We are at a key turning moment in history. The actions that we will soon decide to take will be determined by the beliefs we hold. At a time like this, holding the wrong set of beliefs can destroy your wealth, sap your joy, and even prove to be life-shortening.

Knowing the 'right' sets of beliefs to hold is never easy, but it is especially difficult at large turning points because, by definition, most people are holding onto old beliefs. Running against the crowd is difficult for everyone and impossible for many.

“If you think you can or think you cannot, you are correct.”

~ Henry Ford

Beliefs matter. A lot.

One’s experiences in life and one’s beliefs are closely connected, an idea that we explore in depth in our seminars. (The next ones are coming up in March and June). For instance, simply believing in the likelihood of success vastly improves the chances of good things happening to us and our accomplishing difficult tasks.

Whether it is the case that our beliefs help to shape reality, or merely how we experience it, is a distinction without a difference.

The tricky part is that our beliefs are usually hidden from us. Without conscious examination, they escape notice: lurking, shaping, and coloring our daily lives. Worse, beliefs quite often are not ‘ours’ in the sense that we create them by our individual thoughts and experiences. Instead, they are gifted to us by our society, culture, and media. Of course, when such beliefs are cynically shaped by those wishing to influence us (advertisers and big media come to mind), ‘gifted’ might not be the appropriate word.

Two very obvious efforts at shaping beliefs are currently being run in the US by various parties wishing to shape our collective beliefs to their liking. One is around the ‘necessity’ and desirability of going to war with Iran. The second, which we will examine closely in this report, concerns Peak Oil.

Whether or not Peak Oil is true cannot possibly be in doubt. Within anything other than a geological frame of time, oil is a finite substance. When it is burned, it is gone. Without stretching our brains very far, it is easy to conclude that anything that is finite and consumed will someday be gone.

Peak Oil, then, is really an observation, not a theory.

It draws upon and has at its disposal decades of experience with individual oil fields, producing basins, and entire countries all repetitively experiencing the exact same behavior: Oil production increases up to a point, and then it decreases afterwards. This is not theory; it is a related set of facts and careful observations.

It's odd that so many people will trust a psychiatrist to administer psychoactive drugs, about which so little is actually known, yet distrust Peak Oil, an idea about which so much is definitively known. As you can see, I am of the opinion that for some people, information (or data) and beliefs have an awkward relationship at best, and a non-existent one at worst.

The only aspect of Peak Oil that is theory is the precise moment at which the world will experience its final peak in flow rates. When the peak will happen is a theory; Peak Oil itself is not. Because of this, it is flow rates that we care most about, which constitute a description of quantity. But we need to also concern ourselves with the net energy returned from the oil we expend effort to obtain, which is a matter of the quality of the oil.

Those are the two "Q's" that matter. Quantity and quality.

Given all this, note the headlines of the next two linked articles that recently appeared in the news media. Ask yourself, What sorts of beliefs are they reinforcing? And which ones they are minimizing, if not attacking?

The End of the Peak Oil Theory

Feb 16, 2012

If you haven't noticed, the oil apocalypse has been delayed -- again -- and the doomsday predictors are undoubtedly eating crow while they concoct another mega disaster. "Peak oil," the theory that oil production will soon hit a peak and begin declining, sending the world into an economic disaster, failed to live up to its hype again.

It's amazing how fast perceptions of our energy future can change. One day prevailing wisdom tells us that energy costs are going to rise uncontrollably as oil production declines and new energy sources fail to live up to their promise. The next, our problems are solved, and our reliance on foreign oil appears to be evaporating before our eyes.

(Source)

Citigroup Says Peak Oil Is Dead

Feb 17, 2012

Citigroup announced to the world Thursday that peak oil is dead. The controversial idea that world crude oil production is almost at its peak and will soon begin an irrevocable long-term decline has been laid to rest in the highly productive shale oil formations of North Dakota, with potentially big consequences for oil prices, the bank said.

“The belief that global oil production has peaked, or is on the cusp of doing so, has helped to fuel oil’s more than decade-long rally,” Citigroup said in a note to clients. “This is now all changing because of what is happening in North Dakota,” where new technology has led to a large and unexpected surge in oil production from shale rock.

After decades of decline, “U.S. oil production is now on the rise, entirely because of shale oil production,” said Citigroup. Shale oil could add almost 3.5 million barrels a day to US oil production between 2010 and 2022 and has already slashed 1 million barrels a day from U.S. oil imports. One day it may allow the U.S. and Canada to be self-sufficient in oil, it said.

(Source)

Obviously the idea of Peak Oil as a concept is directly under attack in these articles, but there are a host of underlying beliefs in play as well. One concerns the ability of the US (once again) to become self-sufficient in oil by applying a bit of good old-fashioned ingenuity and a healthy slathering of high technology.

Another seems to be the belief that we might not have to change our ways after all; that the energy will be there in sufficient quantity (and quality!) to support an indefinite continuation of past consumption and growth far into the future. Don't worry, be happy is the message.

Avoiding Propaganda

The definition of propaganda is "a form of communication that is aimed at influencing the attitude of a community towards some cause or position." It usually involves the selective use of facts or the avoidance of appropriate context, coupled with loaded messages and words, in order to elicit an emotional rather than rational response.

Whether the goal is to lead an otherwise unwilling populace towards war or to drive the purchase of a new car, propaganda is not only alive and well, but getting steadily better. Consider it a technology; like any technology, it is constantly being refined using the latest and greatest research, studies, and testing.

If you'd like to parse the articles further, go back and re-read them, looking for 'shaping' words that create impressions and are designed to elicit confidence, exude authority, or in other ways bypass the reader's own critical thought processes. Examples of such words and phrases would be 'controversial,' 'concoct,' and 'laid to rest.' These are not neutral words, but heavily biased ones, and we are so surrounded by them in what otherwise appear to be (and should be, ideally) informational articles that they often escape notice.

The emotions being evoked possibly include: feeling silly for holding the wrong ideas (a form of social shame), anger (at being grievously misled by those nasty "Peak Oilers"), and elation ("Yay! No changes necessary!").

These same sorts of emotional devices are constantly at work in the fields of finance, politics, investing, and advertising. Propaganda is a means to an end, and some argue that it can be beneficial if it moves us towards a better future and/or outcome.

But the risk here is that we are faced with propaganda that is sending the exact wrong messages at a very critical time.

What Could Possibly Go Wrong?

For a moment, let's accept the emotional premise of the above articles and shape our decisions around the idea that Peak Oil has been debunked and is a failed concept. What would change?

For starters, we can drop our concerns about the implications of steadily rising energy prices. Instead of buying smaller cars, more efficient homes, and placing our investments in those sectors that will prove resilient to higher energy costs, we can just go back to ignoring energy costs as a factor, content with knowing that they will be going down, not up.

Next, we can dispense with any concerns we might have had about how we will grow the economy going forward. Because you need energy -- especially oil -- to grow an economy, we can wholeheartedly invest in the stock market, confident that growth will once again emerge as it always has, unchanged and unfettered. 10% real, annualized returns are coming back!

The relief at being able to count on the future resembling the past, only bigger and presumably better, is palpable and seductive.

The only problem here is, what if that view of the future is wrong? Then what?

Everything.

All your plans for happiness, safety, wealth, and comfort go right out the window.

And the odd part is that adjusting to the idea of Peak Oil when it can nudge you towards using less energy more efficiently is just good business and good wealth preservation practice under any circumstances, with high oil prices or low. It really makes no sense to internalize any messages that seek to belittle Peak Oil. In fact, it makes sense to spot them and reject them as rapidly as possible. The risks are just too asymmetrical

Is Peak Oil Really Dead?

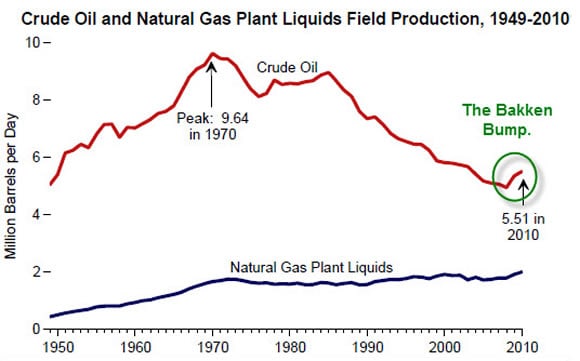

Okay, now it's time for a little data to put the above claims of Peak Oil being dead into proper context. In Part II of this report we'll examine the data more closely, but for now this chart from the US Department of Energy should suffice to show where we are in terms of the US oil production story.

Yes, the Bakken could produce as much as 2 million barrels per day (bpd) up from roughly 500 thousand bpd, maybe as much as 3 million bpd, but the US imports roughly 8 million bpd today under even severe economic conditions, and as much as 10 million bpd under happier economic conditions.

The Bakken and other shale plays are simply not going to replace all of that -- ever. Note, too, the slope of the line before the 'Bakken bump,' and observe that whatever gains are realized from shale oil will be fighting depletion losses from the rest of the tired fields under production.

And the Bakken will someday peak, too, and then where will we be? In the same place as before, wondering where we are going to get our next fix.

A Better Narrative

I would not mind the excitement over the Bakken as much as I do if it came along with a suitable narrative that made sense. Something along the lines of, "The Bakken is very exciting because it offers us the chance to use domestic supply to begin to move away from our national oil dependence and towards a more sustainable energy future, one where we are not shackled to the need for endless production increases to fuel exponential economic growth. This transition will even make our monetary system much more healthy and robust."

But it is never packaged that way. Instead the message is always something like, "Don't worry, be happy (and just get back to whatever it is you do, and be sure to shop a lot)!"

At the very least, the Bakken should be telling the authors of the above articles and positions something quite different than what they are relating. For one thing, the amount of technology and constant expertise involved in squeezing the oil out of the formation clearly tells us that the easy, cheap oil is gone.

The complexity is on display if one just bothers to look. Here's a prime example relating to new attempts to squeeze more oil out of the tight shale formation:

While PetroBakken is bullish on dry natural gas injection, the company isn't ruling out the possibility of injecting water-or other fluids-for future projects in other areas of the Bakken.

PetroBakken is using the pilots to test different concepts or well configurations. For example, in the second pilot-which will inject natural gas at a rate of about two million cubic feet per day-gas will be injected along the entire horizontal section of the injection well, so the flood front will hit the toe of each of four perpendicular producing wells.

"As gas breaks through at the toe of each well, we have the ability to simply plug off the toe area of the producing horizontal well and mitigate the cycling of the gas at that port," LaPrade explains.

"The front would continue to move along the horizontal producing leg to the next port, where we would again plug that port off as the gas breaks through."

Typical wells in the Bakken come in at an average 200 barrels of oil per day and decline about 70-75 per cent in the first year before flattening out at 30-40 barrels per day.

(Source)

I think this is incredible ingenuity, and I admire the creativity and engineering on display. But all of this effort to fight the natural tendency of a Bakken well to produce at 30-40 bpd clearly is not the same thing as chunking a vertical well a thousand feet down and getting 1,000 to 10,000 bpd flow rates. The cost to produce a unit of energy is much higher in the Bakken case than in traditional, historical oil plays.

That is, net energy is lower than in the past, which cycles us back to the quality argument. The difference between cheap and expensive oil is important and clearly on display here, but that subtlety has somehow eluded the authors of the above articles.

Conclusion

Efforts are underway to convince the general populace that our energy concerns are a thing of the past and that the new energy discoveries in the Bakken and other shale formations have proven Peak Oil to be a mistaken idea. Some efforts go even further and flatly state that energy independence is right around the corner.

Nothing could be further from the truth.

There is a very clear relationship between economic growth and sufficient quantities of high quality energy. A crude measure of energy quality is its price. The lower the price for a unit of energy, the higher its quality (or net energy), but this is a very crude measure that can and often is heavily distorted by subsidies, market pressures, and other factors. As we squint at the world price for oil and note that Brent today is trading at $120 per barrel, it is clear that this high price is signaling that energy is now more expensive than it used to be.

By adopting the belief that Peak Oil has been debunked, one runs the risk of missing the larger story that our current economic model is unsustainable. And that stocks and bonds and other traditional investments that derive a large portion of their current value from expectations of future growth simply may not perform anything like they have in the past. And worse, that recent and continuing efforts to revive the old economy by printing money risk the destruction of the money system itself.

Given this all-too-human tendency to attempt to preserve the status quo, in this case by printing money, I must reiterate my advice to be sure that gold forms a significant portion of your core portfolio.

In Part II: Preparing for a Future Defined by Peak Oil, we do the math to show that even using the rosiest estimates, there is no way for the Bakken field to get the US anywhere close to "energy independence" nor stave off the arriving society-changing impact of Peak Oil.

If that's the case, then what's to be done?

Now, more than ever, is the time to develop a full understanding of what the arrival of Peak Oil will do to world economies, financial investments like stocks and bonds, and our energy-indulgent way of living. As I have been writing for some time now, the next twenty years are certain to be quite different from the past twenty. Use the time you have now to invest in the pursuits -- and there are many -- that will reduce your vulnerability to the effects of rising energy costs, and learn that prosperity in such a future is possible if we lay the groundwork for it now.

Click here to access Part II of this report (free executive summary; enrollment required for full access).

This is a companion discussion topic for the original entry at https://peakprosperity.com/dangerous-ideas-2/