No, that’s not a ‘click bait’ sensationalist title. Things are getting ‘weird’ out there if you’re trying to be polite, and downright 'chaotic' if you're being blunt. Everywhere we look, we see signs that the systems that support us are breaking down.

The economy no longer spins off enough surplus for the elites to take what they consider their share with enough left over for everyone else. So the wealth gap grows unchecked into politically and socially destabilizing levels.

The oceans are rapidly dying off: with corals bleaching, tide pools acidifying, and phytoplankton disappearing. Weather weirdness is now so entrenched that all of the 50, 100 and 500-year events that happen each week are mainly reported on locally and garner little national and international attention.

Financial markets are increasingly volatile and dominated by an unruly universe of computer algorithms that now mainly play against each other, having driven off all the humans.

Politically, we're seeing the former fringes of both parties increasingly come into power as they appeal to increasingly disenfranchised and disappointed electorates.

All of these are signs that the status quo has failed and continues to fail us. But the form of power expressed by our so-called ‘leaders’ today seems nearly incapable of healthy introspection coupled to correct action; preferring instead to do more of the same things that got us into this mess in the first place.

Those of us who can read the signs for what they are, not what we wish or believe them to be, have a special duty to first prepare ourselves for what's coming and then help others. To put on our own oxygen masks first, and then help the others around us.

For a variety of reasons, most of them rooted in archaic evolutionary brain structures, most humans are not well adapted to face change, let alone major change.

And the volatility and chaos that's arising all over the globe is well beyond major change. Therefore it's well beyond the capability of most people respond to effectively -- perhaps even at all.

So it’s up to you, the one reading this, to lead the way by becoming the change you wish to see. If you want to live in a world of abundance and where everyone is at least minimally prepared for an uncertain future, then begin by building up your own 8 Forms Of Capital: financial, living, emotional, social, knowledge, cultural, material and time. [Note: The 8 Forms of Capital are fully explained in this podcast with Ethan Roland as well as covered extensively in our new book, so I won’t re-explain them all here. But the concepts are vitally important, and I encourage you to dig deeper now if you haven’t already]

Market Volatility

Recent market volatility, while pretty far from extreme absolute levels, is remarkably aggressive in terms of its relative swings. The ups and downs are getting more frequent, packed together in a way that's increasingly concerning to astute market observers.

There are many factors at play here that have created a fragile market structure. First, the unchecked rise of the machines (computer algorithms) coupled with severe information asymmetry (the very biggest firms have access to tradeable data that you and I never see) has led to a lamentable abandonment of fundamentals in favor of momentum and trend following.

Second, the central banks have nurtured a very unhealthy market dependence on their words and actions. Indeed, the central banks in Japan, the US and Europe have all shown a severe dislike of falling equity prices, and so routinely trot out a series of officials to make soothing noises every time the broad indexes fall even a few percent.

What are they so afraid of?

Well, for starters, they know full well that the global economy is shaky, at best. Financial markets valuations are so high that you might say they are 'priced for perfection'.

The fear is that if these market ever get rolling to the downside, they'll fall a very long way before finally finding a true bottom. And along that path lies a bevy of failed mega-banks and ruined political careers. So, the status quo has a very strong interest in keeping the financial markets propped up for as long as possible.

However, as mentioned before, these unhealthy market conditions have led to a general retreat by flesh and blood traders leaving only the computers to play financial ping pong with each other. This means trading volumes have fallen and volatility has increased:

'Paralyzing Volatility' Means Trouble for Wall Street Giants

May 6, 2016

There’s plenty of volatility, but what happened to the volume?

From stocks to currencies and bonds, the upswing in turbulence to start the year is chasing all but the bravest traders from financial markets.

Despite the recent rebound in U.S. equities, volume in the S&P 500 Index is down 23 percent. Speculative bets on the direction of currencies have also dropped to the lowest in two years, while average daily trading among dealers in U.S. Treasuries is close to a seven-year low.

Worries about the outlook for the U.S., Europe and China, as well as mixed policy signals from central bankers around the world, have all contributed to what UBS Group AG Chief Executive Officer Sergio Ermotti called a “paralyzing volatility” that’s scaring away clients and caused industry-wide trading revenue to tumble to the lowest since 2009.

Normally, a rise in volatility tends to lead to higher trading activity as traders jump in to bet on the market’s ultimate direction, according to Gulberg. That hasn’t been the case this time. Violent swings across assets have whipsawed just about everyone as concern deepens over the state of the global economy and the effectiveness of negative interest rates and quantitative easing.

At the start of the year, it took just six harrowing weeks for the S&P 500 to lose 11 percent and then a mere five weeks to recoup all the losses. What’s more, it came within months of its August swoon, the first time since 1998 that bull-market investors have suffered two such swings in close succession.

Even after stocks rallied in February, trading has fallen off. U.S. equity volume has averaged 7.2 billion shares a day since the bottom, compared with 9.3 billion shares a day in the first six weeks of the year, data compiled by Bloomberg show. Daily moves in the S&P 500 have also averaged 0.84 percent since August, versus 0.55 percent in the prior two years.

“We’re seeing huge dislocations in markets in this year,” said Atul Lele, the chief investment officer at Deltec International Group. “It isn’t the type of volatility where you see opportunities come out of the woodwork.”

(Source)

Yes, the so-called “markets” are not really markets anymore. They are the playgrounds of remorseless computer algorithms which can (and regularly do) turn on a dime and run the other direction simply because that’s where all the other programs are running.

Along the way, traditional traders and investors who do important things like analyze earnings and spot fundamental errors have been routinely trampled and they are doing the sensible thing by backing away.

That’s what I did a number of years back once I understood that the playing field was steeply titled and getting more steeply tilted by the day. Wall Street is always something of a rigged casino but now the rigging is extremely unfair and completely obvious.

And it’s not just the little guys that are harmed here, even the biggest players are being smacked around in these brave new “markets.”

Hedge funds are doing terribly

Apr 22, 2016

Pity the hedge fund manager.

The elite, highly compensated men—they’re mostly men—who run money for the world’s wealthy are having a devil of a time finding a way to make decent returns. As an asset class, hedge funds lost 0.4% during the first quarter, according to research firm Eurekahedge.

Hedge fund clients have noticed that they’re not making money. As a result, they’ve yanked roughly $15 billion in assets from hedge funds in the first quarter, the worst stint of redemptions since 2009, during the nadir of the Great Recession.

(Source)

Even the hedge funds, with nearly $3 trillion under management are not big enough, or well-positioned enough, to figure out what’s going on and make positive returns. This means that you and I stand even less of a chance of gaining access to useful trading information.

The reason for this is contained in this snippet from a FT article on hedge funds:

The [hedge fund] strategy that has been winning the year so far is dictated by computers: systematic hedge funds that surf trends using financial models and algorithms have dominated the lists of the best-performing funds.

(Source)

Yep – computerized “trend surfing” is the latest hot thing. Of course, to do that, nothing need be known about the underlying reason for the price moves, only being on the right side of those moves. If that sounds like a completely societally useless thing to do, except to the extent it lines the pockets of the people playing the game, that’s because it is.

The idea of capital markets existing to align surplus capital with promising ideas has long since given way to a Wild West casino mentality fully supported and coddled by fearful central banks.

This is a terrible ‘reason’ for markets to exist and shows just how far off the tracks we’ve gotten. The Federal Reserve has a lot to answer for in being the leader of the pack in creating these Frankenmarkets.

At any rate, market volatility is increasing and with it the chance of a market crash also increases. Twitchy, trend surfing computers with microsecond reflexes are not exactly the makings of a resilient market structure.

Weather Volatility

Now I happen to live in New England USA so the idea of weather volatility is something I have to try and become worked up about. Hey, weather has always been somewhat unpredictable and chaotic, right?

But recent events have driven home the idea that we are now experiencing highly unusual weather events that even the most ardent Pollyanna would have a hard time overlooking.

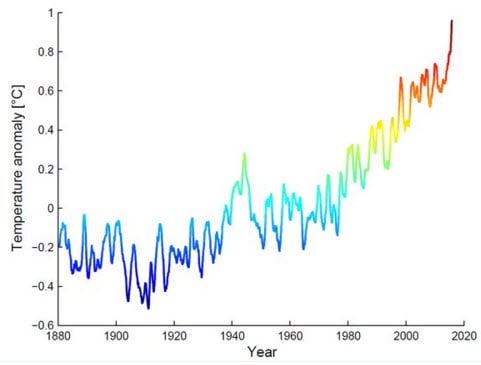

Driving all of this is an extreme spike in atmospheric temperatures itself kicked off by a very pronounced El Niño. Fluid dynamics are notoriously difficult to model but the basic idea is that what are considered stable patterns at one temperature will shift into new patters at a higher or lower temperature.

Think of food coloring dropped in a glass of cold water vs the same dropped in a vessel of hot water the temperature of which is rising. Yes it swirls in both containers, but far faster and in a more wide-ranging way in the hot vessel than the cold.

(Source)

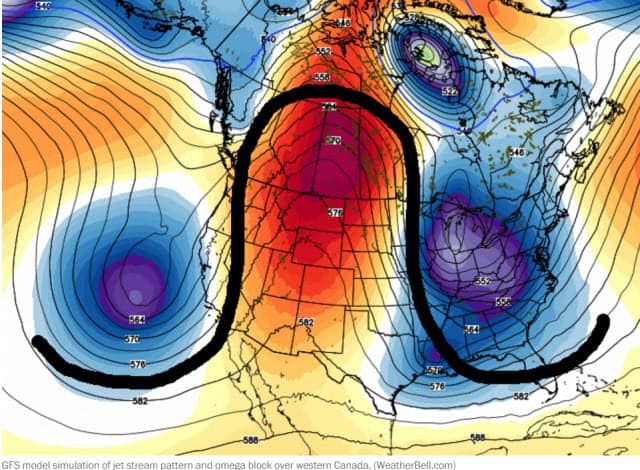

While it’s thought that the moderating El Nino will also moderate the rapid temperature spike, we can already see some of the effects brought about by a jet stream with unusual patterns. The first is in the tragic story of the forest fires that burned through Fort McMurray, which were stoked by a very unusual jet stream pattern that brought temperatures 30 degrees warmer than normal to the area.

Fort McMurray fires

Unseasonably hot weather in Alberta, Canada, is fueling the worst wildfire disaster in the country’s history. An extreme weather pattern, known as an omega block, is the source of the heat.

An omega block is essentially a stoppage in the atmosphere’s flow in which a sprawling area of high pressure forms. This clog impedes the typical west-to-east progress of storms. The jet stream, along which storms track, is forced to flow around the blockage.

At the heart of the block in Canadian’s western provinces, the air is sinking and much warmer than normal. Such a clog can persist for days until the atmosphere’s flow is able to break it down and flush it out.

Centers of storminess form on both sides of the block, and the resulting jet stream configuration takes on the likeness of the Greek letter omega. In this case, cool and unsettled weather is affecting the eastern Pacific Ocean and eastern North America, including much of the U.S. East Coast.

As the Fort McMurray wildfire rapidly spread Tuesday, temperatures surged to 90 degrees (32 Celsius), shattering the daily record of 82 degrees set May 3, 1945.

More records are likely to fall today. Temperatures are forecast to climb well into the 80s today at Fort McMurray, about 30 degrees warmer than normal.

The videos of the fires in Fort McMurray are quite alarming and many people were caught quite unprepared. While the loss of life has been kept to a minimum by prompt evacuation calls, at last count more than 1,600 homes had been burnt to the ground, with some residential communities practically burned to the ground.

More on that lack of preparedness in Part II below.

On the other side of the Atlantic another jet stream anomaly brought unseasonably late ice and snow and hard freezes to areas where fruit production and vine growth were already underway ruining the growing season across entire swaths of Europe:

Extreme snowfall and frost damage in Europe

May 3, 2016

In several European countries – such as Austria, Switzerland, Italy, Croatia, Germany, Slovenia, France and Belgium – apples, pears, cherries and grapes were frozen early last week. The snowfall also created challenges with the roofing systems, and occasionally the snow completely ruined things. Snow and cold temperatures are predicted for some places in the coming nights again. NFO, the Dutch fruit growers association, summarised the results per country as follows:

Austria

In the cultivation area in the state of Styria the words ‘complete catastrophe’ have been used. About 80 per cent of the fruit harvest would be destroyed (see photo left of the news report in which firefighters remove snow from hail nets in Gleisdorf, the link is at the bottom of this article and external). During the night from Monday to Tuesday the small fruits had to endure temperatures of 2 to 6 degrees below freezing according to the Landwirtschaftskammer. Initial estimates concerning approximately 2,000 Styrian cultivators indicate €100 million Euro in damages for the fruit sector (without grapes) alone. Councillor Hans Seitinger: “This is truly a unique situation, which has not occurred in the last 50 years.”

Italy

The Italian agricultural organisation Coldiretti also reported that the fruit cultivation suffered damages from the weather circumstances. The increasingly often occurring results of climate change resulted in more than 14 billion Euro of damages to agriculture in the last ten years, according to Coldiretti. Last winter, Italy had the warmest winter in history. This resulted in an early development of crops.

(Source)

The longer list of country effects shows that fruit and grape production was just hammered making this a lost growing season for those unfortunate farmers.

In my own small corner of the world there may be zero peaches produced by several New England states, mine included, because it dipped to a bud-killing 18 degrees one night and then 19 degrees the next in April. Those are very unusual temperatures courtesy of a late season polar vortex itself courtesy of a wonky jet stream.

So no peaches this year.

Yes, sometimes weather does unusual things. But it is the increasing frequency of such events that makes it increasingly obvious that we had better start planning on them continuing far into the future.

The problem is, we don’t have the slightest clue how to really plan because the new patterns are emergent – they don’t just happen all at once, it’s a process that takes time – and it’s too early to declare anything beyond “change is happening.”

This NYTimes article did a good job of capturing that dynamic:

A New Dark Age Looms

Apr 19, 2016

IMAGINE a future in which humanity’s accumulated wisdom about Earth — our vast experience with weather trends, fish spawning and migration patterns, plant pollination and much more — turns increasingly obsolete.

As each decade passes, knowledge of Earth’s past becomes progressively less effective as a guide to the future. Civilization enters a dark age in its practical understanding of our planet.

To comprehend how this could occur, picture yourself in our grandchildren’s time, a century hence. Significant global warming has occurred, as scientists predicted.

Nature’s longstanding, repeatable patterns — relied on for millenniums by humanity to plan everything from infrastructure to agriculture — are no longer so reliable. Cycles that have been largely unwavering during modern human history are disrupted by substantial changes in temperature and precipitation.

As Earth’s warming stabilizes, new patterns begin to appear. At first, they are confusing and hard to identify. Scientists note similarities to Earth’s emergence from the last ice age. These new patterns need many years — sometimes decades or more — to reveal themselves fully, even when monitored with our sophisticated observing systems.

Until then, farmers will struggle to reliably predict new seasonal patterns and regularly plant the wrong crops. Early signs of major drought will go unrecognized, so costly irrigation will be built in the wrong places. Disruptive societal impacts will be widespread.

Such a dark age is a growing possibility

(Source)

A ‘dark age’ is simply a time when your prior accumulated knowledge is either lost or is no longer applicable. There’s much groping about as culture realigns itself and finds its new footing.

The new wanderings of the jet stream have brought unseasonable cold to some areas and drought to others. It has blocked storms from some areas and dumped unusual amounts of rain in others.

It’s now common to read of “100 year” events, they seem to happen every month.

These new patterns are noticed somewhere in our animal cores, leading people to report a feeling of anxiety, or that “something is just not right.”

Certainly there’s no shortage of things that might contribute to that sense, but we need to hold open the idea that we remain attuned to the natural world and as that shifts dramatically all around us, we are deeply affected.

Summary

Market volatility is on the increase, as are weather anomalies. Perhaps they're connected in some deeper way that is not obvious. Or perhaps each just represents the logical end stage of a system grotesquely deformed by too much hot money (in one case) and trapped heat (in the other).

If you're waiting for things to become even more deformed before you begin to prepare yourself for a future of disruptions -- don’t. Get started right now. Preparing takes time, money and emotional energy. All of those things tend to evaporate once a crisis really gets rolling along.

This new volatility is now here with us. And that has enormous implications -- some we can plan for, and others we cannot. I can plan on losing peaches now and then but if the rains stop falling, I’m screwed.

In Part 2: How To Prepare For Volatility, we conclude that nobody can predict exactly how or when these changes will manifest. We are entering a new dark age, one marked by an unknowing. We can either acknowledge that reality and begin to act on it today, or we can ignore it and assume we’ll have time to react to circumstances later, along with most other people.

And there's much we can do today -- right now -- that will make a huge positive difference difference in our outcomes should crisis arrive soon. But we need to act soon.

Those who wait will mostly be caught off guard and very disappointed in themselves. It happens all the time -- just ask the residents of Fort McMurray.

Click here to read Part 2 of this report (free executive summary, enrollment required for full access)

This is a companion discussion topic for the original entry at https://peakprosperity.com/chaos-volatility-on-the-rise/