Remember in the early part of the last decade, long before he was appointed the Chairman of the Federal Reserve, Ben Bernanke penned an article that caught widespread public attention entitled, “Deflation: It Can’t Happen Here” ?

Bernanke was referring to the deflationary pressures Japan had been dealing with for more than a decade. In the article, Bernanke laid out a game plan for how the Fed would respond if the US ever faced deflationary pressures. His miracle antidote for battling deflation? Printing money. Lots of it.

Little did anyone know at the time that this game plan would become the Fed’s exact response to the credit market crisis and deflationary impulse that erupted in 2008 and 2009.

Moreover, this game plan of printing money was ultimately adopted by every major world central bank in the wake of the meaningful downturn of that period. We continue to live through this grand and unprecedented global experiment.

Huffing & Puffing

Fast forward six years to the present. Since early 2009, central banks globally have printed more than $13 trillion. In addition, governments across the planet have increased their borrowings at historic proportions (the US just crossed $18T – another new high!), all in an effort to stimulate economies and avoid deflationary pressures. Total US Federal debt has more than doubled in five years, an increase of $9.5 trillion and counting. The objective? Generate inflation.

In addition, central bankers have not been bashful about explicitly targeting inflation rates they would like to achieve in their respective countries. We know that in the prior cycle, the attempted reconciliation of credit excesses in the private sector was a key reason the US and global economies experienced a deflationary impulse. Academically, an increase in inflation allows debtors to pay down debt with “inflated dollars” (assuming wages rise), clearly a motivating factor in global central bank decision making over the last half decade. And certainly “inflated dollars” would also allow governments to ease their own ever-accelerating debt burdens. Please remember depreciated currency allows the perception of inflation and “inflated dollars”.

So where do we find ourselves today?

Have the global central banks vanquished the deflationary demon? Have they “created” enough inflation via money printing to allow debt burdens to melt away? Has the Bernanke deflationary antidote been a success for the Fed and their global central banking brethren?

But Where's The Inflation?

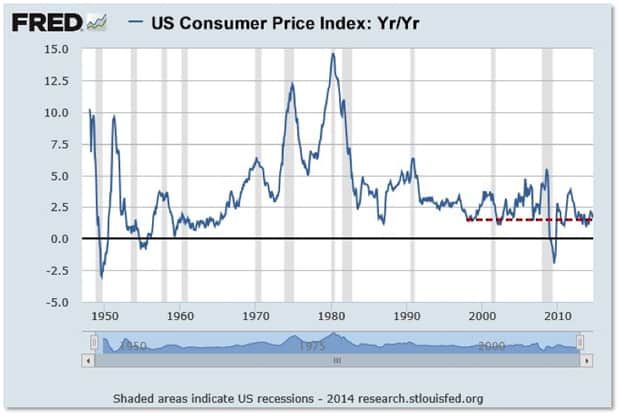

We can start with a very simple look at the year-over-year change in the US consumer price index. What we see is that the current level of rate of change in consumer prices is pushing the lows of the current cycle from 2009 to present. We are not seeing any meaningful inflationary pressures in consumer prices. Yes, selective consumer goods such as food and health care costs have risen, but we have seen deflationary pressures in electronics prices and in non-essential areas of consumer spending. We’re now seeing it in energy prices. On balance, inflationary pressures are modest at best at the headline level.

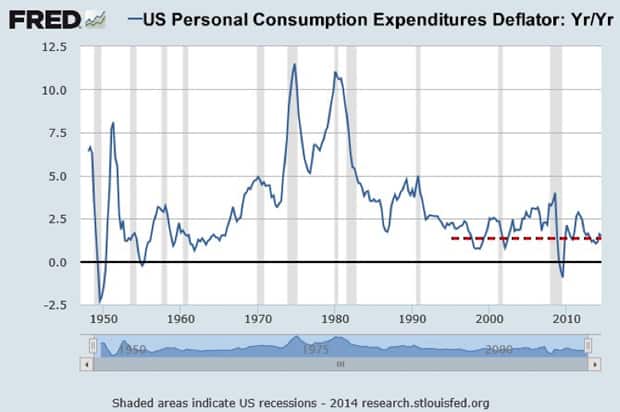

It just so happens that the favorite inflation gauge of the Fed itself is what's called the personal consumption expenditures price deflator. Remember that personal consumption drives roughly 70% of US GDP. Moreover in the current cycle, the Fed professed to believe in the “wealth effect.” If the Fed could engineer higher household balance sheet values (stock prices and real estate values), their belief was that consumers would feel wealthier and would increase consumption. Unfortunately this has not come to pass. Isn’t this clearly the reason the Fed ended Quantitative Easing?

The lack of inflationary pressures in the personal consumption expenditures deflator is clear in this next chart. The message is similar to that of the CPI. Despite unprecedented money printing (academically thought to be very inflationary) by global central banks, the consumer expenditures price inflation needle has barely moved. Rather, it's pushing multi-decade lows and is an outcome anything but desired by the Fed.

The simple message: Quantitative Easing has failed to generate inflation. Stated alternatively: QE has not been able to overcome still extant deflationary pressures.

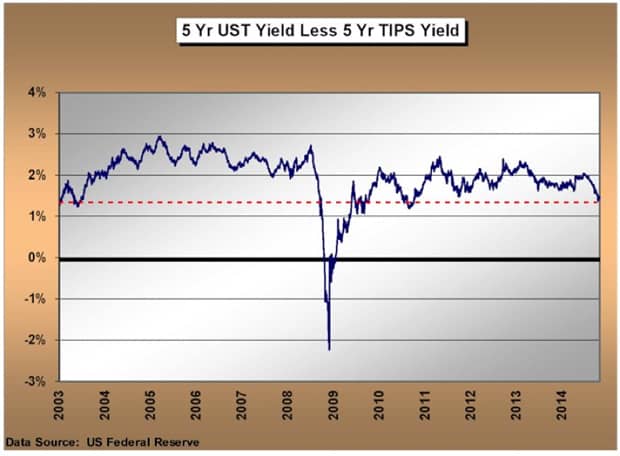

One last data point that's very important in terms of the message of the financial markets themselves: You may remember that a few decades ago, the US began issuing inflation-protected Treasury bonds. One would receive coupon income and the CPI rate for the year as a potential total investment return from these bonds. The securities are known as TIPS – Treasury Inflation Protected Securities. There's a calculation in the financial markets that has come to be known as the “TIPS inflation breakeven rate”. This is calculated by taking the yield on a non-inflation protected Treasury bond and subtracting from it the like maturity TIPS coupon yield, leaving us the implied forward inflationary expectations of the financial market.

In the next chart we are looking at the 5 year inflation expectations rate that is derived by subtracting the yield on a 5-year US Treasury bond from the yield on a 5-year TIPS bond. Once again, the message is strikingly similar to the CPI and personal consumption inflation numbers: the financial market’s expectations for forward inflation is pushing multi-year lows at 1.4% in recent months.

What's important to note is that over the current cycle, inflation expectations in the US (as measured by the TIPS inflation break-even rate) have spiked up temporarily five times, only to turn back down each time. Again, this has occurred while the Fed has printed close to $4 trillion and US Federal debt has simultaneously more than doubled.

Although I won't drag you through a detailed analysis, each time inflation expectations have fallen to current lows, the Fed restarted QE. These restarts also came on the heels of 10% and 20% stock market corrections. But as we stand here today, current financial market expectations of forward inflation are no higher than they were in late 2009!

Deflation Is Winning & Central Banks Are Running Scared

Just what does all of this tell us? It tells us that global central banker actions in printing over $13 trillion of new money over the last 6 years have been insufficient to surmount still existing deflationary forces. It tells us the probability of further global deflationary impulses are very real. This has direct implications for any sector of the economy or financial markets whose fundamentals are negatively leveraged to deflationary pressures (think banks, real estate, etc.) Be assured the central bankers are more than fully aware of this.

During October, the US stock market experienced close to an 8% correction, before recovering all of the losses in less than ten trading days. Foreign markets corrected and recovered in tandem. On the exact day of the stock market bottom, three important global central banker actions occurred:

- The European central bank stated they would begin printing money and buying assets within days.

- The People’s Bank of China delivered a one-time $32 billion immediate stimulus package (after announcing a one-time $100 billion package literally one month prior), and

- a US Fed member publicly suggested that “if needed, the Fed could do QE4.”

The stock market had not even corrected a historically normal 10% before global central bankers were on the scene to promise ever more printed money. Moreover, the Fed had not even concluded QE3! Why would something like this occur unless deflationary pressures were still a significant concern of central banks globally? They could not even allow the equity market to correct at a normal level without yet another intervention, verbal or otherwise.

As a final anecdote of current central banker deflationary concern: on the last day of October, global financial markets were greatly surprised by the Bank of Japan. Japan has been engaging in money printing really for decades now, all to no avail in terms of turning their economy. The money printing heat was turned up significantly in late 2012 when Shinzo Abe was elected prime minister. Since then, the value of the Yen has declined by 35%. Despite all of this turbo-charged money printing, the two negative GDP reads over the last two quarters place Japan in academic recession. Forget growth, unprecedented money printing could not even prevent perceptual recession!

On the last day of October the Bank of Japan (BOJ) announced they would increase their money printing from $70 billion monthly to $90 billion. At this rate, the BOJ will essentially buy all newly issued Japanese government debt looking out over the foreseeable future using money printed out of thin air. There is no precedent for this across history. Once again, global stock markets went vertical with the news of yet another central bank driven liquidity tsunami to come.

What's Coming Next

So, if central bankers are obviously still very worried about deflation, should we as investors worry?

Or will even more money printing in Japan, and elsewhere around the world, eventually be the solution?

We need to watch the global inflation numbers very closely as we move ahead. We need to remember that the major global central banks (US Fed, Bank of Japan, European Central Bank and the People’s Bank of China) have already pushed interest rates to or near zero. As such, the efficiency of their policies now rests virtually entirely on their supposed ability to generate inflation. An ability that has proven elusive for six years now.

In Part 2: What Deflation Means For Investors, we examine the receding level of global liquidity and explore what will happen to all the asset classes so dependent on that -- up until now -- ever-rising tide. The global financial system is now completely tuned for a world of more liquidity, more credit. It's not prepared, and perhaps not able, to deal with the new set of rules deflation is poised to usher in.

Click here to access Part 2 of this report (free executive summary; enrollment required for full access)

This is a companion discussion topic for the original entry at https://peakprosperity.com/deflation-is-winning/