Originally published at: https://peakprosperity.com/adam-rozencwajg-inflation-will-come-roaring-back-golds-tale-and-shale-oils-long-goodbye/

Today, everybody wants to know: why is gold spiking so relentlessly? What’s it telling us? How can its message be so different from oil, which is collapsing in price? Tune in to find out.

Once a quarter, I sit down for an extended podcast with Adam Rozencwajg of the famed resource investment firm Goehring & Rozencwajg to discuss inflation, oil, gold, silver, and other subjects.

Adam’s insights are measured and tempered by decades of experience, and he skillfully deploys logic and reason as he builds his arguments and models.

In this podcast, we discuss their third-quarter 2025 commentary:

I strongly encourage everyone to read this entire commentary – twice – which you can do by heading over to https://www.gorozen.com/ and downloading the report. All it will ‘cost’ you is an email address.

Inflation

We started our conversation discussing inflation. Cutting to the chase, here’s G&R’s view:

We are firmly in the camp that believes the great disinflationary arc, which began in the stern days of Paul Volcker’s Fed, has run its course. The era of falling yields and fading price pressures is over. In its place, a new cycle has begun—an inflationary one, with the potential to stretch across decades. And if history is any indication, it will not pass quietly. It will bring with it the kind of problems that compound—politically, economically, and socially— until they can no longer be ignored.

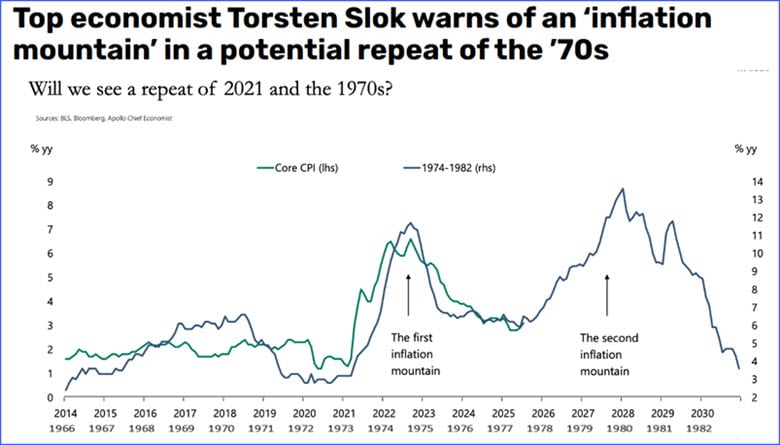

Paul Kiker and I have discussed the idea that inflation is going to repeat the pattern of the 19070’s and come roaring back into our lives. It may even repeat due to an energy shock, this one rooted in the failure of the U.S. and its associated financial geniuses to recognize the profound importance of the peaking of shale oil (more on that below).

A failure to invest in natural resources is the #1 reason that natural resources eventually spike in price. It happens over and over again, and this cycle has about run its course.

Gold & Silver

Similar to all commodities, gold and silver have been subjected to a long regime of paper contracts dominating the pricing landscape as opposed to legitimate supply and demand balancing between producers and consumers.

Accordingly, gold spent ~ four decades not being money. Its share of global reserves declined steadily between 1980 and 2020, finally bottoming out in the yellow box below.

But that has changed. Look at that curve upward beginning around 2020. Gold is now rapidly on track to match and then exceed dollars in terms of global reserves.

That means gold is becoming money again. The pendulum doth swing back and forth. Money, not money, and money again.

Oil & Gas

But here’s the big story. The biggest untold story of 2025. The one I cannot let go of because it is just so painfully and blindingly obvious.

The US shale patch has hit its own personal and geologically customized Peak Oil moment.

The subheadline for the G&R quarterly piece is this:

There’s a lot in this update’s shale oil section, and again, I would strongly encourage you to read it, read it twice, and then read it once more again slowly.

As Adam laid out for us in a prior podcast, there’s a situation in oil production they have termed “The Depletion Paradox.” Briefly, that states that after a critical threshold of drilling has taken place in any given field, a paradox occurs.

The more holes you drill, and at a faster pace, the less oil comes out of the ground per unit of effort. How can this be? It’s a paradox.

The answer lies in understanding a few moving pieces, but none as important as declining per-well productivity. In shale patch terms, this translates into “how much oil comes out of the ground per foot drilled?”

On that front, this shocked me when I read it in their report (bold emphasis mine):

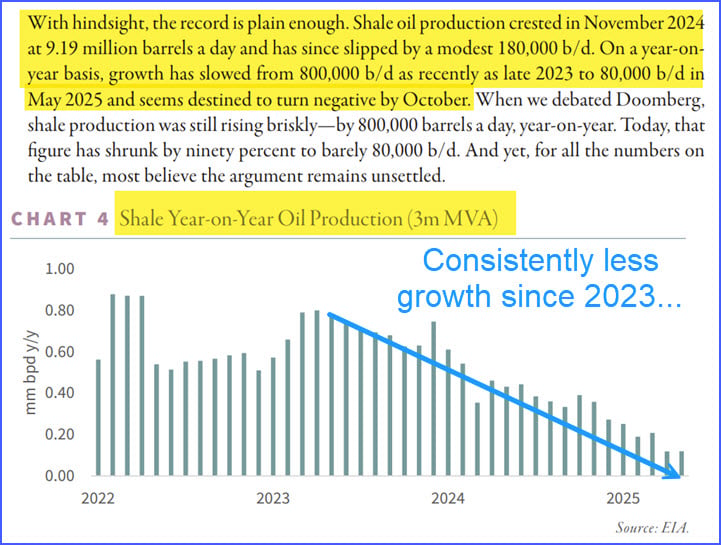

The paradox is plain: with nearly forty percent fewer rigs, companies were drilling thirty percent more wells each month. The wells themselves were almost a third longer than they had been, which meant that, in aggregate, lateral footage drilled each month since October was seventy percent higher than in 2018.

Hold up! The US is reporting stagnant oil output, but the oil companies are drilling 70% more lateral footage than in 2018, when oil production was rising smartly?

Hello Depletion Paradox!

You know what follows next as sure as the sun rises in the East? Declining oil output, which we can plainly see in the steady decline in oil output growth from those shale plays, despite 70% more lateral feet drilled as compared ot 2018!(!!)

Adding fuel to that fire is the broken narrative entrenched in Wall Street’s illustrious cranium that oil is abundant and surpluses are going to dominate as far as the eye can see.

Accordingly, the price of oil is in a sustained downslope, and the oil operators are busy dialing back capital expenditure programs, stacking rigs, and laying off workers.

Which will lead us straight back into the other part of this story, one dominated by falling supplies, evaporating surpluses, and then a mad scramble to pour money back into the beleaguered space.

But, this isn’t just an oil story; it’s the same story for silver and copper, too:

Morgan Stanley forecasts that copper production will fall short of demand by 590,000 tons next year, the biggest supply deficit since 2004.The perfect storm in emerging? Copper...

— Gold Telegraph ⚡ (@GoldTelegraph_) October 16, 2025

This is going to lead to unprecedented market volatility, especially in equities.

Which means that having a risk-managed portfolio strategy is more important than ever , and to seek out a financial advisor who sees these larger risks the same way that you do. To schedule your free, no obligation portfolio review and wealth strategy session with Kiker Wealth Management, just click this link, fill out the simple form, and someone from KWM will get in touch with you within 48 business hours to schedule your session(s).

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.