Originally published at: https://peakprosperity.com/cucumbers-vs-grapes-stocks-go-up-as-the-economy-goes-down/

The twin pillars of a stable society are Reciprocity and Fairness. Both are being deeply challenged this year as the Fed’s magic money machines( and possibly the government owns a few as well, according to Elon Musk) shower rich stock market rewards on the

If you are not familiar, this ~3-minute video on the effect of rewarding some Capuchin monkeys with grapes while others get cucumbers is both funny and highly instructive.

I strongly recommend everyone watch it, and regularly feature it in my talks. Why? Because the current leadership in DC and at the Federal Reserve has so completely lost touch with the basic principles contained within the video that they are now openly and actively creating the conditions that could result in political and cultural tremors far beyond anything we’ve experienced so far.

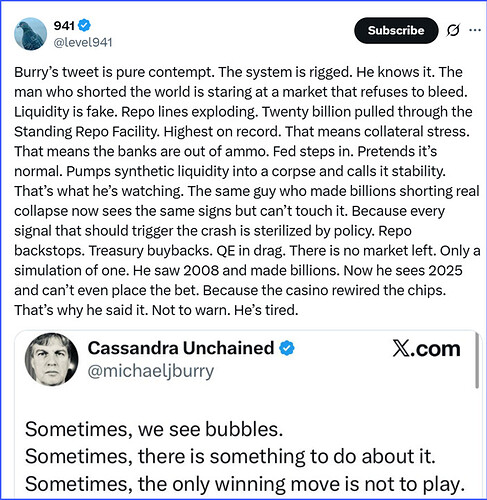

Our system of money is deeply and structurally unfair. But it’s the only one we’ve got, which is why Paul Kiker and I sit down weekly to discuss the trends and the data. Whether we think the game is rigged (and it is) for certain outcomes – or not – it’s the game we’re forced to play.

With SNAP benefits running out on Nov 1st (this podcast was recorded on Oct 31st – Happy Halloween!), there’s both a chance for more social unrest as well as some liquidity tremors as food suppliers and distributors face a sudden demand shock.

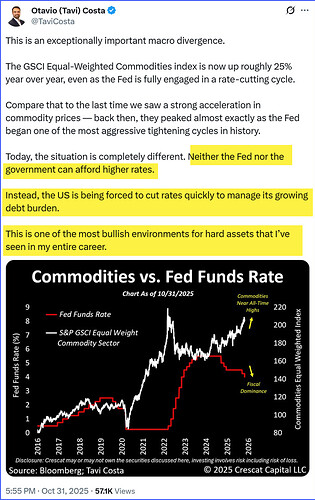

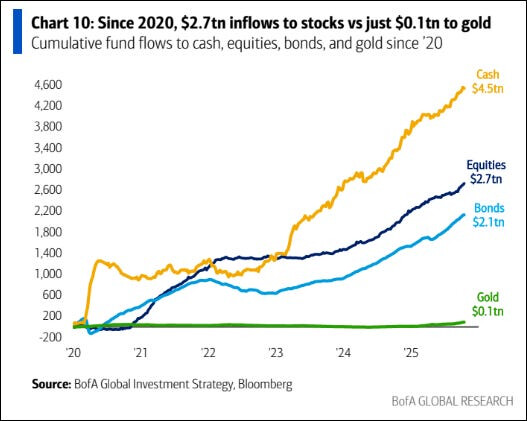

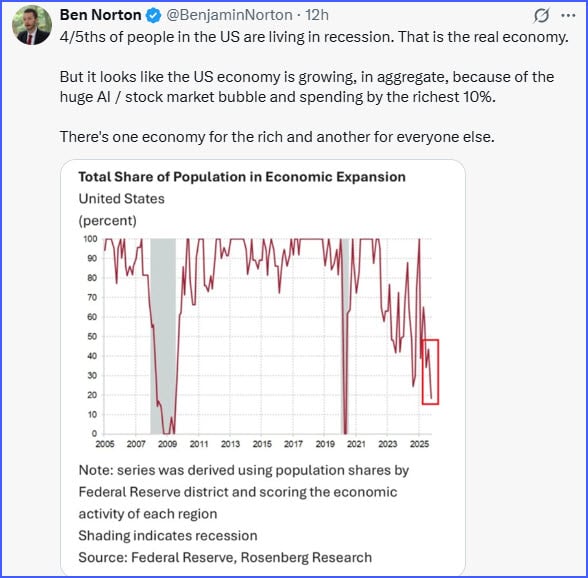

Next, the bottom 90% of the country is really struggling, while the top 10% is doing great. The term for this is a “K-shaped economy” with the top arm of the “K” representing the top 10% and the bottom arm the bottom 90%. Some do very well simply by virtue of already owning the assets the Fed is pumping higher (grapes for them!) while everybody else gets to subsidize that via higher inflation (moldy cucumbers at best).

The recession signs are more and more pronounced, with Kraft reporting a sudden decline in sales, Chipotle turning in terrible earnings, and Indeed’s job postings falling off a cliff, all of which combine into this chart showing that 80% of the US is already living in a recession.

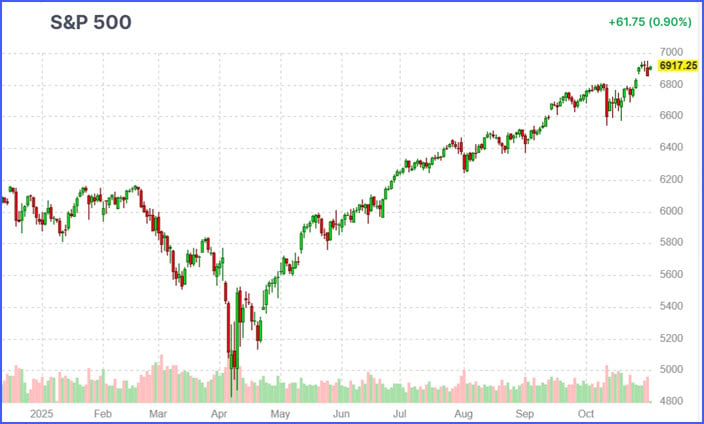

But the Fed keeps goosing the ““markets”” and the Terrific Ten stocks keep reporting spectacular earnings, and the party carries on.

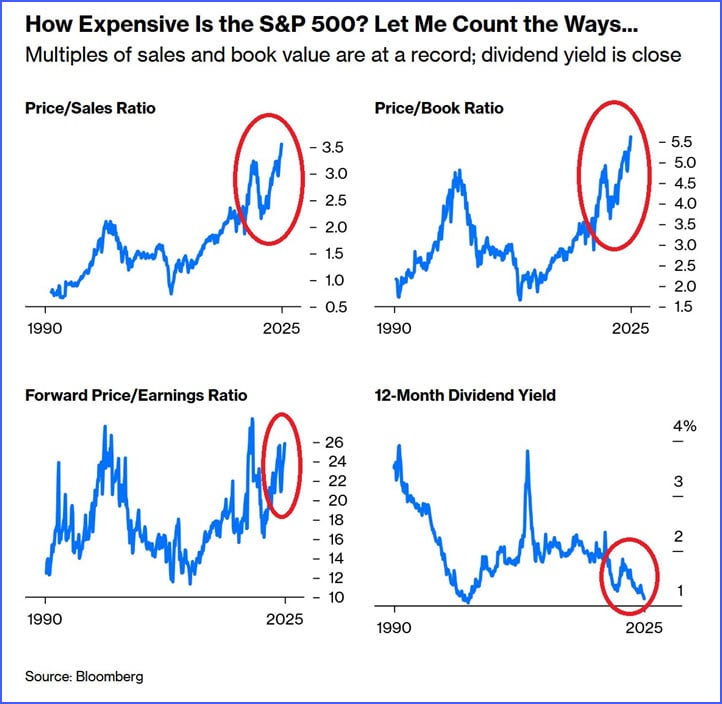

It’s gotten so extreme that even Bloomberg is now putting out the sorts of graphics that Paul and I have been discussing for months.

How much longer can this all continue? Nobody knows. Which is why having a risk-managed portfolio and a strategic plan are more important than ever.

Near the end of this podcast, Paul describes the process he takes everyone through, beginning with an initial get-to-know-each-other phone call, followed by a financial review and planning session, and then finally a third recommendation session.

Every person or couple is unique in their family details, life stage, and resources, which is why Paul and his team spend so much time figuring each client out to ensure there’s a good fit (both ways). In a world of numbers, Paul seeks to ensure he and his team know the people.

To arrange an initial phone call, just go to Peak Financial Investing, fill out the simple form, and someone from Paul’s team will reach out within 48 business hours to arrange the meeting. It’s that simple.

https://peakfinancialinvesting.com/

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.