Originally published at: https://peakprosperity.com/can-or-will-the-fed-paper-over-the-coming-recession/

In our latest Finance U podcast, Paul Kiker and I dove deep into the current economic landscape, focusing on some critical indicators and the implications of recent policy changes.

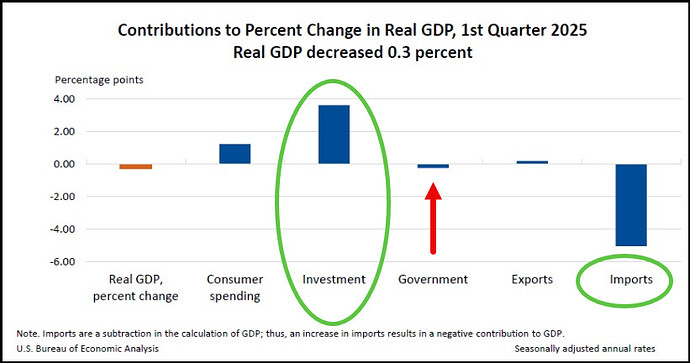

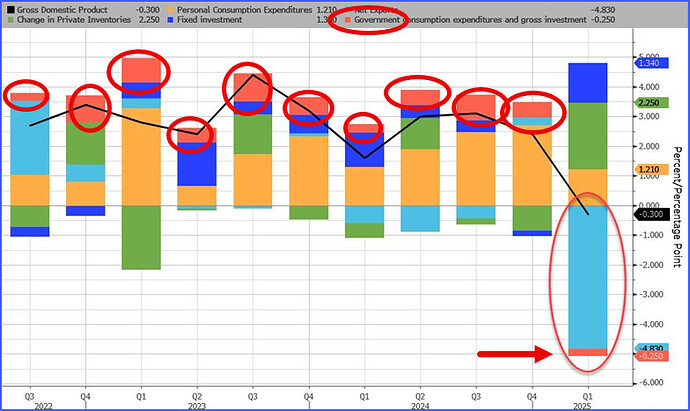

We started by discussing the surprising contraction in U.S. GDP, which was largely influenced by a surge in imports ahead of Trump’s tariffs. This led to a significant trade deficit, pulling down the GDP figures. However, we noted that this might not reflect true economic weakness but rather a distortion due to the tariffs.

We also touched on the labor market, where job openings have decreased, signaling a potential economic slowdown. This aligns with other indicators like reduced consumer spending in sectors like dining, which could be a precursor to broader economic challenges.

There’s been a notable increase in investment, which Trump might claim as a victory for his policies. However, the real concern lies in the sustainability of this growth amidst rising economic uncertainty and potential policy missteps.

We discussed the complexity of Trump’s trade policies, particularly how they might affect our trade deficit and the broader economic implications. There’s a lot of uncertainty about how these policies will play out, especially with the potential for a significant devaluation of the dollar, which could be part of a larger strategy to rebalance trade.

Paul and I also discussed the market’s psychological state. There’s a sense of complacency, with investors perhaps too hopeful that past interventions will continue to prop up the market. However, we’re cautious, noting that historical patterns suggest we might be in a phase where the market could be setting up for a significant correction.

Lastly, we touched on the broader implications of these economic shifts, including the need for more truthful economic reporting and the potential for a more sustainable economic model. The conversation was a mix of concern over immediate economic indicators and a broader discussion on long-term economic health and policy impacts.

Thanks for tuning in, and remember, these are complex times requiring careful analysis and prudent decision-making. Keep your eyes open, and we’ll keep you updated.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.