During the prior economic cycle of 2003-2007, one question I asked again and again was: Is the US running on a business cycle or a credit cycle?

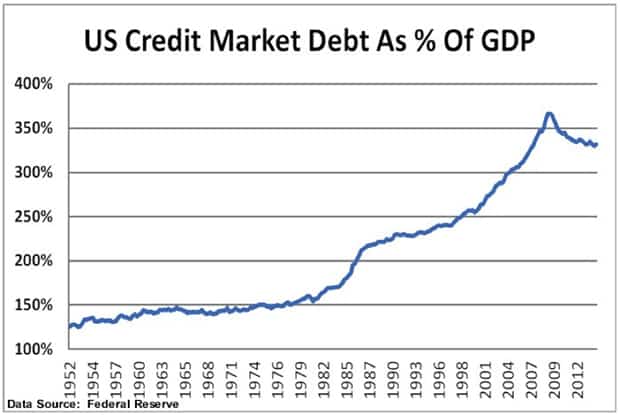

That question was prompted by a series of data I have tracked for decades; data that tells a very important story about the character of the US economy. Specifically, that data series is the relationship of total US Credit Market Debt relative to US GDP.

Let’s put this in simple English. What is total US Credit Market Debt? It's an approximation for total debt in the US economy at any point in time. It’s the sum total of US Government debt, corporate debt, household debt, state and local municipal debt, financial sector and non-corporate business debt outstanding. It's a good representation of the dollar amount of leverage in the economy.

GDP is simply the sum total of the goods and services we produce as a nation.

So the relationship I like to look at is how financial leverage in the economy changes over time relative to the growth of the actual economy itself. Doing so reveals an important long-term trend. From the official inception of this series in the early 1950’s until the early 1980’s, growth in this representation of systemic leverage in the US grew at a moderate pace point to point. But things blasted off in the early 1980’s as the baby boom generation came of age. I find two important demographic developments help explain this change.

First, there's an old saying on Wall Street: People don't repeat the mistakes of their parents. Instead, they repeat the mistakes of their grandparents. From the early 1950’s through the early 1980’s, the generation that lived through the Great Depression was largely alive and well, and able to “tell” their stories. A generation was taught during the Depression that excessive personal debt can ruin household financial outcomes. Debt relative to GDP in the US flat-lined from 1964 through 1980. As our GDP grew, our leverage grew in commensurate fashion. We were living much closer to our means compared with what happened afterwards.

In contrast, from the early 1980’s onward, we witnessed an intergenerational change in attitudes toward leverage. Grandparents that lived through the Depression were no longer around to recite personal stories. The Baby Boom generation moved to the suburbs, bought larger houses, sent the kids to private schools, financed college educations with home equity lines of credit, and carried personal credit balances that would have been considered nightmarish to their grandparents. What was the multi-decade accelerant that sparked this trend of ever-increasing systemic leverage relative to GDP? Continuously lower interest rates for thirty five years -- falling to a level no one ever believed imaginable, grandparents or otherwise. Which is where we find ourselves today:

My underlying point: Increasing leverage has been responsible for total US economic growth for over 30 years.

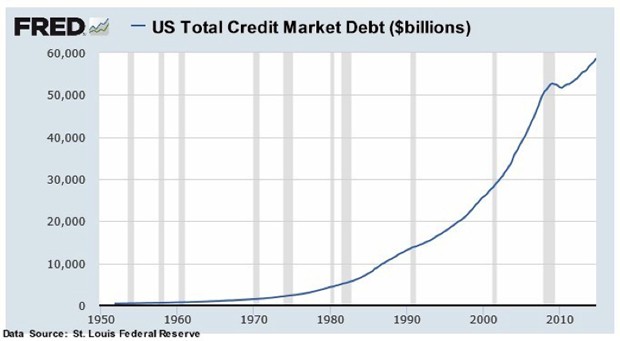

And don’t let the slight decline in the last years of this series fool you. While the ratio of US total debt relative to GDP has fallen since the peak of 2008, in absolute Dollar terms, US total credit market debt has actually increased from $50 to near $60 trillion over this time. The numbers have just become so big that a $10 trillion increase over 7 years is now actually a 'taper'(!):

A lot of the taper came in the form of defaults on mortgages and corporate debt seen in the wake of the 2008 crisis. But, US Federal debt has grown from $8 trillion to close to $18.5 trillion since January 1, 2009, very much offsetting the deflationary pressures of such private sector debt defaults. Back to my main point: credit expansion has been a key support -- indeed, the most important one -- to the real US economy.

Why shout about this now? Two important, timely reasons.

First, we know the US Fed will need to raise interest rates. The bottom line is the Fed will be perceptually powerless if we enter the next recession with the Fed still at the zero bound. We’re now six years into this economic 'recovery' and yet interest rates just marked their seventh year at 0%. Hard to believe, but it has actually been 11 years since the Fed last raised rates. Although Wall Street is obsessing over when the Fed will start hiking them, I’d suggest the much more pertinent question is: Has the Fed waited too long? The answers to both of these questions lays ahead, but when we're talking about the Fed raising interest rates, we're talking about the repricing of credit inside the US financial system. If you believe, as I do, that credit is indeed the one big horse that has powered our economic growth over the last three decades, then anything that acts to reprice that cost of credit -- repricing in a manner that will handicap continued credit expansion -- will have direct and immediate repercussions on our economy.

Second, the current trend in a critical but oft-overlooked indicator of US credit conditions is flashing a yellow light.

In Part 2: The Central Banks Are Losing Control Of The System we analyze the cautionary alarm the data in the NACM Credit Managers Index is sounding, and note the increasing evidence that the central bankers are becoming increasingly panicked about losing control of the bond markets.

The stock market is a sideshow. It’s the credit markets where we see the most extreme bubble. It’s the credit markets that have danced most vigorously to the pied piper Central Banker music of the last six years, which is why we are watching them closely. When confidence in the Central Bankers finally cracks, I believe this is exactly where we'll see it first. And it’s this loss of confidence that will mark the decisive turn in the cycle for credit.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access)

This is a companion discussion topic for the original entry at https://peakprosperity.com/as-goes-the-credit-market-so-goes-the-world/