Originally published at: https://peakprosperity.com/caution-is-advised-as-retail-piles-in/

In today’s discussion with Paul Kiker from Kiker Wealth Management, we turned our attention to the “Kayfabe markets” – a term borrowed from professional wrestling where everyone knows it’s fake, but pretends it’s not to preserve the entertainment.

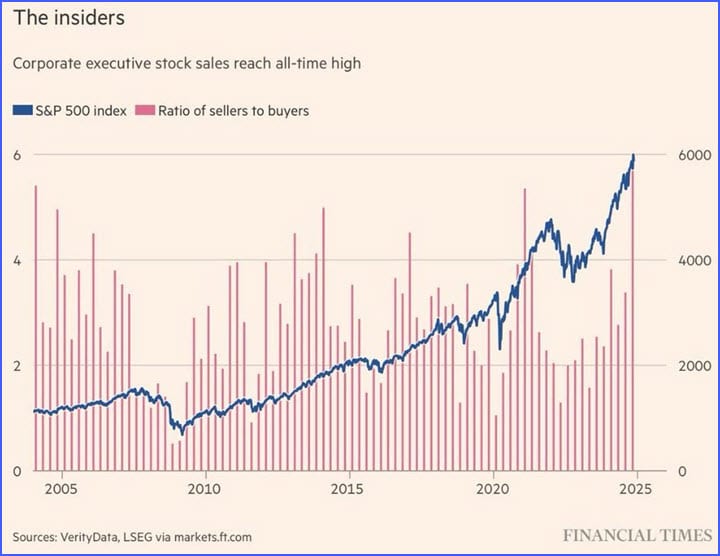

As the “”markets”” power higher, mostly driven by retail money flows, insiders are busy dumping shares at a record pace.

Make of that what you will. To me, that’s not a good sign, and I think that a Mother of All Rug Pulls awaits the average retail investor.

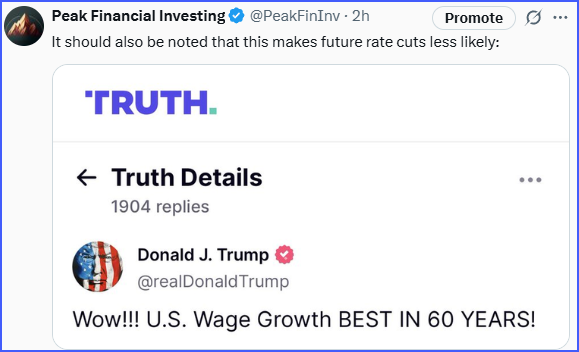

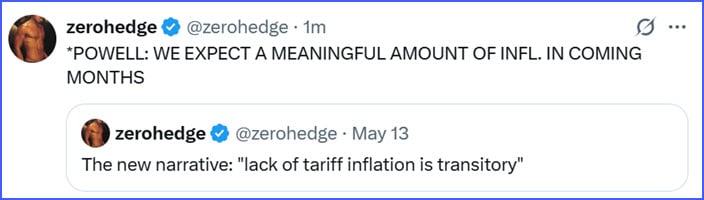

Of course, we had to discuss the Federal Reserve’s statements and the no-rate cut decision made on Wednesday this week. Fed Chairman Powell is in a bind, both wanting to cut rates but being unable to do so because of inflation (plus the stock “”markets”” already being near record highs).

As a note, rising prices aren’t always because of inflation, which is, to be precise, the condition where money falls in value because too much of it is printed and floating around. Prices that rise because of tariffs or product shortages do so because of the dynamic relationship between supply, demand, and prices. Those higher prices caused by supply-demand mismatches might be juiced by too-much-money, but they have their own reasons for happening that are independent from excessive money supplies.

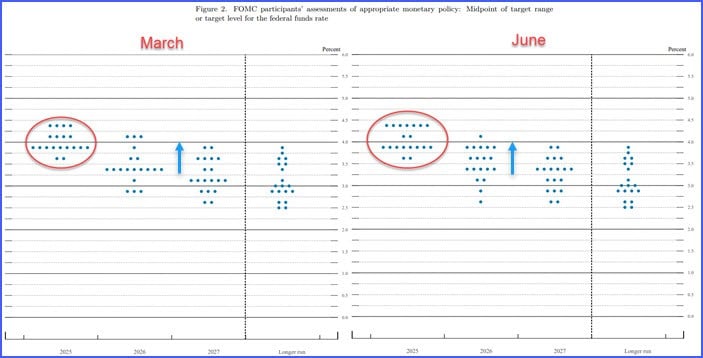

This now creates a confusing scenario for investors expecting rate cuts, as inflation and rate cuts typically don’t go hand in hand. The Fed decided to keep rates unchanged, with the dot plot for the next two rate decisions actually turning a bit more hawkish:

More ‘dots’ (each dot is a FOMC vote) moving upwards = expectations for slightly higher, not lower, rates.

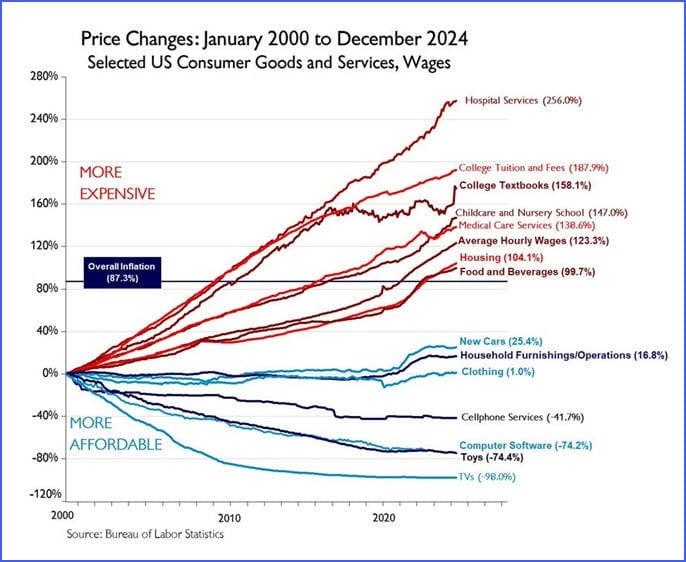

We delved into the real impact of inflation, particularly how it affects essential goods and services like healthcare, food, energy, education, and housing, which have seen significant price increases. These are things that people need. All of those have risen strongly in the official CPI count…offset by the things people want, such as toys and TVs.

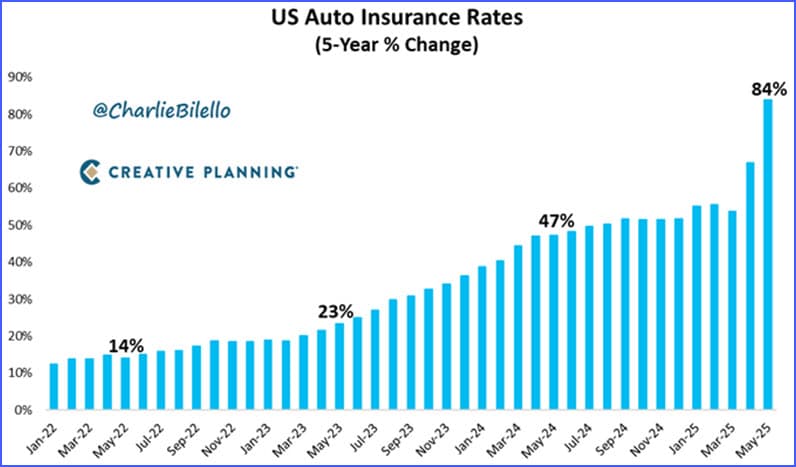

Paul and I also touched on the insurance sector, where premiums are absolutely skyrocketing without any good explanation as to why, possibly due to insurers’ losses in other investments like commercial real estate. This could be a hidden bailout mechanism, where costs are passed onto consumers without much appraent regulatory scrutiny.

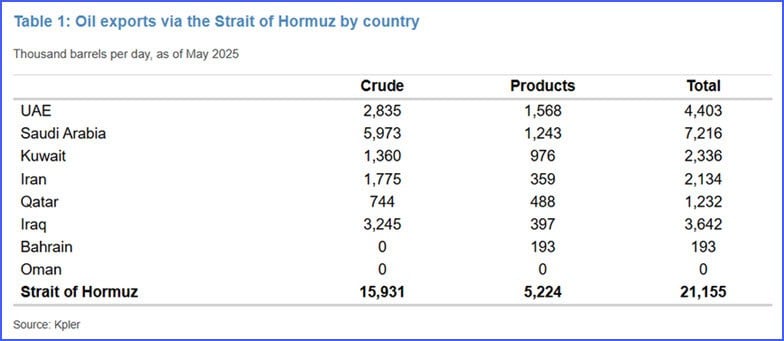

We discussed the potential closure of the Strait of Hormuz, which could disrupt a significant portion of global oil supply, leading to catastrophic economic impacts. This scenario, coupled with the U.S.’s strategic petroleum reserve being at low levels, paints a worrying picture for energy security. If the Strait of Hormuz gets closed for any length of time the you should prepare for oil in the undreds of dolalrs per barrel because some 20% of the world’s daily oil consumption flows through it, representing ~40% of all the exported oil in the world (which is what drives prices the most).

Lastly, we talked about the importance of being prepared for economic downturns. Paul emphasized the need for resilience, suggesting that now might be the time to secure your financial position rather than chasing returns. The path to economic stability is narrow, and the prudent should foresee danger and prepare accordingly.

For those interested in managing these risks or seeking financial advice, Paul’s team at peakfinancialinvesting.com is ready to help. Remember, it’s not just about the return on your capital but the return of your capital in these uncertain times. Until next time, stay informed and stay safe.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.