https://www.imf.org/en/News/Articles/2020/10/15/sp101520-a-new-bretton-woods-moment

Quantum computers breaking the encryption is a potential major disruption if done suddenly without warning, but like Antonopoulos says, they only get one shot. We would either checkpoint and revert with a quantum-resistant algorithm (similar to the 2010 bug when billions of BTC were created and the chain was successfully reverted within a day), or in the worst-case scenario we would transfer to already quantum-resistant cryptos, causing BTC price to plummet and potentially die… but that would only be the end of BTC, or the first version/period of it, not of crypto itself.

With Internet cuts we still have satellite and radio transaction broadcast… or you can simply not use crypto during such times (other assets like PMs, fiat, and barter would likely be more appropriate).

If prolonged Internet partitioning/sharding occurs, as I wrote in the post BTC threats: quantum computing, partitioning, we’d likely end up with parallel chains (forks) like, say, Western BTC (BTCW) and Chinese BTC (BTCC), which can operate in parallel as with BCH and eventually merge back.

In a carefully planned attack scenario by either of (or a combination of) NSA, CCP, SSP, or Google, these two attack vectors could be combined, but even then I don’t think they’d be able to do long-term damage. I’d say fiat and PMs have even greater potential downsides.

Pretty sure you did an article with step by step instructions on how to open an account, purchase BTC, and move it to a hard wallet. Could you repost that please?

Hi Sand puppy,

If you want to dive in yourself I recommend checking out this link: https://bitcoin-intro.com/

If I were to guess at the demographics of this website I would guess that a lot of people might want more individualized help with their bitcoin journey. There are a number of trusted companies that can help you buy and secure your bitcoin using “collaborative custody” i.e. only you can control your bitcoin, they cant touch it, but they can help you if screw up. A lot of the most experienced bitcoin users still opt for services like this instead of doing it all themselves. Here are the top 3 to check out:

https://unchained-capital.com/

https://river.com/

https://keys.casa/

I recommend giving each of them a call, I think all of them give you a free first time consultation to go over your individual situation. And whichever way you choose, I encourage you to start ASAP! The bull run could accelerate at any moment :).

In US:

https://www.investopedia.com/tech/how-to-buy-bitcoin/

In Chinese: 比特幣購買

https://to-coin.com/buy-bitcoin/

tbd wrote: "worst-case scenario we would transfer to already quantum-resistant cryptos, causing BTC price to plummet and potentially die... but that would only be the end of BTC..."That's exactly my point. There is nothing inherent in Bitcoin that guarantees it will be around and valuable in 20 years. There might be a high likelihood, but no guarantee. The Bitcoin firebrand preachers make it sound like it's a sure bet. It's not. Some forms of cryptocurrency will be around, and some forms of public distributed ledgers will exist and have widespread use, but it might not be BTC and blockchain.

^You’re wrong. Bitcoin has already won. It doesn’t matter what you think. “Oh you’re so toxic this is why people don’t like bitcoin”. No. I’m literally just trying to help you. Think of it like tough love.

And obviously nothing is “guaranteed” as in 100% mathematical certainty so I am assuming you didn’t intend to use that meaningless technical definition of the word here.

…it’s at least as true that it very well might be. The question is: is the possibility that it might not be around reason to not invest in case it might be?

Your bank account might not be around in 20 years. There’s a very good chance your “blue chip” company might not be around in 10 years, given that at least a third are zombie corporations. Are those reasons to stop saving money or holding investments?

There’s an equally good chance that the USD won’t be around in 20 years, given the high debt overhang, the move of the world away from dollar dominance, and the potential threat BTC poses as a verifiable hard money. Add in that USD is going to go digital itself, which will actually weaken it and allow power mongers to use it as a cudgel against misbehaving citizens in the US and across the world. Should we all abandon USD today because it might be toxic or gone in 20 years?

Quantum computing might make all of this discussion moot. Shall we abandon all computer-based tech because of what might happen one day?

There’s just no point to this kind of argument. It’s selectively engaged, which means it’s merely rhetorical: a quest for a rationale to reject something that is personally uncomfortable for some other, unnamed (perhaps unrecognized) reason. It seeks to dismiss without serious engagement and examination.

At this point, and looking forward, it is my personal estimation (for whatever that’s worth to anyone else, which ain’t much) from taking a long, deep dive into cryptocurrencies (and from keeping up to date on developments technical and social), that BTC is the cryptocurrency with a proven use case and future. I believe it will steadily bring sovereign currencies into more disciplined behavior by providing an alternative, more secure and less volatile store of value across time, that is untouchable by any person or agency that wants to take or strangle a person’s access to her own wealth. And those sovereign currencies that won’t learn to behave better will go by the wayside as citizens freely opt for the better money.

I don’t think BTC can be stopped. And every time someone else adds BTC to their own portfolio the network gets stronger and the opportunity to stop BTC shrinks. When medium-sized and large corporations start parking money in it, the writing on the wall gets underscored in deep, dark lines. Those who pay the re-election bills of politicians will not allow those politicians to cause them to lose their BTC-held funds. And the more politicians and the Fed water down USD or other sovereign currencies, the more corporations and high net worth individuals opt to put some portion of their wealth in the more stable option: BTC. It’s a virtuous cycle.

Because I don’t think BTC can be stopped, I think everyone should now have some exposure to BTC. (Even Fidelity Investments thinks up to 5% exposure in personal investment accounts is a good idea.[source]) Hey, maybe in 20 years that will have proven to be a mistake. But what if it isn’t? In that case, the 10x to 50x - perhaps even 100x - increase in value will have life-changing implications for the millions of people who dip one foot into this pool of water.

nouvelle, how old are you ?

Name one 1st generation invention that remained unchanged and was never replaced by a better 2nd, 3rd and fourth generation ?

Are you still riding in horse carriages, instead of cars ?

Are you still using big clunky cell phones, instead of smart phones ?

Are you still using a cable-connected landline phone ?

Are you still using MS-DOS ?

Are you still using a black & white TV ?

Are you still buying CDs ?

Are you still watching movies on VCRs ?

Are you still writing paper checks (obviously not) ?

Are you still using light bulbs with carbon filament ?

What’s more amazing is that literally, the one thing that remained “unimproved” over thousands of years is gold. Go figure.

I’m 33 years old. I don’t have time right now to write a long post, but remember bitcoin is a difficult subject and it’s important to think as clearly as you can. Simple analogies like you are offering only work on the surface. None of those products have network effects. They work the same whether you are the only one still using the outdated technology or not. Also, and this is EXTREMELY important: Cryptocurrencies do not actually compete on their technological attributes, they compete on their MONETARY attributes. In which case being boring, stable and batle tested is preferred.

As you say gold is the only thing that has lasted unimproved. I have respect for gold. But now bitcoin IS DISRUPTIVE TO GOLD. That’s how big of a deal this is. Bitcoin beats gold across all properties that make gold valuable: Durability, divisibility, portability, recognizability, and most importantly scarcity. Are you still going to use your old clunky gold like your black & white tv?

nouvelle, you might be too young to remember the dot com bubble.

We have heard the same arguments back then. “This time is different”. “Technology / network effects”. “Product / service xxx is going to change mankind forever”. While these things can be regarded as true in the broader sense (like internet), if you tried to monetize it (“betting on the right horse”), you lost a LOT of money.

I agree with your assessment that BTC / crypto competes on monetary attributes. But what this really means is that it’s all about faith (you call it “network” effect). The issue I have is that mere 10 years is not enough to judge if something can develop the same level of “faith” that gold has build for thousands of years. It’s just too early. That doesn’t mean it can’t happen.

You dismiss that technology progression is actually relevant (“They work the same whether you are the only one still using the outdated technology or not.”)

I assure you, it is. Technology progression (like quantum computing) is a threat to crypto. Heck, I can even see threats to gold - what if a planet / asteroid full of gold is discovered ? Or someone makes alchemy actually work. It could be just a matter of time.

Gold didn’t achieve universal “faith” in a handful of years. Even more, it would have never developed this status if technology had made it obsolete just a few years later. It’s not how this works. Look at other items that were money for dozens or hundreds of years, and had developed a lot of faith, but ultimately fell out of favor. They got usurped. It’s rather presumptuous to think nothing could ever happen to BTC.

I think that technology progression is a greater threat to crypto in the next 10-20 years than it is to gold.

Another important thing you seem to be missing wrt technology network effects: When you have e.g. a Myspace account you can also open a Facebook account and choose the better technology. When you hold a dollar in Bitcoin, that is a dollar you cannot hold in another cryptocurrency at the same time. This creates a massive competitive moat.

Lol stonks, you’re right I was too young for that when it was happening. But please do think deeply about this- How long did the dot com bubble last? How crazy did the prices get? Now consider that the Bitcoin “Bubble” has lasted 11 years so far and it is the BEST PERFORMING ASSET OF ALL TIME. How many years of it being the best performing asset do you need to witness until you capitulate? Consider that if you do not agree with the free market, it is more likely that you are wrong than the market is wrong.

Everyone is defensive at first. I’m not trying to attack you or disrespect you in any way. Most of the world still thinks the same way you do, which is why we are still sooo early. And there is so much glory to be had for early adopters! Imagine being able to buy shares in the internet itself in 1980 or whenever.

Maybe just buy some bitcoin to start. Where your money goes your mind will follow…

When you hold a dollar in Bitcoin, that is a dollar you cannot hold in another cryptocurrency at the same time. This creates a massive competitive moat.I fail to see how this cements the status of bitcoin. You can easily transfer between BTC and and myriads of alt/shitcoins, it's fast and cheap. I think you just made an argument against BTC, rather than for.

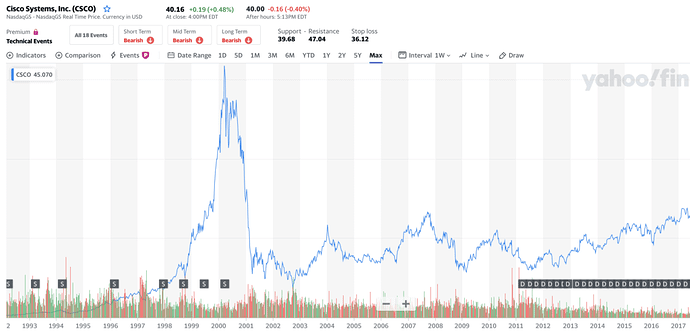

How long did the dot com bubble last? How crazy did the prices get?Very crazy. Started in the mid 90s, and peaked in 2000, and deflated until 2002. Check out a chart for Cisco, going from a few cents early 90ies to $80 in 200. Then it dropped by over 80%, and chopped sideways for almost 20 years. Chart looks a lot like Bitcoin :-)

It sucks when you donate some time trying to help someone on the internet and they just turn out to be a stubborn idiot.

If you are willing to make a bet vs me on bitcoin’s success over the next few years I’m all for it. We can lock up some btc in a multi sig vault, great for situations like this. But I already know that you won’t put your money where you mouth is so not sure why I wasted my time with this post.

None of you scared bitcoin bears will actually put your money where your mouth is. It’s rather telling tbh. I’m willing to go allin on my belief. Come get it, let’s get some real answers here.

Oh, your next best argument: name calling.

I guess you’re also too young to know that this is the surest sign of someone losing an argument on the internet. We’re done.

I’m not trying to win an argument lol. I’m literally trying to help you out. The price of bitcoin will settle this argument in due time.

The surest sign that someone is wrong is that they are all talk but won’t put any skin in the game.

When you know you know.

nhuvelle said,

Bitcoin beats gold across all properties that make gold valuable: Durability, divisibility, portability, recognizability, and most importantly scarcity.I would ask that you substantiate your argument regarding scarcity. I will argue alongside you that Bitcoin has the quality of scarcity integrity... it can't be, "printed" and there will never be more than ~ 21 million in existence. But to just say, "scarcity"... I'm not sure what that means, since Bitcoin is in fact so highly divisible. As you well know, Bitcoin is designed such that a person can own a unit as small as 0.00000001 BTC. Gold is that way too, only more so.. while the idea of owning only a few atoms of Au is absurd, you get the idea.. both are highly divisible, which is a good quality for money to have. Yes, the value of all the Gold in the world today is approximately $10 Trillion, as compared to Bitcoin's $220B, but does that signify scarcity? My opinion is that this difference in total market cap. just speaks to Gold's maturity as a high scarcity integrity money-like asset. Maybe Bitcoin will catch up.. maybe not. How scarce is Gold? I did the calculation years ago and published it here on PP.com (or maybe it was Chrismartenson.com then : ) and I found that if you divided all known Gold evenly across the entire world population, each person would have about 0.9 ounces. I thought this was an interesting metric that spoke to the relative scarcity of Gold as an asset. What is all fiat lost it's value and Gold was the remaining money.. what would an ounce be "worth" in that scenario? Given the divisibility of Bitcoin, there are actually quite a lot of units, or Satoshi's out there, so maybe in a sense Bitcoin is less scarce than Gold. What is the smallest useful unit of Gold that you won't lose in your pocket lint? 1/50th of an ounce? See, I could make the argument that Gold is more scarce than Bitcoin.. but I won't.. because it becomes kind of absurd. Just as absurd as saying with confidence that Bitcoin is more scarce than Gold....... Anyway, I appreciate your comments nhuvelle.. keep toning down the arrogance and toning up your critical thinking and rationale and we will be having some interesting discussion for sure. Best regards, Jim

Paul Tudor Jones this morning on CNBC with another ringing endorsement. The line about how bitcoin has intellectual capital behind it ![]()

https://twitter.com/SwanBitcoin/status/1319289594345443329?s=20

“We’re in the first inning of bitcoin” mmmmm