The Christmas and New Year's break, when Europe shuts down and stops thinking, is now well and truly over, and we are reawakening to the same old problems: Greece, Spain, Cyprus, Portugal, Italy, France…all with their hands out for money from Germany, Holland, Finland, and Austria.

The holiday from the banking crisis, which was the result of the determination of the ECB to put a lid on it, is also over, with yields on the supplicant countries’ debt rising again.

However, joining the bad news list is the United Kingdom. Ominously, the pound is sliding in the foreign exchange markets, providing a very tricky background for Chancellor Osborne’s budget on March 20th. I shall examine the UK’s position later, but first let’s update ourselves on developments in the Eurozone.

The reality is that all the problems of the Eurozone are still with us, despite the fall in bond yields and their modest subsequent recovery. There is now the likelihood that we are about to enter the final phase of the end of the Eurozone experiment, with far wider consequences. So we need to pick up the story where we left off.

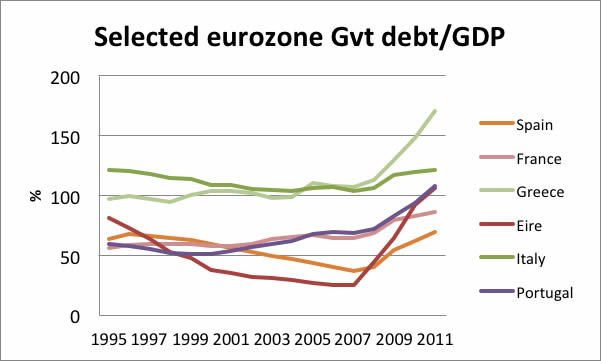

First, let’s look at the trend of government-debt-to-GDP for selected countries (the numbers are from the ECB):

As we can see, government deficits for these countries took off from the time of the banking crisis and are still increasing beyond the charts’ cut-off point into 2012. They reflect poor economic performance, a lack of desire to slash government spending, and contracting bank credit. Only Spain and France were below Carmen Reinhart and Ken Rogoff’s tipping point of 90% government debt-to-GDP (see their book, This Time is Different), but in Spain’s case for 2012, if you add in €27bn raised to pay the backlog of bills incurred by regional governments and the €40bn so far (and rising) to bail out the mortgage banks, today Spain is closer to 100% debt to GDP, and France’s is now over 90%.

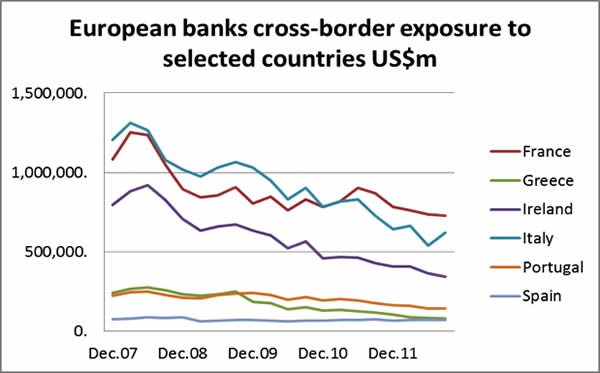

Bank credit continues to be withdrawn by European cross-border lenders, as the figures from the Bank for International Settlements, which run from the time of the banking crisis, show in the next chart:

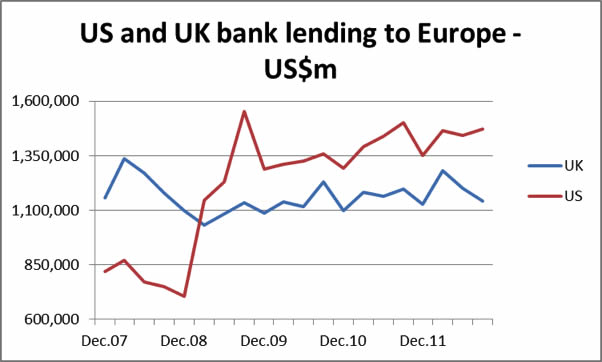

This is a deflating credit bubble. Italy, France, and Ireland have seen the largest withdrawals. Italy has been pursuing aggressive tax collection, driving wealth abroad and deterring economic activity, Ireland has seen a contraction in its financial centre, but France is the surprise suggesting that deflationary forces are stronger than generally understood. The decline in bank lending from European banks has been compensated for by generous Americans, presumably too-big-to-fail banks on instruction from the Fed, putting up an extra $850bn in the first three quarters of 2009. Meanwhile, UK banks have maintained business as usual, slightly increasing their exposure from 2009 onwards. This is shown in the next chart.

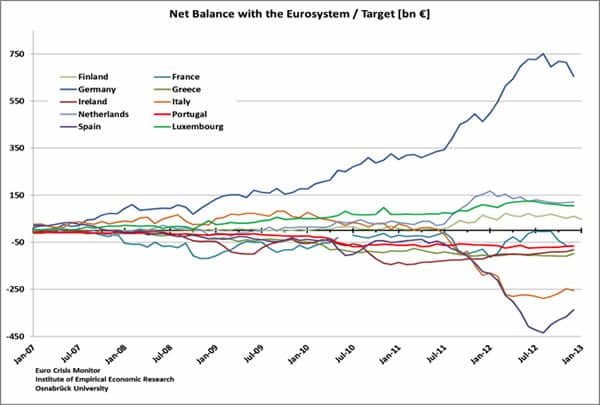

Of course, domestic bank lending in all of these countries, with the possible exception of France, has equally been constrained by capital flight from domestic banks, reflected in TARGET2 balances building up in Germany, Netherlands, Luxembourg, and Finland, as shown in the next chart.

This capital flight has come from the other countries on this chart, and interestingly, there is early evidence that money is now leaving France.

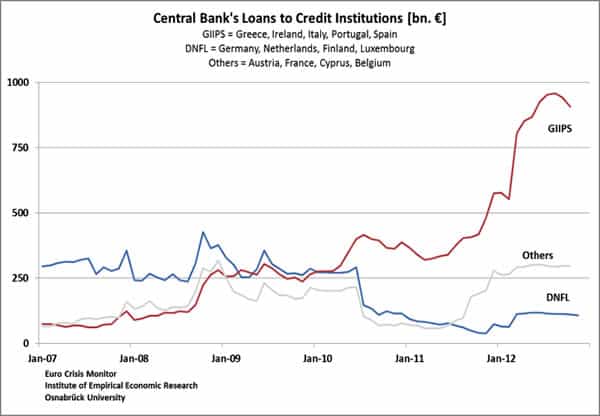

Overall the pressure has come off these imbalances, the natural consequence of a pause in the flow of bad news perhaps, and reflecting the ECB’s success in bringing back a degree of stability. This is also reflected in the next chart, which groups central bank loans to credit institutions in the weak, the strong, and others:

We can clearly see the effect of last year’s crisis on the GIIPS banks, but there is also a worrying pick-up in France, which makes up the bulk of “others”.

This quick tour of European statistics sets the scene. It is clear that some short-term stability has returned, but there is not enough evidence that the underlying position has actually changed. One should bear in mind that European politicians and their economic advisers, with very few exceptions, do not understand markets, and believe that they mostly require confidence. While there is some short-term truth in this belief as recent market performance suggests, the European political establishment appears to go further, believing that confidence is everything. The current economic strategy is therefore little more substantive than to talk markets up.

The reality behind this short-term façade is very different. As time marches on, government employees have to be paid and welfare distributed. Those combined government deficits for the Eurozone need feeding by extra taxes and borrowing at the rate of $40bn per month and rising. And this is only part of the story; along with as central governments, regional governments, cities, and towns (particularly in the periphery) are in deep trouble and have even suspended salaries for employees such as doctors and teachers, as well as payments for essential services.

General government in the Eurozone (which for statistical purposes includes regional and local governments) takes up approximately 50% of GDP. This is the Eurozone’s weakness: The productive capacity of its economy is overwhelmed by the burden of too much government.

Now go back to the first chart, showing the trend of government-debt-to-GDP for selected countries, and worry. It is indicative not only of the suffocating burden of government debt, but because government dominates individual economies, it is also tells us that their private sectors cannot backstop this debt through future taxes.

Therefore there’s no way economic recovery will provide the get-out-of-jail card for the weaker group of countries. The transfer of wealth from a relatively limited private sector to high-spending governments is no solution, as France has found out. If you raise taxes to balance the books, taxpayers walk.

Welfare Costs

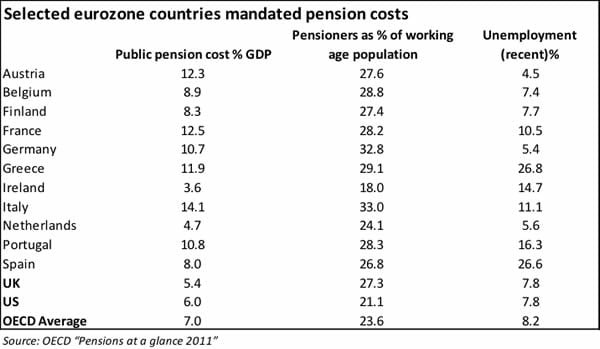

No one in Europe mentions escalating welfare costs. So far as I am aware, there are no estimates for the net present value of future welfare costs for Eurozone countries, such as the one by Professor Kotlikoff of Boston University for the United States. The element of “baby-boomers” in European demographics varies, but the state pensions, healthcare costs, and other benefits are very high, as shown in the following table (data mostly supplied by the OECD “Pensions at a glance 2011”). Over the last year, pension costs as a proportion of GDP will have risen above these figures due to the increasing retirement rate, and even more sharply in those countries where GDP has fallen. These figures will therefore be under-estimates for the current position.

We know from Professor Kotlikoff’s estimates that the net present value of the US’s future welfare costs rose $11 trillion in 2012, we also know that free healthcare in the eurozone is more advanced – meaning more expensive - than in the US. With the eurozone’s public pension costs on average nearly twice that of the US, we can see that the baby-boomer and longevity problems faced by the United States are nothing compared with key Eurozone countries. It is also important to note that the cost on government finances of a retiring wage-earner is two-fold: The state loses tax revenue and gains a cost.

The only Eurozone countries in the table with lower pension costs are Ireland and the Netherlands, both smaller population countries. Furthermore, all Eurozone countries, with the exception of Ireland, have a higher proportion of pensioners than the OECD average, implying again that future welfare costs are substantially greater than those of the U.S.

The level of unemployment (the last column) must be taken into account as well, because an unemployed person does not pay the taxes to fund pensions. The countries with a high level of unemployment and higher-than-average numbers of pensioners as a proportion of the working population are in deep trouble. The worst, in descending order, are Greece, Italy, Spain, Portugal, and France. Furthermore, Spain, and Ireland have raided their public pension funds to support general government finances.

We can therefore conclude that even if somehow the Eurozone extracts itself from its current difficulties it will have to address the burden of these future welfare costs as a matter of urgency.

While on the subject of welfare and pensions, it is worth mentioning the impact on Scandinavian countries with their exceptionally high taxes, which vary from Norway’s 57.9% of GDP to Sweden’s 51.4%. These countries, which everyone assumes are financially stable, will be badly hit by the demographic time-bomb.

So far, welfare has not been a headline issue anywhere and until fairly recently politicians have stayed off the subject. However, it is now being recognised as a growing problem to which there is no easy solution. Properly accounted for with reasonable provisions made, it is obvious that including the net present value of these future commitments true government deficits are multiples higher than officially stated.

Eurozone Politics

The political balance has changed substantially over the last year, from the cosy days when Merkel met Sarkozy and Monti kept the Italians in order. First, Sarkozy was dumped by the French electorate, which preferred welfare to austerity, and now Monti has been dumped for similar reasons. The idea that Chancellor Merkel can trade greater fiscal control over the Eurozone debtors for her own electoral support in Germany has been disproved. The ramifications of the hung Parliament in Rome are likely to be profound, not least in Berlin.

Germany faces full elections in September this year, and it will be difficult for Chancellor Merkel to win, given that her party, the Christian Democrats, did badly in the local German elections in January. The German voter has generally been more concerned with Germany’s relative economic success, bringing low unemployment, than the intractable problem of supporting other Eurozone nations. This may be changing, with Germany’s more dynamic export markets – China, Russia, and the other emerging economies – slowing somewhat. If this trend continues and unemployment rises, the Christian Democrats will find it a struggle to get re-elected.

For this reason, it is likely that Merkel’s room for manoeuvre will be increasingly limited. It is apparent to the German voter that the government has no prospect of recovering money lent to the Eurozone periphery through the banks, reflected in TARGET2 balances, nor directly through the European Stability Mechanism (ESM). So far, the ESM has only lent €40bn to Spain to recapitalise the Spanish mortgage banks, but the demands on the ESM are bound to increase. Germany’s contribution to date is €21.72bn, which can be increased, if required, to €190bn.

Given Merkel’s political difficulties, she is likely to be slow to subscribe Germany’s full commitment and can use the excuse that she can only be expected to match the other large contributors – who are by the way, France, Italy, and Spain. It is likely to be a political virtue for her to take a tougher line.

It would therefore be a mistake to think that Germany is going to continue to fund profligate governments. Since the ECB has already created the precedent (quote from Mr Draghi: “Whatever it takes”), the ECB will have to end up creating the money required.

In Part II - Europe: Welcome to the Domino Effect, we conclude therefore that the Eurozone is now on track for a hyper-inflationary outcome, rather than a deflationary collapse, similar to prospects for the other major currencies. Its collective banking system is also extremely vulnerable to shocks with accumulated bad debts from prior bubbles and prospective bad debts from insolvent government debts.

To understand how this will play out, one needs to understand the likely future in store for each of the most unfluential, unstable players in this unfolding melodrama: Spain, Italy, France – and a recent addition, the UK.

Click here to read Part II of this report (free executive summary; enrollment required for full access).

<a href="#_ftnref1" name="_ftn1" title=">[1]</a> This and the next chart are reproduced with kind permission from the Institute of Empirical Economic Research, Osnabruck University.</p>

This is a companion discussion topic for the original entry at https://peakprosperity.com/europe-is-drowning-under-too-much-government/