You wouldn’t know it from the ever-rising stock ““market””, but something is really wrong beneath the surface of the financial system.

The Fed is lying about it, too. So is the mainstream financial press, through sins of omission, seemingly unable to perform the most basic function of asking obvious questions and following them up.

Maybe this all gets resolved peacefully, maybe not.

I’m not taking the chance. That’s why I’m filled with a practical urgency to close on our new home in the country, on good soil and with abundant water. As well, the plans to collaboratively purchase an additional property are moving along better than expected with amazing people wishing to be part of and support something that is at least promises to aim towards doing something positive about our many predicaments.

This lack of transparency by the Fed, et al., is what worries me the most. Either they’re outright lying about what’s going on – which means it’s so bad they don’t want to say what it is – or they themselves don’t know what’s happening, which is a repeat of 2007/2008. Which is worse, ignorance or malfeasance? They’re both bad.

Remember all those times Bernanke said “subprime is contained” and the Fed staffers were busy cranking out paper ‘proving’ there was no housing bubble?

Yeah, me too, and that’s why I’m worried.

Charles Hugh Smith put it very well in his piece last week where he said:

A "market" that needs $1 trillion in panic-money-printing by the Fed to stave off a karmic-overdue implosion is not a market: a legitimate market enables price discovery. What is price discovery? The decisions and actions of buyers and sellers set the price of everything: assets, goods, services, risk and the price of borrowing money, i.e. interest rates and the availability of credit.The dirty little secret that nobody dares whisper lest the whisper trigger a self-reinforcing avalanche is that this Fed-manipulated “market” is illiquid: if any serious selling were to arise, there wouldn’t be enough buyers to stave off a complete implosion of the bubbles.

The Fed’s game is to create the illusion of liquidity by being the buyer of last resort, only now the Fed is the only buyer. This is the toxic consequence of the Fed’s 12 long years of Socialism for the Super-Wealthy: thanks to the Fed’s destruction of price discovery, the super-wealthy no longer worry about liquidity, so leverage is the name of the game.

The Super-Wealthy can gamble with hundreds of billions to stripmine the economy and not worry about whether a buyer will actually pay the overvalued price of the asset, because they can count on the Fed to step up and panic-money-print whatever sums are needed to maintain the illusion of liquidity.

(Source – OfTwoMinds)

The “illusion of liquidity.” That’s exactly what this all looks and feels like.

The Fed’s only game is to keep the charade going. But they are apparently completely unaware, as they were back in 2008, of what exactly the problems really are.

The issues cannot be fixed with more liquidity, only temporarily papered over. Tell me, how does ‘more liquidity’ address any of the following?

- Record levels of corporate debt

- Record levels of corporate ‘liar loans’ (i.e. cov-lite and ‘massaged’ EBITDA junk debt)

- Exploding fiscal deficits

- Over-leveraged households

- The impossibility of infinite growth on a finite planet

- The fact that shale oil is a consistent money loser at every price but it’s the entire hope for the future?

- Disappearing species, especially phytoplankton and insects (i.e. the bottom of the food pyramid)

- Unaffordable housing in many major cities

REPO Madness

Last week Martin Armstrong had a couple of really insightful article that ‘rang true’ for me about the REPO loan madness that has been playing out since September (2019).Armstrong writes:

The unannounced meeting between the Fed and Trump was a briefing on the Repo Crisis BECAUSE the real crisis cannot be discussed publicly.I have not been getting much sleep lately. This is a very serious crisis and all the BS on TV of these pretend analysts giving their two cents is really amazing. They are making up stuff and speculating because they have no idea how the global economy truly functions and they do not advise institutions. They do not understand the risks for year-end and calling this QE proves they do not understand what is taking place.

There are too many people trying to sound authoritative when they are clueless. Yet they seem to have to say something to pretend they know what is going on when all they are doing is creating confusion. We have more institutional clients around the globe on every side than anyone would imagine. We are in the front row with real live clients in the middle of this issue.

I appreciate the severity of this crisis. Requests to attend board meetings I have only been available by phone. I simply cannot fly all over the place. I really wish I could just come out and spill the beans, but this situation is too critical at this point and I fear that if someone does not blink here, we are headed into a global political contagion.

This is why a deal had to be tentatively arranged with China on trade. There are politicians out of the loop and this whole thing which is way too far above their heads to even grasp an understanding.

(Source – Armstrong Economics)

The crisis is very real and quite severe. The fact that it’s not on the front pages of the WSJ, et al., confirms just how serious it is (another crime of omissions that speaks as loudly as an obvious lie).

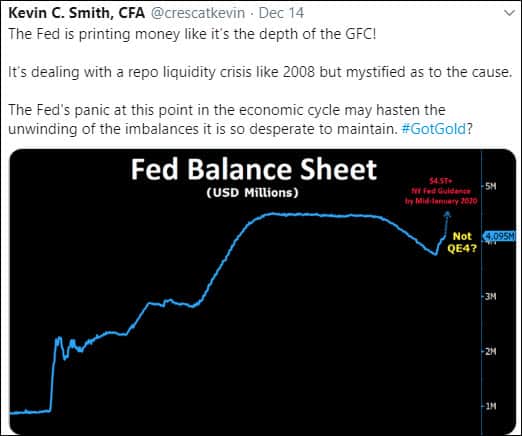

What was supposed to be a ‘temporary’ program has only grown larger and larger, and the finally scramble into year-end is going to break every possible record of ‘temporary’ liquidity injections by the Fed at any point during or since the Great Financial Crisis.

The power structure doesn’t want to ‘spook the herd.’ They truly believe that they are doing some sort of public good by not panicking anyone, the same rationalization used by the Japanese government to lie to its own citizens about the Fukushima nuclear disaster.

All we can do out here in the cheap seats is squint through the smoke to try and assess just how dangerous the fires truly are.

A Credit Suisse analyst, Zoltan Pozsar, made a big splash last week when he called the Fed’s actions “QE4 for year-end” and warned that there was a very large risk of a market melt-down if the Fed didn’t pump in enough liquidity.

Again, Armstrong on the topic:

I do not know if Pozsar is being too cavalier with his comments or if he’s deliberately trying to spread disinformation. This is by no means a “fourth version of quantitative easing” when the US economy remains strong and the Fed has acknowledged that fact. It does seem to me that he is trying to deflect people from looking at Europe and pointing his finger at the Fed.The Fed is compelled to be the man in the middle because banks have withdrawn from lending to banks because they do not know who has the risk with Europe.

The US Treasury stated it is investigating the over-regulation by the BIS, which has impacted the repo market. The Fed is trying to control short-term rates and this has NOTHING to do with “stimulating” the economy. The BIS has impacted the regulation with Basel III, which the BIS will not accept responsibility.

Calling this Repo Crisis QE is up there with calling Trump a racist because of his wall. Yet, Mexican is not a “race” any more than being American, German, Greek, Italian, Spanish, or British. The term is ethnicity, not race. This is not Quantitative Easing, which is lowering interest rates and stimulating the economy. The Fed is trying to prevent short-term rates from rising because there is a liquidity crisis created by banks refusing to participate in the repo market.

The suggestion that the Fed will have to move to long-term bonds fails to understand what is taking place. I cannot imagine that any banker would make such a statement. They either do not know what the repo market is or they are trying to create disinformation to protect Europe. This is very curious.

I believe the White House has been briefed on the crisis and it has also impacted the China trade negotiations.

(Source – Armstrong Economics)

That’s an interesting supposition set. The China trade deal was goosed along because Trump met with Powell and learned of some serious indigestion happening in the financial plumbing that needed some help. The China ‘deal’ was therefore rushed through (nobody even knew for two days how many soybeans China was allegedly buying, including China) and it had an odd urgency to it.

The other idea here is that the problem isn’t located in the US, it is a European banking problem. That’s an idea I can get behind, especially since the share price of Deutsche Bank has been in a headlock for months:

Deutsche Bank is my #1 candidate, as it is for many, to be ”the hot mess” at the center of the European banking crisis that Armstrong is theorizing about.

That it has been magically ‘floored’ at $7 per share for so many months has struck me as rather odd.

Once again, all I can do at this stage is to pose this challenge:

Except now I need to expand that to Europe’s equity markets too. We already know that Japan’s are a government utility, so that doesn’t need to be posed – that’s already been securely moved to the “conspiracy fact” side of the ledger.

So many things have made that same transition of late from ‘nutball theory’ to ‘recognized truth’ that it’s now a certified fad – the hot new thing.

Conclusion

The world’s central banks are in panic mode. Again. Or maybe still.Their words are soothing, but their actions are panicky.

They are a one-trick pony. Here’s that trick:

What we need to ask is “So then what?”

Okay, the equity markets have been whipped higher by central bank printing, So then what?

Has infinite growth suddenly become possible? Will the insects come back? Will the wealth gap shrink? Will shale oil suddenly become profitable? Will corporate debt and fiscal deficits come back to manageable levels?

No.

In fact, the exact opposites of all these things occur instead. The Fed is enabling or papering over every possible symptom of distress and rot as if Band-Aids could cure cancer.

Even if I generously assume that the Fed is comprised of well-meaning people who are trying to accomplish something good, they remind me of that one relative that ruins every holiday get-together with toxic comments they think are “helpful.”

I’m expecting stocks to explode even higher because the Fed is busy firehosing liquidity all over the place, as if that were “helpful”. Instead it’s toxic. It will end badly.

It’s all a shame, because it doesn’t have to go this way.

Unfortunately, the people who will be harmed the worst will be ‘the little people’. The deep insiders will be safe and secure, likely even made whole by whatever series of future bailouts will follow the current REPO bailouts (because that’s what they truly are).

In closing, I agree with Armstrong: this a serious crisis. It’s being lied about, nobody really gets it, and it probably has something to do with Europe.

This is a companion discussion topic for the original entry at https://peakprosperity.com/a-hot-mess/