Originally published at: https://peakprosperity.com/finance-u-with-adam-rozencwagj-platinum-gold-silver-oil-and-natural-gas-oh-my/

Once a quarter, I get to sit down with Adam Rozencwajg of Geohring and Rozencwajg, the natural resources investment firm, and record a podcast.

This quarter, I asked Adam about their remarkably prescient bullish call on platinum (and palladium), which came out with remarkably good timing a few weeks before a 53% rise.

Adam politely demurred on getting the timing right, saying that’s a matter of luck. But what was a matter of fundamentals and sound analysis was the profound disconnect between physical platinum supplies and demand.

[Link to G&R’s “The Hidden Revival Of Platinum and Palladium” Report]

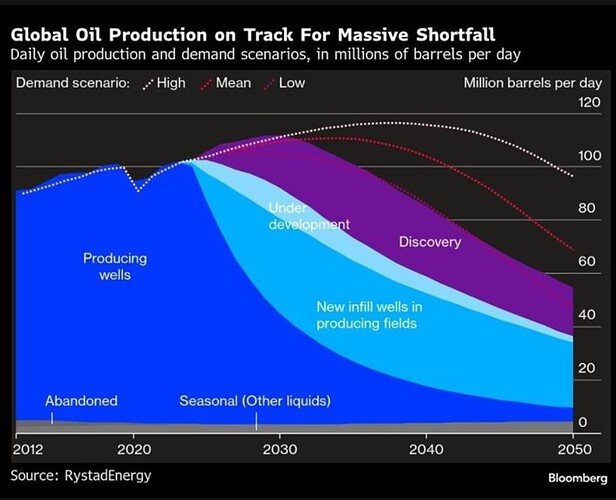

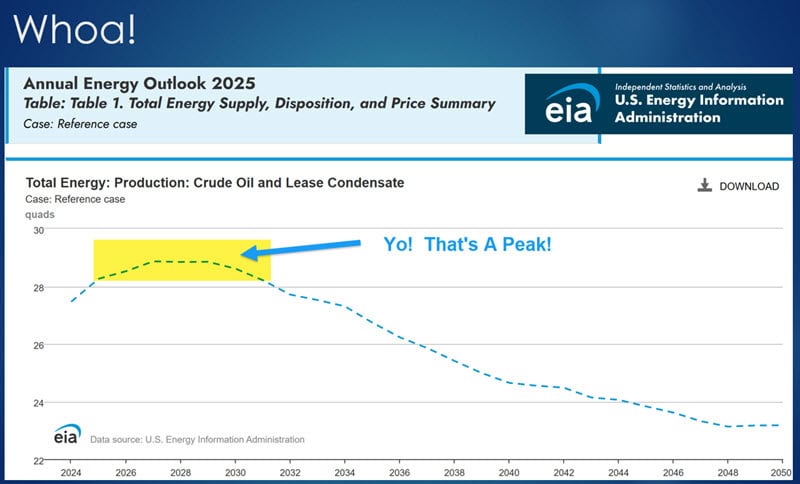

Naturally, I had to follow up on our prior conversation which focused on the G&R neural net model of shale oil production which had been predicting a 2025 peak that has now been confirmed by the EIA itself.

How are so few focusing on this profound reality?

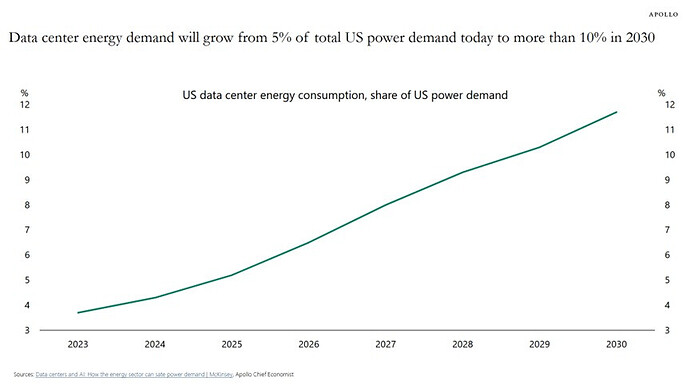

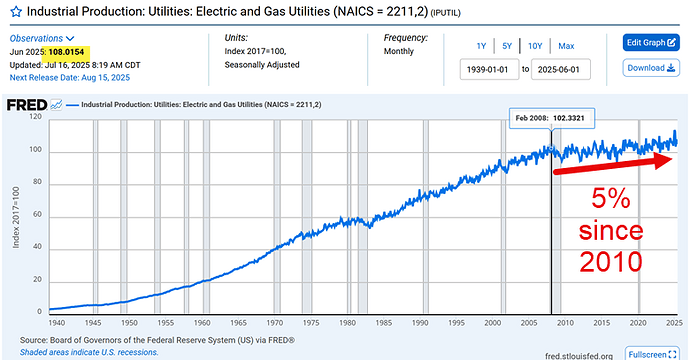

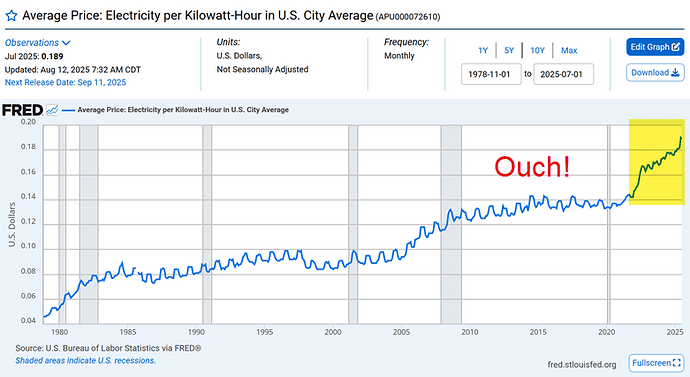

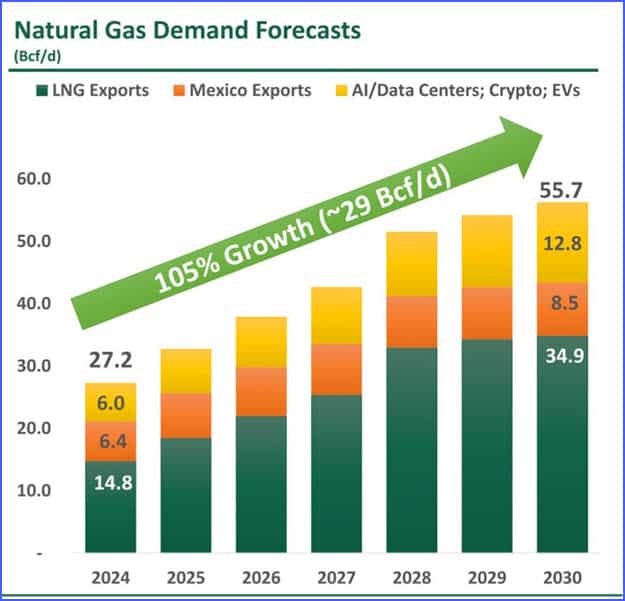

Similarly, everybody and their uncle knows that AI data center demand is gobbling up electricity, and the US is going to have to install a LOT more electrical generation capability, and soon. The only “shelf-ready” solution is going to be natural gas.

There, too, we wondered if anybody besides us was at all concerned about the supply side of the NG story. Somehow, by 2030, ~30% more NG needs to come out of the ground than does today.

How is that going to happen? We have questions…

Most of that demand is being driven by NG exports, which Adam had an incredible story of a company that tossed aside its visionary founder because – gasp! – he believed in such strange things as owning the upstream NG asset producing the gas that was being put through his company’s LNG plants for export.

It’s a tale of bean-counting over common sense; a tale as old as money itself.

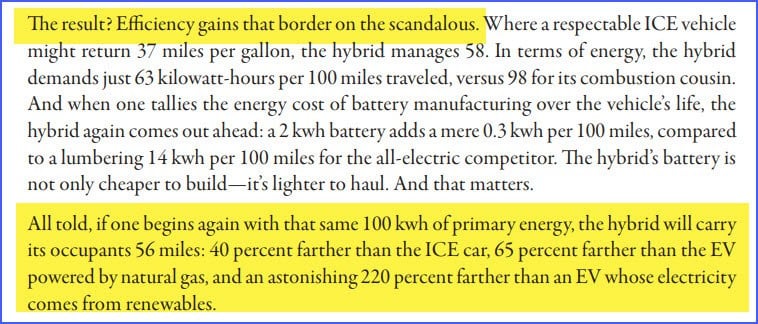

One surprising nugget hidden in the G&R 2Q25 report was the discovery – once they ran numbers – that hybrid cars were by far the most efficient at carrying occupants. Far more efficient than either ICE vehicles or EV cars.

That nugget alone is worth the price of admission.

We also discussed G&R’s fund (GRHAX), which has achieved a 22% year-to-date return as of June 30, 2025, with investments in uranium, U.S. natural gas, crude oil, gold miners, copper, agriculture, and coal. Uranium is favored for exposure to the nuclear cycle, while small modular reactor (SMR) investments are approached cautiously due to high valuations.

In other words, if you want exposure to a well-curated list of stock and resource investments within the natural resources space, this is a good fund to check out.

Finally, we also discussed silver in the context of Samsung’s silver battery announcement (which could consume a huge proportion of silver) as well as the explosion in silver demand driven by TOPcon solar panels.

As always, Adam was a wealth of knowledge and insights, and a steady voice during turbulent times.

Enjoy!

FINANCIAL DISCLAIMER. PEAK PROSPERITY, LLC, AND PEAK FINANCIAL INVESTING ARE NOT ENGAGED IN RENDERING LEGAL, TAX, OR FINANCIAL ADVICE OR SERVICES VIA THIS WEBSITE. NEITHER PEAK PROSPERITY, LLC NOR PEAK FINANCIAL INVESTING ARE FINANCIAL PLANNERS, BROKERS, OR TAX ADVISORS. Their websites are intended only to assist you in your financial education. Your personal financial situation is unique, and any information and advice obtained through this website may not be appropriate for your situation. Accordingly, before making any final decisions or implementing any financial strategy, you should consider obtaining additional information and advice from your accountant or other financial advisers who are fully aware of your individual circumstances.