After five years of aggressive Federal Reserve and government intervention in our monetary and financial systems, it's time to ask: Where are we?

The "plan," such as it has been, is to let future growth sweep everything under the rug. To print some money, close their eyes, cross their fingers, and hope for the best.

On that, I give them an "A" for wishful thinking – and an "F" for actual results.

For the big banks, the plan has involved giving them free money so that they can be "healthy." This has been conducted via direct (TARP, etc.) and semi-direct bailouts (such as offering them money at zero percent and then paying them 0.25% for stashing that same money back at the Fed), and indirectly via telegraphing future market interventions so that the big banks could 'front run' those moves to make virtually risk-free money.

This has been fabulously lucrative for the big banks that are in the inner circle. As we've noted somewhat monotonously, the big banks enjoy "win ratios" on their trading activities that are, well, implausible at best.

Here's a chart of J.P. Morgan's trading revenues for the first three quarters of 2013, showing how many days the bank made or lost money:

(Source)

Do you see the number of days the bank lost money? No? Oh, that's right. There weren't any.

Now, for you or me, trading involves losses, or risk. Sometimes you win, and sometimes you lose. There appears to be zero risk at all to JP Morgan's trading activities. They won virtually all of the time over this 9-month period.

That's like living at a casino poker table for months and never losing.

Of course, Bank of America/Merrill Lynch, Goldman Sachs, and a few other U.S.-based banks were able to turn in roughly similar results. Pretty sweet deal being a bank these days, huh?

So one might think, Well, that's just how banks are now. Bernanke's flood of liquidity is allowing them to simply 'win' at trading. If true (which it appears to be), we can't call this trading. The act of "trading" implies risk. And it's clear that what the big banks are doing carries no risk; otherwise they would be posting at least some degree of losses. We should call it sanctioned theft, corporate welfare, cronyism – the list goes on. And it is most grossly unfair, as well as corrosive to the long-term health of our markets.

Therefore, sadly, I have to give Bernanke an A++ on his objective of handing the banks a truly massive amount of risk-free money. He's done fabulously well there.

But will this be sufficient to carry the day? Will this be enough to set us back on the path of high growth?

And even if we do magically return to the sort of high-octane growth that we used to enjoy back in the day, will that really solve anything?

Endless Growth Is Plan A Through Plan Z

The problem I see with the current rescue plans is that they are piling on massive amounts of new debts.

These debts represent obligations taken on today that will have to be repaid in the future. And the only way repayment can possibly happen is if the future consists of a LOT of uninterrupted growth upwards from here.

It's always easiest to make a case when you go to silly extremes, so let's examine Japan. It's no secret that Japan is piling on sovereign debt and just going nuts in an attempt to get its economy working again. At least that's the publicly stated reason. The real reason is to keep its banking system from imploding.

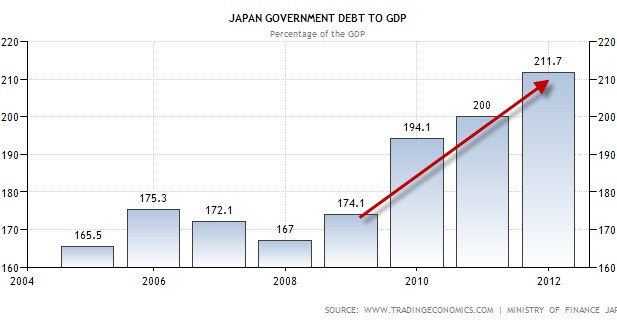

After all, exponential debt-based financial systems function especially poorly in reverse. So Japan keeps piling on the debt in rather stunning amounts:

(Source)

That's up nearly 40% in three years (!).

It's the people of Japan who are on the hook for all that borrowing, now standing well over 200% of GDP. So here's the kicker: In 2010, Japan had a population of 128 million. In 2100, the 'best case' projected outcome for Japan is that its population will stand at 65 million. The worst case? 38 million.

So...who, exactly, is going to be paying all of that debt back?

The answer: Japan's steadily shrinking pool of citizens.

This is simple math, and the trends are very, very clear. Japan has a swiftly rising debt load and a falling population. Whoever it is that is buying 30-year Japanese debt at 1.69% today either cannot perform simple math, or, more likely, is merely playing along for the moment but plans on getting out ahead of everybody else.

But the fact remains that Japan's long-term economic prospects are pretty terrible. And they will remain so as long as the Japanese government, slave to the concept of debt-based money, cannot think of any other response to the current economic condition besides trying to shock the patient back to vigorous life by borrowing and spending like crazy.

If, instead, Japan had used its glory days of manufacturing export surpluses to build up real stores of actual wealth that would persist into the future, then the prognosis could be entirely different. But it didn't.

The U.S. Is No Different

Except for some timing differences, the U.S. is largely in the same place as Japan twenty years ago and following a nearly identical trajectory. Currently, it's an economic powerhouse, folks are generally optimistic on the domestic economic front (relatively speaking), and its politicians are making exceptionally short-sighted decisions. But the long-term math is the same.

There's too much debt representing too many promises. The only possible way those can be met is if rapid and persistent economic growth returns.

However, even under the very best of circumstances, where the economy rises from here without a hitch – say, at historically usual rates of around 3.5% in real terms (6% or more, nominally) – we know that various pension and entitlement programs will still be in big trouble.

Worse, we know that the environment is screaming for attention based on our poor stewardship. Addressing issues such as over-farming, water wastage, and oceanic fishery depletion – to say nothing of carbon levels in the atmosphere - will be hugely expensive.

Likewise, a complete focus on consumer borrowing and spending at the exclusion of everything else (except bailing out big banks, of course), along with a dab of excessive state security spending, has left the U.S. with an enormous infrastructure bill that also must be paid, one way or the other. That is, short-term decisions have left us with long-term challenges.

But what happens if that expected (required?) high rate of growth does not appear?

What if there are hitches and glitches along the way in the form of recessions, as is certain to be the case? There always have been moments of economic retreat, despite the Fed's heroic recent attempts to end them. Then what happens?

Well, that's when an already implausible story of 'recovery' becomes ludicrous.

If we take a closer look at the projections, the idea that we're going to grow – even remotely – into a gigantic future that will consume all entitlement shortfalls within its cornucopian maw becomes all but laughable.

Of course, the purpose of this exercise is not to make fun of anyone, nor to mock any particular beliefs, but to create an actionable understanding of the true nature of where we really are and what you should be doing about it.

In Part II: Why Your Own Plan Better Be Different, we examine more deeply the unsustainability of our current economic system and why it is folly to assume "things will get better from here."

Given the unforgiving math at the macro altitudes, the need for adopting a saner, more prudent plan at the individual level is the best option available to us now.

Click here to access Part II of this report (free executive summary; enrollment required for full access).

This is a companion discussion topic for the original entry at https://peakprosperity.com/endless-growth-is-the-plan-there-is-no-plan-b/