The Fed is in a bind. No matter which way it turns, utter failure is a risk. Putting more money into the system risks no less than the dollar itself. Stopping quantitative easing (QE) risks plunging the economy and financial system into another period of turbulent decline. It looks like the Fed is going to choose the latter.

In a recent report, I made the case that pressure was building on the Fed to end its QE 2 program in June, and that if it did, there would be an enormous rout in the stock, bond, and commodity markets. That analysis still stands.

This new two-part report will analyze the many competing factors, both for and against, that will determine whether QE 2 really is the end of the Fed's efforts at printing up a recovery, or merely the event that precedes QE 3. The factors are numerous and polarized. On the one hand, there are many signs of economic recovery - the very best that a few trillion can buy - and on the other hand, there's $108/barrel oil and a deeply uncertain future for Japan over the next 3-12 months.

Fed Adopting Tougher Posture

Recently the Fed has trotted out several of its governors to make the case that they are serious about ending QE2. Strangely, they chose Friday and Saturday to go on a publicity tour -- days of the week normally reserved for news that is being buried, not exposed.

I found the following news snippets odd, not just because of their Friday/Saturday timing, but because they are all versions of the story purporting that the Fed is "thinking about tightening."

Fed’s Fisher Says He Backs Ending Central Bank’s Jobs Mandate

March 25, 2011, 2:45 PM EDT By Vivien Lou Chen and Jennifer Ryan March 25 (Bloomberg) -- Federal Reserve Bank of Dallas President Richard W. Fisher said he supports the idea of dropping the central bank’s congressional mandate for achieving full employment.

Fed's Plosser: Funds rate should hit 2.5% in year

March 25, 2011, 12:38 p.m. EDT By Greg Robb WASHINGTON (MarketWatch) - The Federal Reserve should hike interest rates from current range near zero to 2.5% within a year under a plan unveiled Friday by Charles Plosser, the president of the Philadelphia Federal Reserve Bank. Plosser did not give a specific time when this exit would begin but said it would have to start in the "not-too-distant future." In a speech to economists from the monetarist school on Friday, Plosser laid out an aggressive plan where the Fed would sell $125 billion of assets for each 25 basis point increase in the funds rate.

Fed Policy Makers Should Review QE2 Strategy, Bullard Says

March 26, 2011, 9:00 AM EDT By Scott Hamilton March 26 (Bloomberg) -- U.S. Federal Reserve policy makers should review whether to complete a second round of quantitative-easing purchasing due to end in June because of strong U.S. economic data, Federal Reserve Bank of St. Louis President James Bullard said.

All of these are part of a carefully choreographed PR campaign by the Fed to signal to the market that it is serious about ending QE efforts.

A week later, in another Saturday release (April 2, 2011), Bill Dudley offered up perhaps the clearest view of what the Fed is thinking:

Faster-than-expected payroll growth last month shouldn’t alter the U.S. central bank’s plans to buy $600 billion in Treasuries through June to prop up the recovery, said William C. Dudley, president of the Federal Reserve Bank of New York.

“I don’t see any reason to pull back from that yet,” Dudley said to reporters after a speech yesterday in San Juan, Puerto Rico. Market expectations are for the Fed to complete its planned bond purchases in June and not to announce additional buying, he said. “I don’t view those expectations as unreasonable in any significant way.”

(Source)

So the messages given a week earlier were digested by the markets, and the Fed decided to sharpen things up a bit by saying that the $600 billion program would be completed, but that's it. It seems clear that they want us to prepare ourselves for a sudden termination of QE at the end of June.

To further drive the point home, the Fed recently conducted a couple of "reverse QE" transactions, a.k.a. 'tri-party reverse repos,' which are nothing more than the Fed doing the exact opposite of QE -- putting Treasury bonds out and taking cash back in.

The scope of these operations was quite small, $1.75 billion in one instance and $0.75 billion in the other. But their true importance lies in their signal to the market that the Fed may someday not only stop the QE program, but reverse it.

Altogether, the Fed is sending out very strong signals that it intends to at least halt QE2 on schedule and not immediately move to QE3. There will be a pause.

What happens if the Fed abandons QE?

The reason we should all be quite concerned about the Fed ending its QE efforts is that the asset markets will take quite a dive if it does, but each for their own reasons.

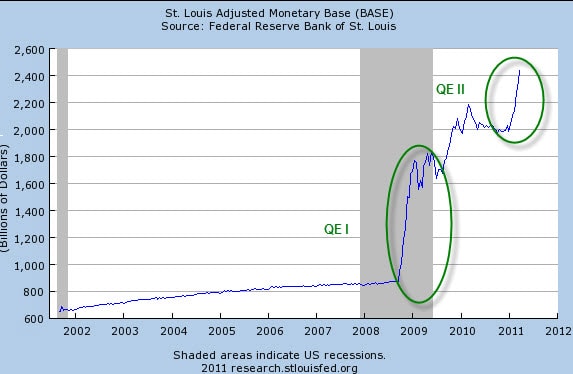

Let's be clear about what the Fed has been doing with its QE programs: It has been printing up high-powered money out of thin air and exchanging it for Treasury notes (and bills and bonds). This shows up beautifully in the monetary base charts dutifully kept over at the St. Louis Fed:

(Source)

The monetary base has gone up by some 300% since the start of the crisis. This is the money that has been sneaking out into the commodity, stock, and bond markets.

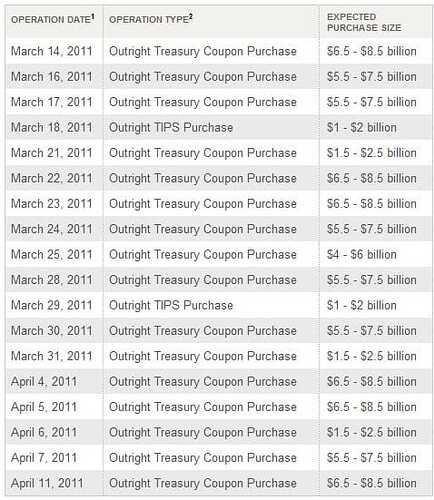

We can appreciate the scale of this in the amounts that are now being funneled into the capital markets on a near-daily basis:

(Source)

What we need to consider is what will happen when an average of $4.4 billion dollars per business day are no longer flooding into the markets. Will asset prices be at risk of falling without these massive daily infusions of liquidity? You bet.

And add to this an unexpected threat that's just entered the picture: Japan.

A Disturbance in the Force

The biggest risk here, aside from parts shortages and supply chain difficulties, is what happens when the flood of liquidity that has emanated from Japan over the past two decades reverses course and flows in the other direction. This is a major transition (which I expounded upon more deeply in a recent post for my enrolled members) for which both Japan and the world economy at large are wholly unprepared.

If we add the idea of the Fed's termination of QE, which has been enormously supportive of Treasury prices (and therefore low interest rates) to the idea of Japan suddenly becoming a net importer of funds instead of an exporter, we can quickly arrive at the risk of a rather unpleasant period for US Treasuries -- and, by extension, many other government bonds.

Already the governments of Portugal, Greece, and Ireland are paying rates on their sovereign bonds that are way above their nominal rates of GDP growth, which is a certain recipe for financial disaster. It's as if to survive, you need to borrow by using your credit card, even though your rate of interest on the card is several times larger than your yearly salary increases. Eventually that ends badly, and everyone knows it.

Along with this, we have to consider the idea that rapidly rising interest rates in the US Treasury market are destabilizing in other ways, but especially to the $600 trillion dollar derivative market, a significant portion of which is tied to US Treasury interest rates. Who knows what sorts of accidents await in a market that is too complicated to grasp in its entirety?

Of course, the US housing market, still struggling from poor sales, a massive shadow inventory, falling prices, and far too much negative equity, will perform especially poorly if interest rates rise.

If the Fed terminates QE on schedule, then I think a tsunami metaphor is apt. First, all of the liquidity will drain out of the bay, leaving countries, governments, and institutions to flop about in the mud. Then the Fed will panic and resume the liquidity flood, feeding the wave that will rush back in to destroy the lives and portfolios of those who positioned their wealth in harm's way.

The biggest problem with the current situation is that there's practically nowhere to hide. To an unprecedented degree, all of the world's markets and all assets classes are now trading in synchrony. If all of the assets in all the world's markets are moving up and down together, where does one go to sidestep the policy foibles of the Fed?

In Part II of this report, Finding Shelter From the Storm, we delve into specific strategies to consider for preserving wealth during these very turbulent times - as well as offer trading guidance for those willing to put risk capital into play. We explore what is likely to happen to the major asset classes (stocks, bonds, precious metals, housing, commodities) as the Fed attempts to tighten, and what is then likely to transpire if it later throws in the towel and begins printing again.

There are treacherous waters ahead. Liquidity will leave of the system and then come crashing back in. The unwary will lose nearly everything in the process, and so will some of the wary. Beating this current period of financial disruption by preserving your wealth will not be an easy task. Those looking to do so should consider reading Part II of this report (free executive summary; paid enrollment required to access).

This is a companion discussion topic for the original entry at https://peakprosperity.com/a-global-tsunami-courtesy-of-the-fed-2/