Many people asked me publicly and privately to respond to Doomberg’s recent piece entitled “The Peak Cheap Oil Myth.”

I respect Doomberg a lot, and I always welcome a good challenge to sharpen my thinking, and it was time to revisit the US shale oil miracle anyway, so this was a win-win-win opportunity.

If you are thinking, “I don’t really care about oil, or oil data” let me gently suggest that you should. Whether you care about oil abundance, or not, its presence or absence will affect your entire economic life more than anything else

Not just at the gas pumps, of course, but because oil is integral to every single thing that is manufactured elsewhere and shipped to you, every calorie of food that lands on your plate, and to the rate of inflation you experience.

With an abundance of high-quality (and high net energy) oil everything is possible, including making and recovering from colossal mistakes.

With a deficit of oil, everything gets harder and harder, and more and more expensive. Mistakes are expensive and sometimes irreversible.

So, when Doomberg put out a thesis that said not only will oil output grow seamlessly by 2% per year for the next 50 years, but it will get cheaper along the way, I had to respond.

In part I you will get my major thesis which is “as goes US shale, so goes the world’s oil abundance” and then put forth the data that strongly suggests that the US is pretty much at its peak of cheap oil and oil itself.

Remember, if the data changes, I’ll change. But this is the data I have.

More importantly, the entire world is facing a significant and ever-widening shortfall of oil supplies between here and 2030 according to JP Morgan’s commodities desk. Yet China and India are importing more and more. This is a recipe for vastly higher oil prices, and those would be quite bad for a world saddled with too much debt.

Bottom line: I am normally quite impressed with the depth of research and experience Doomberg brings to the game, but in this case I was unimpressed with the lack of data presented to bolster his thesis. So I think there’s not enough meat on Doomberg’s thesis yet to give it high marks. It basically boils down to, “The future is going to look exactly like the past - more oil at cheaper prices because people are inventive.”

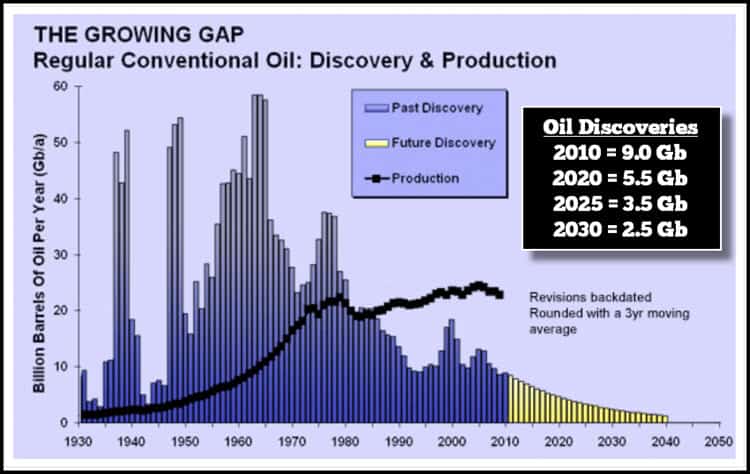

To which I must respond, but in which basins, and which fields, and in which countries specifically? Where will all this magical technology be applied? After all, you have to find it before you can produce it, and the world has been running an enormous discovery- vs. production deficit since the mid-1980’s(!)

(Hat tip SRSRocco for reposting the above graphic to Twitter recently)

While I cannot discount human ingenuity, I can interpret oil data and right now that says, “the days of heady oil growth in the US are over.” Maybe forever due to geology (we’ll have to wait and see), but certainly oil output cannot appreciably grow at these too-low prices (currently ~$72/bbl for WTIC oil).

What could possibly get more oil to come out of the ground (for a while) in the US?

Higher prices. In other words, oil that’s not as cheap.

As always I heartily welcome any and all challenges, alternative data sets, and different interpretations, especially from people with actual industry, on-the-ground experience.

This is a companion discussion topic for the original entry at https://peakprosperity.com/brace-yourself-us-oil-output-on-the-verge-of-decline-heres-why/