Asset bubbles are brutal.

The most difficult time to remain centered and focused is during their last stages as everyone around you is going nuts. Logic has been tossed out the window, sentiment is manic, and every narrative – the stories we hear and use to make sense of our world – is thoroughly ungrounded.

After a decade of price deformation – such as UBER being valued by the ““markets”” at $45 to $50 billion despite having no viable path for ever making a profit – it seems that practically everyone has lost the ability to perform even basic math or reality checks.

For example, this week – for what must have been the 42nd time – the Trump administration has proclaimed a massive victory in the China Trade Deal.

The narrative being sold to us is that along with the immediate roll-back of tariffs (which is Trump caving, not ‘winning’), China will buy $50 billion of US agricultural products in 2020.

Huge excitement in the global equity markets has greeted this news. Stocks exploded higher and bonds have been sold off. Unleash the hounds of economic growth!!

All this based on the premise that China has (verbally) agreed to buy $50 billion of US agriculture products in 2020.

Now, about that…

What does $50 billion a year in Ag trade look like? Is it even possible?

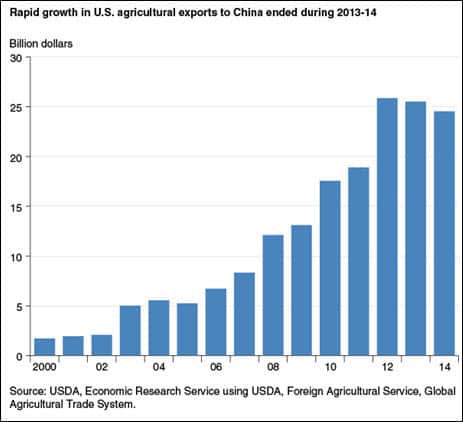

The all-time record of China buying Ag products happens to have been in 2012 when:

- Ag products cost a lot more on a unit basis (this was the food inflation which you may remember kicked off the Arab spring riots in 2011?) and

- China hadn’t yet formed solid trade relations with other Ag producers such as Brazil and Russia.

But now, suddenly China is going to double that amount? In a single year?

After securing and formalizing huge trade deals with Russia and Brazil? After being so dissed during the trade negotiations that China’s press and ministers openly criticize the arrogance and hostility of the US?

Yeah, that’s not very likely at all, is my assessment. China is not going to stiff its new trade partners just to make Trump happy.

More than that, it’s also unlikely that China could even find a way to spend that much on US products:

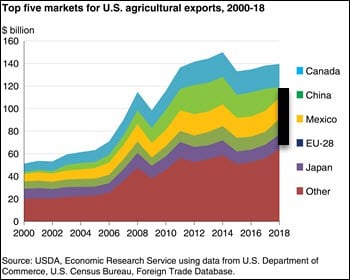

The entire US Ag export market was $140 billion in 2018. For China to suddenly become $50 billion of that would be rather disruptive to say the least.

The black bar I’ve drawn on the above graph represent $50 billion of goods. If China were to become that large of a consumer, it would displace the equivalent of 100% of its current consumption, plus that of Mexico, the EU and most of Japan.

Yeah, that’s just not going to happen.

This is just so completely brain-dead obvious that I’m surprised it went completely unnoticed by the entire US financial press.

Though I shouldn’t be, because the tail end of a massive bubble comes with a near-complete loss of the masses’ ability to think or reason.

Of course, we humans have been here many times before:

Today, the herd has gone mad. So much so that it can’t recognize the simple math that “$50 billion” in annual Ag purchases is simply not realistic.

I have a lot of compassion for just how difficult it is to keep one’s sense during a massive bubble, especially during the one we’re in now. Because today’s bubble isn’t just a product of the magnificently dumb one the Federal Reserve/ECB,/BOJ/et al., have been blowing since 2008.

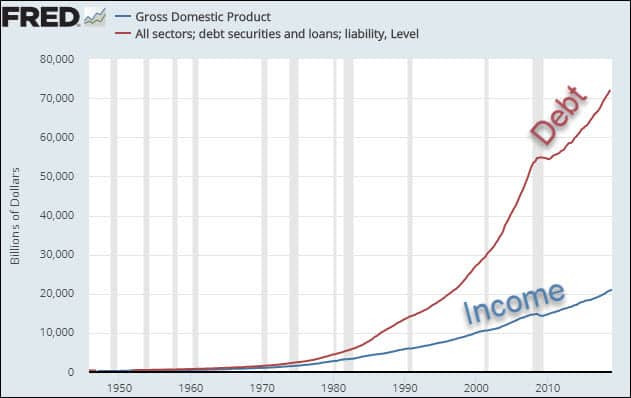

Rather, its origin starts back on August 15th, 1971 and it is rooted in a most ‘mad’ idea: that one can grow one’s debts faster than one’s income forever, Hey hosanna, Amen.

This is such a flawed concept that it annoys me to have to re-re-re-explain it to the shepherds overseeing the mad herd.

Expensively educated ‘professionals’ will very earnestly try to explain to me that this is both a stable and good system, when it’s clear the math doesn’t work.

The only way you could possibly defend the above chart, mathematically, is in a world without any limits. As long as exponential growth can continue unchecked – forever – then the debt trajectory of the above chart can be maintained.

But in the world we live in, like it or not, limits exist. And our debt is fast becoming a black hole whose inescapable event horizon approaches nearer all the time.

Yet at the political and institutional levels, “growth forever” is the only narrative. Even as it’s becoming increasingly clear that sustainable growth is proving more and more elusive. And the increasingly desperate efforts to pursue it are creating long-term damage to our future prospects (worsening unaffordability, wealth inequality, environmental destruction, geo-political pressures, etc.)

The effect of that? More and more people are losing trust in the system.

And in a faith-based system of money, as all fiat currencies today operate in, trust is the single most important commodity. Once it’s gone, it’s gone.

Conclusion

The trade deal is simply this week's inane excuse for why the ““markets”” have been blasting higher.The real reason has nothing to do with trade. Or with anything fundamental at all.

It’s all about central bank money printing.

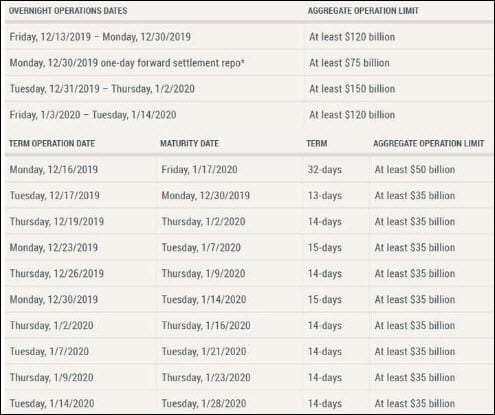

The Fed is now in full emergency mode. Its December money printing is truly a work of pure desperation. Hundreds and hundreds of billions poured into the system to prevent a crisis:

Though the Fed isn’t fessing up here. It’s not even yet admitting there’s a problem to be concerned about.

But its actions belie its desperation. And whatever’s going on behind the scenes is none of the truly ridiculous explanations they’ve offered so far.

It’s utterly, completely, totally ludicrous to suggest (as Powell did) that the banking system is suffering from a shortage of excess reserves. Puh-leeze!

At $1,388 billion, excess bank reserves are $1,358 billion more than they were before the Great Financial Crisis hit. $30 billion was enough a decade ago, but now 46x more than that is supposed to be insufficient??

So, that ain’t it.

Instead when banks won’t lend to each other overnight it’s because they don’t trust each other enough to do it.

That’s it. Full stop.

Which means the Fed know something we don’t. And it means Powell is a lying sack for suggesting otherwise.

And it means this whole thing could go 2008 nuclear at any time, and the system won’t be able to control the meltdown.

Which is why the Fed is fighting like crazy to prevent that sort of thing from ever getting started.

So here we find ourselves, at the twilight of the Everything Bubble, with asset prices at all-time highs and the mainstream narrative crooning that the future’s so bright we need darker sunglasses.

Yet paradoxically in parallel with that, a cursory peek behind the curtain and a little cocktail-napkin math show us that the entire financial, economic and monetary system is teetering on the brink. In the Fed’s latest half-$trillion liquidity dump, we can see how radically extreme the measures now need to be to keep things from falling apart.

Bottom line: This whole thing is going to blow up at some point. It will be a before-and-after story for the generations that follow, in the same way the Great Depression was.

You’ll either be emotionally, physically and financially ready for it or you’ll become collateral damage along with the rest of the herd.

In Part 2: Take Action Locally To These Global Threats, we make it clear that all is not lost; you likely have more agency to protect yourself than you realize – and to position wisely to prosper – from the unfolding collapse if you commit to taking smart action now.

I myself have ramped up my plans to an even greater extent that I had before the 2008 crisis. In Part 2 I share the big step I’ve just taken in my own life to prepare for what’s coming, and I encourage you to get busy following suit with your own preps.

Bubbles are brutal. As John Hussman wisely quips, they force us to decide to either “look like an idiot before the crash, or look like an idiot after it”.

Break from the herd, no matter how awkward it may feel, and secure your future. Don’t be one of the countless idiots who ignore the warnings.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access).

This is a companion discussion topic for the original entry at https://peakprosperity.com/bubbles-are-brutal/