As the first month of the year concludes, it's becoming clear that 2019 will be a very different kind of year.

The near-decade of 'recovery' following the Great Financial Crisis enjoyed a stability and tranquility that suddenly evaporated at the end of 2018.

Here in 2019, instability reigns.

The world's central banks are absolutely panicking. After last year's bursting of the Everything Bubble, their coordinated plans for Quantitative Tightening have been summarily thrown out the window. Suddenly, no chairman can prove himself too dovish.

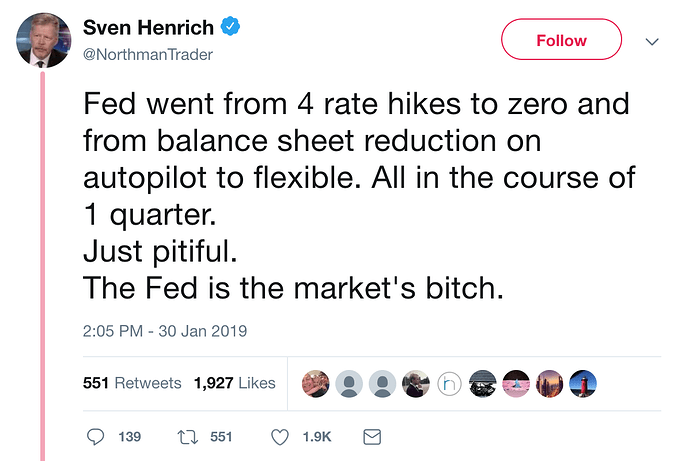

Jerome Powell, the supposed hardliner among them, completely capitulated in the wake of the recent -15% tantrum in stocks, which, as Sven Henrich colorfully quipped, proved what we suspected all along:

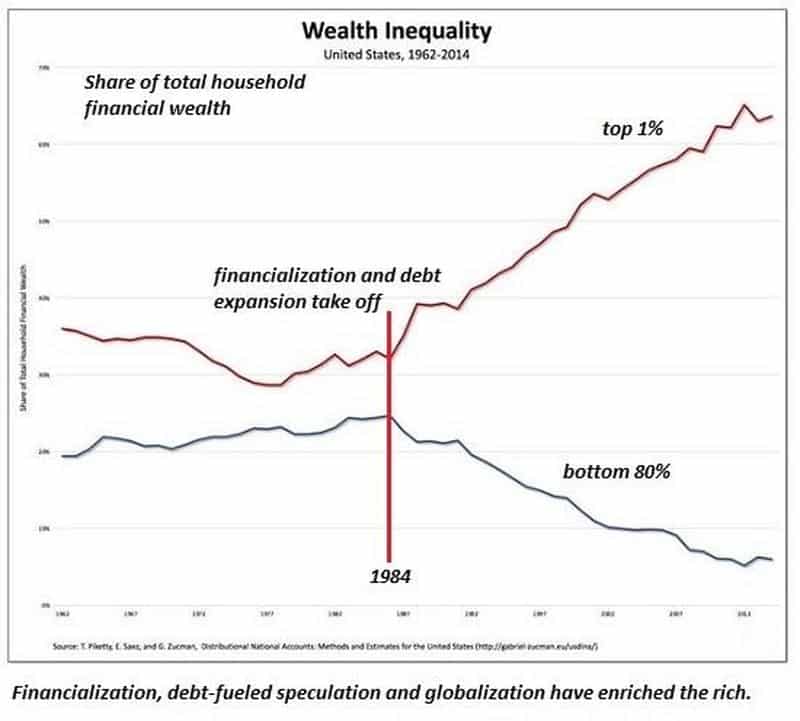

The global tsunami of liquidity (i.e. thin-air money printing) released by the central banking cartel has been the defining trend of the past decade. It has driven, directly or indirectly, more world events than any other factor.

And one of its more notorious legacies is the massive disparity and wealth and income resulting from its favoring of the top 0.1% over everyone else. The mega-rich have seen their assets skyrocket in value, while the masses have been mercilessly squeezed between similarly rising costs of living and stagnant wages.

How have the tone-deaf politicians responded? With tax breaks for their Establishment masters and new taxes imposed on the public. As a result, populist ire is catching fire in an accelerating number of countries, which the authorities are anxious to suppress by all means to prevent it from conflagrating further -- most visibly demonstrated right now by the French government's increasingly jack-booted attempts to quash the Yellow Vest protests:

Meanwhile, two other principal drivers of the past decade's 'prosperity' are also suddenly in jeopardy.

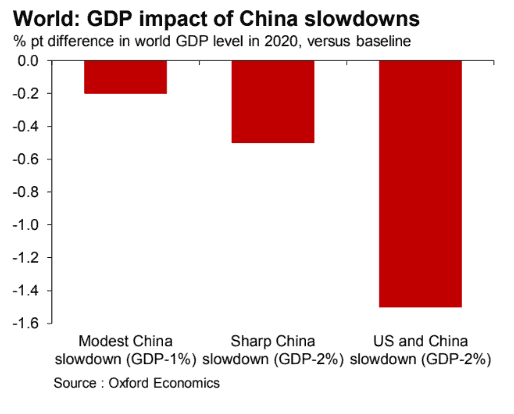

China's once-unstoppable economic growth engine is now sputtering badly. The slowdown is so pronounced that it's now feared it will drag world GDP down to a decade low this year:

And all those headlines that claimed the US shale oil 'miracle' has ushered in a new era of over-abundant cheap domestic oil? Well, as we've long warned, it's becoming clear that promise was dangerously overhyped. It's recently been exposed that the shale operators -- who have never made a profit as an industry -- have been overstating their output by as much as 50%. That, plus a host of geological and financing challenges, is making the future production prospects of the Permian and other major shale basins look a lot dimmer:

Is The Permian Bull Run Coming To An End?

With the big Wall Street players now questioning the value of their existing investments in shale oil, the industry is finding it hard to raise money. Not a single bond sale has come off since November in an industry which must continuously raise capital to survive.

To add to the problems, the future of U.S. shale oil production seems to be in the Permian Basin in Texas which has been providing the lion's share of oil production growth for the entire country. But ongoing drought in an already arid West Texas has raised doubts about whether the Permian will have enough water to meet all the demand for fracking new wells.

If the needed capital is not forthcoming, it means that companies will be faced with declining revenues from declining production. With lower operating cash flow and little access to additional capital, these companies will be unable to drill enough wells to offset declining ones. That means even lower revenues in the future which will mean even lower investment in new wells. That's what a death spiral looks like.

(Source)

A Poisonous Cocktail

Mix together a slowing global economy hopelessly addicted to central bank stimulus, festering social unrest and an approaching oil price spike/supply squeeze. The result?

Recession and revolt.

It's anybody's guess what will happen from here. But it seems certain that events will not recede back to the tranquility of the past decade.

Our prediction here at PeakProsperity.com is that the long-awaited (and, yes, perhaps too-long-predicted) downturn is nigh.

Either the economy descends into recession, resulting in widespread job losses and a deflationary correction of today's ridiculously-inflated financial markets. Or the central banks go "all in" and launch QE4ever, leading to runaway inflation (runaway stagflation, more likely) and possibly hyperinflation.

Either way, the pain and losses will be severe. And those hurt the most -- the working poor, the elderly unable to support themselves, the younger generations limited by diminished prospects -- will have no option but to rise up against the political regimes that have failed them so badly.

A Survival Guide For 2019

With the bursting of the Everything Bubble, we declared last year as the 'Year Everything Changed'. This will be the 'Year of Instability', possibly preceding an upcoming 'Year Of Woe' in 2020.

But look, we're not saying the world is the process of ending imminently. It's just that we've entered the part of the timeline when things are going to start to get really rocky.

And we think it's much more useful to think of 2019 as the 'Year Resilience Matters'. It shifts the focus away from fear and instead towards the many things you can do to protect yourself and those you care about - and even to position yourself to prosper through the coming challenges.

Here are recent articles/resources we've created to help you get started. Focus on the areas where you currently feel the most vulnerable.

- Lose weight/Get fit -- after all, if you don't have your health, the rest doesn't matter. Resilience starts with your most important asset: your body. Our free how-to primers on successful and sustainable weight loss and functional fitness are great resources for everyone looking for guidance on how to boost their physical health.

- Shore up your key relationships -- whatever the future brings, no single person can be prepared for every possible outcome. We're going to need to rely on others, on key relationships and trusted community ties, when events play to our weaknesses. How do we nurture the kind of relationships that thrive, instead of unravel, during times of stress? Our free report breaks down the science behind successful social bonds.

- Prepare for deflation -- asset prices desperately want to deflate. The past decade of money-printing (QE 1,2 & 3) has blown prices well into bubble territory and allowed for credit to expand way beyond what fundamentals allow. With the bursting of the Everything Bubble, especially if the central banks somehow resume their committed tightening plans, *much* lower prices should lie ahead. A recession will only exacerbate this trend further. So we recommend that investors get liquid and preserve 'dry powder' to ride out the correction and be poised to re-enter the market when quality assets can be purchased at much better valuations than today. Our primers on holding cash in short-term US T-bills and in hedging for a major market correction are important resources for anyone looking to position their capital for a deflationary purge.

- Prepare for inflation -- of course, today's central banks hate deflation. They may well take a "damn the consequences" approach when serious deflation next raises its head and kick-off QE 4-ever -- which would have to be on a scale much larger than the previous QE efforts to achieve it's desired effect. But at that magnitude, it is highly likely the central banks will kill the purchasing power of their underlying currencies -- unleashing runaway inflation (runaway stagflation, more likely) and quite possibly hyperinflation. So, it's wise to have a portion of your portfolio in assets that will weather the ravages of inflation better than most. This is why we recommend folks consider owning precious metals (and why we endorse the Hard Assets Alliance for doing so) as well as invest for inflation-adjusted income going forward (vs speculating for capital gain).

- Prepare for likely emergencies -- one of the few things we can predict with certainty is that 2019 will have its fair share of floods, fires, hurricanes, blizzards, and blackouts. Every location has its own set of probable disasters than can be anticipated. Preparing for these is relatively straightforward and absolutely prudent. Our free guide to emergency preparedness is full of battle-tested recommendations and advice for doing it well.

- Prepare for unlikely emergencies -- another thing we can predict with confidence is that nothing this year will go 100% according to plan. There will be errors, unintended consequences, surprises, and accidents. We've written in the past of the wisdom of holding umbrella liability insurance for protection against the unexpected. More than 80% of US households either don't own any or are under-insured. If you think you may be one of them, read our free primer on the topic.

- Develop your master plan -- as with most goals, success dramatically improves when working with an experienced coach. Those looking for help in making key decisions and/or getting custom answers to their unique personal situations can schedule a consultation with us. And those looking to have a crash-audit of their investment portfolio can schedule a free review with our endorsed financial advisor.

- Live resiliently - they say "The best revenge is to live well". The same is true when it comes to resilience. Creating a resilient life is the best way to overcome adversity and enjoy prosperity in your daily living. Our book Prosper!: How To Prepare For The Future And Create A World Worth Inheriting offers a blueprint for doing just this. As does our intensive 3-day seminar (this year's is nearly sold out, so register soon if interested), which also connects you into the Peak Prosperity tribe -- a worldwide community of smart, accomplished truth-seekers with big hearts eager to support each other in their journey to live more resilient lives.

The goal here is not perfection; no one can be fully prepared for every eventuality. It's to be "good enough" across as many of these dimensions as possible.

By taking prudent action today in these areas, you'll be vastly more able to navigate the instabilities that 2019 throws at you.

And, just as important, you'll be well-positioned to be in service to the many less-prepared folks around you.

This is a companion discussion topic for the original entry at https://peakprosperity.com/a-survival-guide-for-2019/