Originally published at: https://peakprosperity.com/either-trumps-dollar-weakening-works-or-it-doesnt/

It’s all coming into focus now. Huge volatility will be the name of the game going forward if the “de-financialization” thesis is right.

To begin, the definition of financialization is “making money with money.”

It turns out that when “making money with money” is possible, that’s the thing that people very much prefer to do. It’s easy, you can do it in a café from a laptop, and you don’t have to worry about hiring and firing people, making payroll, logistics, inventory management, or marketing.

That stuff is hard, risky, and time-intensive.

The world’s central banks have spent all of their efforts over the past 20–30 years suppressing volatility and pumping financial assets higher, which paved the way for massive financialized activities to sprout like mushrooms after a spring drenching.

While the unwinding of all those leveraged trades is beyond the scope of this podcast, Paul Kiker and I noted the many signs that they are ending.

Rapid surges in gold and silver, uranium, and copper are early signs that something is amiss.

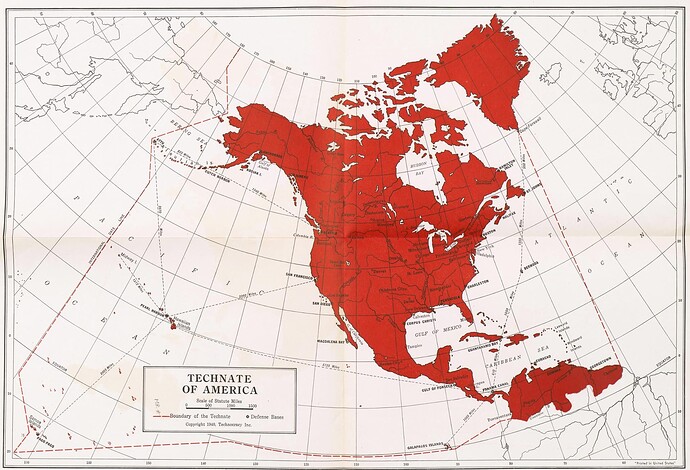

Goosing all of this along are the ambitious plans by the Trump administration to breathe life into the so-called “Mar-a-Lago Accord,” which calls for a weaker dollar, higher tariffs, reduced NATO involvement, and a US-centric global economic realignment.

Recently, Trump really trash-talked the dollar, and it took quite a dump.

Alongside that, we have had numerous revelations of dollar-truth made by the likes of Ray Dalio (Bridgewater fund manager), Ron Baron (billionaire investor), Warren Buffett (ditto), Ken Griffin (Citadel), and David Malpass (former World Bank president).

They are all saying some version of “Dollar excesses seem to have gone too far and there will be heck to pay.”

The reason we care about this is that once the titans of the financial industry are all making such warnings, we are not all that far off from “common knowledge,” which is when everybody knows that everybody knows that the dollar is toast.

From there, it’s a hop, skip, and a very short jump to really massive moves that will frighten most people. But not those who have a risk-managed portfolio approach or who have a lot of hard assets to their name.

Timestamps

00:00 Introduction and Fishing Trip Plans

00:59 Market Dynamics and Economic Realignment

02:49 The Debasement Trade and Currency Pegging

06:02 Counterparty and Systemic Risks

08:59 Gold, Silver, and the Debasement Trade

12:06 Bitcoin’s Role in the Current Market

15:00 Market Manipulation and Silver’s Surge

17:00 Insights from Industry Titans

20:03 Investment Strategies for a Changing Economy

22:57 Market Trends and Asset Performance

25:42 The Impact of Currency Strength on Investments

27:30 Risks of a Weaker Dollar

30:11 Systemic Risks in the Financial System

32:44 The Role of Derivatives in Financial Stability

40:55 Planning for Inflation in Retirement

51:45 The Uncontrollable Factors in Inflation

54:12 Historical Parallels: The 1970s Inflation Crisis

56:06 Investment Strategies in a Changing Economic Landscape

01:01:43 The Role of Government Policies in Economic Disparities

01:06:35 The Fed’s Dilemma: Balancing Act of Monetary Policy

01:12:53 Navigating Future Economic Challenges

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.