murder: a flock of crows

~ Miriam-Webster dictionary

Many view the appearance of crows as an omen of death because ravens and crows are scavengers and are generally associated with dead bodies, battlefields, and cemeteries, and they’re thought to circle in large numbers above sites where animals or people are expected to soon die.

~ "Nature", PBS.org

Running PeakProsperity.com requires me to read and process a lot of data on a daily basis. As it's hard to digest it all in real-time, I keep a running list of charts, tables and articles that catch my attention, to return to when I have the time to give them my full focus.

Lately, that list has been getting quite long. And it's largely full of indicators that concern me; signals that the long era of "extend and pretend" in today's markets may finally be at its terminus.

Like crows circling overhead, every day brings with it new worrisome statistics that portend an ill change ahead. Indeed, these omens are increasing so quickly now that it's hard not to feel like Tippi Hedren in Hitchcock's suspense classic The Birds:

So what are the data that make me think these crows will soon be feasting on the carcass of the great bull market that has powered stock, bonds, real estate and most other asset classes to record highs since 2009?

Rogue's Gallery

Complacent Investors

Investors have enjoyed remarkably gentle treatment by the stock markets over the past half-decade. Retracements have occurred much less frequently than historical norms, and have been shallow and short-lived when they happened.

Tom Lee, head of research at Fundstrat and often referred to as "Wall Street's biggest bull" notes that 2016 was the mildest year on record for the S&P 500, with only 7 days in which the index traded at less than 3% of its 52-week high. Similarly, the 2013-2016 period has seen the lowest volatility of any 4-year stretch in history:

Lee notes that despite the record calm, annual returns are moderating. As conditions begin to mean-revert, he worries that lower prices are ahead and is predicting a 5-7% market correction in the first half of 2017.

JP Morgan's lead quant Marko Kalanovic also issues a striking similar warning: "Following the recent rally, a level of risk complacency has started to set in. The ratio of S&P 500 Puts to Calls has dropped to a ~3 year low, and the VIX reached near-record lows of ~10. " He, too, is calling for a ~5% pullback in the first half of this year.

Bizarre Price Action

Assets like stocks are (or, at least, are supposed to be) valued based on expectations of income. If income is increasing, then so should prices. But that's not what we're seeing.

The famed Dow Jones Industrial Average hit 20,000 for the first time ever on January 25th. Things must be going great, right?

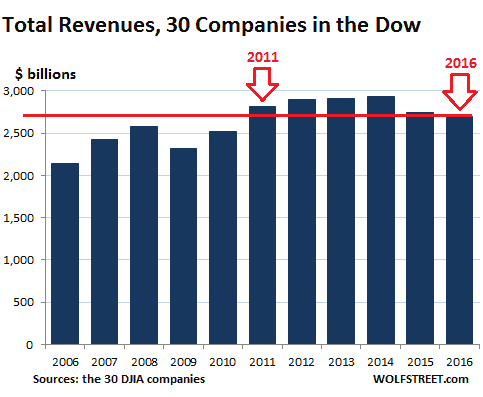

Well, not that great. Wolf Richter shows that the total aggregate revenues for the 30 companies that make up this index was actually lower in 2016 than in every year from 2011 onwards:

Hmmm. Well, revenue isn't everything. At the end of the day, it's earnings that matter. Perhaps corporate America is becoming more efficient and posting record profits.

Nope.

(Source)

We're seeing a clear trend of rising prices in the face of lagging performance. One of those will need to correct. Which seems more likely?

Dismal Outlook For Future Returns

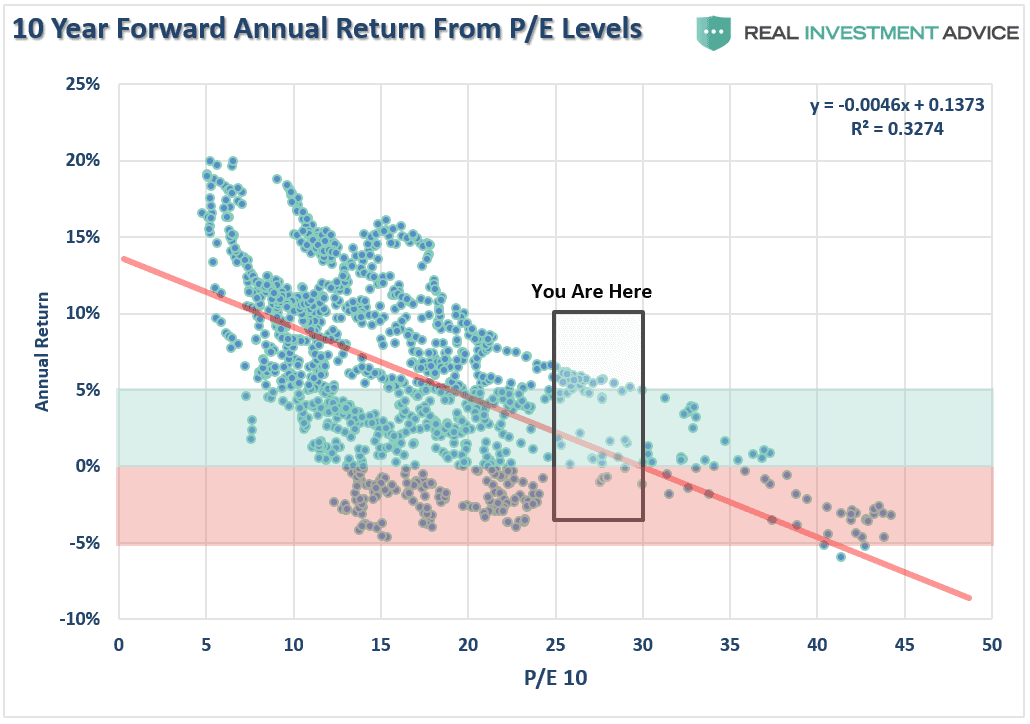

John Hussman was been warning us for years that QE/etc has pulled all the value of future returns into present asset prices. Today's investor has to make a choice: either buy now and expect no/low returns for the next 10 years; or wait for a price correction in the markets and then buy at low valuations to get appreciation from there.

Lance Roberts visualizes this pickle in the chart below, which shows that, historically, markets as richly-priced as today's have offered sub-par annual returns for the following decade:

(Source)

As you can also see from the above chart, the S&P spends at lot less time at price-to-earnings (P/E) ratios above 20 as it does below. At today's average P/E of 28+, prices have a long way to fall when a return to historic averages occurs.

Complacent Consumers

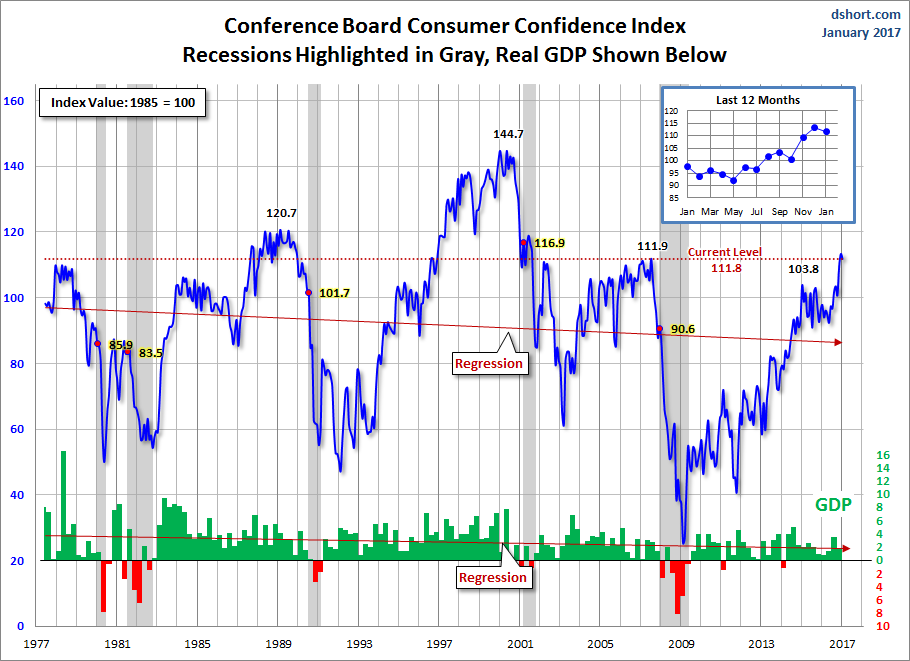

Like investors, consumers' worries about the future have dissipated as borrowing rates have lowered, and home and 401k prices have risen. Consumer confidence hit a 16-year high in December, surpassing levels preceding the 2008 financial crisis:

(Source)

Note how confidence levels at this current height are nearly always followed soon after by recession.

Bubblicious Housing Prices

The latest Case-Shiller home price index report shows that US housing prices have, in aggregate, for the first time exceeded their previous peak seen right before the 2007 collapse:

(Source)

Are current prices unsustainably high? Very likely. But what's not up for debate is an important point Zero Hedge makes about the above chart. It's latest data point is from November 2016 (that's the most recent Case-Shiller data available as of now). Mortgage rates have spiked dramatically since then. Given the mathematical 'see saw' relationship between home prices and mortgage rates, the most likely future trajectory for this chart is downwards.

Unbalanced Bets

The net result of all the above is that the vast majority of investment capital is crowded into the same trades. Trades, mind you, that anticipate the recent near-magical era of historically-low volatility and historically-high stock prices will continue unabated for the foreseeable future.

As in sailing, whenever everyone crowds to the same side of the boat, folks usually end up wet:

(Source)

So is it any surprise that those with a superior record of profitable trading (due, usually, to unfair advantage -- but that's a different story) are positioned very differently than the herd? Sentiment Trader's Smart Money/Dumb Money Confidence index is showing an historically extreme divergence, with the "dumb money" betting on a continued rally and the "smart money" anticipating a decline:

A Reality-Check

Given the multiplying and shrilly-squawking omens of hubris and overconfidence in today's hyper-extended markets -- a murder of complacencies, if you will -- we conclude we've reached the point in this storyline where the suspense has risen to its zenith, and the real violence then begins. Hitchcock would be proud.

We reiterate our advice to prepare for approaching mayhem in the markets. If you have money in stocks and bonds (in a brokerage account, retirement account, pension, trust, etc), please make sure you are working with a financial professional who is taking the above risks in mind in their approach to managing your portfolio (if you're having trouble finding one who is, consider scheduling a free consultation with the adviser we endorse).

If you're a homeowner, prepare for the probability of lower prices ahead. If you're thinking of selling your house in the near future, you may want to move up your timetable. Conversely, if you're a potential buyer, ask yourself if you can afford to wait until a correction offers better bargains.

Of course, a major market correction doesn't just affect the prices of stock, bonds, and housing. Through repercussions like job layoffs, company closures, cuts to social programs, and the like -- the mood and functioning of society at large is impacted.

And we're not the only ones concerned about what the future holds. Our recent report When The Rich Become Preppers, It's Time To Worry is a must-read for understanding that the average Joe is being played for a sucker by today's "everything is awesome" meme.

Those executives who run the companies we hold stock in? They're furiously preparing for a future of social unrest.

Click here to read When The Rich Become Preppers, It's Time To Worry (free to all)

This is a companion discussion topic for the original entry at https://peakprosperity.com/a-murderous-complacency/