Originally published at: Euphoria: Tracking The Many Bubbles – Peak Prosperity

In today’s episode of Finance U Paul Kiker and I discuss the many apparent bubbles and what happens when they burst.

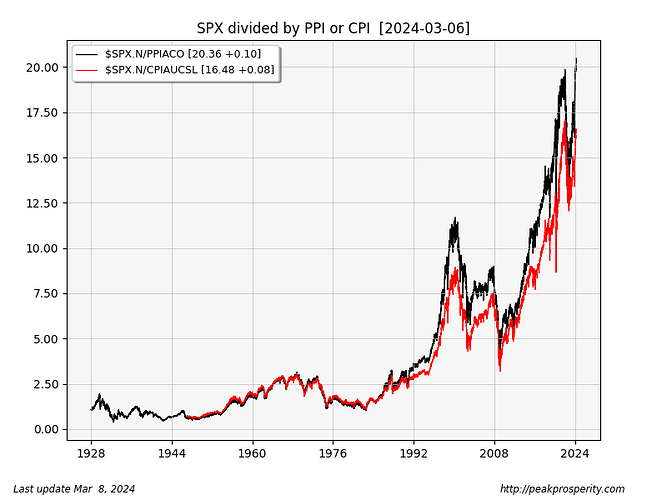

Sadly, the vast majority of people are unaware of the fact that they are living through another set of Federal Reserve/central banker bubbles. Made sadder because they also have no plans in place for how to evade the worst effects of their eventual bursting.

The insanity is global – the chipmaker Nvidia is now more highly valued by the world than the world’s largest oil company Saudi Aramco. This is nuts.

To make sense of this insanity, it helps to drill down and observe that the German stock market has also been powering to new highs despite Germany (1) being in a recession, (2) starved for affordable energy, and (3) in the midst of a very large banking bust due to souring commercial real estate loans.

Peak Prosperity endorses and promotes Kiker Wealth Management’s financial services. To arrange a completely free, no-obligation discussion of your personal financial circumstances and goals with someone who speaks your language and thoroughly shares your outlook on the world, please click this link to go to Peak Financial Investing to begin the process.

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOT PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.