Originally published at: https://peakprosperity.com/daily-digest/brics-prepare-for-change-and-conflict-dollar-crisis-coming/

Health

Switzerland has made its first compensation payout to a victim of a COVID-19 vaccine injury. The Swiss Federal Department of Home Affairs confirmed the payout of approximately $15,000 to an unnamed individual, based on an established causal link between the vaccine and the injury. This case is part of a broader context where 320 applications for compensation have been submitted, with 50 pending approval. This development occurs amid global scrutiny of vaccine side effects, with studies highlighting increased risks of conditions such as myocarditis and pericarditis following mRNA COVID-19 vaccinations.

Economy

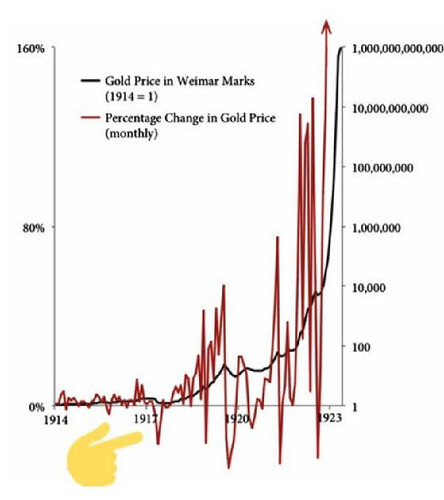

Mike Maloney has warned of a potential crisis reminiscent of the 2007-2008 financial downturn. Indicators such as bond yield inversions and the Su Rule suggest a possible recession, compounded by criticism of the Federal Reserve’s response to market trends. The U.S. national debt has reached $35.3 trillion, raising concerns over economic stability. Demographic shifts and negative national net savings further strain the economy, with credit card defaults and housing market issues adding to the distress. Internationally, financial markets, including China’s, are showing signs of strain, with BlackRock reportedly preparing for a potential Federal Reserve dollar crisis.

In labor news, U.S. port workers have concluded a three-day strike after securing a 62% wage increase over six years. The strike, involving 45,000 dockworkers, threatened economic disruption but was resolved following negotiations involving the White House. The agreement, which extends the previous contract until January 2025, raises questions about potential effects on other labor unions and wage inflation.

Geopolitics

The upcoming BRICS meeting in Kazan, Russia, may discuss the introduction of a new currency backed by gold and member currencies, potentially impacting global economic dynamics. The meeting occurs amid escalating tensions, with recent attacks on Russian infrastructure and the reported assassination of Hezbollah leader Hassan Nasrallah increasing the risk of broader conflicts. China’s recent economic stimulus measures highlight its strategic positioning in anticipation of potential global conflicts.

Relatedly, a Russian court has frozen nearly $1 billion in assets belonging to JP Morgan Chase and The Bank of New York Mellon. This action is part of a legal case related to the liquidation of the International Reserve Bank by Ukrainian authorities. The funds, held in restricted accounts, are part of a broader effort by Russia to counter Western sanctions and financial restrictions.

In defense technology, Palmer Luckey, founder of Anduril, has advocated for the development of autonomous weapons, citing their necessity for preserving freedom. Speaking at Pepperdine University, Luckey recounted his interactions with Ukrainian President Volodymyr Zelenskyy and highlighted Anduril’s role in supplying weapons to Ukraine. He also mentioned a potential IPO for Anduril, indicating the company’s strategic ambitions in the defense sector.

US Politics

As the 2024 U.S. election approaches, concerns about mail-in ballots and election integrity continue to be raised. Allegations of ballots being collected from ineligible addresses have prompted calls for improved technology and data analysis to ensure election integrity. Some critics suggest that the Republican Party’s current strategies are outdated, with new methods proposed to track voter registration patterns and identify potential illegal ballot mills.

In Lake Lure, North Carolina, a local fire chief’s decision to halt a private rescue operation during Hurricane Helene has sparked public debate. A pilot using his helicopter to rescue flood victims was reportedly threatened with arrest, raising questions about local leadership and bureaucratic procedures in crisis situations. The incident has drawn attention on social media, highlighting the tension between official protocols and individual actions in emergency response efforts.

Sources

Switzerland Awards First COVID Vaccine Injury Compensation Amid Rising Concerns

Switzerland is finally paying out its first victim of the experimental COVID-19 vaccines.

Source | Submitted by Walberga

30 Seconds to Midnight: Are We on the Brink of a Financial Crisis?

It’s 30 seconds to midnight. There is a freight train coming, and we are all strapped to the tracks.

Source | Submitted by AaronMcKeon

US Port Workers End Strike with 62% Wage Boost: A Lesson in Negotiation and Toilet Paper Returns

US Port Workers Agree To End Strike After Accepting 62% Wage Increase

Source | Submitted by AaronMcKeon

BRICS Summit in Kazan: A Potential Shift in Global Economic Power?

There’s a very important meeting that takes place in Kazan, Russia, on the 22nd of October. It is the summit meeting of BRICS, and at that meeting, it is thought that a series of very important decisions will be made—everything from exchange rates to investment to currencies.

Source | Submitted by rhollenb

Palmer Luckey Advocates for a ‘Warrior Class’ and Autonomous Weapons at Pepperdine Talk

“Societies have always needed a warrior class that is enthused and excited about enacting violence on others in pursuit of good aims,” he told Gash.

Source | Submitted by Shplad

Russian Court Freezes $1 Billion in Assets of JP Morgan and Bank of New York Mellon Amid Legal Dispute

The Moscow Region arbitration court on Wednesday ordered a freeze of funds belonging to two US banking majors, JP Morgan Chase and The Bank of New York Mellon.

Source | Submitted by Shplad

Election 2024: The Battle Over Ballot Mills and Voter Roll Anomalies in Swing States

Source | Submitted by andrewgorton

Election Integrity Concerns: The Battle Over Mail-In Ballots and Alleged Fraud in Swing States

Source | Submitted by andrewgorton

Lake Lure Fire Chief Faces Backlash for Threatening Arrest of Heroic Rescuers Amid Hurricane Helene Crisis

Why stop those saving lives in a crisis?

Source | Submitted by DieSonneScheint