In Crash Course Chapter 14 - Assets and Demographics I make these statements:

The boomers are the wealthiest generation ever, they hold nearly all of the assets, and they will need to dispose of those assets to fund their retirements.

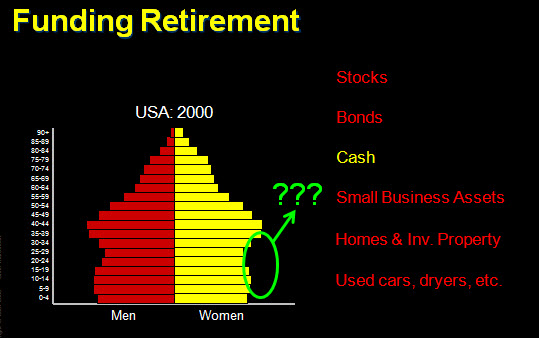

In order to fund their retirement dreams, boomers are going to have to sell off their assets. Who exactly are the boomers planning on selling their assets to? Even if [the smaller following] generation somehow could afford to buy all these assets, there simply aren’t enough people in this generation to buy them.

Figure 1

Figure 1: the Yellow and Red bars represent the US population broken out into age bands of five year increments for women and men, respectively. The green circle draws attention to a “hole” that exists in the population demographics with the Boomers represented as the “bulge” just a little higher up the chart from the hole. In red and yellow text to the right we see the six main sources of wealth for boomers (not ranked). Of the six, the five in red have to be sold in order to extract the wealth contained within them.

Now, within a single decade, both stocks and then homes have failed boomers as investment vehicles. Prior to these setbacks, boomers had only known a world dominated by constant inflation and a future that was always larger. The retirement dreams of an entire generation were built upon these two conditions remaining true.

But now we have ample evidence that there was some sort of a flaw in these plans. As I wrote recently, much of this inflation and growth was an illusion based on an unsustainable expansion of debt that was destined to stop. Why? Because it’s not possible to consume beyond your means forever. Sooner or later the bills must be paid.

At this point I am wondering if widespread retirement was a two-generation long experiment, a happy artifact of an oil-driven bonanza of growth that will not soon be replicated. Retirement was a foreign concept prior to 1930 and may well prove to become an exotic destination in the future.

The next illusion to pop, if it hasn’t already for many, is the notion that a substantially larger pool of boomers can sell their assets to a significantly smaller group of younger folks for anything close to their full asking price.

Remember, markets have a very simple rule:

Well, if boomers outnumber the generation behind them, then it stands to reason that, sooner or later, there will be more sellers than buyers.

So while I think it’s reasonable to discount the value of any potential future Social Security payments downward, I also think the total value of boomer assets have to be discounted as well.

And this brings us to the most likely source of future value: community.

If our monetary assets stand a chance of failing us, then it’s time for us to plan on obtaining what we need and want by other methods.

In this, there’s a bright silver lining, because lives filled with deeper connections and personal interdependencies can be just what the doctor ordered.

This is a companion discussion topic for the original entry at https://peakprosperity.com/baby-boomers-financial-illusion-2/