Originally published at: https://peakprosperity.com/daily-digest/foreign-investors-return-fed-faces-204b-operating-loss/

Economy

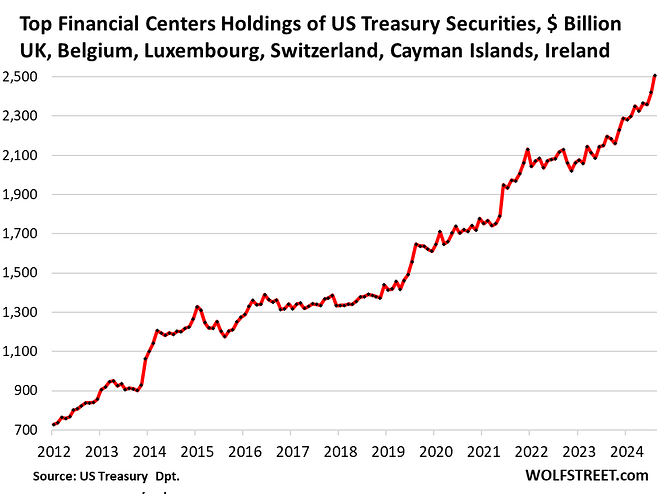

Foreign investors have shown interest in U.S. Treasury securities, even as the national debt reaches $35.8 trillion. While China and Japan’s interest has decreased, regions like the Euro Area and major financial centers have reportedly increased their holdings, attracted by the yields of U.S. debt. Foreign holdings reached $8.50 trillion in August, with contributions from financial hubs such as London and Luxembourg. Although the share of foreign holdings has decreased since 2015, recent trends indicate a resurgence, with foreign investors increasing their stakes faster than the debt’s growth.

Meanwhile, the Federal Reserve is facing scrutiny over its financial management, having recorded operating losses of $204 billion. These losses are attributed to the Fed’s $6.6 trillion portfolio, which yields less interest than the rates paid to banks. This situation has raised concerns about the Fed’s practices and its relationship with Wall Street, prompting calls for reform and transparency.

Danielle DiMartino Booth of Qi Research highlights rising inflation, particularly in food and natural gas, and a shift in housing costs. She critiques government inefficiencies and suggests that AI could enhance productivity. Booth also discusses potential political implications of the upcoming election, including possible shifts in Federal Reserve leadership and the introduction of a central bank digital currency.

In the commodities market, silver prices have increased, indicating the start of a potential bull market. The rise, confirmed by strong trading volume, suggests major institutional involvement. Silver’s rally is reportedly supported by rising industrial demand and declining mine production, creating a structural deficit. This, combined with a shift in the gold-to-silver ratio, indicates silver’s potential for gains.

Gold is also experiencing a rally, with prices reaching new highs. Banks like ING and Bank of America predict prices could reach $3,000 an ounce. Financial experts emphasize gold’s role as a safe haven amidst economic uncertainties, driven by overvalued equities and unsustainable debt levels.

Catherine Austin Fitts, a financial expert, shares her views on gold, Kamala Harris, and Donald Trump. She advocates for gold as a monetary reserve and warns of central bankers’ control over money. Fitts also criticizes the use of certain vaccines and promotes the use of cash over digital transactions.

US Politics

The Biden administration faces criticism from some quarters for allegedly setting economic challenges for a potential future Trump administration. These purported challenges include an overstated jobs market, real inflation higher than reported, and a banking sector with hidden vulnerabilities. It is suggested that these issues could complicate efforts to manage deficit spending and inflation.

James O’Keefe III has claimed that individuals involved in assassination attempts on Donald Trump were ActBlue donors, raising questions about the integrity of donation records. This claim has led to calls for an investigation into ActBlue’s practices.

Lastly, the Biden administration is criticized for attributing a $1.8 trillion deficit to former President Trump. It is argued that increased tax revenues and spending on initiatives like the war in Ukraine contribute to the deficit. There are calls for a reevaluation of economic strategies, suggesting that current policies may not effectively address the nation’s fiscal challenges.

Sources

Foreign Appetite for US Debt: Who’s Buying and Why It Matters

Foreign investors had a big appetite all year for Treasury securities. But China lost interest, Japan struggled with the yen.

Source | Submitted by rhollenb

Economic Insights and Political Predictions: A Deep Dive with Danielle DiMartino Booth and Keith McCullough

Why is corporate America capitalizing on AI and other technologies and coming into this century, and the federal government of the United States cannot?

Source | Submitted by rhollenb

Federal Reserve’s $204 Billion Losses: A Historic Financial Fiasco

Operating losses of this magnitude are unprecedented at the Fed, which was created in 1913.

Source | Submitted by rhollenb

Economic Booby Traps: How Biden’s Policies Could Hamper a Future Trump Administration

The private employment market for US-born citizens is effectively collapsing

Source | Submitted by bcoop

Trump Assassination Attempts: Alleged Attackers Linked to ActBlue Donations

Both Individuals Involved in Trump Assassination Attempts Identified as ActBlue Donors

Source | Submitted by bcoop

Catherine Austin Fitts on Gold’s Rise, Kamala’s Meltdown, and the Deep State’s Grip on Cash and Control

“Gold is very important. We divide gold into two positions: Your ‘core’ position and your ‘investment’ position.”

Source | Submitted by pinecarr

Silver’s Shiny Surge: A Bull Market Breakout or Just a Flash in the Pan?

The Silver Squeeze Has Officially Begun

Source | Submitted by PhilH

Biden’s $1.8 Trillion Deficit: A Blame Game with Trump and the Economic Reality Check

Biden Blames Trump For His $1.8 Trillion Deficit – What Propaganda

Source | Submitted by rhollenb

Gold Hits Record High Amidst Market Skepticism: Experts Debate Overvaluation and Economic Outlook on The Danela Kon Show

The gold price has just made a new record all-time high.

Source | Submitted by rhollenb