Originally published at: Biden’s Massive Cap Gains Tax Hike, The Yen, And Investing – Peak Prosperity

Will this be the year that the “”markets”” get away from the Fed and their dedicated public-private Wall Street manipulation crew? If that happens, will that be the pressure that finally pulls the Great Taking trigger?

Listen, if you found yourself alarmed at any point by the 99.95% survival rate of Covid, you are positively going to be impacted far more significantly – directly or indirectly- by the economic turmoil that our weak leaders have all but ensured is on the way.

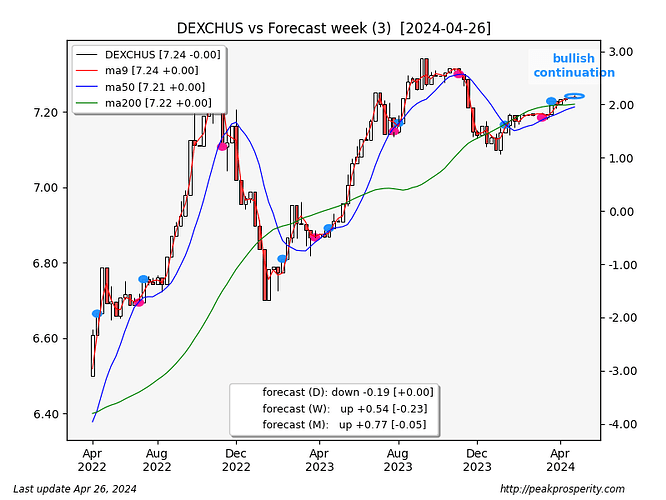

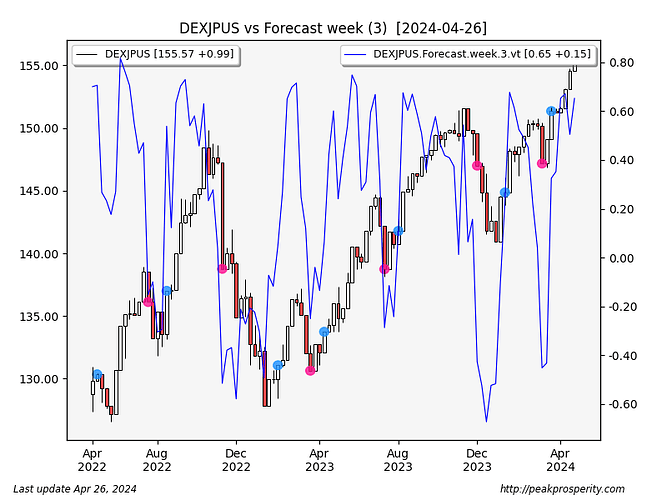

Paul Kiker and I discuss the Japanese yen, the (seemingly) insane proposal by Team Biden to jack up capital gains tax rates from 24% to 44.6%(!!), and the possible impact of the newly and unilaterally declared ‘climate crisis’ on markets and portfolios.

If these and many other terrible policies come to pass, the market impacts could be enormous as people rush to sell their holdings before the new gains rates kick in and/or the new burden of ridiculously expensive electricity begins to bite (as it has in Germany, decimating its industrial base).

Weak men lead to hard times. We’d do better with a package of mop handles running the show, and that’s not hyperbole.

Peak Prosperity endorses and promotes Kiker Wealth Management’s financial services. To arrange a completely free, no-obligation discussion of your personal financial circumstances and goals with someone who speaks your language and thoroughly shares your outlook on the world, please click this link to go to Peak Financial Investing to begin the process.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOT PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.