When an asset rises by almost 30% in a few weeks, it tends to attract attention. Recently, that asset was bitcoin (BTC). The price of BTC in dollars rose from $454 on May 23 to $590 on June 6th.

When an asset doubles in a matter of a few months, it tends to attract attention. The cryptocurrency Ether (part of the Ethereum platform) doubled from around $7 in April to roughly $14 in early June.

Are these cryptocurrencies mere fads? Or are they potentially game-changing alternatives to the conventional currencies such as the U.S. dollar, Chinese RMB, Japanese yen or European Union euro?

There’s no lack of skeptics and critics of bitcoin and other cryptocurrencies. For example, “National currencies aren’t as Centralized, and Bitcoin isn’t as Decentralized, as you think.” (Source)

There are plenty of defenders of cryptocurrencies as well, for example this response to the article above.

The controversy is understandable; bitcoin has had a difficult adolescence. After soaring from $15 in early 2013 to over $1,000 in December 2013, the cryptocurrency crashed to $215 in early 2015 in the wake of the bankruptcy of a major exchange (Mt. Gox) that cost bitcoin investors $470 million in losses.

Yet despite concerns about security, criminal use and volatility, cryptocurrencies have proliferated at a dizzying pace, and new models such as the “smart contracts” of Ethereum have been developed.

So what are those of us who can’t follow the technical arguments supposed to make of all this? For that audience, here's my stab at making sense of the potential global role of cryptocurrencies.

Cryptocurrencies Are Digital Currencies That Are Not Issued by Governments

What’s a cryptocurrency? Wikipedia’s definition is “a medium of exchange using cryptography to secure the transactions and to control the creation of new units.” Cryptocurrencies exist only in the digital realm; there are no physical coins or paper notes.

Cryptocurrencies have no intrinsic value. They share this characteristic with fiat currencies issued by governments/central banks:

“Fiat money is currency that a government has declared to be legal tender, but is not backed by a physical commodity. The value of fiat money is derived from the relationship between supply and demand rather than the value of the material that the money is made of. Historically, most currencies were based on physical commodities such as gold or silver, but fiat money is based solely on faith. Fiat is the Latin word for “it shall be.” (Source)

Though major central banks own gold, the currency they issue is not “backed by gold,” i.e. it cannot be converted into gold upon demand.

The value of fiat currency is a function of supply and demand. There are many sources of demand for currency: governments demand taxes be paid in their fiat currency, for example, and this creates demand for the currency.

There is however only two sources of supply: the central banks of nation-states (or regional unions like the Eurozone) and private banks in fractional reserve money systems that enable banks to create new money via issuing new loans.

In a fractional reserve banking system, if a bank has $10 in cash deposits (i.e. in reserve), it can issue a new loan of $100. This loan is new money that was created out of thin air. When the loan is paid in full, this new money disappears from the system.

When central banks or states issue new currency in excess of what the economy is actually producing, the supply overwhelms demand and the currency’s value (i.e. purchasing power) falls accordingly. Venezuela offers a present-day example: the official exchange rate of the Venezuelan bolivar is 10 to the U.S. dollar (USD), but the “street”/black market value is closer to 1,000 to 1 USD. (My correspondents in Venezuela report that it is illegal to post the black-market exchange rate on a website.)

Governments typically restrict alternative currencies to protect their monopoly on money issuance: residents must use the government-sanctified currency or face prosecution and prison.

The U.S. government has declared bitcoin is a commodity (i.e. property) rather than a currency. Other nations have banned bitcoin (presumably out of recognition that it is an alternative currency outside their control.)

Why does bitcoin have any value at all? There are two basic reasons:

- The supply is limited. The design of bitcoin limits the total number of bitcoins to 21 million. (If you really want to know why this is so, you’ll need to understand the blockchain and bitcoin mining, topics that are beyond the scope of this article.) At present, there are over 15.5 million bitcoins in circulation, roughly three-quarters of the eventual issuance of 21 million.

- There is demand for bitcoin precisely because it is outside the control of governments/central banks and cannot be devalued at will by governments/central banks.

Why Fiat Currencies Are Being Devalued

Why are most governments/central banks trying to devalue/depreciate their fiat currencies? After all, devaluing the currency reduces the purchasing power of everyone who holds the currency, meaning that the currency buys fewer goods and services. This loss of purchasing power makes everyone who must use the currency poorer.

Why do governments/central banks pursue a policy that makes their citizens poorer?

There are two primary reasons why governments seek to devalue their currency:

- To make the nation’s exports cheaper, i.e. more competitive, in the belief that expanding exports will make the overall economy grow, despite the fact that devaluing the currency makes imports more expensive, hurting everyone who buys imports.

- To make it easier for debtors to service their loans. As our currency loses its value, we experience that loss of purchasing power as inflation: the prices of goods and services rises as the purchasing power of the currency declines. Governments/central banks presume that wages will rise along with the prices of goods and services. This rise in wages will make it easier for debtors to service their debts, i.e. make their monthly payments. In a system that depends on the expansion of debt to fuel consumption, making it easier to service existing debt is of critical importance: if debt becomes more difficult to service, debt expansion slows and so does consumption. As consumption slows, the economy slides into recession.

As their currency is devalued (by intention or by unintended consequences), the great problem for many people will be transferring their remaining financial wealth out of depreciating currencies into a more stable currency or into assets in a more stable nation.

The Role of Cryptocurrencies in Capital Preservation

This is where cryptocurrencies have a role that could increase as global currencies are devalued: if you can shift financial wealth out of a currency that is losing purchasing power into a cryptocurrency that is holding its own or even gaining in purchasing power, it would be irrational not to do so.

What advantage do cryptocurrencies have over other stores of value such as gold, silver or cash? All of these traditional stores of value have advantages—portability and universal recognition that they are money—but they cannot be transported across the globe quite as easily as digital currencies.

Though it is a topic of hot debate, many observers believe it is technically difficult to the point of impossibility to stop people from buying, selling and sending cryptocurrencies because currencies such as bitcoin live in a network that is scattered around the globe—a network that can be accessed by anyone with a web browser.

While local exchanges could be shut down by governments, and businesses could be prohibited from accepting cryptocurrencies, stopping people from logging onto servers sited elsewhere is a bigger challenge. (Many governments have outlawed cryptocurrencies, though their success rate in stopping their citizenry from owning/using cryptocurrencies is unknown.)

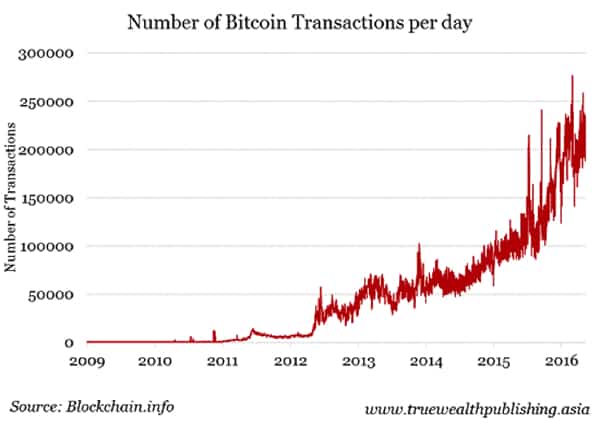

The rise in daily transactions in bitcoin suggests an expanding base of users globally.

In Part 2: Will Cryptocurrencies Soar As The Global Economy Falters? we explore the potential demand for cryptocurrencies as a means of transferring and preserving capital, and the potential impact of these capital flows on valuations of cryptocurrencies.

As governments actively devalue their currencies (thereby making everyone using the currency poorer), their citizenry with financial capital are forced to seek ways to move their at-risk wealth into other currencies or assets. And as the stability and valuations of cryptocurrencies increase, the potential for a self-reinforcing feedback loop increases: as the value of cryptocurrency rises, it attracts more capital, which pushes prices higher, and so on.

Are we in the infancy of a global stampede into cryptocurrencies?

Click here to read Part 2 of this report (free executive summary, enrollment required for full access)

This is a companion discussion topic for the original entry at https://peakprosperity.com/an-everymans-guide-to-understanding-cryptocurrencies/