Every year, friend-of-the-site David Collum writes a detailed "Year in Review" synopsis full of keen perspective and plenty of wit. This year's is no exception. As with past years, he has graciously selected PeakProsperity.com as the site where it will be published in full. It's quite longer than our usual posts, but worth the time to read in full. A downloadable pdf of the full article is available here, for those who prefer to do their power-reading offline. — cheers, AdamDavid B. Collum Betty R. Miller Professor of Chemistry and Chemical Biology - Cornell University Email: dbc6@cornell.edu - Twitter: @DavidBCollum

Introduction

David Collum is willfully ignorant.~ Mountain Man (@Pjas77)

Imagine, if you will, a man wakes up from a year-long induced coma—a long hauler of a higher order—to a world gone mad. During his slumber, the President of the United States was impeached for colluding with the Russians using a dossier prepared by his political opponents, themselves colluding with the FBI, intelligence agencies, and the Russians. A pandemic that may have emanated from a Chinese virology laboratory swept the globe killing millions and is still on the loose. A controlled demolition of the global economy forced hundreds of millions into unemployment in a matter of weeks. Metropolitan hotels plummeted to 10% occupancy. The 10% of the global economy corresponding to hospitality and tourism had been smashed on the shoals and was foundering. The Federal Reserve has been buying junk corporate bonds in total desperation. A social movement of monumental proportions swept the US and the world, triggering months of rioting and looting while mayors, frozen in the headlights, were unable to fathom an appropriate response. The rise of neo-Marxism on college campuses and beyond had become palpable. The most contentious election in US history pitted the undeniably polarizing and irascible Donald Trump against the DNC A-Team including a 76-year-old showing early signs of dementia paired with a sassy neo-Marxist grifter with an undetectable moral compass. Many have lost faith in the fairness of the election as challenges hit the courts. Peering through the virus-induced brain fog the man sees CNBC playing on the TV with the scrolling Chiron stating, “S&P up 12% year to date. Nasdaq soars 36%.” The man has entered The Twilight Zone.

A nutty Chem prof from Cornell Has interesting stories to tell The year 2020 Had crazy-a-plenty T’was a year that was crafted in hell~ @TheLimerickKing

Figure 1. The one graphic that rules them all.

Figure 2. “Largely peaceful protest” meme at its inception.

Putting ideas on paper is the best way to organize them in one place, and getting everything in one place is essential to understanding ideas as more than the gut reactions they often hide as.~ Morgan Housel (@morganhousel), columnist on why we write

Every year I ponder not writing a review. One of the voices in my head was pleading with me, “Don’t write it. There is nothing to be gained.” A much louder voice that chimes in seconds before every major decision that I make, however, was saying, “Fuck it. Let’s do it.” Someday I may drop the mic but not yet. I personally benefit because my life’s experiences and observations—those wild moments and funny-assed one-liners—don’t get shoved down (or up) the memory hole. I get boluses of serotonin. Mike “Mish” Shedlock referred to 2019’s version as “Satirical, Comedic, Insulting…” as part of a thorough Collumoscopy.ref 1 To the guy who keeps emailing me urging me to clean it up so his daughters can read it, save your breath. They are either too young, which means they should be reading the Harry Potter series written by that transgender-bashing cis white billionaire, or probably have long since rounded the bases and are getting kinky with their boyfriends in ways that would curdle your blood. I also write this for Gerry (and his kids)…

Collum is a whiny moron...You would interview someone like that, a Trump-supporting climate denier...he's a total idiot who needs to FOAD [fuck off and die]. He simply refuses to acknowledge facts...~ Gerry Muller, my most audacious hate mailer, responding to Jim Kunstler for his audacity.

The title is a takeoff on the website entitled, “WTF Happened in 1971”, which uses 50 graphics to document that the world changed abruptly in 1971.ref 2 (The gold bugs know why.) It is undeniable that 2020 will be a year of abrupt change as well—a phase change so to speak—but to what future is unclear. We all squandered inordinate kilos of ATP trying to understand events in ways that would not make us happier people and for which an answer key eventually would be forthcoming.

We have to be very careful about how we spend our time...be very careful about not being manipulated into narrative after narrative....The Eye of Sauron is focused on climate, covid, and race. I’m not going to get caught up in it...Everything we get distracted onto we don’t make better.~ Douglas Murray (@DouglasKMurray), author of The Madness of Crowds

This year posed challenges writing the damned thing, some common and others unique. Of course, I don’t have the luxury of casually surveying a year. Ya can’t be Toobin’ all day and patch it together in your spare time. Ya gotta Stephen-King the mother. Why not write it quarterly? Simple: it takes my beautiful mind that long to spot patterns in random noise and deconvolute the chorus of voices in my head. Also, nobody—and I mean nobody—in their right mind wants to rehash the events of 2020. The annual YIR is always about human folly, but how much folly is there when we’re all living in our basements (Joe)?

I tease Dave about his “Technical Analysis Wizardry,” because I want him to write a children’s book on charting. Still, I can’t deny that he often captures the market zeitgeist in one tweet.~ Tony Greer (@TGMacro), TGMacro

Keeping it light was a Herculean task. I kept getting pulled by Lord Vader toward a revenge mindset, which I have curbed with only partial success. Epithet-rich allusions to baseball bats kept getting smuggled into the prose stemming from undiagnosed coprolalia, the acute swearing component of Tourette’s Syndrome. Some commenter after a podcast said (paraphrased), “This guy sure wants to put a hurt on a lot of people.” Indeed. The sense of frontier justice runs deep in the entire Collum clan. Horse thieves beware. I don’t need anger management; I need people to stop pissing me off. Ad hominem attacks are reserved for the total douche bags.

Writers are desperate people, and when they stop being desperate they stop being writers.~ Charles Bukowski, American Poet

I was inadvertently ready for the pandemic in some odd ways. I love medieval history, had just finished a book on the Black Death in the fall of 2019, and was pondering immunology when Covid-19 struck. Ah, the first contention: I refuse to capitalize the whole thing because COVID-19 makes no sense linguistically—it’s not correct for an acronym or proper name—and using all caps is shouting and distracts from other attempts at emphasis. SHOULD I TYPE LIKE THIS? I don’t care what everybody else on the planet does. They are wrong. Screw ‘em. I appear to have gotten Covid-19 at birth; I have been tasteless and urged by friends and family to social distance since childhood. Obviously I should wax philosophically about the Covid-19, right? But what do you say to 350 million basement-dwelling bunker monkeys who are now expert epidemiologists and virologists with rock-solid opinions of what parts of the pandemic sucked the saltiest balls? I dedicate far less page space to the pandemic or the elections than you might expect.

It is so much better to tell the truth than to just shut up.~ Douglas Murray (@DouglasKMurray), author of The Madness of Crowds

The YIR poses risk—possibly considerable risk—every year, but this year is special. No guff no glory I guess. There are a ton of social justice crazies (SJCs) out there. In the 65th year of my personal sitcom, the writers keep hurling absurdities to keep the series running, but I got canceled anyway. No, not by Covid-19 (unless this is The Sixth Sense) but by the diversity-industrial complex otherwise known as the Klan of the Kancel Kulture (KKK), virtuously broadcasting to the world that I am a seriously twisted bastard. It is hard to argue with that. However, if people in visible positions feel they cannot speak up right now, when will they speak up? On their deathbeds? If a 65-year-old tenured professor can’t express unpopular ideas, who can? A 9-to-5-er who could be fired in a heartbeat has no voice. I will keep spewing drivel because somebody has to do it.

Factoid: You cannot breathe with your tongue sticking out of your mouth.Stuff your tongues back in your mouths you idiots. Of course you can. I have become increasingly aware that we are all looking through our own lens with an emerging plotline that is self-consistent with our own unique narrative. As described in The Social Dilemma, the narrative is shaped nefariously by ideologically dubious weasels in Silicon Valley running their MK-Ultra experiments on us through mass and social media. As I jam more pixelated pseudo-factoids into my noggin, doubts about their veracities are debilitating. How is it that smart blokes can peer at the same data and draw diametrically opposite conclusions? If I offered you $1000 to convince just one person—one person—that they were wrong about Russia collusion, the Biden laptop, election fraud, or the merits of sheltering, could you do it? Didn’t think so. Some of us must be, as Gerry would say, whiny morons who should simply FOAD, but we all have our truths that we will defend, Goddammit! This annual tome is, necessarily, the World According to Dave. At times it will sound narcissistic, but it’s not. [Editor’s note: yes it is.] It wanders through a range of topics in no way statistically weighted to their global importance but presented in a Michael-Lewis way sniffing out the story beneath the story. What my four regular readers would tell you is that I try to write about what others are not pondering. I don’t always find the rotting corpse, but I am attracted to foul odors.

Sturgeon’s Law: 90% of everything is crapThe Year in Review (YIR) is broken into two parts with individual sections hot-linked in the contents below. The whole beast can be downloaded as a single PDF here. The references are in files listed by Chapter titles Part 1 and Part 2.

Contents

Part 1- Introduction

- Contents

- My Personal Year

- Conspiracy Theories

- Decade in Review

- Investing

- Gold

- Wealth Creation

- Valuations

- Broken Markets

- Bailouts

- Healthcare

- Link in Part 1

- Epilogue–Epstein

- Epilogue-Climate Change

- Rise of the Cancel Culture

- The Tweet and Cancel

- The Buffalo Shove: The Real Story

- College Life

- Political Correctness—Adult Division

- Group Statements and Identity Science

- Anatomy of the Riots

- The Death of George Floyd

- Covid-19: Just Opinions

- Where to from Here?

- Acknowledgments

- Books

- Links in Part 2

My Personal Year

How about 'Batshit political views and how to succeed despite them?’~ a colleague, when asked what topic I should present in a guest lecture

We all suffered from suffocating acedia—a melancholy specifically resulting from monastic isolation known only to ye olde linguists.ref 1 All things considered, I personally had it as good as you could ever hope, and none of us were sleeping in the London Tube at night to avoid the Luftwaffe. We sheltered with my 30-year-old youngest son Thomas and his main squeeze, got a lot of sun enjoying casual dinners and great chats, followed by a ritualistic dragging our asses through the grass after running out of toilet paper. But by mid-year there was a notable pall over the Shire, and orcs were spotted in the woods. One prays this is not a trilogy.

We are all biodegradable and progress through three stages of life: stud, dud, and thud. I thought getting old would take a while. I was wrong. You start life trying not to wet yourself and end life trying not to wet yourself. The middle is the fun part. The final days—pretty much gruel and drool I figure—will probably suck. While trying to avoid stage three, I put on 6 lbs sheltering but ripped off 26 lbs in the last 10 weeks (within 40 lbs of my crack weight.) You’ve gotta touch that bag before leading off again. I didn’t make it to the gym this year. That makes 15 in a row. I had a hernia fixed before the lockdown, still piss bladder stones every week or two (trying not to wet myself), came up negative on prostate cancer, make sound effects simply getting out of a chair, and learned how to cut my own hair. (The ears are easy, the back is quite a reach, and manscaping is unnerving.) We started with five dogs in the house and ended with six. The two visiting Boston Terriers inspired us to get Charlie. (Check out this video.ref 2) Charlie is great. It is nothing but Boston Terriers (and turtles) from here on.

Dave is the man who can rant better than anybody I’ve ever met.~ Marty Bent (@MartyBent), Tales from the Crypt podcast

I did a lot of podcasts—some with encore performances—since my last Year in Review. They are listed unceremoniously as follows:

Chris Martenson (Peak Prosperity, @chrismartenson)ref 3

Jim Kunstler (Kunstlercast; @Jhkunstler)ref 4

Rick Sanchez (RT; @RickSanchezTV)ref 5

Chris Irons (Quoth the Raven; @QTRResearch)ref 6

Marty “Hodler King” Bent (Tales from the Crypt; @MartyBent)ref 7

Sam McCullough (end of Chain; @traders_insight)ref 8

Jason Burack (Wall St for Main St, @JasonEBurack)ref 9

Zach Abraham (KYR Radio; @KYRRadio)ref 10

Elijah Wood (Silver Doctors; @SilverDoctors)ref 11

Justin O’Connell (Gold Silver Bitcoin Podcast; @GldSlvBtc)ref 12

Anthony “Pomp” Pompliano (Morgan Creek Digital; @APompliano)ref 13

Ryan Ortega (Jelly Donut, @JellyDonutPod)ref 14

Thomas George (Grizzle; @thomasg_grizzle)ref 15

Kenneth Ameduri (Crush the Street)ref 16

Dan Ferris (Stansberry Research; @dferris1961)ref 17

Max Keiser and Stacey Herbert (Keiser Report; @staceyherbert and @maxkeiser)ref 18

Fergus Hodgson and Brien Lundin (Gold Newsletter Podcast; @GoldNewsletter)ref 19

Phil Kennedy (Kennedy Financial)ref 20

Phil Bak, CIO at Signal Advisors (@philbak1)ref 21

A bucket-list interview with Tony Greer (@TGMacro) on RealVision that had disappeared for months was found last year and officially posted this year.ref 22 (I actually suspect it had been censored by a former employee to protect their reputation.) I had a ball serving on a panel discussion at the 2020 New Orleans Investment Conference with Adam Taggart, Chris Martenson, and Dominic Frisby.ref 23 A quick search of Zerohedge shows 61 mentions over the years. That officially makes me a Tool of the Kremlin. (I haven't run into The Donald nor Tulsi there yet). I found a webpage that professed to help you “Find out what the best investors are reading, writing, and saying” and was shocked to find my name on it. That ten minutes of fame has now rolled off the page to the Dark Web. My Keiser Report interview got translated to Spanish and was real haga clic en cebo.ref 24 I had a tweet make it into an elite medical journal, Stats:ref 25

Conspiracy Theories

Are Conspiracy Theorists Epistemically Vicious?Charles R. Pigden, sophist-douche bag

Hanlon’s razor says that you should never assume malice where incompetence will suffice. OK, but oftentimes it does not suffice. Collum’s razor says never be so narrow-minded that you refuse to believe men and women of wealth and power conspire. Those who do are probably happy not to swat those flies. Years ago I served on a PhD committee of Jim Rankin, a successful businessman from Dallas, who wrote a pretty damned interesting thesis on conspiracy theories.ref 1 There is scholarly work out there, and then there is Charles Pigden, Cass Sunstein (whose wife, Samantha Power, is a neocon), and Michael Shermer, all writing embarrassingly biased tripe that pays their mortgages. I say this every year: Stop declaring, “I am not a conspiracy theorist but…” and grow a pair. Embrace the label that horrifies you. Admit that the world is filled with sociopaths trying to screw us with complex plans. Use your fookin’ head and your gonads to stand up to the scoundrels.

A University of Chicago study estimated in 2014 that half of the American public consistently endorses at least one conspiracy theory. When they repeated the survey last November, the proportion had risen to 61%. The startling finding was echoed by a recent study from the University of Cambridge that found 60% of Britons are wedded to a false narrative.

A chemist at Cornell reports that a disturbing 39% of the American public are mushrooms—in the dark and fed horse manure.

Decade in Review

I love metaphors and similes. A particularly instructive one is Parker Brothers, Monopoly. The players all start with reasonable amounts of money. As the game proceeds, players collect $200 by simply passing Go and use this money to speculate on real estate. By the end of the game, only $500 bills are worth anything, the whole thing blows up, and most of the players end up destitute. I wonder why the originator of the game (Elizabeth Magie, not Charles Darrow) didn’t name it Inflation. In a twist of irony, an original game board sells for about $50,000.~ Year in Review, 2010

I took a little time to thumb through a decade of YIRs to find sections that I am still proud of and seem to have withstood the test of time. Few have read all ten—Hi Mom!—but I know of fintwit legends who have. In some ways, I think the earlier YIRs were better because I was working at lower levels of the intellectual strata. To minimize repetition, I bypass ideas worth talking about. For example, I was writing about a disturbing change in the mood of society by 2011. Some of these sections are wiggy topics that stayed off radars and were stuffed down memory holes, but I still stand by them and think they retain appeal to the open-minded. In chronological order:

2002 Subprime Crisis prediction (republished in 2012): My best prediction.

Buffett Takes a Bath (2011): Pulling the curtain back on the Orifice of Omaha.

The Constitution and the Fourth Estate (2011): Early thoughts on the failure of media.

Paul Krugman’s Greatest Quotes (2013): This guy is just too funny.

Militarization of the Police and Civil Asset Forfeiture (2014): Police problems are not new.

Problems with the Roth IRA (talk given in Las Vegas in 2014): Consult your financial advisor.

Election (2016): My analysis of WTF Happened in 2016.

Price Gouging (2017): Why they are neither evil nor pervasive.

Antifa (2017): They’ve gotten worse.

Russiagate (2017): Baloney from the outset.

Las Vegas Shootings (2017): A seriously untold story.

Pension Crisis (2017 and 2018): The latter was reproduced verbatim by Solari.

Valuations (2018): Exhaustive look as a setup for this year’s writeup.

Syria (2018): Story of fake gas attacks before the media got it.

Kavanaugh versus Blasey-Ford (2018): The sub-surface details.

Skripal Poisonings (2018): Not what they appeared to be.

In Defense of Religion (2018): Through the lens of a pro-choice atheist.

Collum-An Autobiography (2019): In case you care to know.

Modern Monetary Theory (2019): From risk to reality in one year.

Climate Change (2019): Where science and politics collide (briefly mentioned in Part 2).

The Jeffrey Epstein Affair (2019): He ain’t dead (and briefly mentioned in part 2)

Investing

I finished 2020 with my total assets distributed 23% gold, 2% silver, 54% cash-like entities, 12% in real estate (my house, no mortgage), and 9% in a smattering of equities. The large cash prevents my returns from ever moving abruptly. I hope to put it to work someday. This year gold and silver returned a respectable 20% and 32%, respectively, although the fairly standard early-season rally began looking like a dead-ingot bounce by November. My overall accrual of wealth (ex-house appreciation) came in at 10.9% following 5.7% last year. Of course, it failed to keep up with Tesla, Moderna, and Bitcoin, but my crystal ball and Ouija board remain in the shop. (Note to self: pick up laptop.)My best decade of the past four was from 01/01/00 through 12/31/09 with 13% annualized returns while the S&P made nothin’ (dividends included). Hold your applause. There is plenty of schadenfreude to go around. I missed the equity ramp from ’09–present. I am also not stupid; I sure wish I had caught that ramp. My reasoning behind the decision to sit it out (delineated in “Valuations”) was based on far superior reasoning to the completely vacuous reasoning in the 1990s that lavished me with wild returns including one year >100%. All you have is reasoning and luck. Those unsatisfied with decent returns are doomed to lose it all. “Easy come easy go” but Nick Carnot would disagree. I have enough to retire with inflation-adjusted zero-percent returns. I do, however, wish to leave some money to my kids, who are in a generation that will struggle to accrue wealth. I worked hard to bestow such privilege.

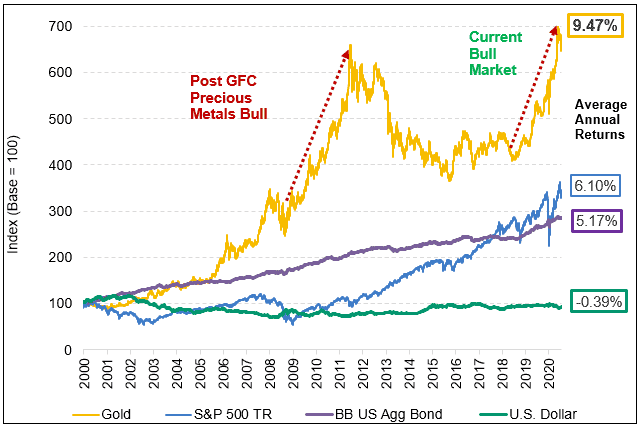

Figure 3. Two decades of gold versus equities (ex-dividends, taxes, fees, and inflation).

I’ve been a gold bug since 1999, chasing it down from 290 to 270, chasing it up from 300 to 450, and topping off the stash in 2016 in the 1200s after the swaffling by a cyclical bear market seemed to subside. It has served me well with a position that now is equivalent to six gross annual salaries. While the equity wankers thump their chests, the gold bugs quietly whooped their asses for two decades (Figure 3). JPM showed that gold beat the total returns of the S&P by 2% annualized. GThis is a companion discussion topic for the original entry at https://peakprosperity.com/dave-collum-2020-year-in-review-part-1/