Originally published at: https://peakprosperity.com/craig-hemke-just-be-ready-and-keep-stacking/

Hey folks, we have a bonus Finance U episode for you this week, in honor of Silver breaking out and Gold hitting new all-time highs.

When’s a bonus truly a bonus? When the guest is as awesome as Craig Hemke, the person behind the TFMetals Report.

Craig and I go way back, and we’ve got the frustrations and battle scars to prove it, as there’s been nothing easy or straightforward about believing in precious metals over the past few decades.

But, to really understand the root causes of precious metal’s recent run, you have dig into the macroeconomics and monetary and fiscal policies that are driving everything.

So, we did just that.

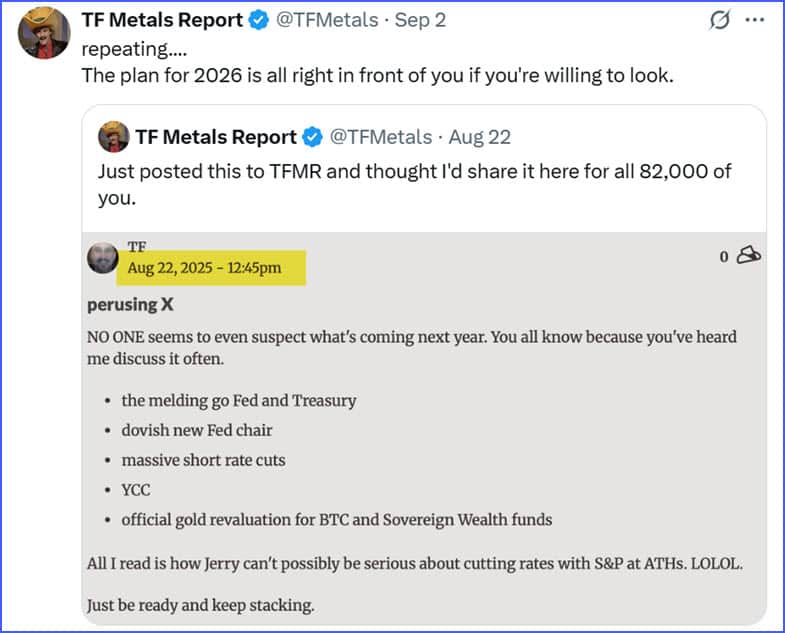

To set the stage, here are Craig’s calls for 2026:

(Source – X)

He thinks that the melding of the US Treasury and Federal Reserve functions, which began under Janet Yellen (first a Fed chair, then a Treasury secretary), will continue under Trump and Bessent.

Obviously, Trump will exert pressure, probably successfully, to have the 2026 Fed cut interest rates aggressively.

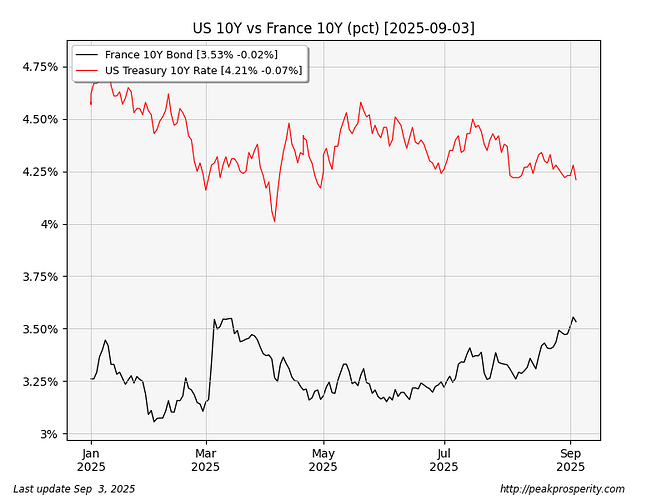

But to get away with that, without blowing up the long-bond yields, they will have to engage in something called “Yield Curve Control” or YCC. This is fancy speak fo the Fed printing up money out of thin air and buying long bonds whenever they peek above some target level, like 3% or something.

Whatever, it means vast gobs of new money printing.

To possibly mitigate that somewhat, stablecoins (the GENIUS Act) and gold seem to have a role to play. But gold is odd, because we have no idea if or how much Ft Knox actually has. Hey, no audit has happened as promised, and more importantly, no talk of not having an audit.

Add it all up, and here we are, watching gold plow to new highs day after day.

Craig’s view is that gold and silver are authentic hedges against dollar devaluation as well as systemic financial risks, with gold potentially reaching $3,900-$4,000 per ounce as a next ‘resting spot.’

I’d also like to promote Craig’s TF Metals Report as it provides daily insights to help investors navigate these trends, emphasizing the inevitability of the “math” in a debt-based system. Let Craig be your eyes and ears while you attend to the rest of your life.

Enjoy the show!

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.