Originally published at: https://peakprosperity.com/betting-on-an-uncertain-market/

Executive Summary

Chris Martenson and Paul Kiker discuss the potential impacts of the upcoming election on financial markets, the BRICS movement, and the current state of gold and silver prices. They explore the complexities of the current economic environment, including rising US Treasury yields, the role of central banks, and the potential for a recession. The conversation also touches on the challenges of interpreting market signals amidst political and economic uncertainty.

Election Concerns

Paul shares that many clients have expressed concerns about the election’s outcome and its impact on their investments. He emphasizes the importance of staying informed and making decisions based on unfolding information.

Market Uncertainty

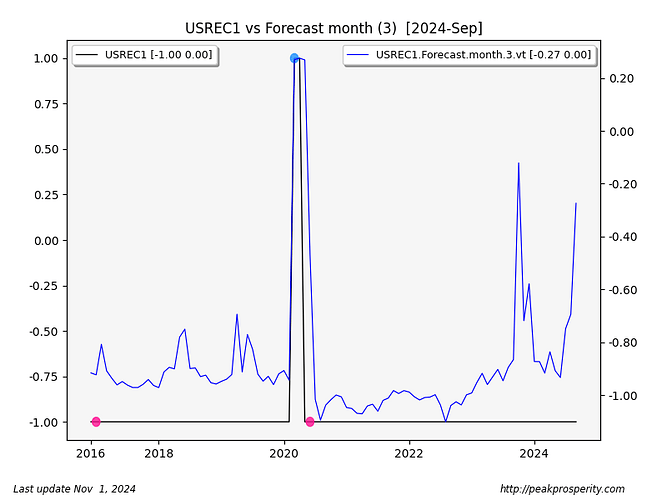

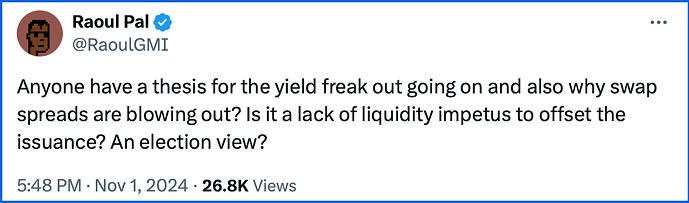

Chris and Paul discuss the difficulty of interpreting market signals due to factors like dark pools and central bank activities. They note the unusual behavior of markets, with rising yields and gold prices, and the potential implications of these trends.

Oil and Economic Signals

Paul highlights the decline in oil prices and diesel consumption as indicators of potential recessionary conditions, despite market optimism. He draws parallels to past economic downturns and questions the reliability of current data.

Key Data

- Gold is currently at $2,800 an ounce.

- US Treasury yields have risen despite a recent rate cut.

- 95% of Russia’s external trade is now in national currencies.

Predictions

- There is a potential for a recession, as indicated by declining oil prices and diesel consumption.

- The US bond market may experience significant moves due to rising national debt.

- Commodities may become a valuable asset in the future.

Implication

- Investors may face increased risk due to market volatility and political uncertainty.

- The de-dollarization efforts by BRICS countries could impact the global financial system.

Recommendations

- Consider shortening the maturity of investments to mitigate risk.

- Be cautious about tying money up in long-term treasuries due to inflation risks.