One of the conclusions that I try to coax, lead, and/or nudge people towards is acceptance of the fact that the economy can't be fixed. By this I mean that the old regime of general economic stability and rising standards of living fueled by excessive credit are a thing of the past. At least they are for the debt-encrusted developed nations over the short haul -- and, over the long haul, across the entire soon-to-be energy-starved globe.

The sooner we can accept that idea and make other plans the better. To paraphrase a famous saying, Anything that can't be fixed, won't.

The basis for this view stems from understanding that debt-based money systems operate best when they can grow exponentially forever. Of course, nothing can, which means that even without natural limits, such systems are prone to increasingly chaotic behavior, until the money that undergirds them collapses into utter worthlessness, allowing the cycle to begin anew.

All economic depressions share the same root cause. Too much credit that does not lead to enhanced future cash flows is extended. In other words, this means lending without regard for the ability of the loan to repay both the principal and interest from enhanced production; money is loaned for consumption, and poor investment decisions are made. Eventually gravity takes over, debts are defaulted upon, no more borrowers can be found, and the system is rather painfully scrubbed clean. It's a very normal and usual process.

When we bring in natural limits, however, (such as is the case for petroleum right now), what emerges is a forcing function that pushes a debt-based, exponential money system over the brink all that much faster and harder.

But for the moment, let's ignore the imminent energy crisis. On a pure debt, deficit, and liability basis, the US, much of Europe, and Japan are all well past the point of no return. No matter what policy tweaks, tax and benefit adjustments, or spending cuts are made -- individually or in combination -- nothing really pencils out to anything that remotely resembles a solution that would allow us to return to business as usual.

At the heart of it all, the developed nations blew themselves a gigantic credit bubble, which fed all kinds of grotesque distortions, of which housing is perhaps the most visible poster child. However, outsized government budgets and promises, overconsumption of nearly everything imaginable, bloated college tuition costs, and rising prices in healthcare utterly disconnected from economics are other symptoms, too. This report will examine the deficits, debts, and liabilities in such a way as to make the case that there's no possibility of a return of generally rising living standards for most of the developed world. A new era is upon us. There's always a slight chance , should some transformative technology come along, like another Internet, or perhaps the equivalent of another Industrial Revolution, but no such catalysts are on the horizon, let alone at the ready.

At the end, we will tie this understanding of the debt predicament to the energy situation raised in my prior report to fully develop the conclusion that we can -- and really should -- seriously entertain the premise that there's just no way for all the debts to be paid back. There are many implications to this line of thinking, not the least of which is the risk that the debt-based, fiat money system itself is in danger of failing.

Too Little Debt! (or, Your One Chart That Explains Everything)

[Note: this next section is an excerpt from a recent Martenson Blog entry, so if this seems familiar to any site members, it's because you've seen it before.]

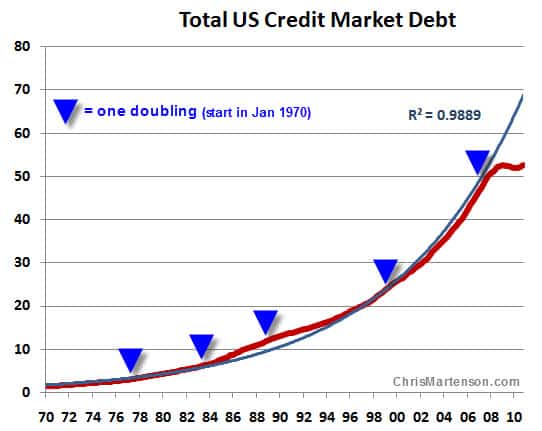

If I were to be given just one chart, by which I had to explain everything about why Bernanke's printed efforts have so far failed to actually cure anything and why I am pessimistic that further efforts will fall short, it is this one:

There's a lot going on in this deceptively simple chart so let's take it one step at a time. First, "Total Credit Market Debt" is everything - financial sector debt, government debt (federal, state, and local), household debt, and corporate debt - and that is the bold red line (data from the Federal Reserve).

Next, if we start in January 1970 and ask the question, "How long before that debt doubled and then doubled again?" we find that debt has doubled five times in four decades (blue triangles).

Then if we perform an exponential curve fit (blue line) and round up, we find a nearly perfect fit with a R2 of 0.99. This means that debt has been growing in a nearly perfect exponential fashion through the 1970's, the 1980's, the 1990's and the 2000's. In order for the 2010 decade to mirror, match, or in any way resemble the prior four decades, credit market debt will need to double again, from $52 trillion to $104 trillion.

Finally, note that the most serious departure between the idealized exponential curve fit and the data occurred beginning in 2008, and it has not yet even remotely begun to return to its former trajectory.

This explains everything.

It explains why Bernanke's $2 trillion has not created a spectacular party in anything other than a few select areas (banking, corporate profits), which were positioned to directly benefit from the money. It explains why things don't feel right, or the same, and why most people are still feeling quite queasy about the state of the economy. It explains why the massive disconnects between government pensions and promises, all developed and doled out during the prior four decades, cannot be met by current budget realities.

Our entire system of money, and by extension our sense of entitlement and expectations of future growth, were formed during and are utterly dependent on exponential credit growth. Of course, as you know, money is loaned into existence and is therefore really just the other side of the credit coin. This is why Bernanke can print a few trillion and not really accomplish all that much, because the main engine of growth expects, requires, and is otherwise dependent on credit doubling over the next decade.

To put this into perspective, a doubling will take us from $52 to $104 trillion, requiring close to $5 trillion in new credit creation each year of that decade. Nearly three years has passed without any appreciable increase in total credit market debt, which puts us roughly $15 trillion behind the curve.

What will happen when credit cannot grow exponentially? We already have our answers; it's been the reality for the past three years. Debts cannot be serviced, the weaker and more highly leveraged participants get clobbered first (Lehman, Greece, Las Vegas housing, etc.), and the dominoes topple from the outside in towards the center. Money is dumped in, but traction is weak. What begins as a temporary program of providing liquidity becomes a permanent program of printing money needed in order for the system to merely function.

Debt and Europe

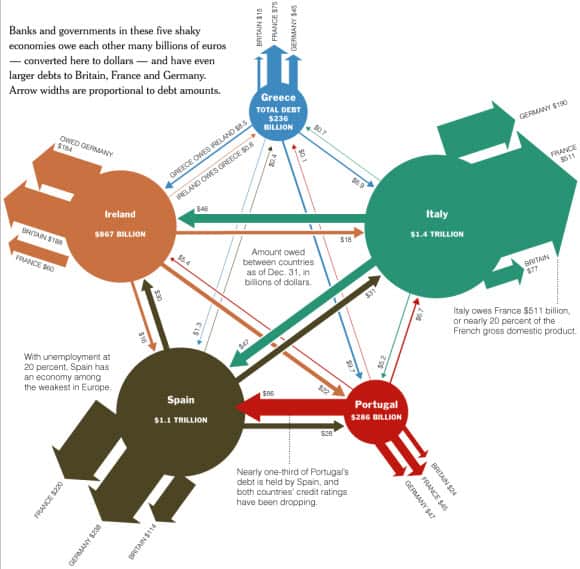

The debt situation in Europe is fairly typical of the developed world and mirrors the debt chart of the US seen above. There's entirely too much debt, and most of the unserviceable amounts are concentrated in certain spots (i.e., PIIGS), while the amounts owed are concentrated in the German, French, and British banks.

This New York Times graphic did an excellent job of summing everything up:

(Source - click to view larger graphic at source)

Here is a slightly less-complicated image that expresses the same dynamic:

If everybody owes everybody else, then kicking the can down the road only works if there's more wealth, more growth, and sufficient economic activity down that road to service the past debts. If any one participant drops the baton in the debt relay race, the absurdity of the situation becomes unavoidable and the cause is lost.

When we hold this view, it is abundantly clear that adding more debt along the way only increases the burdens and is therefore ultimately counterproductive, although it does grant the gift of additional time to avoid facing the truth.

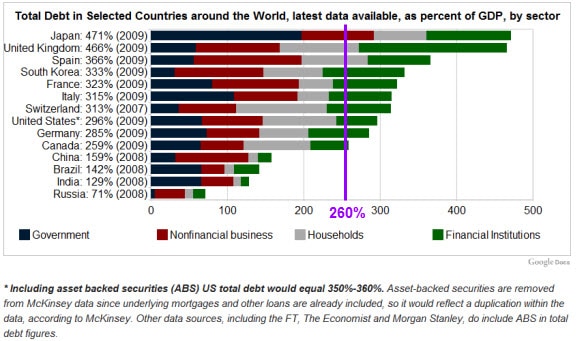

When all of the most indebted countries are stacked up, we see that all but Russia carry a total indebtedness greater than 100% of GDP and that nine are carrying debt levels higher than any that have ever been repaid historically.

(Source) Note: 260% debt-to-GDP is the all time record for repayment, accomplished by England between 1815 and 1900, but required both massive cuts in spending and an industrial revolution.

Without mincing words, the world does not face a crisis of liquidity, nor a crisis of insufficient debt, but one of entirely too much debt. That's the entire predicament in three words: too much debt.

More debt is only going to compound the predicament, yet that is what the world's central banks and political structures are busy manufacturing. More debt.

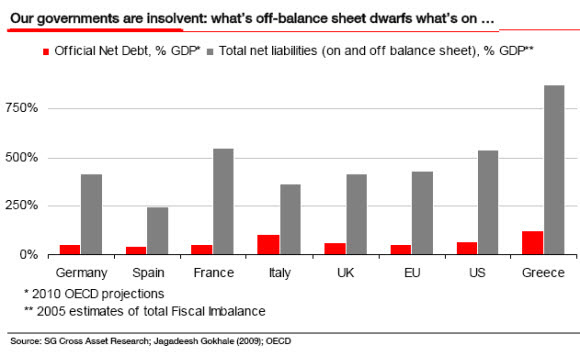

Of course, debt is only one component of the story; there are also liabilities to consider. The above chart merely graphs the legally defined debts involved. If we bother to add back in the liability components, which are pensions, social security and government medical plans, the predicament is seen to be three to six times larger:

Whereas the prior chart showed all debts incurred by all sectors of each nation, the above chart only displays government debt and liabilities. For reference, the red bars, above, are the amounts that you read about in the paper when commentators note that the US, for example, still has a debt-to-GDP ratio that is under 100%. It's a comforting tale, but not an accurate description of the situation.

Again, there are no historical examples of any country ever digging itself out from so deep a hole, and yet we find that the entire developed world has bravely pushed itself deep into unknown territory, seemingly without any serious discussions about whether or not this made sense.

Where We Are Now

So here we are, just a few weeks away from the end of the second round of quantitative easing (QE II) , with massive public debts and liabilities having only grown larger instead of shrinking during the Great Recession, everybody in nearly the same boat, and no clear plan for how all the sovereign debts will be funded from current productive cash flows (i.e., existing GDP).

This is why so many commentators, myself included, are convinced that more thin-air money printing is on the way. My thesis, laid out back in early March is that the Fed will stop QE II on schedule and that the financial markets will react exceptionally poorly to this loss of support. Commodities will tank first, then stocks, then bonds; from riskiest and most-leveraged to least.

It is time to face the music; the levels of indebtedness now require permanent support from thin-air money in order to avoid a deflationary collapse. Given this reality, we explore key questions in detail in Part II of this report: Understanding the Endgame:

- How will the global debt crisis play out?

- What does a world economy without growth look like?

- What steps should we, as individuals, need to take in preparation?

- How can investors safeguard their purchasing power during the coming rout in the finanical markets?

Click here to access Part II of this report (free executive summary; paid enrollment required)

This is a companion discussion topic for the original entry at https://peakprosperity.com/death-by-debt-2/