“Digitization and the online platform have become too successful. So much so that they have exceeded the capacity of [the world's] physical structures to deliver to their success.”Demand for commodities, tangible assets and the companies that mine, manufacture and transport them is about to blow sky-high predicts, Steen Jakobsen, Chief Economist and CIO at Saxo Bank.

He bases this prediction on several factors.

First, the digital world does not exist independently from the physical world. And the massive success of virtual platforms over the past several decades has now reached a point where the infrastructure to source, build and deliver the products they sell is becoming a serious constraint.

Second, governments are becoming more concerned about social equity and stability. Steen predicts a significant increase in federal spending on ‘green’ infrastructure to drive jobs and upgrade capacity for commerce.

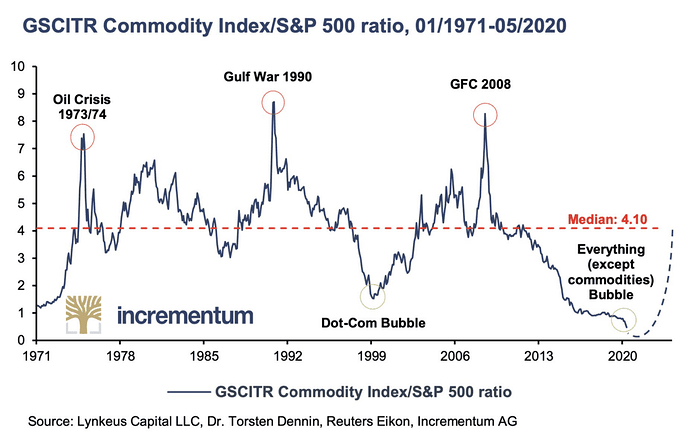

Third, Steen believes the market is not pricing in the prior two factors. So he expects a price-boom to occur once investors wake up to the fact that commodities haven’t been this undervalued relative to other financial assets for at least 50 years:

Which is why now, more than ever, is the time to partner with a financial advisor who understands both the opportunities and the risks in play, can craft an appropriate portfolio strategy for you given your needs, and apply sound risk management protection where appropriate:

Anyone interested in scheduling a free consultation and portfolio review with Mike Preston and John Llodra and their team at New Harbor Financial can do so by clicking here.

And if you’re one of the many readers brand new to Peak Prosperity over the past few months, we strongly urge you get your financial situation in order in parallel with your ongoing physical coronavirus preparations.

We recommend you do so in partnership with a professional financial advisor who understands the macro risks to the market that we discuss on this website. If you’ve already got one, great.

But if not, consider talking to the team at New Harbor. We’ve set up this ‘free consultation’ relationship with them to help folks exactly like you.

This is a companion discussion topic for the original entry at https://peakprosperity.com/an-epic-commodities-boom-is-starting/