Originally published at: https://peakprosperity.com/coffee-and-a-mike-why-i-hate-microsoft/

Executive Summary

Chris and Mike dive into the complex and often underreported issues surrounding the current state of global economics, politics, and the potential for a significant financial reset. I explore the implications of these developments, particularly focusing on the Mar-a-Lago Accord and its potential impact on the global financial system. The conversation touches on the historical context of tariffs, the role of gold, and the shifting geopolitical landscape, all while considering the broader implications for the average person.

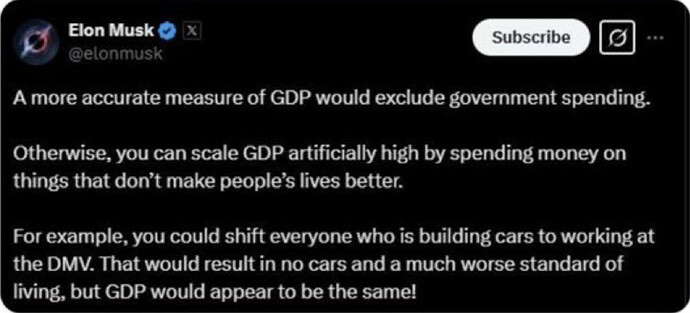

The Mar-a-Lago Accord

The Mar-a-Lago Accord is a proposed economic strategy that aims to restructure the global trading system. This plan, which has not been widely publicized, involves using tariffs as a tool to negotiate currency exchange rates and encourage international cooperation. The idea is reminiscent of past economic strategies like the Plaza Accord and the Smithsonian Agreement, where tariffs were used to bring countries to the negotiating table. The goal is to address the unsustainable levels of debt and the need for a monetary reset.

The Role of Gold

Gold is playing a crucial role in the current economic landscape. Since the U.S. sanctioned Russia’s sovereign reserves, there has been a significant shift in gold flows, with countries like China and India increasing their gold purchases. This movement suggests a lack of confidence in the U.S. dollar and a potential shift towards gold-backed currencies. The U.S. has also been repatriating large amounts of gold, raising questions about the motivations behind these actions.

Key Data

- The U.S. holds about 30% of the world’s total debt, despite being only 5% of the global population.

- Since February 2022, there has been a sustained rise in the price of gold, with significant purchases by China and India.

- The U.S. has repatriated at least 500 tons of gold from London since Trump’s election.

Predictions

- The current economic system is unsustainable and will likely lead to a significant financial reset.

- There will be a shift towards a multipolar world, with China emerging as a major economic force.

- Gold-backed currencies could become a viable alternative to the U.S. dollar.

Implications

- The average person may experience a loss of purchasing power as the economic system undergoes changes.

- There could be significant disruptions in the global financial system, affecting everyday transactions and savings.

- People may need to adapt to a new economic reality, with potential changes in employment and financial stability.

Recommendations

- Consider holding gold as an insurance policy against potential economic instability.

- Evaluate personal skills and how they add value in a changing economic landscape.

- Stay informed about global economic developments and their potential impact on personal finances.