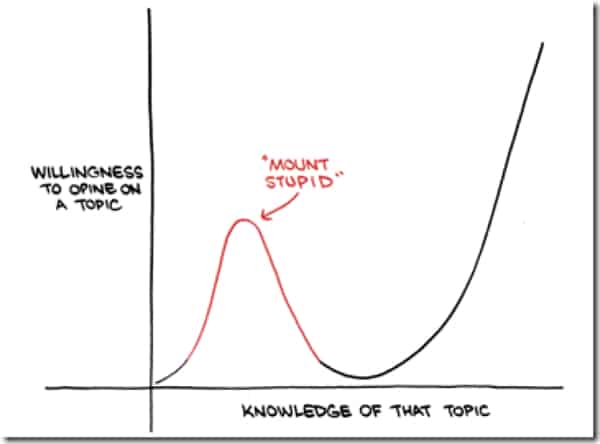

In an e-mail in early April, I told a friend and Master of the Universe that I wasn’t grasping the year’s theme. He assured me the year was young, but I had a deeper angst. I eventually realized that I had ascended Mount Stupid (Figure 1) and may be heading down The Far Side. Whether we are talking Greece, the Middle East, monetary policy, bonds, domestic politics, or sex changes, I am baffled by it all. Maybe life in the third millennium is like a sci-fi movie: it doesn’t have to make any sense. So my qualifications to comment on geopolitics are not in dispute: I am an organic chemist, a clueless academic one at that. Nothing should inspire you to read on. But—a big Kim Kardashian butt—I have somehow managed to capture a readership.

Figure 1. Mount Stupid

Occasionally I get a few selfies with prominent players, airtime on Russia Today, and some ink in The Guardian and Wall Street Journal.1 All help keep the ruse going. As this review is being uploaded to Peak Prosperity and soon thereafter to Zerohedge (hopefully). I offer just a little more elevator résumé disguised as a survey of personal events. My favorite interview this year was with a colleague-and sponsored by Cornell.8 I did podcasts with the likes of James Kunstler,9 Chris Martenson,10 Ed Rankin,11 and Jason Burack.12 Four BTFD.tv episodes chaperoned by Bob Lehman included a solo shot,13 two with Eric Hunsader of Nanex,14,15 and the last as a threesome with Eric and Joe Saluzzi,16 founder of Themis Trading and author of Broken Markets. A gig at the Stansberry Investment Conference in Vegas landed me some free meals and a shared stage with some actual famous guys. (Porter Stansberry is a self-proclaimed huckster and, in my opinion, brilliant.) The title of my talk was “College Life: The Good, the Bad, and the Ugly.” It came out a week before Yale and Mizzou went batshit and mercifully hid behind a paywall while outrageously uneventful ideas triggered mayhem across college campuses. I even found my nose stuck in the tail end of the Tim Hunt scandal, which I talk about herein. Last, I'm taking a bow for using a single Tweet to nip some corporate misbehavior in the bud.17 Ya gotta tweet ‘em right.

I draw inspiration from a Bloomberg headline:18

And with that, I am obliged to offer the following:

**Trigger Warning**

We face an epidemic of wusses, which is sanitized for “pussies,” which some believe finds its origins at pusillanimous. This document is laced with childish tripe, microaggressions, horsemeat, rat hairs, human DNA, central bankers, and presidential candidates. If I’ve already offended you, I apologize. (Just kidding. It only gets worse.) But you need not read on.

Presenting such a review poses a multitude of challenges. There are important topics from past years that remain important but will not be repeated. How many times can one rail on underfunded pension plans, unfunded liabilities, or a quadrillion-dollar derivatives market? These matters are important, but the plot line doesn’t change much year to year. I’m skipping right over Japan; it’s a basket case, but not enough has changed to spill some ink. Despite reams of accrued notes and links, I am light on the Middle East because nobody understands it (or eats parsley.) It’s that Mount Stupid descent again. I leave topics like global warming, mass shootings, and Israel versus Palestine to those who like to shout a lot. Other ideas manage to stay at center stage year after year. Compartmentalizing the topics can seem artificial. How does one separate broken markets from the Federal Reserve? Sovereign debt levels from bond markets? Government from civil liberties? It is also laced with blogger porn (quotes). Somehow 450 pages of notes, quotes, and anecdotes describing a web of interconnected concepts must be distilled into the “Year in Review,” all in a few short weeks. So let’s head to the choppers.

Contents

Part 1

- Background

- Contents

- Investing

- The Economy and the Next Recession

- Broken Markets

- Share Buybacks and Balance Sheet Rot

- Gold and Silver

- Energy

- Personal Debt

- State and Municipal Debt

- Bonds

- Inflation versus Deflation

- ZIRP and NIRP

- The War on Cash

- References Part 1 | Part 2

Part 2

- Banks and Bankers

- The Federal Reserve

- Baptists

- Bootleggers

- Europe

- China

- Russia

- The Middle East

- South America

- Random Human Tricks

- Patsies and Scapegoats

- Government

- Election 2016

- The Clintons

- Civil Liberties

- Campus Life: the Good, the Bad, and the Ugly

- Conclusion

- Books

- Acknowledgments

- References Part 1 | Part 2

Investing

Precious little of my portfolio changes most years. I began 2015 with the distribution shown below. Owing to downward adjustments in energy and metals prices and upward adjustments of putting savings back into those asset classes, my percent allocations remain about the same.

1/1/15

Precious metals etc.: 21%

Energy: 10%

Cash equiv (short term): 60%

Standard equities: 9%

The total change in my net wealth over the year was -5%. This results from downdrafts in physical gold (-11%), gold equities (-19%), and energy (-21%). The standard equities moved little (-1%). The huge short-term fixed income and cash attenuate even the most abrupt upward and downward movements. A net savings of 24% of my gross income elevated the total wealth accumulation by 1%.

My 16-year return beginning 01/01/00—a wild period to say the least—is an annually compounded 7%. Although this handily beats most investors, the huge commodity rout starting last year and precious metal rout beginning in 2011, which contrasts sharply with a 170% run in the S&P since 2009, has eroded what was once a huge lead. For a little perspective to the braggadocious chortlers, however, gold is up approximately 300% and the XLE up 128% over the 16-year period compared with only 46% by the S&P (ex-dividends). I am expecting to see many of the extreme moves over the last few years reversed, but only time will tell. In the infinite loop we loosely call markets, there is a relentless debate:

Market winners: “See. I told you so!”

Market losers: “Just you wait!”

I have been on both sides of that debate (preferring the former). I believe we are still in a secular bear market despite the evidence accrued over the last six years. For almost 20 years I have subscribed to a “three legs down” model of secular bears that translates as follows:

Phase 1 (2000–03): a flesh wound

Phase 2 (2008–09): damaging pain

Phase 3 (20??–??): deracination of hearts, minds, and souls

It’s the third leg down that causes generational changes in attitudes. Let me be clear, however. I have an exit strategy—a strategy to repot myself—from my bearish conundrum (assuming, of course, that I am not neuroplasticly too damaged to react.) I was deeply moved by A Random Walk Down Wall Street (see Books). Author Burton Malkiel convinced me that under most circumstances average blokes cannot beat the markets through active management. My premise is that the next recession will be a barn-burner—a category 5 shitstorm—that ushers in Phase 3. If the Fed fails to juice the markets (unlike in ’09), the markets will finally overcorrect and drop well below fair value. (The Fed snuffed this overcorrection in ’09.) When the next recession is in full bloom—when it is so obvious that even economists are writing about it—I will once again try to enter the markets. I will be taking my cue from Tobin’s Q (discussed later in Broken Markets). I started buying at fair value in ’09, figuring I would average down, but the markets jumped away from me too quickly. I will again start buying at fair value, be seriously buying at well below fair value, and wishing I had saved my ammo at rock bottom. Hopefully, at this point of maximum remorse, I will have reconstructed a long position from the spolia and asset carrion.

“There are segments of the perma-bear community that literally live their lives on the lunatic fringe.”

~David Rosenberg, chief economist at Gluskin Sheff

What will I buy? Probably a global index fund, but I have a few specialized ideas. Russia interests me as a scratch-and-dent opportunity. I recently began buying token quantities of closed-end Russian mutual funds (RBL, RSX, and TRF)—0.2% of my total assets—simply to put them on my radar. TRF will be liquidated as of December 18, 2015, which has a bottom feel to it. Commodity funds were locking their doors on me 15 years ago. Iran and parts of Persia look interesting, although it is legally difficult to invest there right now. How about Africa? Not a chance. Hernando de Soto (The Mystery of Capital) convinced me that Africa’s problems are deeply structural.

The Economy and the Next Recession

“I think there is more of a risk of a depression than a recession.”

~Ray Dalio, Bridgewater Associates

“I think we could have five or 10 years without a recession.”

~Paul McCulley, May 2015 Strategic Investment Conference

Thousands of economists see low unemployment, but 100 million people (41% of working-age adults) not in the workforce disagree. On January I got into a minor Twitter disagreement—a Twiff?—with a confident young economist, which led to a gentlemen’s bet:

George Pearkes: We will not see a recession starting before 2017, in my opinion. I could well be wrong of course.

Me: OK. I'll take now.

My cockiness stems from a 1991 survey described in John Mauldin’s Code Red in which a poll of 53 economists put the probability of a recession that year at 3%, ignoring the 15% probability for recession in any year. The final arbiter of recessions—the NBER—eventually showed that the poll had been taken five months into a recession. Economists use the tools of science, but they are still tools. (How ambiguous.) The bet got edgier in April when Barry Ritholtz asked me which indicator I was using. I suggested it was many indicators, which promptly ended the discussion. I wasn’t alone, however. Many pundits not endorsed by the mainstream were reporting negative first derivatives. Even Bank of America seemed to lack optimism—but then predicted no recession for 10 years.19 That’s just stupid.

“This drop in oil prices, this drop in industrial metal prices, this is not good. It’s a canary in the coal mine that something is not right in the global economy.”

~Stephen Schork, The Schork Report

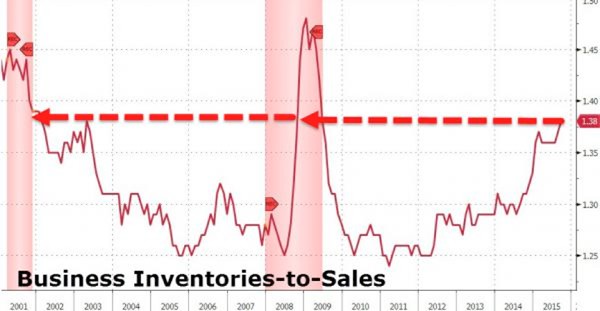

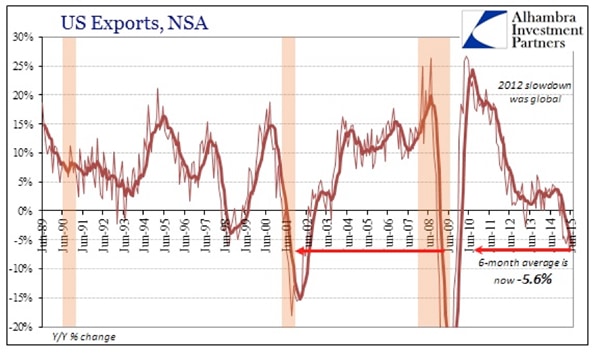

As I reminded Barry, a number of indicators were heading south. Wholesale inventories began surging at the end of 2014 (Figure 2), reaching an all-time high by the second quarter.20 Energy and energy sector jobs were getting annihilated. Commodities (not just energy) were getting crushed. Commodity routs often precede recessions. The Baltic Dry Index had turned down (Figure 3), indicating a global slowdown. The Chicago PMI crashed to 45.8 verses expectations of 58.7, reaching the lowest level since June 2009.21 U.S. labor participation was still dropping, undermining all claims of strong employment. Exports and U.S. factory orders were headed south (Figures 4 and 5.) Vehicle sales dropped in January. Q1 GDP “missed economists GDP targets” by fivefold to the downside.22 (Note to economists: your predictions miss the facts, not vice versa.) Credit was noticeably tightening by May. Consumer spending dropped as steeply in late spring as in the 2008 financial crisis.23 By April, Goldman was claiming four months of contraction.24 A survey of Wall Street forecasters blamed the slowdown in the first quarter on winter weather and the West Coast port slowdown.25 Of course, we have winter weather every winter, and the port slowdown might be a consequence rather than a cause. In a bit of journalistic genius, one headline noted “plant closings could make jobless claims jumpy.” The often-overlooked story is that Caterpillar sales had been quietly contracting for almost three years.26 This undoubtedly reflects emerging market problems, but it’s also our problem.

Figure 2. Wholesale inventories (shading are recessions)

Figure 3. Global economic activity

Figure 4. U.S. exports (shading are recessions)

Figure 5. U.S. factory orders (shading are recessions)

“This goes down as the sixth longest expansion since the Civil War.”

~David Rosenberg, chief economist at Gluskin Sheff

“Business cycles don’t typically die of old age. They are usually killed off by higher interest rates, a financial crisis, or some other shock…”

~Greg Ip, Wall Street Journal

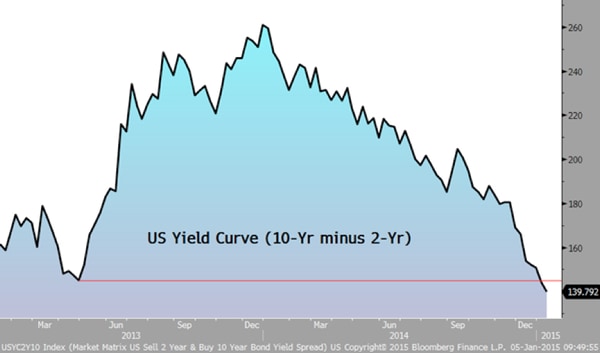

That is some crisply worded gibberish. Yes, Greg, and people die of coronary heart disease, strokes, and organ failure rather than old age. Maybe we missed a recession by the technical definition and Pearkes was right, but there is a suspicious odor emanating from the basement. The yield curve can’t fully invert with rates at zero, but it sure flattened (Figure 6).27 The economy seems sick; capital expenditures—capitalism’s seed corn—have been largely sacrificed to buy back shares (vide infra). Pensions are being left underfunded to maximize profits per share. How underfunded will they be at the next downturn? Overstock.com’s CEO Jonathan Johnson has gone TEOTWAWKI and stockpiled $10 million in small-denomination gold coins to meet payroll and three months of food for his employees.28 I’m not that bearish.

Figure 6. Two years of yield curve flattening

Broken Markets

“These markets are all rigged, and I don’t say that critically. I just say that factually.”

~Ed Yardeni, president of Yardeni Research, Inc.

“Whether it’s QE in the West or China’s recent regulatory intervention in the aftermath of the bursting of its equity bubble, market manipulation has become global in scope.”

~Stephen Roach, Yale University and former executive director of Morgan Stanley

The markets began breaking way back when Alan Greenspan went narcissistic and accepted the dual mandate to (1) preclude equity price discovery, and (2) subvert the business cycle. Let’s look at the bomb we’ve strapped on by first considering valuation. Goldman put price–earnings (P/E) ratios in the 98th percentile. Not a problem. The Fed model asserts that equity prices should correlate inversely with interest rates, which are at ridiculous multi-century lows. As the Fed jams rates to zero in the limit, the composite P/E ratios should go to infinity, right? (Hey: I didn't invent the model.) Now let’s drop some acid and ponder Fed chair Janet Yellen’s recent warning:

“Potentially anything—including negative interest rates—would be on the table. But we would have to study carefully how they would work here in the U.S.”

What does the Fed model predict now? Cliff Asness nicely explains why we should fight the Fed model.29 Common sense says fight the Fed model. David Einhorn says negative interest rates are like taking the square root of minus one.

“Nobody ever talks about the incentives to lie about the earnings.”

~Benjamin Friedman, Harvard University

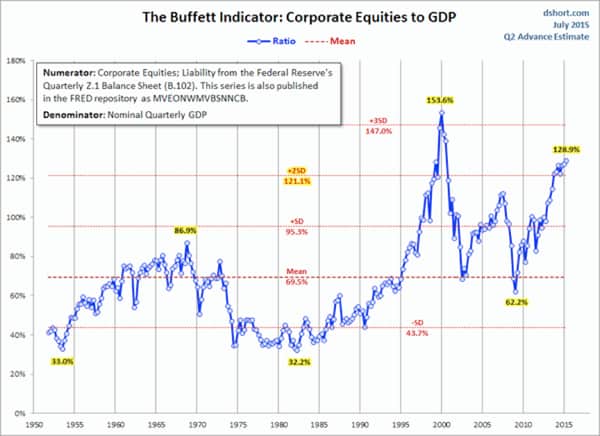

Apparently Harvard doesn’t have Internet yet. In any event, guys with market experience have alternative back-tested metrics for market valuations with historical comps. Warren Buffett’s favorite, the market cap-to-GDP ratio (Figure 7), began the year at all-time highs. The understated Mr. Buffett noted, “if we get back to normal interest rates, stocks at these prices will look high.” A regression to the mean would require a >40% equity haircut. Regression through the mean? Priceless. Lest we forget, folks, mathematically you must spend half your statistically weighted time on each side of the mean.

Figure 7. Buffett’s valuation model 1950-2015

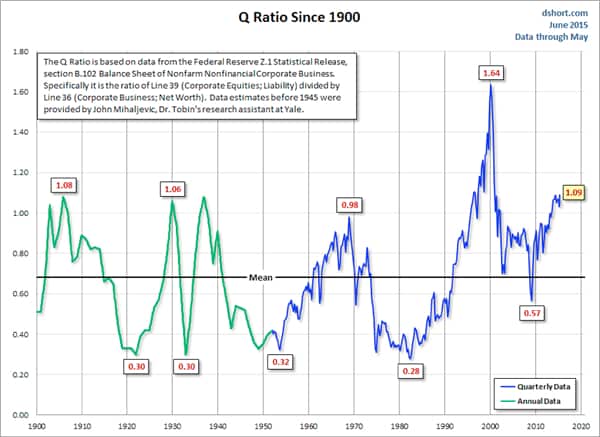

The always popular CAPE--Robert Shiller's cyclically adjusted P/E ratio smooths earnings over 10 years and began the year looking for a 40% correction to reach the historical mean. These nosebleed levels were surpassed only by the blackout levels in the tech bubbles of 1929 and 2000. Societe Generale has a proprietary guesstimate that predicts a “30% correction if all goes well and 60% if China hits a snag.” What are the odds of that? Mark Spitznagel likes Tobin’s Q (Figure 8), which is essentially the price-to-book ratio, and he assured me “it is the cleanest metric.” It’s not at a record level but is massively above the norm. Tobin’s Q reached fair value in 2009 and bounced like a golf ball off a cart path. After the ’09 crisis, Jeremy Grantham lamented the remarkably brief stay at fair value with deeply discounted bargains rare and fleeting at best. Even more interesting, check out Tobin’s Q in 1938—the year the Fed sinned by tightening monetary policy. Supposedly this little faux pas—French for “f*** up” (asterisk speak for “fuck up”)—elicited a belated apology from Ben Bernanke to Milton Friedman. I didn’t realize Ben did it or that Milton tried to stop him. In any event, Tobin’s Q had soared: the Fed had blown yet another frothy equity splooge with raging pinkeye. Maybe it had to act. Maybe, just maybe, the modern Fed is deathly afraid of being forced to act again.

Figure 8. Tobin’s Q 1900-2015

These plot-rich approaches to looking at valuations with those fancy schmancy, small-fonted x- and y-axes and hard data may be too confusing. Let’s just get the sage advice of grizzled gurus:

“On balance there’s no margin of safety.”

~Mario “The Bull” Gabelli, founder of Gamco Investors Inc.

“We're in the middle of a disastrous market mania . . . historically, these kinds of gaps get closed in one of three ways: by revolution, higher taxes, or wars. None are on my bucket list.”

~Paul Tudor Jones, Tudor Investment Management

“The good times are over.”

~Bill Gross, Janus Funds

“The median New York Stock Exchange stock is currently at a postwar record high P/E multiple, a record high relative to cash flow, and near a record high relative to book value!”

~Jim Paulsen, Wells Capital’s perennial bull

“[G]lobal financial markets are more distorted than ever before.”

~Felix Zulauf, Zulauf Asset Management and Barrons Round Table

“Sadly, I don’t think anybody’s capable of telling you precisely how and when the whole thing will come unstuck. Nevertheless, you know that at some point, it has to.”

~William White, Bank of International Settlements

“Markets will discover that they have been pushing asset prices to an excessively high level, and there will be a major downward shock to asset prices.”

~Mervyn King, former governor of the Bank of England

Here we are: ridiculous valuations for the third time in two decades, and you’ve been warned. You’ve been warned by Jim friggin’ Paulsen. The requisite leverage was provided by central banks worldwide. What makes this all so absurd is that there isn’t even a good narrative bias. The 1995–2000 mania was based on a very cool, world-changing tech revolution not unlike the tech revolution of the 1920s. Being duped by the narrative bias was forgivable. The current global equity run, by contrast, is based on the assumption that a bunch of second-rate economists (but first-rate bureaucrats) running monetary policy using third-rate Gaussian models have our backs covered. And get this: they are going to help us with controlled demolition of our currencies because . . . wait for it . . . inflation is good, and they know exactly how much is optimal because they are omnipotent.

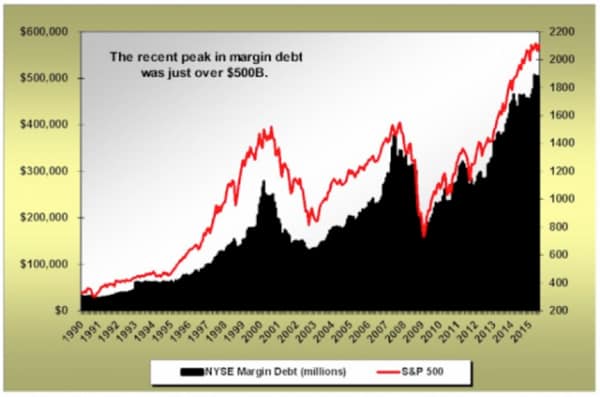

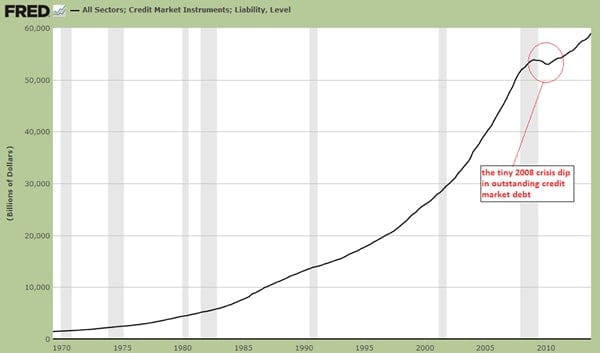

You’ve all seen some variant of the plot of margin debt versus equity prices in Figure 9, unless of course you’ve been hanging out in the basement of the Eccles Building with Governor Boo Radley. It is collective debt accrued within the entire system, however, that fuels bubbles (Figure 10). In this grand game of Texas Hold‘em, the Big Money is all-in, waiting to distribute the equities to retail investors. But this ain’t gonna play out like a typical blow-off top: the retail investor is broke and broken. As the 75-month-old expansion stretches 30 months past the historical mean, the Big Money is the dumb money. I actually heard a bull say, “I am smart enough to get out early.” Ding. Ding. Ding. All those smart guys will be exiting through a keyhole if history is a guide. In the meantime, keep listening to the sell-side analysts: they have called every equity rally since the beginning of markets.

“At particular times a great many stupid people have a great deal of stupid money.”

~Walter Bagehot, clueless geezer

Figure 9. Margin debt and S&P 500 price 1990-2015

Figure 10. Debt showing the near fatal blip

Doom porn aside, the markets seemed rather typical. Ken Griffin of Citadel brought in $1.3 billion owing to high-frequency earnings.30 The Swiss National Bank (SNB) picked up the slack in equity markets by increasing its exposure to U.S. equities by 40%.31 The SNB is ahead of the crowd by buying the dip before it appears. Very sneaky. With timing like a Swiss watch, they even bought pre-dip Valeant, the pharma that largely went bust on corporate shenanigans.32 A fake leveraged buyout (LBO) offer triggered a 22% short squeeze on Avon Products and was good for a few laughs.33 The dollar flash crashed 4%. Gilead did a 10% flash crash for a few minutes.34 Commodity trader Glencore was said to be doing a Lehman, but that was to be expected in a commodity rout.35

Meanwhile, bargains were to be had for those with a discerning eye. In San Francisco, shacks that, if they weren’t so run down, would normally be sold in the parking lot of a Home Depot are selling for $1.2 million (Figure 11).36 Closets under stairwells in London are renting for $700 per month.37 The pinnacle of value investing, however, appeared in the art market (Figure 11) when Geriatric Patriot was scooped up for a mere $1.5 million38 and Big Fat German Chick on Sofa was wrestled down by an eager investor for $58 million ($100K per pound).39 You want classy art, you gotta pay up. And if those gems are unappealing, you could have dipped your toe into an IPO of a company searching for Sasquatch.39a

Figure 11. $1.2 million (left), $1.5 million (center), and $58 million (right).

The good times seemed to be long in the tooth as fear

This is a companion discussion topic for the original entry at https://peakprosperity.com/2015-year-in-review/