Originally published at: https://peakprosperity.com/breaking-the-frame/

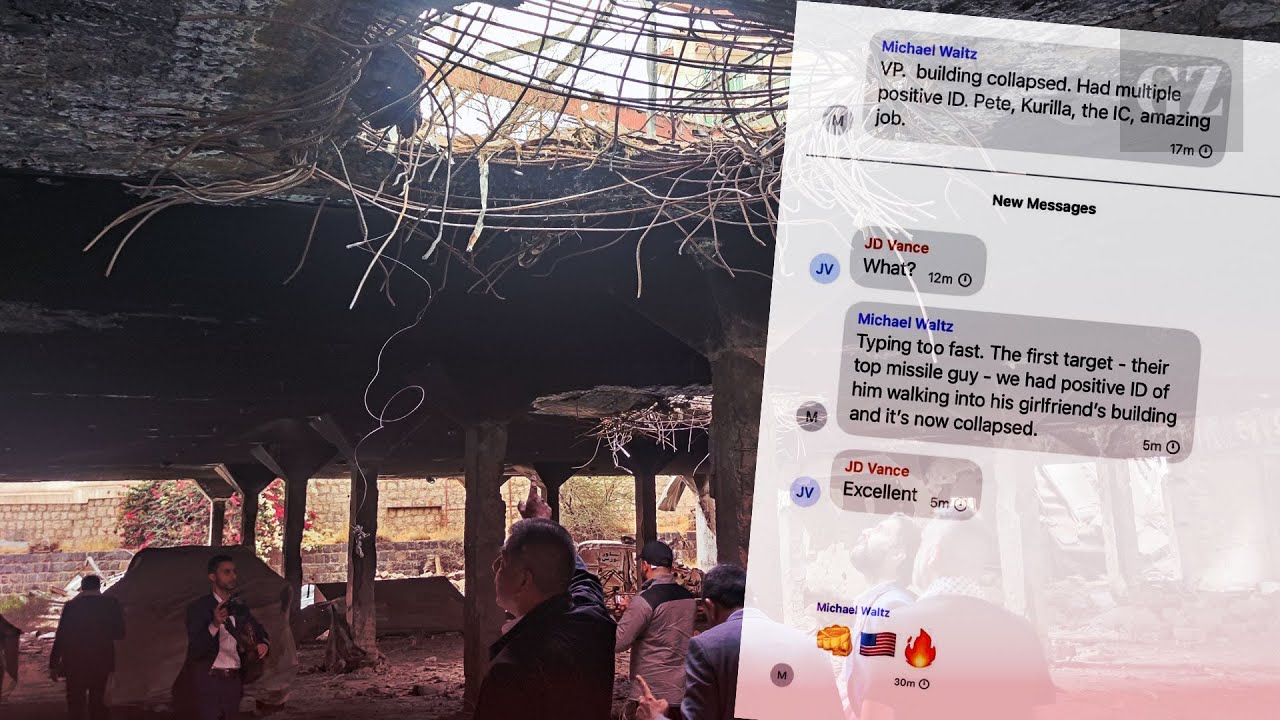

The winners of the future are going to be those who can still concentrate, and have the patience to learn and absorb actual context in depth. The losers are going to be the people blindly reacting, lacking any and all content, like these people

I saw that a "Takedown Tesla" event was happening in Langford, BC today, so I drove 1.5 hours to get down there to check it out. Enjoy these 5 glorious minutes of boomer NPCs who don't even know why they believe the things they say. 🤣💀👍 pic.twitter.com/HysCSX1bMX

— Kat Kanada 🍁 (@KatKanada_TM) March 24, 2025

Covid was bad, but the economic damage that has been accumulated over the past 54 years is far worse. When the dam breaks on that more people are going to become destitute and even die from the effects than from Covid by an entire order of magnitude (at a minimum).

Break The Frame

During Covid, people who had jobs were separated into two categories, essential and non-essential workers. The “essential” workers were mainly the low-level service workers that would bring food to the doors of the “non-essential” workers, a.k.a. “the laptop class,” who were actually more important than the “essential workers” because they were afforded the luxury of staying home during what was described as a deadly pandemic.

Of course, it was no such thing, but still the message was received. “Essential” meant “expendable,” and “non-essential” meant “those who must be preserved.”

The list of non-essential office workers is quite extensive:

Generally speaking, these were people who, before Covid, commuted to office jobs. During Covid they got to work from home.

After Covid, companies had to resort to draconian tactics to try and force people back into the office:

What happened was that the old frame of “a job requires you to get in a car or on a train, commute, work all day in a downtown office, and then commute back home” got broken.

People suddenly discovered that they hated commuting, and often got more done at home anyway, and together, these offered a better lifestyle and satisfaction.

The frame of “work = commuting” got broken.

Once broken, it’s proving exceptionally difficult to unbreak.

This demonstrates that something that was just widely accepted gets reexamined; it can be impossible to put that genie back in the bottle.

Those holding this context knew to avoid commercial office space as an investment and to dodge the associated CMBS mortgage paper like it was on fire. Those without the context got hosed.

It’s a huge deal, still more-or-less papered over, but it’s going to bite hard in 2025 and beyond:

Those who have the right context know what the underlying issues are and the drivers. But it’s always more than numbers…it’s the psychology of it all. It’s the frame that people hold and operate within.

In this case, it’s understanding that people really just don’t like commuting. It’s a waste of time and life energy. Often it’s a miserable, traffic-jammed experience. The frame was “Oh, everybody has to do it, so I do too.” Covid suddenly revealed that’s not true.

That genie is not going back into the bottle.

The Bigger Frame That’s Breaking

Just as the vast bulk of people (myself among them during the time I was a commuting worker) never questioned or thought to challenge the idea of commuting to work in an office building, very few people question the core premises of investing.

Their frame is entirely contained by living in an air-tight dollar universe where the one and only rule is “dollars lose their value over time.”

We call that “inflation,” but it’s more accurately described as “the dollar losing value.”

I describe this in great detail in The Crash Course, but here’s a quick review. Suppose you have an orange, a house, and an ounce of gold, and those cost $1, $300,000, and $3,000 today. But in five years, you discover that those now cost $5, $1,200,000, and $15,000. With a dollar frame-of-reference, you might think you’d picked wisely and ‘gotten rich!’ You are now “worth” 5x as much as before, assuming your orange didn’t rot away.

But you really aren’t any richer than before. In fact, you are in exactly the same position as before because the orange still has exactly one orange’s worth of utility, the house still provides precisely one house’s worth of utility, and absolutely nothing happened to the gold ounce because gold’s atomic and molecular character is immutable.

Further, the relationship between each of those items is unchanged from a ratio standpoint. It takes exactly the same number of each of them to buy the others this year as in five years. What has changed is the number of dollars that it takes to buy each of them.

That is, it’s the measuring stick (the dollar) that is changing, not the thing being measured.

This might seem esoteric, but it’s not; it’s actually the true frame, and it’s been true for millennia.

As I pointed out in the original Crash Course (2008), in Roman times, it took the equivalent of a troy ounce of gold to buy a fine toga. Today, it takes about an ounce of gold to buy a really nice suit. The more things change, the more they stay the same.

You Must Invest!

So I haven’t quite gotten to the frame that needs breaking. Sure, it can be a mind-bender to discover that it’s your measuring stick that’s changing, not the things being measured.

But even that is less of a challenge than understanding the intense marketing you’ve undergone from Wall Street and the Mainstream Media (MSM) to “invest.”

The reason you have to invest, implied but almost never explicitly stated, is because inflation is going to erode your savings. Nobody has to say it because you know it. You know it from your lived life experience.

It’s just how things work. Like commuting to work. It’s just a fact of life.

But is it? Is the choice between losing the purchasing power of my money if I save it or placing it at risk to try and grow it faster than inflation?

The gold example above suggests that there’s a third option. You can simply put it in gold and it won’t make you rich, but it will keep pace with inflation.

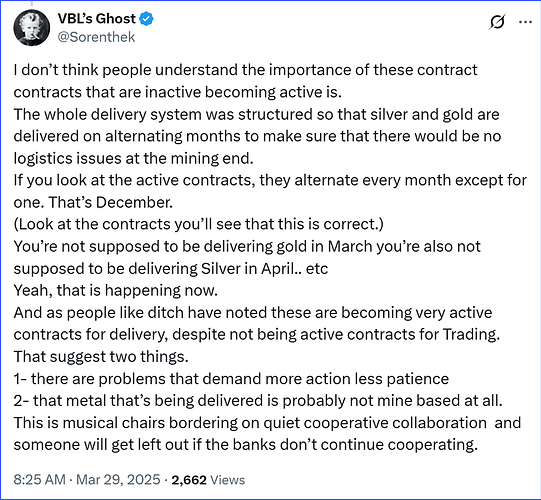

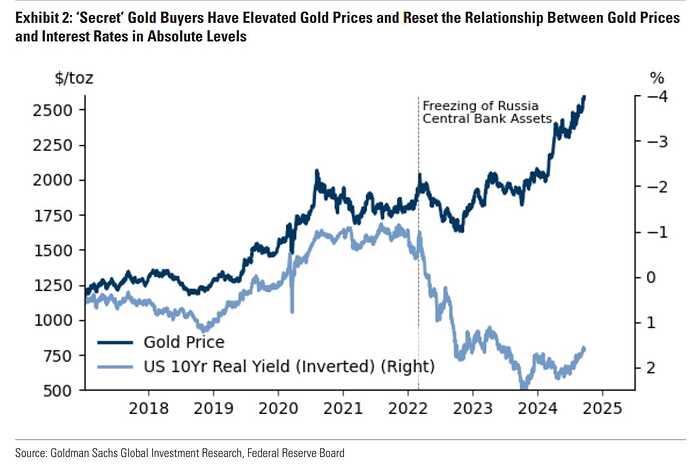

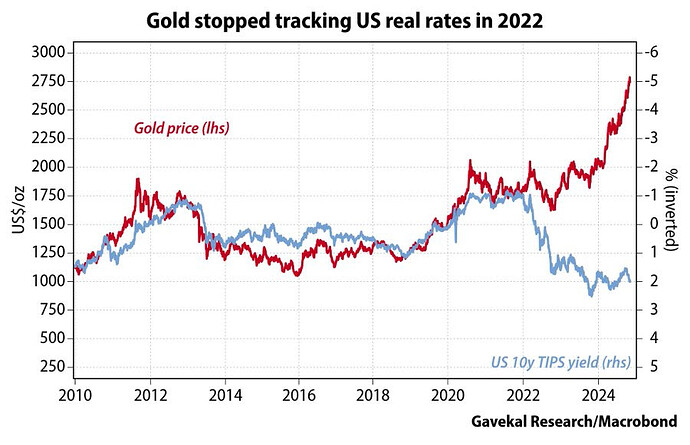

Surprising to many, perhaps, is the fact that this millennium gold was a far better investment than the US stock market:

My readers will also appreciate that gold did this without any of the raccoon-risks associated with Wall Street. In particular, physical gold held in your hot little hands had zero risk from being appropriated by those who installed and operate The Great Taking machinery, which is both a significant and underappreciated risk by most. Again, context is everything.

The story that we’ve all come to accept, usually without questioning or context, is that inflation is simply a fact of life, it’s just how things are, and we have to take risks in the stock market to offset that reality.

But I will stress that persistent inflation is both a modern invention and is a function of the intense mismanagement of our fiat money system by the Federal and Washington DC, with the enabling assistance of bankers and Wall Street.:

In the above chart, you can see that prior to WWII, sometimes prices went up and sometimes they went down. Until WW II, and then the system we all know and love (or hate) was put in place, and ever since prices have only ever gone up. Which is to say, the value of a dollar, our supposed national and international measuring stick, has gone down.

Putting that same data into a different chart where the price levels accumulate over time, we get this:

Between the country’s founding and the creation of the Federal Reserve, a dollar neither gained nor lost any value at all.

Sure, there were brief periods of government excess spending during various wars, but after they concluded, prices went back down.

That’s because we were on a silver standard with gold at a fixed reference to a silver dollar, which was 371.25 grains of silver, no more and no less.

The reason prices went back down after going up? Because a house, an orange, a suit of clothes, and an ounce of gold all still have the same relationship to each other after the war as before.

Before the Federal Reserve came along, you didn’t have to invest to avoid losing your savings. You simply worked, and whatever surplus income you had and you bought gold and silver and that was that.

If you wanted to invest and place your capital at risk, that was a separate decision to make, one that carried the usual relationship between return and risk. But nobody forced you to invest.

Today, you are all but forced, or given no alternative, as is the case for company-matched 410k plans that only have access to a limited universe of Wall Street-operated long-only stock and bond funds.

It’s just what everybody does, so I do it too.

Now that frame is breaking. More and more, I am hearing from people for whom these lightbulbs are now going off.

As with commuting, once that frame is broken, it’s ridiculously hard to return to the original frame. It’s the proverbial red-pill moment from which there’s no return.

There is nothing more important to your financial future than knowing where this ship is headed. And in order to know that, you have to understand how we got here.

In part II, for my subscribers, we’ll dive into my macro view of how and why the dollar system is going to have to be sacrificed by the Federal Reserve (in order to preserve the bond market) why the Fed is going to have to begin printing money again, this time more than ever before, and how this all inescapably leads to hard assets.

If you are not a subscriber, I wish you the best of luck and strongly encourage you to become as resilient as you can possibly.

Please join me for Part II (for subscribers) where we discuss all this and more.